Like many of you, I enjoy Matt’s critical weekly commentaries on the markets, the Fed, the warnings from bond and rate signals, and of course, the general bluntness of his data-heavy reporting.

But what does it all boil down to when it comes to portfolio management and real-time performance in a changing world?

As the co-founder in charge of market analysis and portfolio management here at Signals Matter, I’m the guy under the tent who parses through the macro, the micro, the trends, the flows, the analytics, and more to build Your Portfolio and ensure its performance.

Today, I’m authoring a lengthy report to walk you through, step-by-step, how you how we reduce Matt’s macro thinking and my data into a successful, transparent, and consistently managed portfolio.

Welcome to our condensed Investment Primer on how to invest in a changing world.

So Many Ways to Peel an Onion?

There are diverse views on investing and on portfolio management in any economic environment, and these COVID-19 markets are no different.

There are always risks, ranging from the minor to the staggering, along with opportunities, equally ranging from the small to the extraordinary with every turn in the business cycle. There are base cases to explore, as well as bull and bear cases for every market environment.

There are portfolio management approaches based upon a macro-economic (i.e., “big picture”) view vs. micro-economic views based on ground-level signals. There are fundamental vs. technical views, human vs. quant views, and views on value vs. growth.

Then there are US vs. global views. And, not surprisingly, there’s what’s real and what’s fake. There’s the IMF vs. Wall Street; Wall Street vs. the Fed; the FED vs. the US Treasury; the US Treasury vs. the White House; gold vs. currencies, and alas, your advisor’s views vs. your own.

You get the drift…Lots of portfolio management views out there.

In short, the combinations and permutations of approaches to markets and portfolio management are mindboggling, and are equally boggling to a lot of successful and unsuccessful portfolio managers these days.

So, let’s see if we can dial back a bit, simplify and share what works, what’s consistent, and what’s safe when it comes to investing in any market environment, especially in a COVID-19 market.

Your Guides

For those of you who we have yet to meet us, we, Matt and I, have been doing what we’re doing here at Signals Matter for over 50-combined years.

Those who know us well call us (among many things) Brainiac’s, when charitable, but not because we’re some kind of fictional supermen, extraterrestrial cyborgs, or quant-focused androids.

In the end, our portfolio management at SignalsMatter.com is all about common sense, but Subscribers have conveyed that Matt’s right-brain dominance (intuitive, thoughtful, subjective) and my left-brain dominance (logical, analytical, objective) do mesh well when it comes to providing total portfolio management solutions for our Subscribers.

There’s not much overlap here; 1+1=3.

From the World Bank to Wall Street, from Morgan Stanley to Dresdner Bank in Germany, to some of this country’s foremost family offices, we’ve both been around the block, and taken our lumps as well as bagged some big successes.

We’ve profited in the private equity world. We’ve structured, owned, and operated hedge funds that have deployed all manner of sophisticated derivatives. We’ve see n great traders and some real clowns too. We’ve traded futures markets, stock and bond markets, mutual funds, and more-simply derived Exchange Traded Funds (ETFs).

Subscribers might find all this impressive, but we see it as foundational – foundational to delivering a simplified version of portfolio management approaches to Subscribers who want to know how markets work, how to make money, how to stay safe, how to protect their families in upsetting times like these, and how to become better, more informed investors, or just leave and trust the driving to us.

To ensure trust, you need to know how to peel the onion when it comes to portfolio management and transparent performance reporting. Hence this Investment Primer Redux.

In this somewhat different style of Market Reporting, we do aim to shamelessly share and promote what we do, how we do it, and why it works by sharing proven performance.

The Report, admittedly longer than Matt’s reports, is intended as a fresh restart for Subscribers as well. Buckle up as I get technical, but then simplify!

Simplicity

Here’s what works best in all market environments: Simplicity.

At Signals Matter, we strive to make investors better investors by simplifying the complicated. Better investors, as Charlie Ellis reminds, are informed investors. You don’t need to be a professional portfolio manager to invest and protect.

Armed with some basic understanding of what matters most, our Subscribers stick with the programs and investments we suggest, our finest accolade.

You’d be shocked to know how many retail investors, untrained in the basics, leap from one portfolio manager to another through life because their portfolio has not met their benchmark.

They’ll often rotate portfolio managers, just like they change up doctors, because they don’t like the diagnosis or are disappointed in the results. Most of these folks don’t even know what a benchmark is, let alone have their own.

So, I’ll start with benchmarking, for it’s foundational to investing. Then, sequentially, we’ll move on to other investing notions, technical aids, and market macros you need to know, and finish up with the fun part, making money safely and intelligently by deploying the foregoing.

Benchmarking

When it comes to portfolio management, proper benchmarking is essential, and we’re not talking about the S&P 500 Index, which blind monkeys and too many investment advisors simply hug and ride, appearing “smart” in a rising, Fed-driven tide—until the tide goes out, that is, as in March of 2020, or December of 2018.

When it comes to measuring results, we’re talking about you, your family, your family’s budget, your savings for retirement, and never getting in harm’s way when markets fail, especially late in life when it’s too late to recover.

Our suggestion on benchmarking is to build your own benchmark, not blindly accept somebody else’s—and certainly not the famed S&P 500 Index.

The S&P 500 is somebody else’s benchmark, and guess what, it’s not risk-controlled. There are no risk managers in the S&P’s crosstown office looking out for your welfare. And as we recently reported to Subscribers on the back-end, the S&P 500 Index isn’t what you thought it was.

The S&P 500 Index has, in fact, essentially become a tech index, not the broad-based, market index your mother and father remember.

Did you know? Just 5-stocks (Apple, Amazon, Facebook, Microsoft, and Google’s owner, Alphabet) account for virtually all of the percentage gains in the S&P’s rebound this year-to-date. To us, that sounds like a risky (i.e., concentrated) investment, let alone a useless benchmark.

So, here’s what we suggest. Toss the S&P 500 Index in favor of what we’ll call the Family Benchmark. Here’s how it works…

Let’s presume, just for simplicity, that your success in life has generated portfolio assets that total $1,000,000. Nice job! Whether still at work or heading for retirement, you have a certain expectation (or need) for that portfolio to generate a certain rate of return, combined with other income, to cover family expenses. You’ve done the math. Now armed with a family budget, you calculate that the annual portfolio return you need from that portfolio is a dependable 10%. Good.

Then make that your benchmark. 10%.

If your portfolio is down 10%, you will have missed your benchmark by 20%, the distance between your goals, and your portfolio performance. That’s huge. You didn’t just lose 10% in the markets; you lost the other 10% you need to make ends meet.

If you’re down 20%, trust us, you’ll be calling your broker before your broker calls you, because you’re in charge here (not your broker).

Absolute-returns

Welcome to the world of absolute-return vs. relative-return benchmarking and investing.

Your Family Benchmark is an absolute-return benchmark. You absolutely need a 10% return to make ends meet. You’re not looking for a one-trick-pony to save you in some IPO or online miracle solution. You know better. But know this as well: The S&P is not a good benchmark.

The S&P 500 Index is a relative-return benchmark because it measures how your portfolio is doing vs. a market index. How relevant is that, really? What you need in order to cover the budget is 10%, full-stop.

Think absolutely. It’s what you’re making, safely, that counts; not what somebody else is making, or losing when the S&P 500 crashes, as it did in March. Those are the wealth-killing moments you not just want to avoid–you need to avoid.

Our portfolio management goal here at Signals Matter is to avoid such crushing downturns by building an all-weather portfolio that can continuously meet or beat your benchmark in all market environments. That’s what we’ve done this year-to-date by simply avoiding March’s horrific collapse.

As Matt so often reminds, making money starts with not losing money. Bookmark that; it’s true and it’s our objective that you profit without losing, without having to stomach what I call downside volatility (much more to come on that subject).

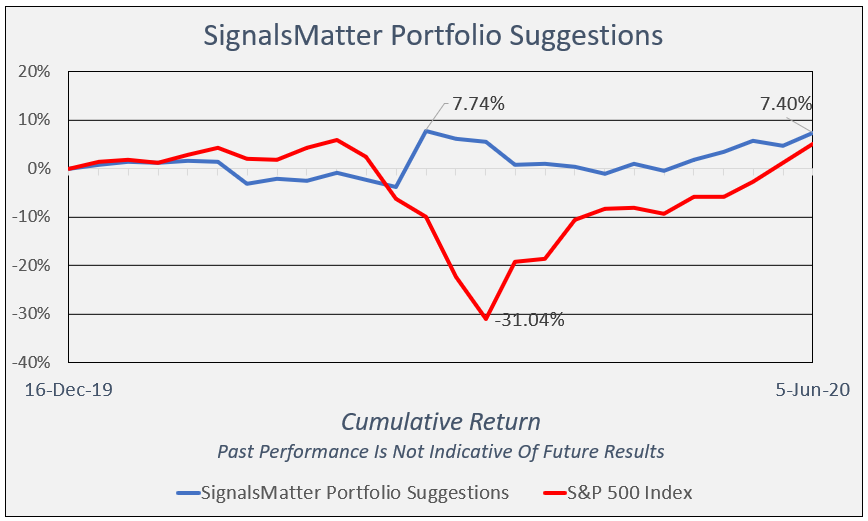

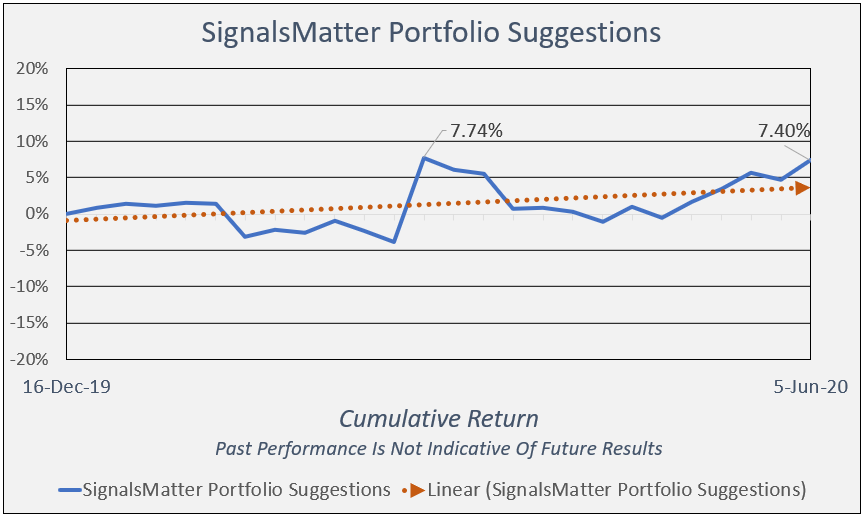

Here’s our All-Weather Portfolio performance, from mid-December of 2019 to last week’s end. If you’d invested as we and our Subscribers have since mid-December, you could have missed that 31% drop in the S&P, and just gone fly-fishing with me (or have joined Matt riding some silly horse in the Dordogne), avoiding the crowds and media noise while worrying more about your catch than your loss.

With concepts of benchmarking and absolute-return investing now in our toolkit, let’s move on to two fundamental patterns that we use when constructing that All-Weather Portfolio, namely Sector Rotation and ETF Flows.

Pattern recognition comes in all shapes and forms, so we’ll contain our discussion in this Market Report to just these two, which are prominently displayed, and updated weekly for our Signals Matter Subscribers.

Sector Rotation

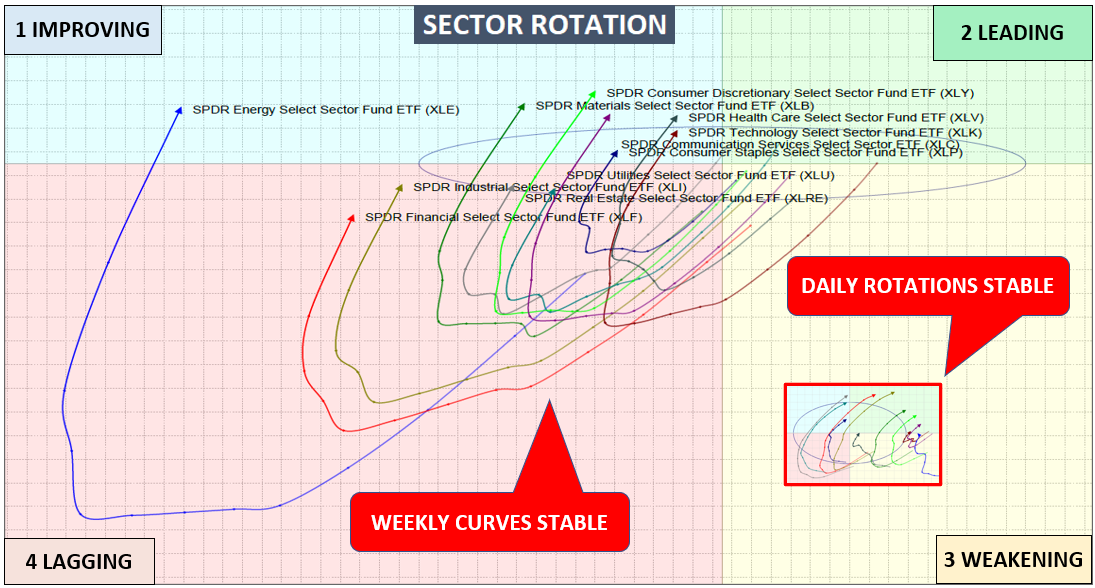

As most experienced traders and investors know, picking the winning sector is the key to solid portfolio management. But how do you know which sector is hot, cold or warm? Is it Energy? Technology? Consumer Staples? Well, we know…Let’s show you the way.

Sector rotation is a theory of patterns with much practical value across whatever range of securities you may chose. For our purposes here at Signals Matter, on the equity side, we like to track the SPDR Sector equity ETFs to see if we can gauge where sectors (and markets) are going vs. where they’ve been, based on the direction of key sectors, where movements are driven by momentum, flows and patterns that smart investment managers can track, and which we do for you every day.

So, we cluster and track the 11 SPDR Sectors according to their relative motion, compared to our trusty benchmark. No surprise here: the benchmark we use is an absolute-return benchmark, just like the one we suggested for you, a rate of return, not the rising or falling S&P 500 Index!

Sectors are hot until they’re not, as you can see in the example Sector Rotation chart below which tracks sector strength and weakness like a Doppler radar, weekly.

Sectors rotate across all timeframes. When they’re hot (circling up from lagging to improving), investors are camping on.

When they’re not (circling down from leading to weakening), it’s time to sell or go short, a strategy we deploy here at Signals Matter so we can make money no matter the direction of the overall markets. (We’ll get to shorting a bit later when we describe our Portfolio Solutions.)

As you can see above, these circular movements are fairly predictable as they have a fundamental basis: they are connected with market cycles and volume flows. With the phased-shift in the performance cycle of sectors, an informed investor can continually hop from a sector that has peaked to another that is oversold and thus potentially about to rise.

Tracking Sector Rotation is not a set-it-and-forget-it investment strategy. It entails decidedly-active, not passive portfolio management. It requires periodic review, simple holdings adjustments, patience and discipline (we provide all of that for you), but does have the potential to outperform passive index investing all day long.

Market Flows

Here’s another valuable tool – tracking Market Flows. To catch salmon, you need to know whether their swimming upstream or downstream. Make’s sense; you need to cast to where the fish are going, not where they’ve been.

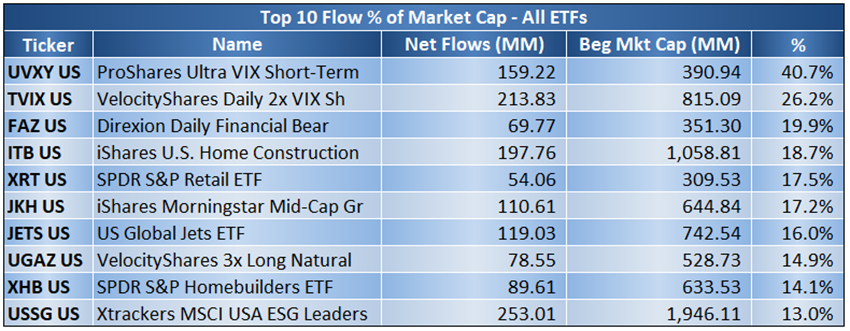

It’s the same deal when it comes to stocks, bonds, sectors, ETFs, whatever we chose to track. Wouldn’t it be wonderful to know if investors are piling into a particular sector or actively-managed ETF, or bailing? After all, that too confirms what’s hot and what’s not.

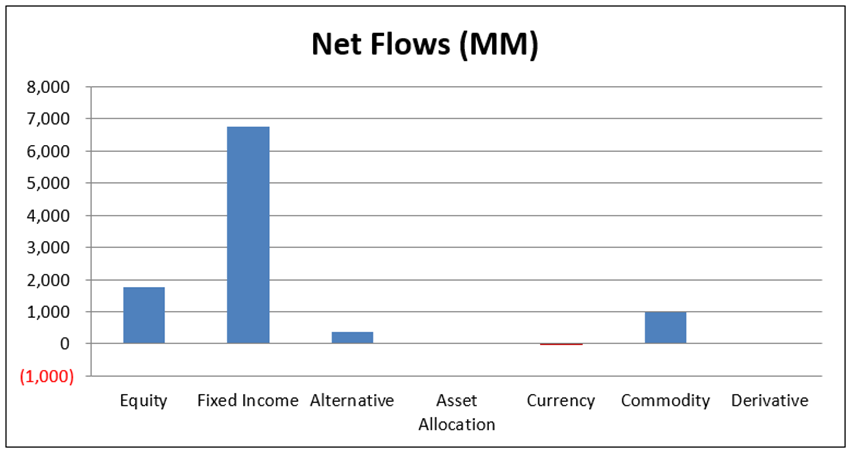

Market Flows are essential, often predictive, and that’s why we post them for Subscribers to see and for us to use and base recommendations for those Subscribers that leave the driving to us.

By example, lately, ETF Flows have favored fixed income and leveraged, precious-metal ETFs, short-term VIX ETFs, and bear (i.e., “inverse” or “short”) financial ETFs.

That means investors are expecting an uptick in volatility and a downtick for financials. Thus, we follow the flows as the market signals direct.

All in, the recent ETF Flows below were conservative in nature and hedge-oriented, suggesting caution ahead. Flows (i.e., the market signals not the media pundits) told us precisely which ETFs were being bought or sold.

We could, honestly, go on and on describing tools like these that we use when parsing investment opportunity and building portfolios for Subscribers, but to contain the word count here, let’s move on to the Matt’s favorite topic, the macro (big picture) environment to see whether the macro confirms the micro rotations and flows that we have just described.

When the micro (as per above) and macro line up, we have a powerful conviction as to where to go, what to do, what to invest, and by how much.

Next, we’ll describe some of our favored macro building blocks within a proprietary tool we call Storm Tracker, our industry-leading indicator of what’s ahead at the big-picture level.

We’ll touch on highlights, but to drill down, be sure to download our FREE 5-Part Storm Tracker Series that takes you behind the tent of what I’m about to describe.

Storm Tracker

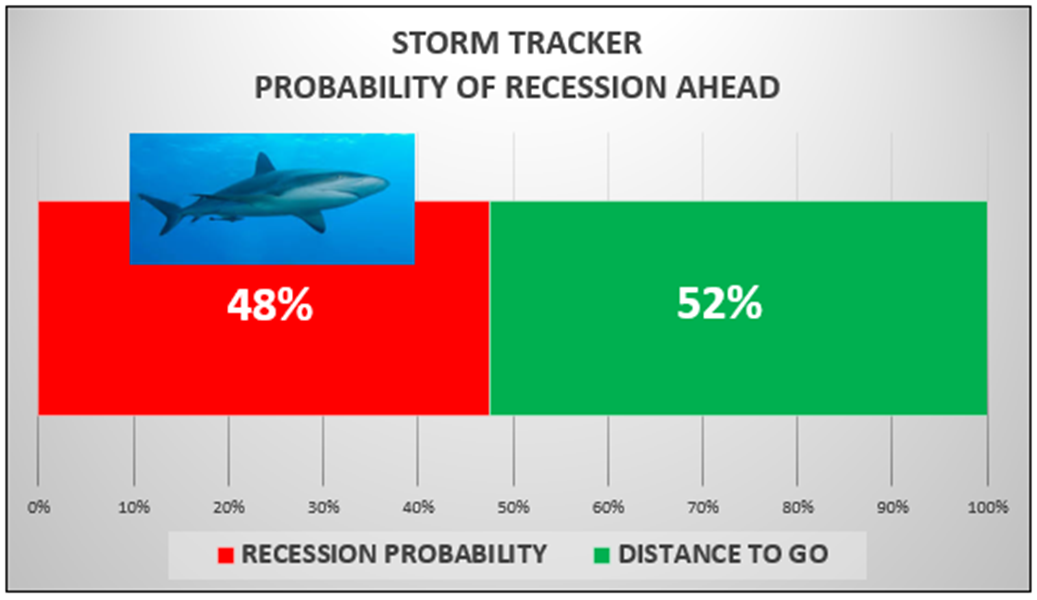

Storm Tracker is a probability gauge of foul weather ahead, complex in its derivation, but simply displayed for Subscribers.

For months now, Storm Tracker concerns have been running hot, in the 50% range, confirming that risks are high, despite massive intervention by the Fed, which we neither fight nor fully trust.

Storm Tracker Components

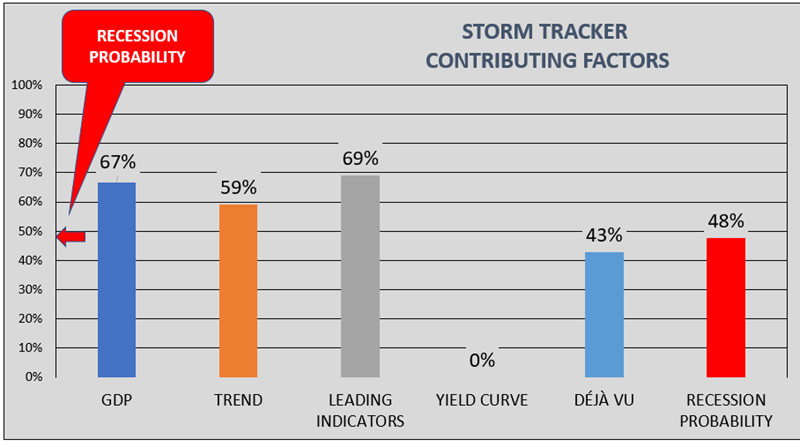

Components to Storm Tracker (or Drivers, as we call them) are detailed in the 5-Part Storm Tracker Series, but here are the cliff notes.

Storm Tracker tracks five essential macro-economic indicators. If you’re going to invest wisely, you need to know what the macros (i.e., the real-world data) are telling you.

Macro makes all the difference when it comes to knowing how much risk to take, let alone where to invest, or whether it’s wise to fully trust the Fed when the macros are tanking, as they are presently.

In a recent version of Storm Tracker, nearly all five macro components were elevated into the red zone, which was not comforting. In short, no time for going all-in, even if the sell-side pundits on TV have you drinking their Kool-aide.

Save for the yield curve (admittedly and temporarily controlled by the FED), trends in GDP (Gross Domestic Product), global market patterns (Trend), a host of Leading Indicators, and “Déjà Vu,” our proprietary market timer, were unanimously signaling: Caution Ahead!

We’ll spare you too much detail here, but below you can see an example of how we display these macros to Subscribers, refreshed each week with ample commentary.

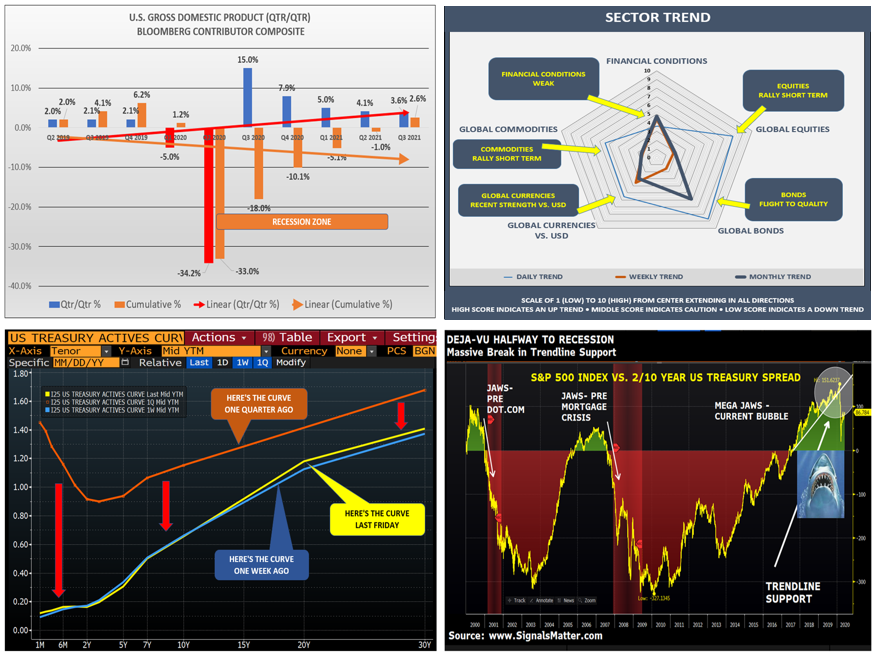

In a nutshell, GDP plots growth (i.e., the horrific lack of growth at present); Sector Trend plots trend (monthly, weekly, and daily) across global indices of stocks, bonds, currencies, commodities, and financial conditions; the Yield Curve plots the can-kicking effect of Fed policy; and Déjà Vu lets us know how close we are to a recession, as it did just prior to the dot.com bubble of 2000, the Great Recession of 2008/09 and, most recently, helped us avoid the COVID-crash in March.

Plain and simple, at Signals Matter…

Summing up, in a nutshell, these macro signals we’ve described, and others we look at, are telling us…

- This Lockdown Recession is going to take us well into 2021, if not beyond;

- Daily trends are improving, but those weekly and monthly trends still look horrible, except for bonds that have benefitted from a global flight-to-quality and gobs of artificial Fed support;

- The US yield curve has been swiftly taken down to the zero-bound level by the Fed, as a strong wrestler takes down a weak opponent; and

- Our recession timing indicator has broken trendline support, big-time.

On to building portfolios, now. We’ve saved the best part for last.

Your Portfolio

By now, you’ve got a pretty good sense of where we’re headed when it comes to building portfolios. But the buck stops here, with our management of Your Portfolio.

Combing Sector Rotation, ETF Flows, Storm Tracker macro trends in GDP, global markets, leading Indicators, yield curves, and our proprietary Déjà Vu, we’re all set to build a Suggested Portfolio, objectively, as follows.

Objective #1: Our first objective is for you to stay safe, stay out of harm’s way. Here, we rely on Storm Tracker. If Storm Tracker probabilities are running hot, at 50%, we’ll suggest a 50% cash position. It’s that simple.

The fancy lads call this risk management or cash-hedging; we call it common sense based on available data.

To keep you safe, we monitor Storm Tracker each week. If it rises, our cash recommendation rises. If it declines, cash falls. Simple. Understandable. Transparent.

We do the math for you. All that Subscribers have to do is take note of Storm Tracker revisions, week-to-week, with the following caveat…

It’s not unusual for some of our Subscribers to have a cash-stash elsewhere, equivalent to the 50% we’re suggesting. In such cases, Subscribers could allocate fully to our Suggestions, for the Suggestions are always diversified in nature, pointing to what’s working now.

We deploy the Honor System here. Those investing as do we, without the recommended stash of cash, but rather fully-allocate to our Suggestions, are taking too much risk when market risk is objectively this high. Full stop.

Objective #2: Our second objective is that you make money the safe way, with our Suggested Portfolio, by allocating to all or a portion of the suggested securities.

Some of you want to cherry-pick? Fine. We have Subscribers that do that across multiple websites, the difference being that a single Portfolio Suggestion at Signal Matter can cover the cost of Subscription for an entire year, as we’ll see shortly.

Objective #3: We want you to have fun. Stop worrying about the pundits, the Fed, or the noise. Enjoy your life and family. Do something else than worry about portfolio management. We’ll do the heavy lifting, and show you the data on the back-end, so that you too can trust, but verify.

Objective #4: We want you to take full advantage of a coming opportunity to build generational wealth here as Signals Matter, a tale told in our recent Amazon Best Seller, Rigged to Fail.

Rigged to Fail is your broader guide to what’s wrong, what’s broken, what’s fake, and what’s not, and of course, what’s to come. The book is not a revenue source for Signals Matter, with prices ranging from $0 if you’re an Amazon Kindle Member to $14.95 for a paperback version. Instead, it’s a source of blunt facts with untold numbers of charts to keep you an informed investor.

Rigged to Fail is a 5-Star-rated, No#1 New Release on Amazon for a reason. It’s blunt-spoken and spot on. You can order your copy of Rigged to Fail here: Rigged to Fail on Amazon.com, or we’ll order it for you should you choose to subscribe.

Moving on…

An Artful Science

Investing and portfolio management is neither an art nor a science. It’s an ‘artful science.’ It’s based upon the art of conceiving a winning strategy, not upon the science of algorithmic trading and back-testing, a trick which we see almost everywhere online.

Transforming all that we’ve shown you so far (from rotations to flows to macro and more) into a simple portfolio that works with low downside risk, is an artful science indeed.

It takes decades of experience to derive an artfully-scientific portfolio. Rather than assemble hedge funds for fancy lads, however, Matt and I founded SignalsMatter.com because we wanted to keep it simple and to share the best signals with the real world—i.e., YOU.

Having been on the buy side, the sell side, the trading and hedge fund side of Wall Street, gives us veterans at Signals Matter a distinctive edge, with yet a further advantage: We’re not conflicted.

Matt and I don’t earn a percentage on Subscriber return generated by our portfolios. Financial advisors and hedge fund managers do, and they charge a whole lot more for portfolio management than a Signals Matter subscription, as we’ll see further on.

Their conflict is this: they don’t get paid unless you are invested. At this moment and at every moment, Wall Street has you all in, fully-invested.

We do not. Instead, we are quick to recommend a considerable cash position during risk-off market environments, despite the tempting Fed-steroids of late. By the way, we don’t care how long those steroids last because a) we know how it ends (badly) and b) we know how track markets not fantasies.

And for the rest of the portfolio, we deploy that artful science that encourages far more diversified, far more risk-averse, and far more stable portfolios than traditional (and dangerous) 60/40 pie chart portfolios.

That’s why our portfolio returns looks like this—slow, steady and smart:

Here’s how we do it, we adjust for risk.

The Truth is in the Return, Adjusted for Risk

This is a really, really, really important concept and our final thought before we walk you through a few Portfolio Suggestions that have covered Signals Matter subscription costs for our Subscribers.

The truth is not just in return; it’s in return, adjusted for risk—i.e., it permissions a great voyage without the icebergs or sea-sick pills.

There is ‘return,’ and there is ‘risk.’ Most investors (and their advisors), to their peril, focus on the return part, not the risk they take in achieving the return. Makes no sense to us. NONE AT ALL.

For example, in the Signals Matter Performance chart above, our return for the period is 7.40%, which means, by the way, that we’ve nearly met your 10% Family Benchmark bogey in just half a year.

The risk for the period, however, is a bit harder to calculate and thus most advisors talk past this part.

We openly address risk by calculating the volatility in the return stream (i.e., swings up and down, or what fancy lads call “standard deviation”). Risk over the period totaled 3.02%, significantly less than the 7.40% return delivered. That’s huge; we made a lot more than we risked.

There’s another way to measure or ratio this that helps when comparing portfolio performance with other performances, like the S&P 500 Index performance, by this example.

By dividing the absolute return above of 7.40% by the associated volatility of 3.02%, your return/risk ratio (called a ‘Sharpe Ratio’ by the fancy lads) was a wonderfully, industry-beating 2.45x.

That compares to the meager 0.68x ratio for the S&P 500 Index over the same period, since there was really no significant return for the S&P, but a whole lot of volatility—remember March?

In sum, markets are celebrating the recent and record-breaking Fed-rally, but when you compare that against the equally sickening crash (i.e. loss) that preceded it, the markets haven’t done much more than make most investors sea-sick, stressed and confused.

But there’s one more step that’s key here when measuring performance, so please stick with me here. I’m going to dive one level deeper by separating volatility (risk) into two flavors—good volatility and bad volatility —which flavor would you prefer?

You see, there are two kinds of volatility associated with every return stream: upside volatility (fast-moving gains, which we crave) and downside volatility (fast-moving losses, which we hate).

Let’s accept the upside volatility, the fast-moving gains, for what they are. After all, when building portfolios, we’re solving for upside volatility. Upside volatility is something we want (which I once dubbed ‘the good cholesterol’ for Futures Magazine back in 2008).

We’ll just strip out the good volatility out of our ratio calculations so we can concentrate on the bad. Then we’ll measure the return of our portfolio, compared to just the downside volatility (the ‘bad cholesterol’).

Et voila. Dividing our portfolio return of 7.40% by its downside volatility of just 1.15% yields a ratio (‘Sortino Ratio’ to the fancy lads) of 4.90x. That’s an off-the-charts awesome Sortino Ratio, folks.

As for the S&P 500 Index over the same period, dividing the S&P’s period return of just 3.41% by the downside volatility that investors had to suffer, namely 4.28%, yields a ratio of 0.80x, which is pathetic in our world, and in your world too.

Now you know benchmark your advisor.

By these performance measures (which are the correct industry standards), the Signals Matter Sharpe Ratio (ROI/overall volatility) was 3.6x higher than the S&P’s; and our Sortino Ratio (ROI/downside risk only) was 6.2x higher. That’s simply a huge difference.

Again: The truth is in return, adjusted for risk, not just return alone.

If you’re new to Signals Matter (i.e. post-April 30, 2020), and you’d like to do a 30-minute Zoom call with me on these concepts; or if you’d like me to run a risk analysis on your portfolio and derive your return/risk ratios; and receive a FREE copy of Rigged to Fail delivered to your address on file, be sure to check these Limited Time Offers when you Subscribe Here.

Ok, now the moment we’ve been leading up to. Here are some examples of our Portfolio Suggestions that drive these robust performance ratios.

Our Portfolio Suggestions

Each week at Signals Matter, we refresh our Portfolio Suggestions by tuning them to the rotations, flows, and macros that we have transparently shared.

We do cheat a bit though, to be perfectly honest, because we see more than we could possibly show you in a website format, and we call regularly upon our 50-combined years’ of experience of deploying tools and strategies like those described above to have kept our clients safe over all these years.

On to some specific trades…

US Global Jets

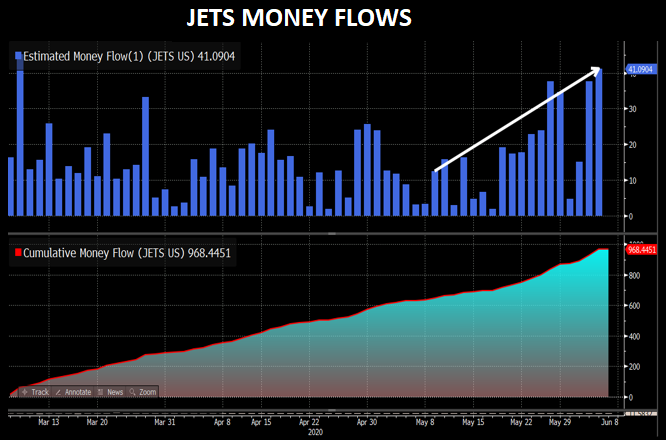

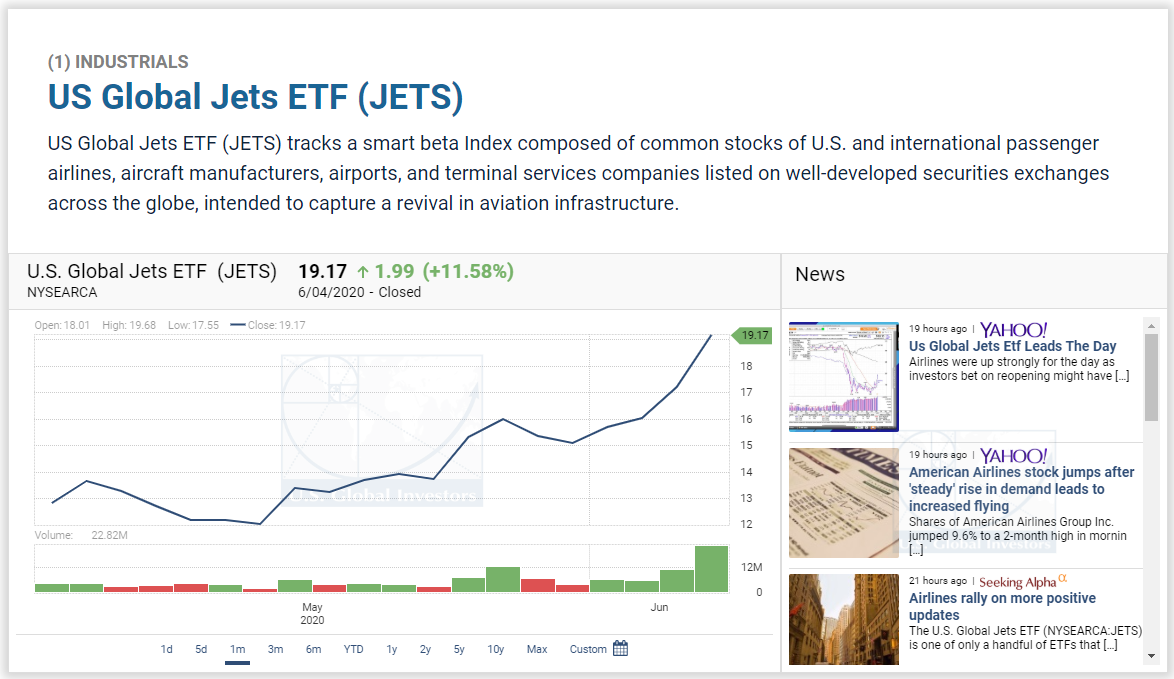

US Global Jets (JETS)For example, we suggested Subscribers consider investing in the US Global Jets ETF (JETS) at the open on May 4, 2020, at $13.00/share.

The US Global Jets ETF (JETS) is an actively managed basket of common stocks of US and international passenger airlines, aircraft manufacturers, airports, and terminal services companies listed on well-developed securities exchanges across the globe. The idea here has a macro objective of capturing the revival in aviation infrastructure in a post-COVID 19 market environment.

We put the trade up as a Suggestion on May 4 because, among other criteria, ETF Investor Inflows were building nicely, supporting the macro story. Investors had been noticeably buying JETS as far back as March 2020, figuring folks would get back in the air at some point.

Here are the flows…

Remember, investor flows precede price momentum time and time again, so come May 4, it was time to put JETS up as a Subscriber Portfolio Suggestion. Besides, aviation infrastructure, from airlines to airports, had been massively oversold on a Sector Rotation basis.

Here’s the trade, as pictured for Subscribers on the back-end of our website:

As a technical note, take a careful look at the bottom of the chart above, and you’ll see that the display is set to 1-month. Many of our Suggestions have a 1-month duration, but for analysis purposes, Subscribers can adjust the chart anywhere from a day to 10 years or more by clicking on preferred timeframes. All charts on all suggestions are refreshed in real-time, each time you refresh the page. Up-to-date news articles on each Suggestion is displayed to the right of each chart, just a click away.

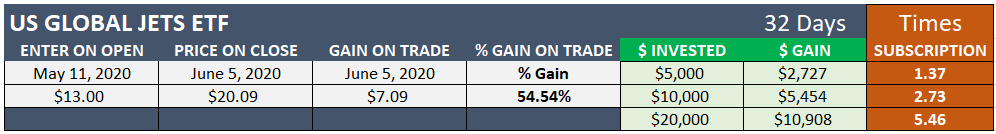

And here are the results:

We’re still in the JETS trade, with an open gain of +54.54% in 32-days. A $5,000 investment in JETS on May 11 paid for an annual ($1,997) subscription to Signals Matter by 1.37 times. A $20,000 investment paid for more than 5-years of annual subscriptions.

Here’s another.

Amplify Online Retail (IBUY)

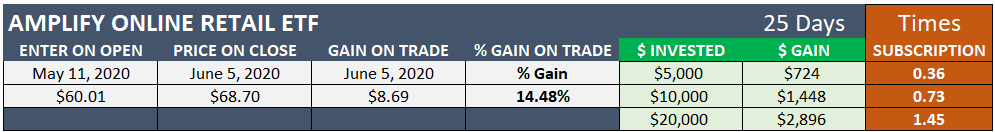

Here’s another active trade on the site, the Amplify Online Retail ETF (IBUY), which tracks the EQM Online Retail Index of equity securities that generate at least 70 percent of their revenues from online purchases, 75% exposure to the United States and 25% exposure to international markets.

The macro for this trade is pretty straightforward. COVID-19 has everyone trapped indoors, globally, so consumers are going online for all manner of needs, COVID-related or not.

Here are the results:

We’re still in the IBUY trade, with an open gain of +14.48% in 25-days. A $5,000 investment in IBUY on May 11 covered a third of an annual subscription to Signals Matter. A $20,000 investment paid for a full year and a half of annual subscriptions.

We’ll close by showing two examples of hedged trades that helped our Subscribers avoid the 34% plunge in stocks from February 20 to March 23, for we too had some long Suggestions on the books. Markets looked soft, so we simply hedged them as follows.

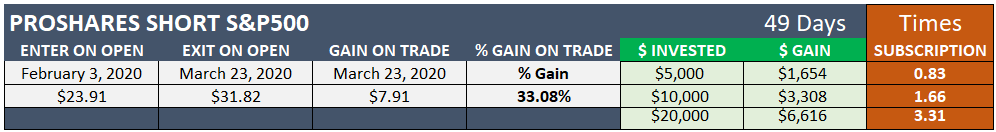

ProShares Short S&P 500 (SH)

In early February, as COVID-19 was gaining momentum, in addition to a lot of safe fixed income suggestions, we recommended the ProShares Short S&P500 ETF (SH) that tracks the inverse (opposite) of the daily performance of the S&P 500 Index. The idea was to get short the stock market with a simple ETF.

Here are the results:

We closed out the SH trade on the open on March 23, with a gain of +33.08% in 49-days. A $5,000 investment in SH on February 3 nearly covered an annual subscription to Signals Matter. A $20,000 investment paid for a full 3-years of annual subscriptions.

And finally, this play on rising volatility:

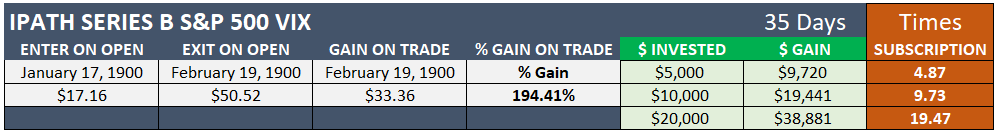

iPath S&P 500 Volatility Index (VIX)

By mid-February, markets were looking even worse. We were making money in SH, and investor flows were chasing rising volatility, so we suggested a long position in the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX), an exchange-traded note that tracks the performance of the S&P 500 Short-Term VIX Futures TR Index. Buying the VXX is a long volatility play that would gain if market volatility were to rise as COVID-19 continued to spread.

As it turned out, volatility not only rose, it spiked to levels not seen since the Great Recession. Here are the results:

We closed out the VXX trade on the open on February 19, for a gain of +194.41% in 35-days. A $5,000 investment in VXX on May 11 covered nearly 5-years of annual subscriptions. A $20,000 investment paid for nearly 20-years of annual subscriptions.

Our Value Proposition

Naturally, as noted, the $-gains across our Portfolio Management Suggestions are primarily driven by the size of investment made, as we describe in some detail in our FREE Investment Primer, where we table a cost-benefit analysis vs. Wall Street Advisors for assets ranging from $100,000 to $1 billion.

For an account size of $1 million, the $1,997 annual cost at Signals Matter compares to a $12,500 cost for a financial advisor, providing a $10,503 Subscriber savings each and every year. The subscription cost for a $1 million investor works out to 20 basis points (0.20%) a year, or $5.47 a day, the price of a morning latte and a muffin.

The value proposition is clear. One, two, or three winning Suggestions is all it takes to pay for an annual Signals Matter subscription. We post 10 Suggestions each week, that’s 520 Suggestions annually, or say 300 new Suggestions a year, taking into account Suggestion longevity.

When we win, we win big, when we lose, we lose small. It’s just that simple; but as you can see, it’s not always that easy if you don’t have the tools and signals to follow.

Case closed. It’s your turn now. Click Here to Subscribe to Signals Matter.com.

Summing Up

Thanks for powering through such a long Market Report. We’ll leave you with these concluding thoughts.

According to scores and scores of subscribers at Signals Matter, here are the top-10 needs and wants which they’ve expressed:

- They want trade suggestions that will work in a COVID-19 environment;

- They want portfolio solutions that protect, without missing the upside;

- They want an all-weather portfolio for all seasons and market condition;

- They want to see and understand how to invest and what’s driving markets;

- They want thoughtful daily updates on what’s going on;

- They want an edge when it comes to making money—i.e., by not losing it;

- They want to fact check their brokers and other advisors;

- They want to protect their money and their families;

- They want to learn; and

- They want something different, yet verified and transparent

If you’d like to meet them and see what they have to say, click here for literally hundreds of happy Subscriber Testimonials.

Testimonials are the most credible source of information you could have when considering a subscription to SignalsMatter.com or any online portfolio service, bar none. In the end, it’s not what we say that matters. What matters is whether what we say matters to others.

That’s our story. That’s how we invest and protect, not just in a COVID-19 environment, but in any environment.

That’s why we have over 1,000 followers, with a marketing budget significantly less than Goldman Sachs or Morgan Stanley, two places we know quite well, as we prefer a more candid, informed, absolute-return approach.

And that’s why we want hundreds more because, shamelessly, we’ve been doing this for more than 50-combined years; we know what we’re doing, and we’re committed to sharing what we have learned with everyone, not just the fancy lads.

For us, that’s the fun part. Total independence, total candor.

Until next time, be well, stay safe, and adjust those portfolios for risk!

Sincerely, Tom & Matt

Subscribe to Signals Matter Here