The market bear is clearly out of his cave, but recent stock surges remind us that bulls don’t die easily.

As lock-downs rattle nerves alongside growing job losses and tanking economic indicators revealed in the charts that follow, tensions are rising as to what policies will bring us out of a viral storm which some passionately argue is akin to the black plague while others decry as just media-hyped hysteria.

Tom and I are not virologists, and save for the ironic anecdote in closing below, we’ll simply stick to market signals rather the viral theories or political wisdom.

As to such signals, the market bear has his claw marks on just about everything that matters.

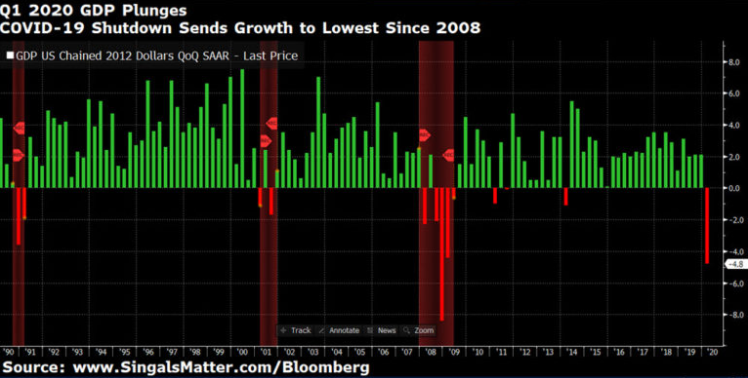

The Market Bear Claws Through GDP

One signal worth revisiting today is the tragic decline in our GDP, which at -4.8% for Q1, just saw its sharpest decline since 2008.

Even worse, Bloomberg’s GDP forecast for Q2 currently stands at -27.3%, which will place us officially in deep recession territory (in case you were still wondering if we were in a recession…).

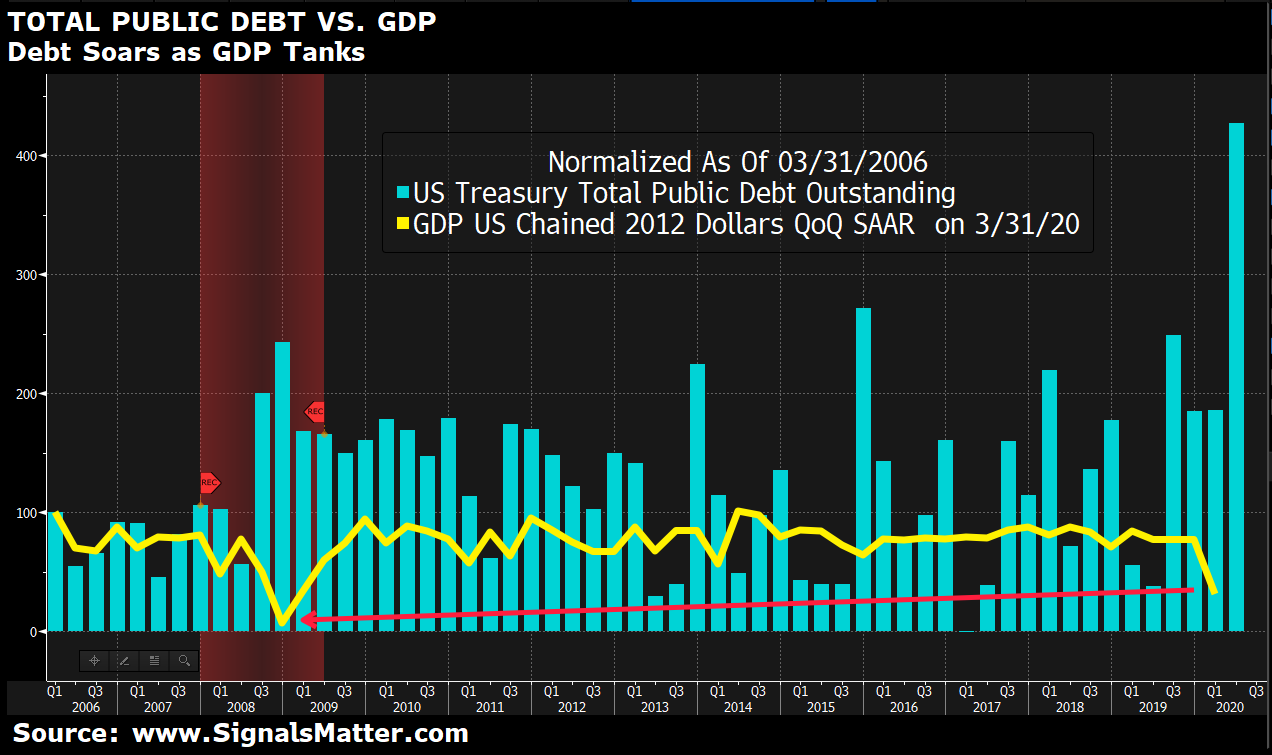

As I wrote on Monday, when GDP tanks and debt levels soar, economic growth is mathematically doomed to fail; subsequent austerity is as inevitable as a hangover after a string of martinis.

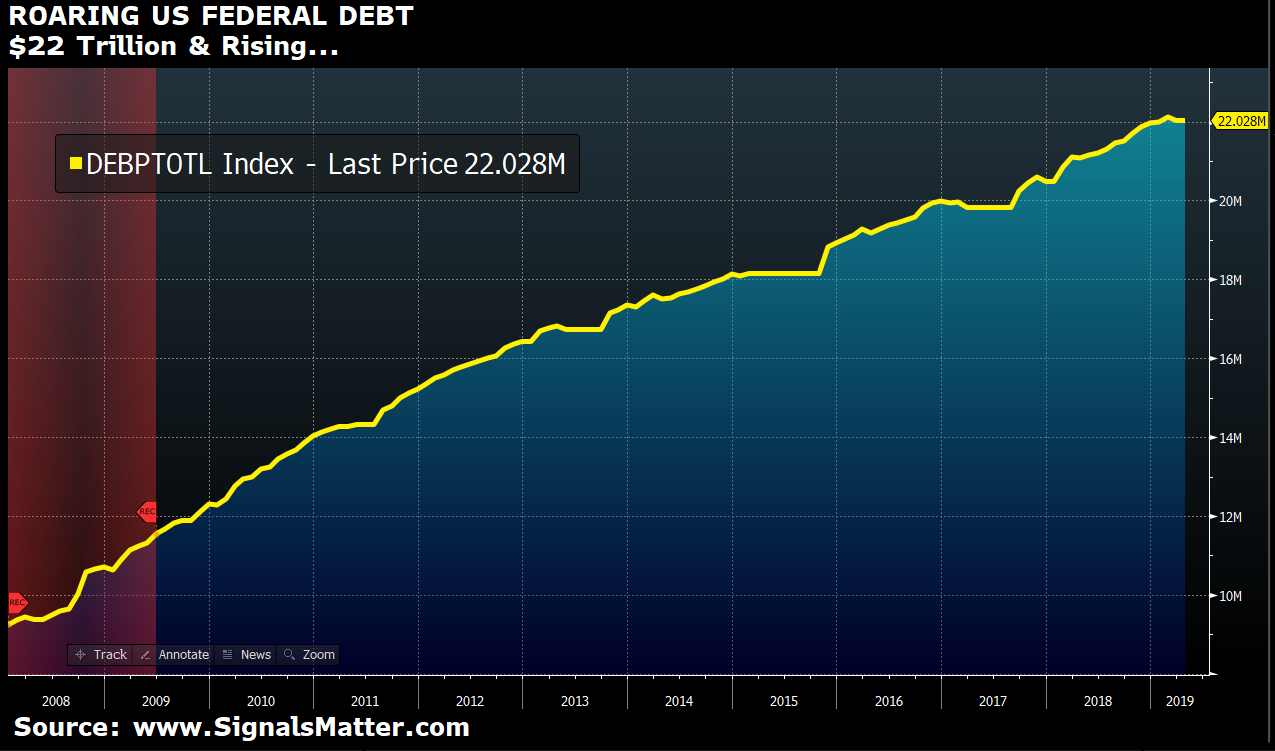

The Market Bear & Roaring Debt Levels

As for current government debt levels in the US, well, at $24 trillion and rising, that number is appalling:

We warned of what such debt binging was doing to our economy in general well before the coronavirus made the headlines.

And when we look at the graph below of rising debt (blue) against tanking GDP (yellow) for 2020, the disconnect between debt and GDP over the last decade is simply staggering, as are its implications:

Bullish Tape, Bearish Facts

Such broad debt to GDP facts are hard to ignore, and yet just yesterday in particular, and in April in general, markets have been rising on the hope that the lock-downs will phase out and oil prices will stabilize, sending markets back to “near normal.”

We hope so too, but hope, as Tom says to me so many times, is not an investment plan—facts are.

And those hard facts, rather than personal bias, boil down to this: Although bearish fundamentals (like tanking GDP and skyrocketing debt) are fighting a bullish Wall Street tape for now, the sheer size of this bear’s teeth are simply too large to defeat.

In short, I’d be running from this bull faster than a tourist in Pamplona.

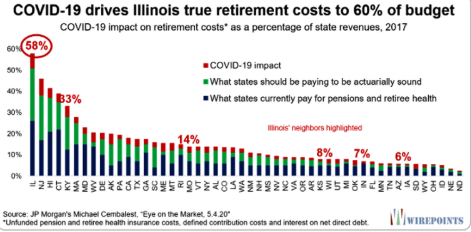

More Bear Teeth Evidence…Pension Funds, Manufacturing, Unemployment and Bankruptcy Woes

The irony is that getting back to “near normal” is hardly a positive meme, as our markets were dangerously abnormal even before the Coronavirus took us from “near normal” to down right insane.

One area of pre-Coronavirus concern was the terrifying state of US pension funds, which we outlined in detail here and here.

Specifically, we warned that Americans heading into retirement were equally heading into a minefield, as a great majority of states (with Illinois at the lead) simply did not have the revenues to meet retirement needs.

As JP Morgan’s latest pension data reveals in graphic detail below, the percentage of state budgets ear-marked to cover retirement costs is simply too high to balance over-all budgetary needs, and the COVID costs are only making a tragic retirement situation even worse.

As for American workers, the April jobs report places the current unemployment rate above 16% and rising by the day.

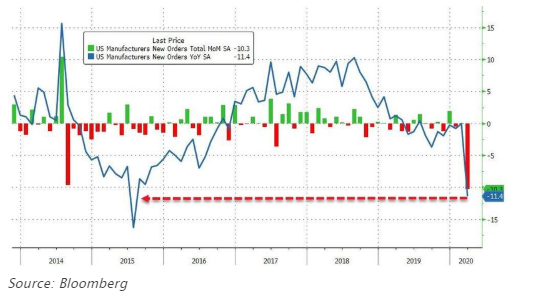

Meanwhile, US manufacturing orders just tanked by 11.4%, the worst month-on-month decline since 2008 (save for the 2014-15 hic-up):

Bullish or Just a Bull-Trap?

Needless to say, retail stores are dying all around us, and once-familiar names like Hertz, J-Crew, Nieman Markus, JC Penny and Gold’s Gym are now heading for bankruptcy.

No matter how you look at it, the combination of record-breaking debt levels against record-breaking GDP declines is impossible to downplay or ignore.

Tack on to that a dying pension system, tanking manufacturing data, soaring unemployment, and the death of once familiar businesses careening toward Chapter 11, it simply becomes difficult to be bullish right now, unless you still think the Fed has outlawed recessions?

Yet based on GDP data alone, we are already in a recession…

Or perhaps you thought you bought the big dip of March, and proudly feel it’s all roses from here?

We’d argue that when it comes to dips, you aint seen nothing yet…

Given the foregoing market bear indicators, for those of you expecting Fed stimulus to send markets to new highs in the face of such tragic fundamentals and facts, we feel strongly that you are heading into a classic bull-trap rather than new bull cycle.

How do we know? Easy, the facts tell us so.

Keeping it Real for Our Subscribers

For our subscribers, we simply ask that you click-here and keep your eyes on our latest portfolio recommendations, as the market signals we track have more bearish teeth than bullish horns.

Opinions vary, but market signals simply say it like it is, and we consistently stick to the signals on our screens rather than the hunches (or even hopes) in our guts to balance risk and reward when it comes to building your portfolio.

In the long run, we make money by not losing it, and by buying big at bottoms rather than betting on precarious tops.

This approach requires patience and data, as well as a calm ability to balance realism against fantasy, and sticks to signals and rules-based thinking as opposed to wishful thinking.

The Great COVID Debate

But as to balancing the opinions vs facts of the current and increasingly debatable COVID measures, we are admittedly out of our depth, as the facts and policies are just too diverse and impassioned for a simple signal or final answer from guys like us.

That said, a recent headline caught my attention and sparked a little groan which I thought I’d share and let you debate within your own circles and thoughts…

Hypocrisy or Just Plain Irony?

You look to our reports for market analysis not opinions as to whether an economy-destroying global lockdown is/was the right or wrong policy reaction for balancing market survival against human survival.

Balancing lives against financial conditions is no easy task, nor is the balancing of individual security against individual liberty. Generations of wiser folks than myself have taken both sides of this passionate debate.

I’m certainly not here to solve this tension, but I will cite a headline for each of us to consider.

London’s Professor Neil Ferguson, who was perhaps the most notable and vocal author of the doomsday model upon which the global economy now hangs, is likely someone who cares about human lives.

As our prior report demonstrated, Professor Fergusson’s opinion thus held critical sway over policy makers around the world, despite the fact that his previous forecasts were, well…largely wrong.

Yet given how scary, invisible and uncertain the unfolding COVID story is, even Ferguson’s prior flaws of analysis perhaps deserved the benefit of some statistical doubt.

Passionate defenders of Constitutional liberties like myself can understand the argument that even such flawed expertise handed down by Ferguson was worth considering, as he just might know what’s best for us.

In short, the case for playing it safe rather than sorry made sense when it came to public safety and human lives.

We get this. We followed his rules.

Unfortunately, Professor Ferguson did not.

What a guy…

As the Telegraph recently reported, Professor Ferguson, the veritable author of the social distancing solution, broke his own lock-down rules and made a couple trans-London trips last week to visit his married lover, despite having tested positive for the Coronavirus weeks prior.

Looking Ahead

As for balancing bearish market signals against temporarily rising exchanges, we stick to our rules not our opinions.

The foregoing signals speak (loudly) for themselves, and the data, graphs and facts discussed above and elsewhere let you know exactly where Tom and I stand as to where these markets are heading.

If your portfolios are not otherwise prepared for the worsening market sickness to come, it’s now time to make them so. Unlike Professor Ferguson, we actually practice what we preach and stick to the rules.

Sincerely, Matt & Tom