This summer’s markets are staring down the barrel of great risk and very little reward; portfolio safety will hinge entirely upon which sectors and asset classes are loaded in your portfolio.

For me, summer means horses and horsing around with close friends, and my two-legged friends are asking me the same thing: When will this overbought US market bubble “pop”?

The short answer is this: I have no idea, but that doesn’t mean we shouldn’t prepare, as the risks are now obvious, as are certain rewards.

As of this writing, stocks continue fall across the major U.S. exchanges, with the DOW (down 1.36% yesterday) leading the way. Nothing major, but the trembling is undeniable, as are the warning signs from the VXX, which tracks the CBOE Volatility Index, up 7.46% (its highest level in 2 months) as equities squirm nervously.

Inflation fears are sending metal prices up and semi conductor’s down. Meanwhile, the Fed, as always, is supporting risk asset markets with ever-more “stimulus”—an “emergency mode” response now in its 12th year, despite Bernanke’s promise it would end in 2010…

In short, the so-called “experts” are nervous, yet they are pushing many risk-blind investors further out on the risk branch.

This always puzzles us.

The Risk Blind

Psychologists, poets and philosophers have written for centuries that many who have eyes refuse to see, and many who can think, refuse to think clearly–all for the simple reason that some truths, like the sun, are just too hard to look straight into.

Or as others have said more bluntly: “Truth is like poetry—everyone [fricking] hates it.”

When it comes to bloated markets, debt orgies and helicopter money, the rising fun of such “stimulus” is embraced, yet the template for its equally market-tanking, social-destroying and currency-debasing consequences are simply ignored.

The same is true when it comes to the “great inflation debate,” which is simply no longer a debate but a neon-screaming reality playing out in real time and growing more pernicious before eyes otherwise blinded by calming Fed-speak and bogus inflation reporting.

Each passing day, the evidence of the inflationary cancer beneath the smiling surface of our still rising markets and “recovering/opening” economy increases, and thus, like it or not, the inflation topic just won’t and can’t be over-stated enough.

In short: Here I go again with the inflation thing… (next week I’ll re-address the deflationary argument).

From the Grocer to Buffett: Inflation is Obvious

Extreme US “stimulus,” vaccine rollouts, Europe’s eventual reopening, and rising commodity costs are accelerating the inflationary tailwinds which everyone from grocery store clerks and home builders to Warren Buffett can no longer deny or ignore.

As facts rather than theories confirm, commodity prices have surged from steel to copper, or corn to lumber while precious metals steadily rise against COMEX price fixers, CPI lies and other unsustainable boots to the neck of a coiled gold market positioned for big moves into late 2021 and beyond.

Commodities, of course, represent the cost of goods, and when they soar, retail prices generally aren’t far behind, as seen (and growing) daily in the rise of food, home construction, auto, and other everyday purchases—you know, things that matter.

Meanwhile, as corn, copper, aluminum, and lumber pricing heads north, ESG bets for renewable energy, power grids, and electric vehicles are also booming.

According to Bloomberg NEF (or BNEF, a Bloomberg strategic research provider), the price of copper alone is up more than 90% in the past year and is expected to nearly double by 2050, while demand for other low carbon technologies like electric vehicles (lithium is up 93% YTD) and solar panels are expected to balloon as well.

Blind Experts Leading Blind Investors

Despite such clear inflationary gusts, openly laughable figures like Powell at the Federal Reserve and other central banks continue to remain calm about inflation, encouraging their economies to run hot, allowing demand to accelerate against shrinking supply chain forces—which just adds more inflationary fuel to the global economic fire.

As we’ve said countless times, the central bankers want to have their cake and eat it too; meaning: They want to inflate (and lie) away their debt yet keep the cost of that debt repressed.

Such manipulative data rigging results in crushing Main Street families/savers with intentionally under-reported (but openly felt) inflation while simultaneously gifting central bankers (and Wall Street’s asset bubbles) with more artificially repressed yields and low debt tailwinds—which means an even bigger debt bubble and an even more dangerous securities market/bubble.

Yet bigger debt bubbles, of course, are also the perfect historical and mathematical set up for an inevitable economic and market catastrophe.

As usual, of course, our financial leadership will not tell you this.

Instead, their job is to roll out the adjectives, policies and poker faces to deny (and extend) this catastrophic inevitably as well as their central role in creating it.

Many investors, sadly, will follow such trusted “accommodation” to new (and coming) needle-peak highs in risk assets like soldiers marching into a line of freshly painted cannons.

Facts Are Stubborn Things

But as we like to say, facts (like cannister shot) are stubborn things, and the facts keep flying in the face of policy fictions by the hour, minute and second.

Consider the following market facts…

The US Treasury Inflation-Indexed Curve (interest rates less inflation), for example, remains negative out to 30-years(!).

Folks, this means you are getting zero return for massive and unprecedented bond-bubble risk.

At the shorter end of the curve, it’s far worse. You are getting negative (rather than just zero) returns for massive bond bubble risk.

The moment you buy a short-term treasury, you are literally paying Uncle Sam to lose you money.

Meanwhile, the Fed is buying those unwanted IOUs from the same Uncle Sam for the simple reason that nobody else wants them.

The U.S. government’s $40 billion sale of four-week Treasury bills last Thursday, for example, went off with a yield of 0%, and that was before subtracting for inflation.

The last time a Treasury auction touched levels this low was in March of 2020, when anxious investors poured cash into money-market funds at the pandemic’s outset.

With inflation rising along with the rising demand for commodities, both unlikely to subside, it seems only a matter of time before these repressed interest rates and yields rise temporarily from the floor of history, at which point the Fed will have no choice but to print more money and repress those same yields.

Why?

Because in order for Uncle Sam to have any chance at all to pay his interest expense on $30T in otherwise unpayable public debt, yields and rates MUST be suppressed.

Policy Fictions Are Expected Things

Meanwhile, of course, the Fed will maintain that they can “control,” “allow,” or “target” inflation like a thermostat in one’s home, which represents the kind of delusion of a surfer who claims to control a wave’s height on the North Shore of Oahu or a polo player claiming to control the speed of a wild mustang without reins or a saddle.

In addition to QE (i.e., printed money) for the banks and markets to the tune of $120B per month, we now have QE for the people to the tune of trillions per year as stock earnings (and markets) once again hit record highs in a tidal wave of new M1 and M2 money supply which the Fed is now seeking to hide from public view.

Politicians, of course, will speak and spend to buy votes with zero regard for economic risk or history as investors give zero regard to market risk.

This double whammy of money for banks and money for the masses (including another $2T in Biden deficit spending) will hit the headlines with fanfare while the “re-open trade” will likely send markets higher, seducing the un-hedged investor class into a bliss that will end in tears once central bankers lose control of the bond and rate markets.

Meanwhile, consumer prices are skyrocketing on the backs of rising (hand-out money) demand and shrinking supply. Of course, low supply and high demand means one thing: Price inflation.

In our surreal post-COVID new normal, restaurants can’t find waiters, building companies can’t find builders, and car companies can’t find parts—all of which leads to price-driven inflation in things consumers need—food, shelter and transportation.

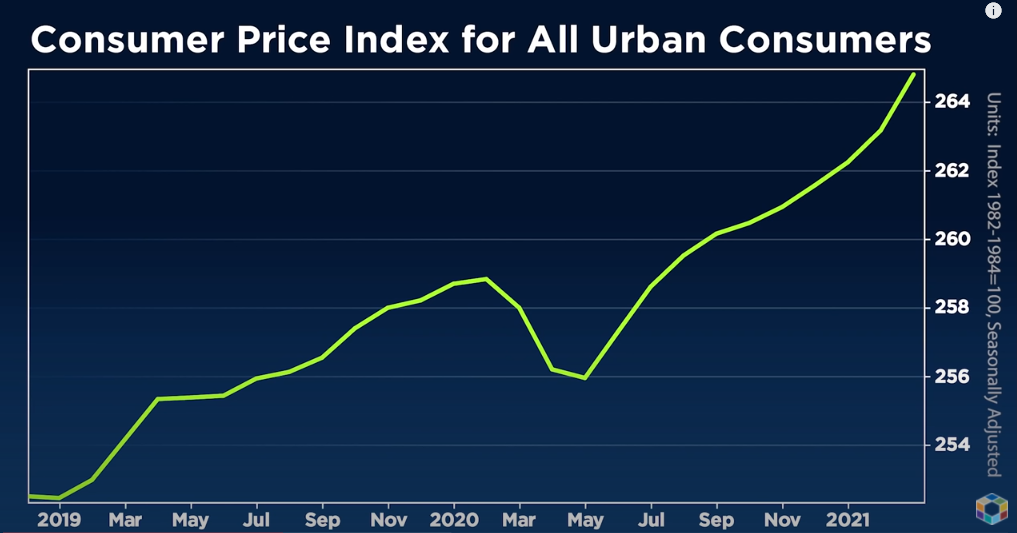

Meanwhile, the Fed will spin its web of now transparent lies in a CPI-measured inflation scale that has creeped to a “sustainable” 2.64%.

But what those Fed-heads are neglecting to mention is that while the CPI is at 2.64% today, it’s in fact growing at a rate of 4.3% (compounding average rate based on monthly numbers).

So, there you have it: Rates rigged to the floor and inflation heading for the sky—the ultimate backdrop for precious metals in the months and years ahead.

But for those still rolling their eyes and claiming such inflation figures or projections are just the delusions of a gold-bug, let’s get back to math, data and facts rather than illusions, labels or tired debates.

“Substantial Inflation”

Warren Buffett, for example, is anything but a gold bug, but the key theme and concern of his latest Berkshire Hathaway shareholder meeting is about the arrival of “substantial inflation” due to rising prices.

In case the brief commodity discussion above hasn’t made rising prices crystal clear, let’s just do a deeper dive on a few more pricing facts (and surges) which confirm actual inflationary price pain far more accurately than the comical CPI scale used by the Fed.

Year to date, and despite that “2.6% CPI inflation read” above, prices have risen by the following percentages for the following “real world” goods and assets:

Gasoline Up 47%

Crude oil Up 31%

Heating Oil Up 8%

Propane Up 26%

Natural Gas Up 15%

Lumber Up 70%

Corn Up 54%

Wheat Up 41%

Sugar Up 14%

Cotton Up 12%

Lean Hogs Up 56%

Beef Up 12%

In short, if every product needed to feed, house, clothe and move consumers is rising by high, double-digits, how can we trust a Fed or CPI scale that tells us consumer pricing is hanging at the “allowed” 2% range?

In short, how can 2+2 = 2?

Fantasies Are Seductive Things

Markets will and can continue to rebound and rise on the backs of such government stimulus, lies and inflationary number-crunching.

For those with an appetite for risk and Fed support, we fully get it. Ride the Fed’s risk-asset wave!

But bring a life-jacket, because that wave is a killer.

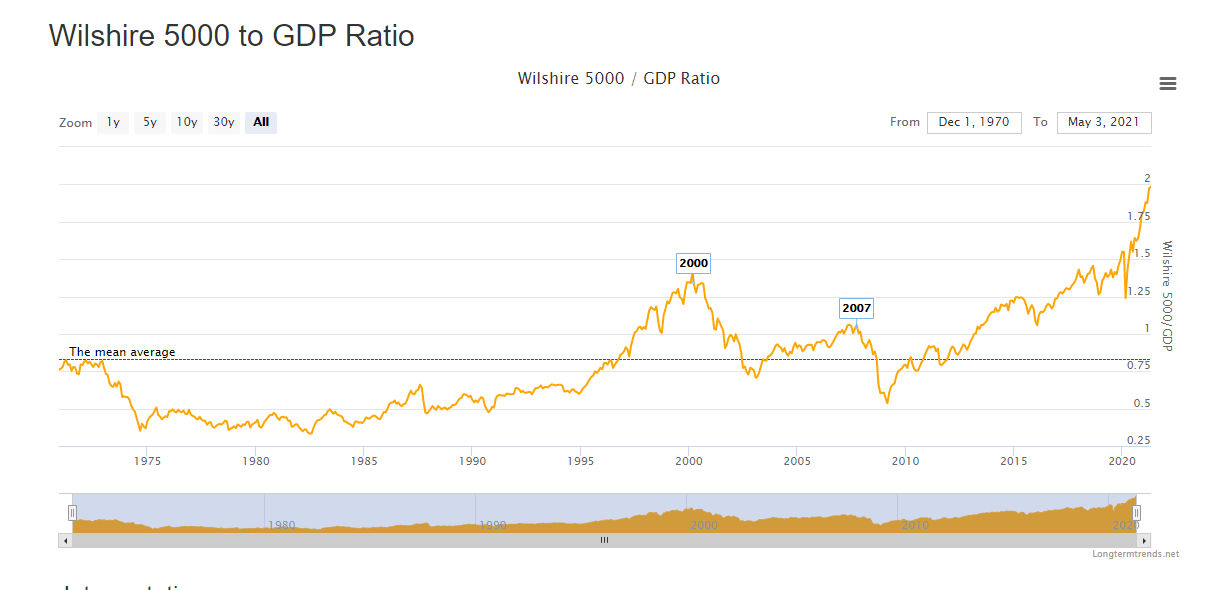

US stocks have never, not ever, been this expensive, as the current market cap of US stocks to US GDP has never, not ever, been this high—higher even than the dot.com bubble of 2000—when Treasury yields where 6% not 0%.

As for bonds, when your real yield is negative, that just makes credit instruments even more expensive and over-valued than current record-high stock valuations.

Unlike that 2000 dot.com bubble, moreover, investors can no longer go to negative-yielding bonds for “safety” and yield.

In short, good luck with that stock and bond wave when it crashes, as all waves (bubbles) do.

Where to Paddle?

For those looking for a safe place to paddle in this new, surreal “normal,” all conversations, and all market waves, eventually land upon gold.

Always have. Always will.

And yet there are still those hugging equity ETF’s and tech stocks who boldly claim gold is over-priced, despite stocks openly mocking every single metric of sound valuation.

Hmmm.

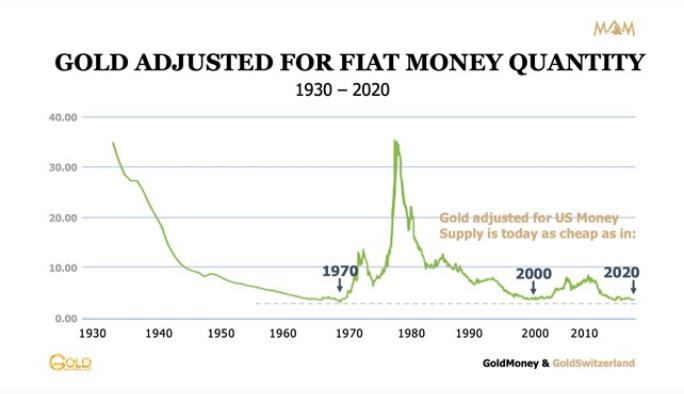

In fact, when measured against U.S. money supply, gold is extremely undervalued, even when using its 2020 price high.

The following graph shows that gold was as cheap in 2020 as it was in 1970 (when gold was $35) or in 2000 (when gold was $288).

Furthermore, given that inflation is now obvious and rising, and given that rates, even if they naturally rise, will be un-naturally repressed by the Fed seconds later, the perfect setting for gold (which is inflation grossly outpacing bond yields) is as much a foregone conclusion as one can make for the near and distant future.

Thus, those looking to swing at a fat pitch and invest for the long term in an asset that will rise in price while simultaneously hedging against now obvious inflation and equally obvious currency debasement, the gold solution is axiomatic rather than theoretical or speculative.

And for you speculators looking for value rather than just Fed-induced trends rising over-debt-jagged rocks, the large cap gold miners are producing gold (at $1000) well under the current spot price ($1780) and are thus poised to sky rocket when gold makes its move well above last August’s highs.

Just saying.

De-worsification: Traditional Portfolios are Very Dangerous

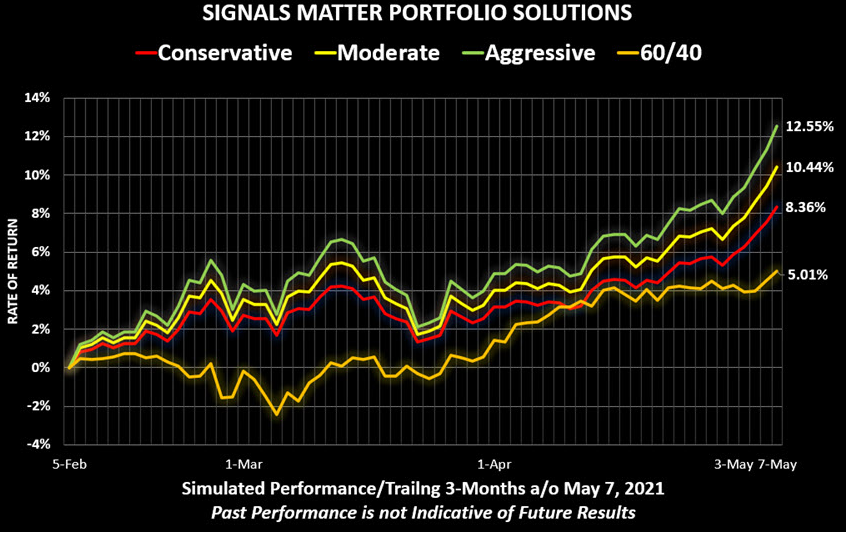

As we’ve written here, here and elsewhere, if you still follow the consensus-think of nearly all (CYA) traditional portfolio advisers who “de-worsify” you into a “diversified” pell-mell of various stocks and various bonds, you are literally investing into diversified portfolio of risk rather than reward.

Stocks and bonds are correlated assets in historically extreme overbought territory; rather than hedge each other, stocks and bonds simply poison each other.

That’s why our portfolio solution is far more active than passive, and far more diversified than just clever stocks and clever bonds, which are not clever at all—just massively “accommodated” and ripe for many moments of “uh-oh” ahead.

In short, we hope you are re-thinking what true portfolio wealth and true portfolio protection entails, for it requires thinking differently, which is what we do, and why our portfolios are beating rather than tracking these broken markets.

Sincerely,

Matt & Tom