Below, we look at stocks, bonds, central banks, and the inevitable bursting of the market bubbles in which we currently bathe.

Drinking Wine

Oh, we do live in interesting times…

I was chatting with an Australian vineyard owner the other day near Solvang. He asked what I did for work. I told him. Then he looked at me and said: “It’s all gonna blow soon, ain’t it?”

I drank his wine and said: “Yep.”

Then again, I’ve been saying that for years…

That’s why macro views aren’t as important as market signals. After all: Signals Matter!

I recently posted some videos on the bear v. bull arguments for 2018 as well as the risk v. reward profile of what top-chasers can expect (and patient money can anticipate). If you’d rather watch me than read me, feel free to click above. I recommend you do both.

For now, let’s take a step back and consider our “interesting” economic landscape as we enter our 109th month of an entirely debt-driven and central-bank created “market cycle.” Toward that end, I’ll open with a metaphor –a device I do so enjoy…and it’s the same one I offered to my wine owner.

Matt’s Metaphors…

The image I have is a beautiful little desert village with fruit stands in the streets, children running through sun-bathed flower beds, and yuppies driving blissfully about in convertibles listening to Michael Bolton’s Greatest Hits.

The sun is shining, not a cloud in the sky. All is well, as far as the eye can see. And up there, on the distant horizon, sits a massive dam, behind which millions upon millions of gallons of deadly river water are pushing.

And somewhere, hidden among the walls of that great dam are a group of very nervous folks dangling from repelling ropes with their stubby little fingers plugging holes which are now appearing with increasing frequency.

The image I like to use includes Ben Bernanke, Alan Greenspan, Mario Draghi, and Janet Yellen scurrying from hole to hole to hole shouting for more corks, fingers, or even silly putty to keep the great dam from, well, crushing them (and the village below) to death…

So where am I going with this?

Well, think of that blissfully naive village as the global market economy, that slowly decaying dam as central-bank “magic,” and those ever-rising water levels as the current debt market, stock bubble, and totally ignored fear-index.

Global Markets: The Blissfully Ignorant Village Square

Now let’s look at each aspect of my silly metaphor, starting with the naive little village.

Today, the global markets have become quite complacent. There is very little fear as the MSM and Wall Street’s sell-side cheerleaders pump out earnings and “synchronized global growth” memes with all the positive furor of a Michael Bolton solo…

After all, why be worried?

Since that unfortunate little sub-prime banking crime and bailout in 2008 (aka the “Great Recession”), the Nasdaq 100 is up 220%, and the Russel 2000 (RUT) has climbed by 105% (and counting). Earnings projections out of the Street are promising double digit percentage growth into 2019, balance sheets are heralded as “strong,” and the S&P is expected to easily hit 3,000, which it may.

In fact, things are looking so good in this perfect village that insurance salesman are making a fortune taking in premiums for selling flood insurance to homeowners they know will never need it.

[This by the way, is the market equivalent to that fancy term called “selling vol”—i.e. what hedge funds like Bridgewater ($125B in AUM) do: selling market puts (and collecting premiums) for a market that never seems to go down. After all, who would ever “short” (buy puts) a perfect market?]

So, there you have it, the markets and the world are like gleeful children laughing and running through fields of flowers and cotton candy. All is well. Smile 😉

The Central Bank Miracle Dam

And why shouldn’t all be well?

After all, privately owned banks disguised as something “federal” (i.e. like the Fed and its cadres of PhD-carrying supermen) and departments like the US Treasury (and its cadres of bureaucratic yes-sayers) discovered the miracle cure for all market risk in 2008.

Namely: If markets ever go dramatically down, just print trillions of dollars, crank rates to zero, and let the smart central bankers rather than natural market-demand “buy” good times. In fact, it’s such a great plan that central banks all over the world are doing it too! Yippee-Yay!

Such an elegant solution! Think of all the possibilities. The Fed can buy all the government (and toxic sub-prime mortgage) debt that no one else wants to buy and thereby prevent an otherwise deserved credit crisis and yield shock; rates are crammed to the floor so companies on every exchange can borrow trillions upon trillions of dollars to buy back their own shares and pay dividends so that share prices skyrocket, markets reach all-time highs, and confidence soars to the moon.

And as confidence in the Miracle Dam soars, Wall Street rolls out its bubble-head pundit de jour (typically compliments of the big banks’ sell-side staff) on left and right-wing media pulpits, who tell us that culture-saving wonder companies like Facebook and Amazon will surely lead us to greatness as ETF’s enjoy a 5X inflow (growing from $800B in 08 to over $4T today).

I mean, where else but in a miracle market could a small handful of brilliant FANG stocks (FB, AMZN, et al) reach a market cap from pre-08 billions to the current $4.2T (!) number while trading at 39X net income and 32X free-cash flow?

Such efficiencies! Such wise valuations! Such obvious “creative capitalism” at its finest. Bubble? What bubble???!

Meanwhile, market front-runners (and their high-speed algo-efficiencies), who see all this central-bank support have also joined the party. For years, they have been buying up all the securities the Fed has “forward-guided” them to buy, making the bond market a veritable levered free-lunch of front-running since 2008, rising day after day after day in price and thus pushing yields (i.e. “borrowing costs”) down and launching a miraculous, debt-driven keg party on bond floors across the globe!

Again: Yippee-Yay!

Hats off to central-bank planning and miracle markets. Hats off to Greenspan and Bernanke! Best of luck on their book tours! And please, buy more Amazon and Facebook—Tech is saving the world! And don’t forget TESLA—it’s a miracle too!

But wait…

What about all that water pushing against that dam? And what about all those holes popping up on its walls?

Those Millions of Gallons of Dangerous River Water…

Here’s where the idyllic picture above turns a bit, well, darker.

You see, market forces, like raging rivers, can only be contained for so long. If the dam is made out of clay (or PhD’s), it just might burst despite its impressive surface shine.

And market forces (unlike the market salesmen, which comprise 90% of Wall Street) today are telling us loud and clearly that this raging river water is about to burst through that miracle dam.

What are the signs? Well, first, even those great minds at the magical central banks know that if you print trillions of dollars out of thin air to “support” or “stimulate” markets, you run the risk of a few (and often unmentioned) “side-effects.”

For example, if you support a market artificially for too long, you run the risk of market “addiction” to the “stimulus.” That is, markets become overly reliant on good times, low rates, continued “risk-free” borrowing and continued “buy at any price” investing.

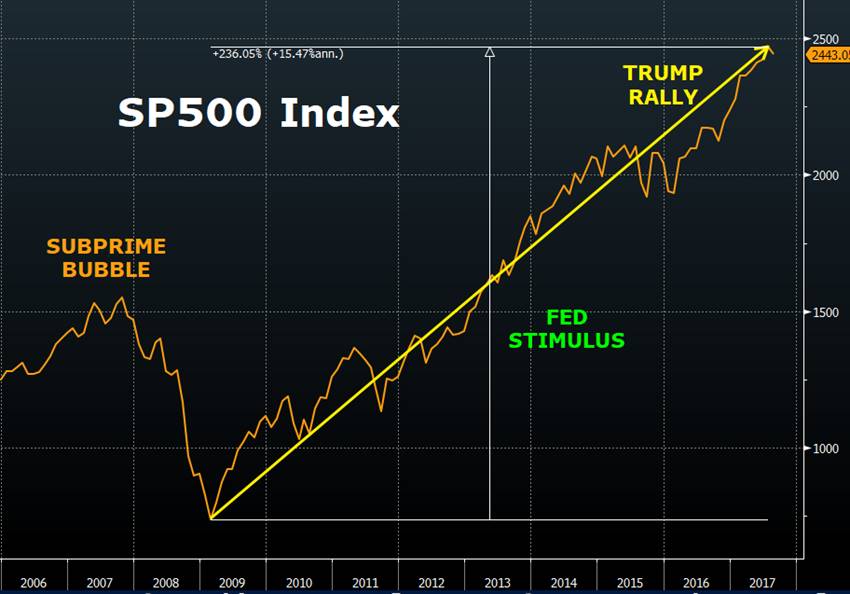

This kind of addiction might explain why the S&P since 2008 looks like this:

When markets believe in miracles and memes (like the “Fed has our back,” “earnings are strong” or “global synchronized growth” will save us), money flows too quickly and thickly into over-valued securities.

The 5X expansion of the ETF vehicle since 2008 is a perfect example. Equally symptomatic of this dangerous “flow” are the high-frequency algo traders who pump fast money into rising markets to catch the market “trend.”

Evidence of the dangerous over-valuation that follows dangerous money flows is all around us. We see it in the CAPE indicator, in PE Multiples, in massively over-valued sectors, individual stocks, exchanges, and spreads. I’ve written at length and separately about each of these symptoms and recommend clicking through the above links if you need more math to support these conclusions.

And add to this dangerous market wave the countless number of bond traders front-running the central-bank-created (and grossly distorted) bond and rate markets, one quickly sees that the size and speed of this dangerous flow only increases—thereby creating more holes in that market “dam.”

And lest we forget, artificial low rates (nod to the central banks) also makes borrowing so easy that publicaly traded companies are buying buy back their own stock at record levels and at peak valuations, thereby momentarily boosting the markets even more.

Of course, the moment rates rise, this short-sighted boost becomes a fatal head wound.

The symptomatic evidence of the bond-market dangers and flows are even more obvious. As central banks buy trillions worth of sovereign, bank and sub-prime debt from Toledo to Tokyo to Turin, yields (and hence rates) get temporarily compressed (from the low 1-2% range in the US, to negative yields overseas).

This compression creates a borrowing binge and feeling of safety (in everything from Real Estate to Securities) which ALWAYS (and like a coiled spring) precedes a major market panic, sell-off, recession, and hence downturn. ALWAYS. Just look at market history.

In good times, as markets are rising, such dramatic and “stimulated” flows increase the pace of rising returns and the dangerous psychological consequence of over-confidence and over-exuberance, such as we are seeing now in the “village by the dam.”

But here’s the rub, for the very forces/flows (i.e. ETF’s, algos, front-runners, and over-confident, central-bank supported stock purchases and historical, debt-driven stock buy-backs) which cause markets to rapidly rise, are also the very same forces and vehicles which cause markets to sell off and collapse—and at a much greater speed.

Remember: Markets fall much faster than they climb.

Now, holes are appearing all over the walls of the magical dam, and the central bankers are running out of fingers by which to plug them.

In a debt driven “recovery” such as handed out to us by the Fed in 2008, the experiment fails if GDP and Main Street growth are not rising. Sadly, since 2008, neither GDP (annualizing at 2%) or Main Street have grown.

What has grown (or “inflated”) is the stock and bond market. Unfortunately, they’ve grown to historical “bubble” levels by every metric. Every metric.

The Fed (like the central banks in Europe—see Italy—and Asia) also know that they can’t print money forever to buoy up bonds and keep borrowing costs (rates) down. To do so would risk destroying their currency and flirting with the inflation elephant in the room.

On the flip side, central banks also know that if they don’t buy otherwise unwanted bonds here and abroad, then rates and borrowing costs will skyrocket.

In a post-08 “recovery” driven by QE, low rates, and debt, a rising yield/rate environment is the end of the party, the end of the “magic,” and the end of the happy village meme.

In short, rising rates represent the proverbial “Oh Sh!#” moment in the life of our “magical dam.”

And guess what?

Rates are rising.

I’ve written about this here, here, and here. Please take a look. It’s not to be bearish, it’s to be prepared.

Not only are central banks like the Fed and ECB now tapering, ending, or reversing their bond buying (i.e. the “QT Two Step”), the Treasury will be issuing more bonds ($1.2T by 2019), which mathematically means $1.8T of supply and demand forces are returning and the magical dam is decaying.

In short, as bond supply rises and demand falls, rates have nowhere to go but up.

Rates are rising. And there won’t be enough fingers in the dam to prevent a long-repressed market river from drowning the village below…Even Ray Dalio, the great “vol seller” who front ran this magical dam for years at Bridgewater knows the vol trade (selling vol) is nearing its end…All financial assets are grotesquely over-valued, and as for me, I just can’t wait to short the hell out of Facebook and Amazon.

But that requires signals, not blogs. 😉

As always: Be careful out there.