We are now experiencing a market failure, possibly just points away from the worst week in US history.

Making History?

The flip-flopping market volatility up and down continues.

As of this Friday the 13th, the DOW, having already fallen by 18.5% this week alone, opened with a surge but as of this noon writing, is falling off its session highs and re-tracing again. That said, markets are rising today on the backs of more “support” from outside natural and supply and demand forces. In short: more “faking it.”

This type of price movement (and emergency “support”) is a classic symptom of an uncertain market, as well as uncertainty (and distrust) for an increasingly less credible Fed “experiment,” nearing its end.

Depending upon where today’s close hits, we are potentially headed toward the worst week of market failure in our stock market’s 124-year history.

As expected, blame for this week’s most recent market failure is falling squarely on the shoulders of the COVID-19 pandemic which has dramatically thwarted personal, business and market activity for weeks, culminating this week with extreme losses across the US and global exchanges.

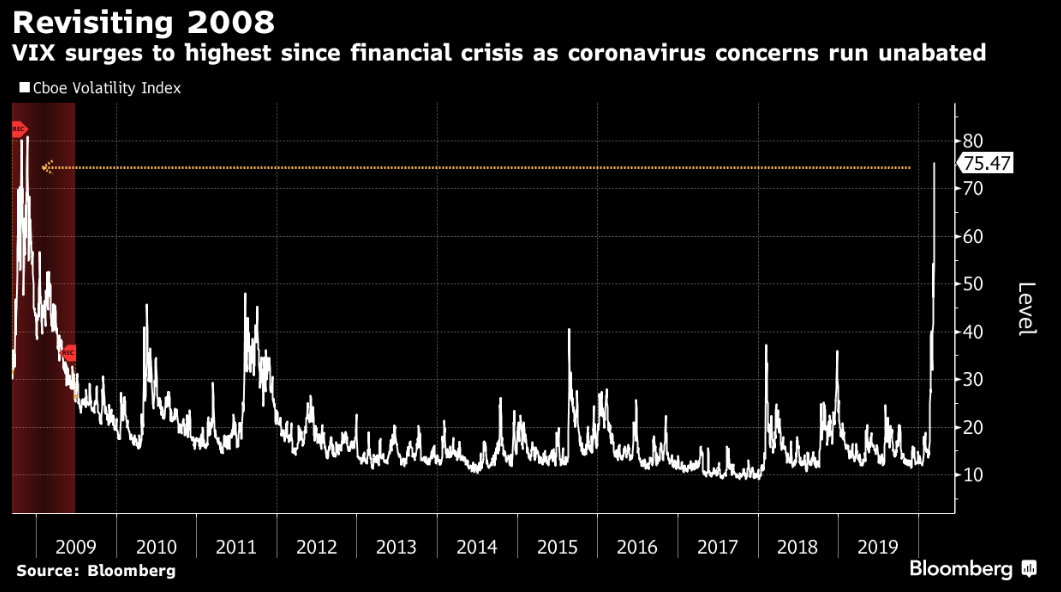

In short, we are now all witnesses to an historical moment, and the extreme volatility seen in the VIX and the markets this week brings the reality of this market failure into sharp clarity:

The Fear Index…

The Market Failure…

That big bad bear has knocked global stocks down by more than 20% from their peak.

Reckless Fed, Fragile System, and the Power of Uncertainty

It’s both fair and understandable to intuitively regard COVID-19 as the primary culprit for such an historical market failure.

But as we’ve also made empirically clear here, here and again here, these fragile markets were made vulnerable to extraneous headwinds well before the virus made its debut.

That said, the uncertainty which surrounds the virus continues to spread, and its human toll has only added to the uncertainty as well as risk which now defines these markets.

As we’ve reported elsewhere, there’s a big difference between risk and uncertainty: The former can me measured, the latter cannot.

It also goes without saying that we place equal if not greater blame for the current yet market-signaled meltdown and market failure upon central banks in general, and the Federal Reserve in particular.

In fact, we even listed a black swan virus trigger as one of 8 potential market-killers as far back as April of 2019.

But again, the deeper illness lies in debt, not viruses.

Too Much Debt

That is, 11+ years of artificially suppressed interest rates and the ever-present promise of more money printing have collectively acted to create a now undeniable as well as easily foreseeable moral hazard within Wall Street—namely, investors had essentially ignored risk and focused only on upside.

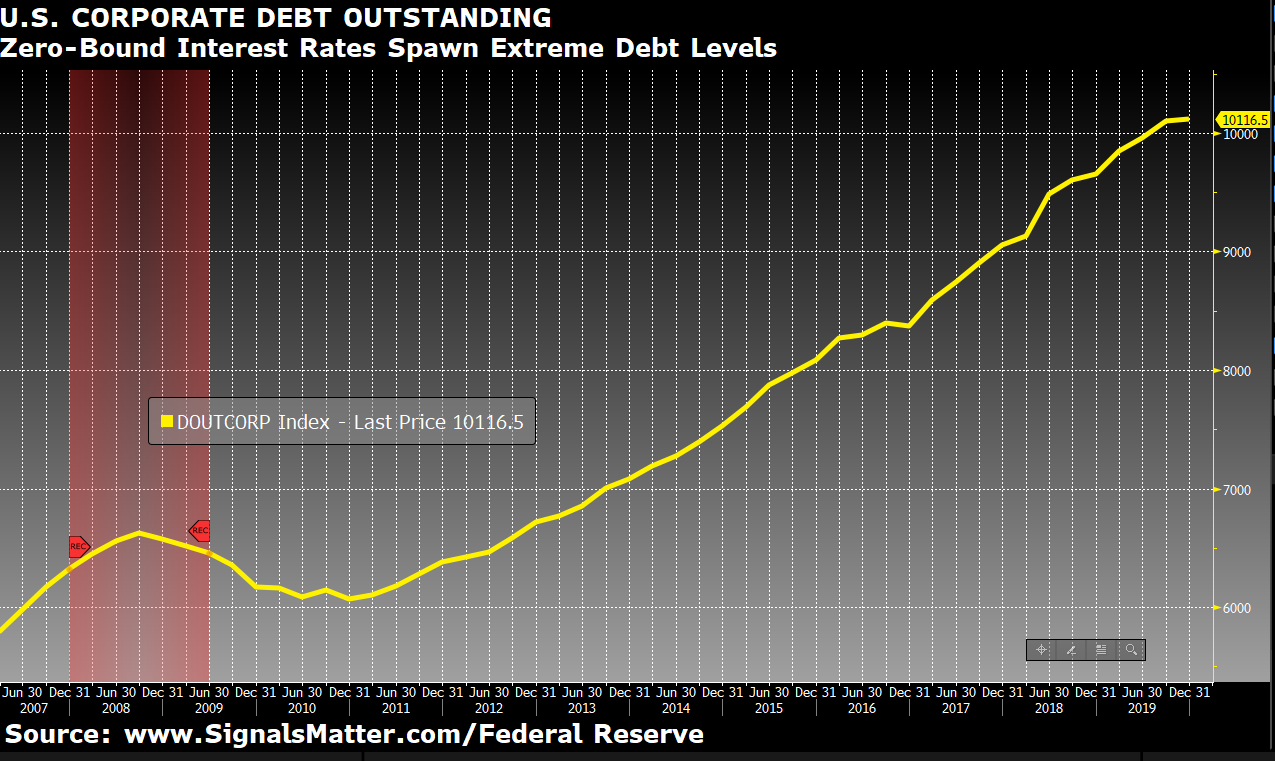

Years of extreme, zero-bound interest rate policies have had direct correlations to extreme debt levels, particularly in the US corporate debt markets.

This cheap debt has led to exaggerated levels of stock buy backs, and hence extreme distortions of earnings reporting and thus equally extreme, and hence dangerous, complacency.

Additionally, cheap debt has led to extreme mal-investment, as borrowed funds were used more for speculation and executive salary-pumping than business re-investment.

Such gross provisions, as well as equally gross misallocations, of debt has left our financial and businesses markets dangerously fragile.

But again, such fragility was ignored due to the false confidence provided by an artificially, Fed-stimulated stock market, who’s hitherto ignored overvaluations and “bubble levels” clearly popped this week.

In short, no one is ignoring this fragility now.

It’s simply unfortunate that it took an epic market failure to drive this ignored debt reality home.

Easy Liquidity

Furthermore, the creation of over $4 trillion in printed US dollars since the last crisis did far more than provide needed and “temporary” liquidity in the early hours of the 2008 debacle.

Instead, and by extending such “emergency measures” years past their intended expiration date, markets became accustomed, as well as addicted, to omni-present liquidity (aka “Quantitative Easing”) from an obliging Fed.

Such extreme QE, which was temporarily paused in late 2014 and re-ignited in October of 2018, has had a direct, as well as un-natural impact in pushing stock markets to unsustainable and profoundly fragile highs.

The equally ignored, yet foreseeable risks behind such QE-driven fragility, are only now being acknowledged, though again nearly all the blame is being pointed at the virus rather than the systemic fragility that preceded it.

Blaming the Match Rather than the Barrel of Gasoline

In short, the pundits are almost universally placing the blame for this latest market failure on the match (i.e. the virus) rather than the barrel of market gasoline (i.e. the Fed-induced market bubble) that preceded it.

And as to this “match-meets-gasoline-moment,” what was the Fed’s response yesterday to potentially the worst week of market failure in our history?

Well, believe it or not, their response was to add more gasoline to the fire.

Yesterday, the Fed signaled another $1.5 trillion in emergency repo-market liquidity to keep that bank-centric, overnight lending market alive.

Needless to say, the markets responded today with a boost. I mean c’mon: $1.5 trillion ought to buy at least a day of performance…

Such desperate measures, of course, only buys time, it hardly solves the underlying problem of too much debt, which can only be cleansed and resolved by a painful yet long-overdue (and deeply necessary) repricing of financial assets back to normalized levels—in short: a bear market event.

Such painful lessons in mean-reversion to price normalcy as seen this week are critical to keeping markets fair and rational rather than rigged and un-natural.

The Fed, however, refuses to see this, and thus continues to pursue staggeringly desperate (and profligate) policies that ignore the key tenets of free-market capitalism, financial history and common sense.

In short, the Fed just refuses to admit that their experiment is failing.

The Fed’s Monty Python Moment

The Fed’s behavior is strangely reminiscent of a rather grotesquely comical scene in Monty Python’s classic film, The Holy Grail, in which King Arthur clearly vanquishes the Black Knight by severing both his arms and legs. (Note: Viewer discretion is advised).

As each limb is severed, the stubborn but obviously daft Black Knight, refuses to admit defeat.

Finally, after having both his arms and legs removed in a comical duel, the same proud Knight can only agree to “call it a draw” despite the evidence of his failure all around him.

Sadly, the Fed is equally arrogant, equally stubborn and equally as daft as this armless and legless Black Knight.

For despite the undeniably apparent evidence of the failures that they’ve created in sending stock and bond markets to such fragile highs and now market failure lows, the Fed refuses to acknowledge their defeat.

Going forward, then, we can expect more “Black Knight” bravery (and reality blindness) from a now discredited and deeply wounded central bank.

Powell and the Fed, of course, will toss more money and even cheaper debt at the debt nightmare which they alone created.

Thus, it is more than likely that the Fed will send interest rates to zero or near zero by their next meeting in April.

If markets continue to fall, we can also expect more inevitable money printing to be tossed on the pyre of this failed, decade+ experiment of excessive “stimulus.”

Stay Calm, Stay Protected

Until then, we can only watch the market’s reaction to this now armless and legless Fed, which based at least upon this week’s market failure, was anything but positive.

For investors who see the tragic comedy behind this week’s market disaster and the Fed’s predictable response to it, we feel you’ll be right at home at Signals Matter.

Here, we guide portfolio’s through these tragic-comedy markets and the extreme volatility ahead with calm rather than cinematic chaos.

As of this writing, and since early December (and well before COVID-19 made headlines), we’ve been managing risk rather than fantasy for our subscribers while beating the equity markets by a spread of 28-percentage points (that’s 2,800 basis points) while producing absolute returns rather than just relative outperformance.

If such sane portfolio performance and approaches make sense to YOU, then simply join us by subscribing here.

Also, take look at our recently-published and No.1 Amazon New Release, Rigged to Fail, which more than foresaw what is happening this week. More importantly, it provides solutions rather than predictions.

Stay tuned as well for Monday’s report, when my colleague, Tom Lott, will provide a clear, graphical recap of what has transpired and what lies ahead based on market signals rather than Fed arm-flailing…

Sincerely,

Matt Piepenburg

Macro Strategist

I thinkk you might mean “tenets” rather than “tenants”.

Thanks Paul. I could pretend to blame this on spell-check, but alas I’ll confess to just lousy spelling skills. Nice catch. There’ll likely be more to come 😉 I’ll make the edit though.