Below we offer investment solutions as a necessary compliment to the endless list of market risks and macro problems we report upon each week for free to all investors/readers.

Over the past six months, our daily lives have been dramatically impacted by a global pandemic and its controversial policy-reactions, changing how we view and value the world around us and how we interact within it and its markets—as well as how we interact with those closest to (or distanced from) us.

Investors find themselves facing levels of uncertainty never experienced before.

Problems, Problems, Problems—But What About Investment SOLUTIONS?

Our readers, of course, are used to me reporting on all the macro problems we and our markets face, from Fed policy over-reach to disingenuous data reporting from DC, or from over-valued bond markets and stock markets rising to dangerous heights despite a global economy clearly on its knees.

And yes, it’s important to face and understand such staggering problems. Our readers and subscribers are certainly well informed as to what’s wrong out there…Again, we wrote an entire book, Rigged to Fail, which makes these problems obvious.

But investment solutions, of course, matter too.

In fact, micro solutions are easier to see once one confronts the reality of the macro problems.

And as to specific ways investors can address all of the snowballing problems and risks percolating at the macro level, it’s important to share the micro-level signals, tools and steps you can take today to avoid the inevitable pitfalls of tomorrow.

Below, then, we ask: What investment solutions can we act upon today?

Solutions, Solutions, Solutions.

Toward this end, we’ve written numerous free reports on how we carefully and bluntly build portfolios at Signals Matter to solve for those many macro problems we share with the public each week.

Thus, as we turn now to investment solutions that folks can implement today, much of what we will be covering below is somewhat repetitive, but worth repeating—and more importantly, worth consolidating into a single report.

So, here we go.

Investment Solution Number One: Toss Out Your Passive, 60/40 (or 80/20 or 70/30) Stock/Bond Pie Chart Portfolio.

Again, I’ve already written here and here about the ignored dangers of such traditional portfolio construction in a now totally non-traditional market environment.

Those traditional (yet still peddled) passive portfolios are literally rigged to fail for all the reasons discussed in prior reports.

But if these old-school portfolios are really so dangerous, then why are they still so popular?

One Reason for the Popularity of Traditional 60/40 Portfolios: Safety in Numbers

One reason for the continued presence of such 60/40 pie chart portfolios is that big firms like Goldman Sachs, Morgan Stanley, and UBS, or online juggernauts like Wealthfront or Betterment.com and even the smaller advisory shops down the road, see safety in numbers.

In short: Most financial advisors (online to across town) think alike.

Tom and I know these traditional “strategies” and services all too well, and here’s a secret: They are driven: 1) by fees not savvy, and 2) by bull market support (luck) not risk-management “skill.”

In fact, for any college grad with a FINRA license, it takes about 10 minutes to build such a traditional, 60/40 stock bond “diversified” portfolio.

The rest of the advisor’s time is then spent raising assets for fees and seeking clients on stale concepts supported by consensus.

Another Reason: Traditional 60/40 Portfolios Really Did Work

In fact, we respect the fact that such passively managed 60/40 approaches to investing have had a massive run.

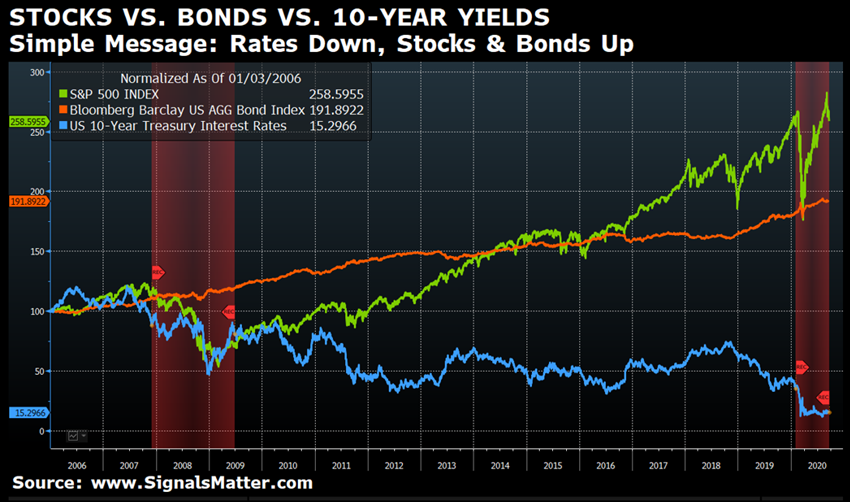

Just have a look at the chart below.

Using 1) the S&P 500 Index as a proxy for stocks (Yellow Line); 2) the Bloomberg Barclays US Aggregate Bond Index as a proxy for bonds (Red Line), and 3) the US 10-Year Treasury Note as a proxy for interest rates (Blue Line), Tom and I have plotted just how well stocks and bonds have fared in the last decades of a falling interest-rate falling environment.

During this amazing run, interest rates (as measured by the blue yield on the US 10Y Treasury) have tumbled from a high of 5.3% to a low of 0.52%.

Falling interest rates reward stocks (yellow) and bonds (red) alike.

And as made clear above, stocks have made the most significant contribution to P&L, with bonds plugging along, up and to the right as well.

In short: As interest rates (blue) continued to be forced down, stocks (yellow) and bonds (red) rose together.

Why?

For stocks, corporate debt carry (i.e. the cost of debt) was cheaper. As interest rates fell, interest expense fell too, boosting profits and earnings per share for stocks. Hence stocks went up.

For bonds, it’s a bit trickier.

As interest rates fell, new bonds were issued at even lower interest rates, providing less income to investors. So, new bond buyers flocked to the older (i.e. 10 -Year) and higher-priced bonds, thus bidding their price even higher, as graphed above.

Rising Bonds and Stocks, Compliments of the Fed

For decades, Fed “Intervention” has manipulated (repressed) inflation by intentionally repressing interest rates, not only because they wanted to, but because they had to in order get us (or at least Wall Street) out of multiple recessions.

Taking the Federal Funds Rate to zero or near-zero has greatly favored financial assets (and passive 60/40 portfolios) for decades.

As interest rates have declined, traditional, passively-managed portfolios have thus outperformed active managers because falling interest rates have been the key driver behind passive investing.

But here’s the rub: These traditional portfolios won’t protect you in all conditions—not any more. Full stop.

Passively managed portfolios will get crushed when rates rise, which means that stocks, including those in the dangerously topping and “upward-melting” Nasdaq will also get crushed.

For example, the current market party is seeing more hangover warnings of “uh-oh” ahead, as Bloomberg’s Kyoungwha Kim noted on Bloomberg’s Markets Live earlier this week.

09/21 Nasdaq Crisis Far from Over

By now many would have thought we would get clarity on whether the U.S. tech stocks rally would revive or fade away. The jury remains out on that, though Thomas Lott, co-founder of Signals Matter LLC in Washington, D.C., is among those who expect the next 10% move for the Nasdaq will be a decline. Below is an excerpt of his emailed comments:

- The easiest part of markets’ rebound was engineered by the Fed’s stimulus, so “the hard part is just ahead, complicated by virus mutations, a divisive U.S. Election, a falling U.S. dollar, an MMT new normal” and a “we’ve never been here before problem” narrative.

- The greatest experiment ever has been undertaken by global central banks, which will work until it doesn’t.

- “We do know that little of this Fed stimulus money is going to be used productively, to build growth/GDP. We do as well believe those long rates will rise at some point and when they do, bonds are going to get crushed and so are stocks, the end of the 60/40 portfolio.”

Source: Kyoungwha Kim, Bloomberg Markets Live, Hong Kong

The Bottom-Line Risk of Traditional, 60/40 Portfolio Thinking

If bonds and stocks rise together in an artificially controlled low interest rate environment, they can and will fall together when those same rates incrementally begin to rise.

In other words, the critical yet almost totally ignored problem with traditional 60/40 stock/bond portfolios is that today they are in fact more correlated than they are the diversified.

As such, all that these co-rising assets really offer in the current bull-run of Fed Experimentation peddled as “accommodation” is de-worsefication, not diversification.

Such policy tailwinds have created a dangerous sense of complacency among investors, who like to believe that stocks and bonds will just keep going up together for the simple reason that interest rates will stay down forever.

Such fantasy-thinking means most investors aren’t seeing the risk-reality signs ahead—i.e. how this low-rate tailwind is and will slowly run out of wind-speed.

After all, we are now at 0% rates—how much lower can we go before the Fed tailwind simply stops?

Unless interest rates fall below zero (which we’ll save for another Market Report), they’ve gone almost as low as they can go, which means the ride up we’ve been enjoying for years in both stocks and bonds is approaching a dangerous turning point.

Today, investors are not getting paid a whole lot to hold bonds. It follows, therefore, that bonds themselves don’t have a whole lot of runway left to appreciate.

So much for the 40% bond “support” in the 60/40 passively-managed, traditional portfolio.

The so-called “diversity hedge” for bonds is thus illusory, leaving stocks unprotected and exposed whenever the bear emerges from his cave.

But when (not if) rates rise, stock-issuers, who survive off of low-rate debt roll-overs, will start to tank as well.

So much, then, for the 60% stock “support” in the 60/40 passively-managed, traditional portfolio.

Stated simply, traditional portfolios which rise together in an artificial, Fed-created bull markets, will not “hedge” each other in the next bear market, they’ll simply tank together.

Thus, and to repeat: If you really want an immediate portfolio solution, simply get rid of the traditional 60/40 pie chart portfolio which the vast majority of advisors are pushing today.

Investment Solution Number 2: Manage Volatility

Since my autumn 2018 volatility warning from Malibu (of all places, good grief), global stock markets have experienced unparalleled volatility, with historic drawdowns followed by equally historic recoveries.

This type of volatility can be disastrous for the average investor, as most do not know their risk tolerance until it is too late.

And even if they did, most don’t know how to contain risk when it comes to portfolio investing.

So, what can investors do today, to contain that volatility risk?

Shamelessly, the easiest solution is to subscribe to our service and follow our constantly updated (i.e. active) portfolio recommendations…

But readers want more than a sales-pitch; we get this.

Thus, here are is another tip we can offer (after decades of trading through every kind of market cycle) to help investors manage rising market volatility, namely:

Investment Solution Number 3: Use Alternative Asset Classes as Opposed to Just “Bonds” to Protect Your Portfolio

Informed, reality-conscious investors understand that actively-managed investing (not passive investing) is critical to building a truly diversified portfolio, the kind of diversification that dampens volatility.

This specifically means actively allocating to “alternative” asset classes—i.e. anything other than just traditional stocks and bonds. More on this below.

Unfortunately, however, many investors understandably don’t know how to track, select or measure such alternative asset classes—and so they stick to stocks and bonds.

We recommend that such investors realty-check their own advisors and seek out better diversification instruments, as signaled.

However, if you or your advisors are unable to effectively address and execute this task or read these signals, well…just join us at Signals Matter.

Why?

Because unlike traditional advisors (and their traditional 60/40, passive pie chart portfolios), we understand the following:

Better Portfolios Are Meaningfully Diversified Portfolios

Better performing portfolios in the current and entirely non-traditional “New Abnormal” need to be meaningfully-diversified portfolios, a notion that extends beyond the common understanding of most investors.

Meaningful diversification is not about stock vs. bond, growth vs. value, or high-yield vs. investment grade bond diversification.

It’s about allocating smartly across less-correlated stocks, interest rates, bonds, real estate, currencies, commodities, precious metals, countries, sector-focused funds, alternative asset classes, long and short, actively-managed ETFs, mutual funds, and more.

Toward this end, here are the key principals we follow:

- Diversified holdings demand uncorrelated investing.

Meaningful diversification contains portfolio volatility. - Containing portfolio volatility lowers risk.

Lowering risk leads to higher risk-adjusted returns. - Higher risk-adjusted returns drive profitability.

And keep you safe in all weather conditions.

Memorize these words. Understand them. Pin them on your mirror. Net positive performance is all that matters, which means that not all portfolio selections are going (or need) to be winners.

If they were, they’d all be correlated. And as we’ve learned, if they’re all correlated, when they tank, they’re all going to tank together.

If you think you are diversified when your adviser puts you in growth stocks vs. value, or in high-cap vs. low, or in consumer staples vs. technology, forget it.

These are all stocks. When the bear shows up, they’ll all be eaten alive. In a crisis, everything correlates to 1 in the equity markets.

Of course, almost no one sees this during Melt-Ups or grotesquely over-extended bull markets handed to us by decades of seductive yet dangerous Fed “support.”

Spaghetti Against a Wall

At Signals Matter, we go the extra mile to assure meaningful diversification by combining investment slections that are uncorrelated, and that will therefore not move in synch when adverse market events occur.

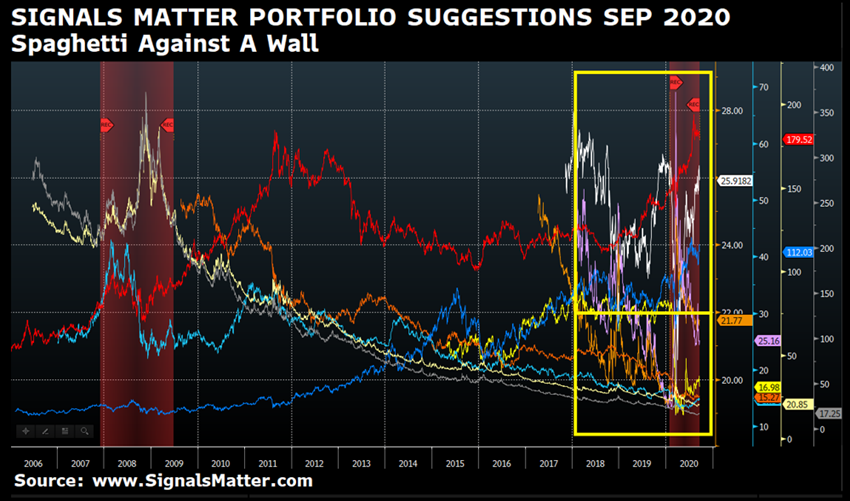

In the chart below, we plotted 10 ETF portfolio suggestions on our books in September 2020.

We call this “Spaghetti Against a Wall,” for this is precisely the desired outcome.

Put your hand in a bowl of wet, cooked spaghetti and toss it against the wall or on the floor. It’ll look like a mishmash, just like our charted portfolio selections.

At a single glance, you can see that the September Signals Matter portfolio is as diversified as the spaghetti on the wall.

Nothing is moving in synch. There are no common variables, like declining (or rising) interest rates.

Now take a look at the embedded yellow box in the graph above. Our goal is simply this…to be in the upper two-thirds of the box, where the winners reside.

The non-performing suggestions in the lower third of the box provide our ship’s ballast. The ballast keeps our portfolio afloat in any weather condition because it flattens the sea’s water (volatility) in our portfolio.

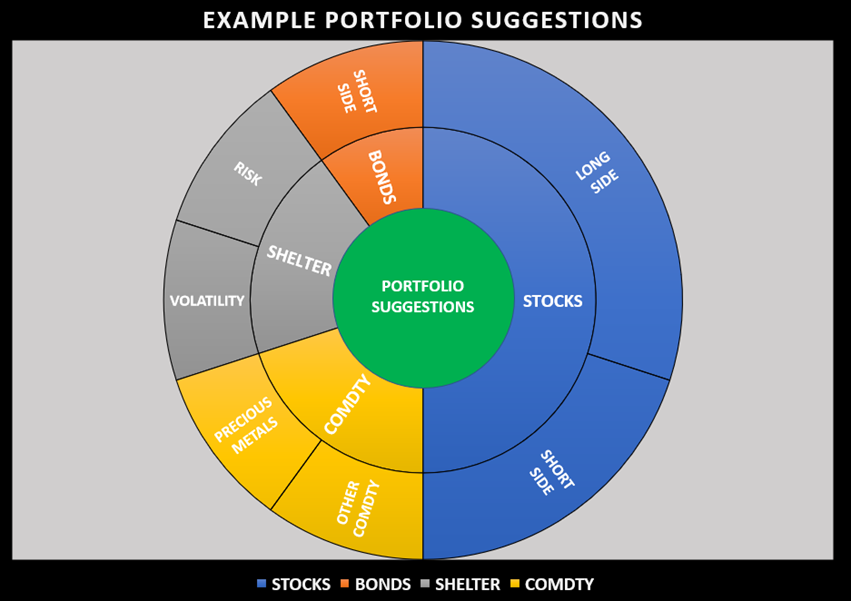

Organizing Our Spaghetti into a User-Friendly Pie Chart Portfolio

In the portfolio below, we remove the spaghetti from the wall and put it into a user-friendly pie chart.

Our pie chart includes the very same allocations in the graph above, i.e. ten ETF portfolio suggestions that are meaningfully diversified because:

- The portfolio is not just about stocks and bonds.

- Within stocks and bonds, some positions are long; others are short.

- Commodity suggestions are in full display.

- Other suggestions, i.e. investments in risk and volatility, are also included to shelter the portfolio.

(As a refresher on long and short, we are “long” the market when we expect a security to go up; we are “short” the market when we expect a security to go down. The universe of ETFs includes ETFs with holdings that allow us to be long or short. By example ProShares Short QQQ (PSQ) is an ETF that does just that; it seeks daily investment results that correspond to the inverse (opposite) of the daily performance of the NASDAQ-100 Index.)

The Proof is in the Pudding (Made from Our Spaghetti)

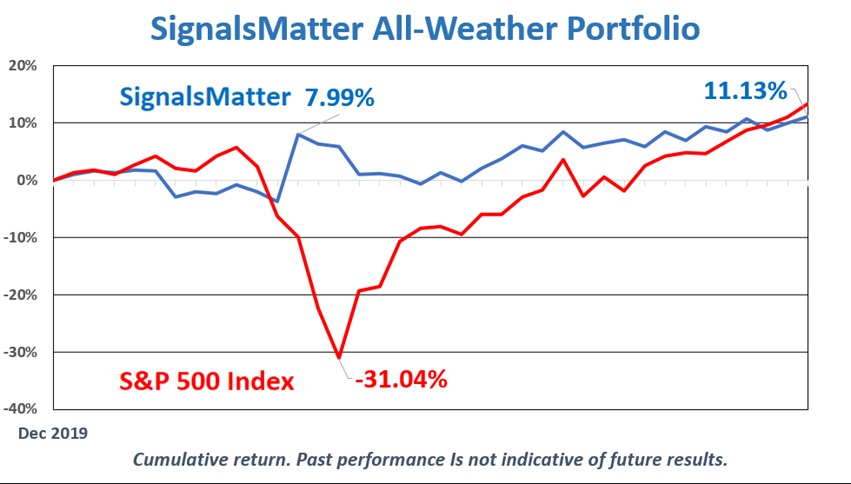

Diversifying portfolios the Signals Matter way kept our subscribers safe back in February and March of 2020 when Covid-19 hit and markets (as well as 60/40 portfolios) tanked.

Did we psychically prep the portfolio in December or January, knowing that C-19 was about to shatter markets?

Of course not.

We simply did what we do every day of every week. We make informed decisions based upon hundreds of signals. We diversify our portfolio suggestions our way, to build wealth reliably.

See for yourself. Our results are real, not back-tested.

Informed Investing | Foundational Tools

In this Market Report, we’ve shared the science of portfolio construction. But constructing portfolios that hold up in all-weather conditions is more than a science.

It’s an artful science, built upon decades of informed investing, market cycle discovery, meaningful diversification, expert technical analysis, deep competency in risk containment, and knowing which benchmark to use.

Combined, our foundational tools are geared to generate and protect your wealth reliably.

Please visit www.SignalsMatter.com for a full description of our Portfolio Service and our underlying portfolio building blocks, which we call Market Insights.

Our Market Insights are foundational to smart investing. They give us and you an informational edge. Knowing what’s valuable and what’s not is essential.

Going the Extra Mile

That’s why we go the extra mile at Signals Matter to educate and inform on what we do and how we do it, so you can learn how to build portfolios yourself, or just leave the driving to us.

Either way, if you’re into smart investing, Join Now to get started. You can meet our hundreds of happy subscribers and learn what they have to say about our Portfolio Service Here.

Stay safe. Stay informed, and stay properly invested the Signals Matter way.

Matt & Tom