Below we address key market questions as risk assets reach new highs against a tired buying cycle.

Hedging Market Tops

Last Tuesday, November 24, was a day for the history books, marking the first time the Dow Jones Industrial Average pierced (and closed above) 30,000 (at 30,046.24 to be exact).

The milestone was recorded the very next day in Wikipedia, along with a dozen other such milestones reaching back as far as the late 19th Century Bull Market of 1885-1890.

Investors owe a special gratitude to Mr. Market (and a Fed-inspired “new abnormal”) for enabling equity highs in the midst of one of the worst global pandemics (and recessions) in history.

So, Now What?

Monday’s close left the Dow 30,000 in the rearview mirror, as the Index fell back to 29,638, which prompts a few market questions.

What does one do now? Where do we go from here, how do we gauge market sentiment, protect profits, and even make money on the way back down (or further up)?

There are other big market questions.

Will the vaccines coming to market in early 2021 solve the pandemic and take the Dow to 35,000 or 40,000?

Or have the markets feasted ahead of a coming famine?

Are investors fearful or greedy? Is this a volatility spike or just base building for further gain? When will this uptrend stall?

And when it does, what should you do? How? And when?

Again: All excellent market questions which we address every day for our Subscribers at www.SignalsMatter.com.

It’s What’s Ahead that Counts

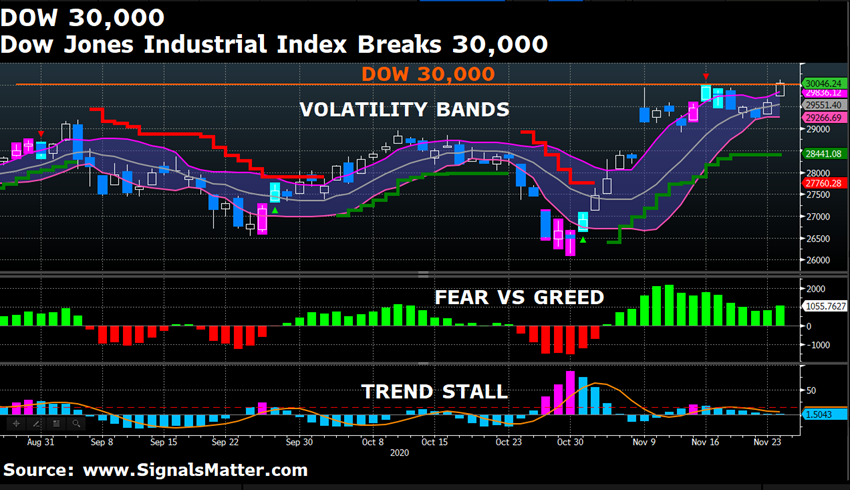

In a recent and private chart we posted last week as a Subscriber Daily Insight, we plotted the Dow Jones Industrial Average up to (and including) November 24, surrounding the event with education-minded indicators that track all these market questions.

Here’s what we see:

- Volatility expanding above a recently narrowed channel (that’s bullish);

- An uptrend in place (also bullish);

- A fear/greed index that’s dipped but is still in the green (bullish);

- And a trend that seems some distance from stalling (bullish, as well).

That’s a lot of bullish signs, but on the other hand, markets do have a habit of reaching for bullish milestones on the journey to bearish exhaustion.

It’s what’s ahead that counts. Let’s discuss.

Market Exhaustion

Market exhaustion is the telltale sign of a market about to correct—i.e. start falling.

Markets typically become exhausted when the majority of market participants all pile on the same side of the trade, be that to the long or to short side.

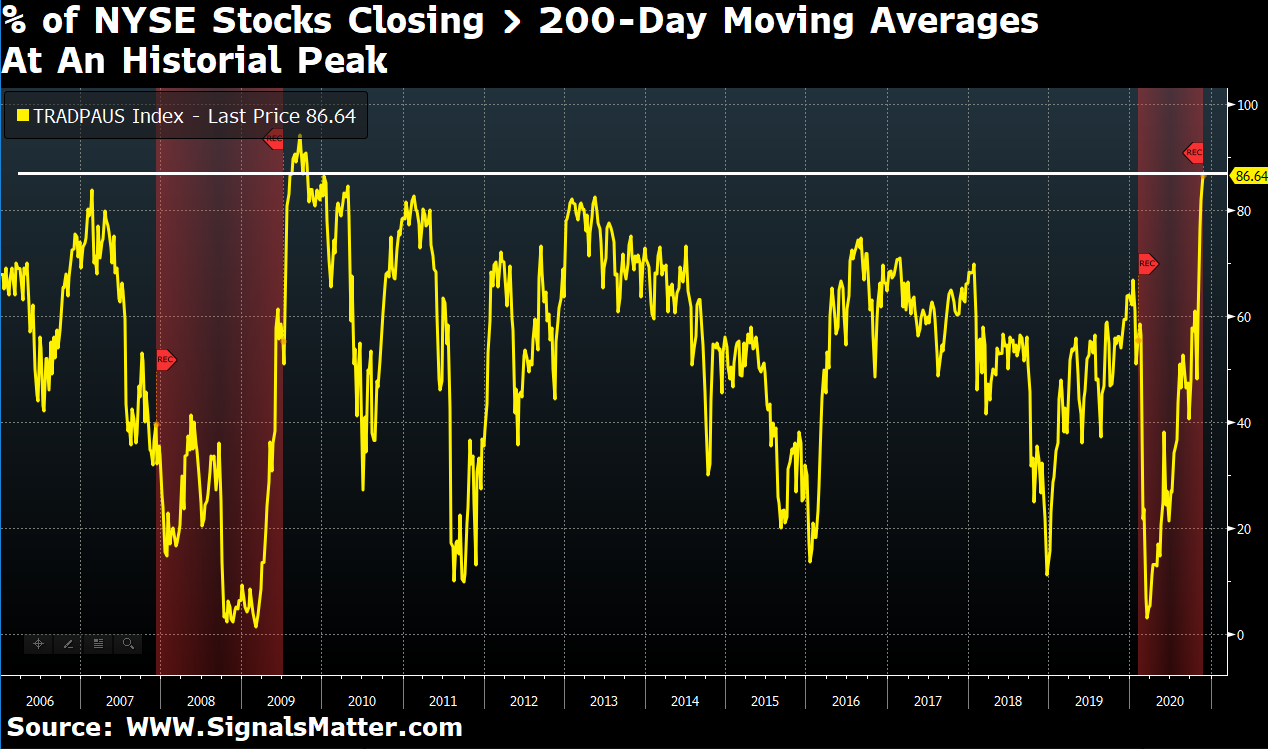

On November 24, when the Dow hit 30,000, 84% of NYSE stocks closed above their 200-day moving average, charted below, an extreme reading for sure, one that preceded/called a number of previous market corrections including the 2007/8 market crash.

Exhaustion is prevalent when too few investors are left to take the other side of the trade once investors decide to take their profits and run.

In those moments, markets drop, not because everybody is selling, but simply because there’s nobody left to do any buying.

In short: The buyers have all left the room, causing markets to reverse and dive.

What to do?

Let’s discuss that too.

Hedging the Markets

Hedging the markets involves taking an investment position to offset potential losses or gains that may be incurred by a companion investment, like long-only stock positions.

As alumni of the hedge fund industry, your Signals Matter Co-Founders are experienced at hedging and outright shorting (betting against) the markets.

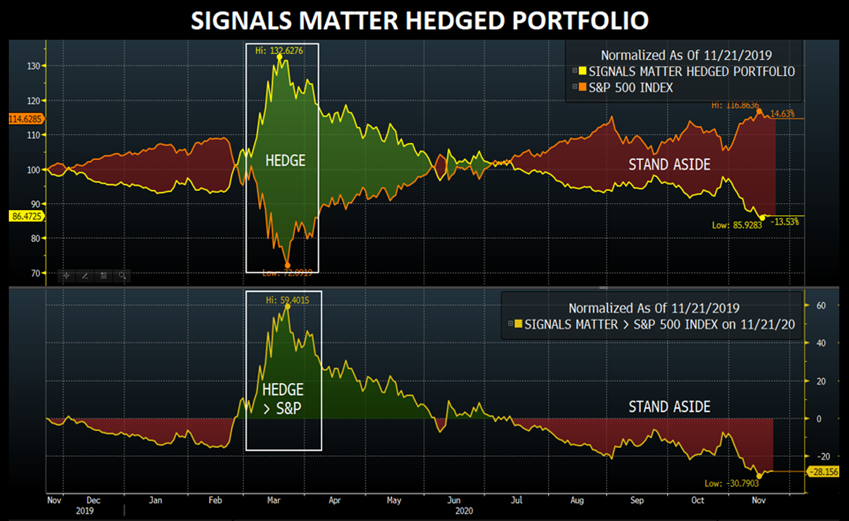

It’s precisely at market tops that Signals Matter readies its hedged portfolio, a bucket of ten Portfolio Suggestions geared to not just offset the losses when markets tank, but generate gains as well.

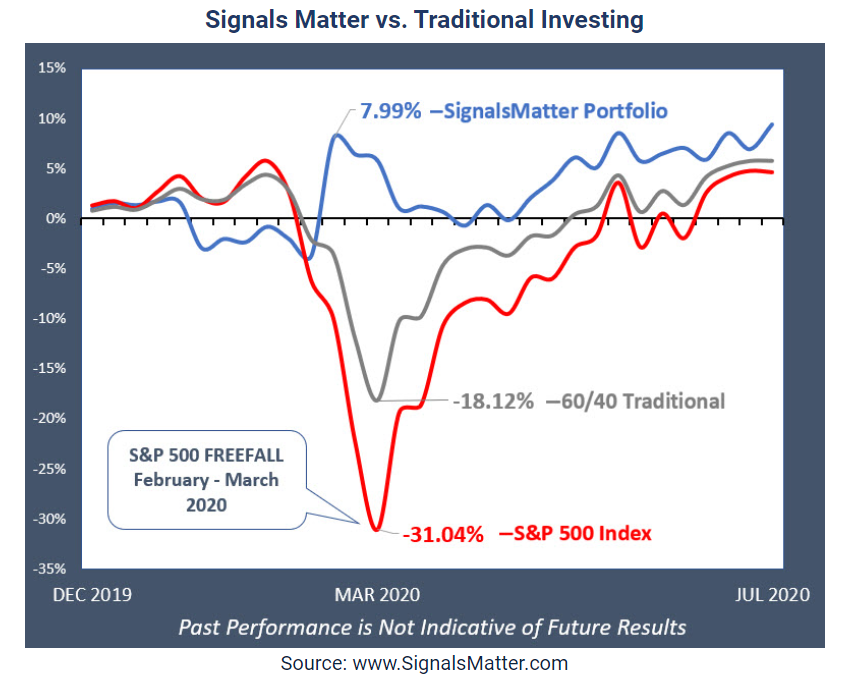

A less-formalized rendition of the Hedged Portfolio was suggested for Signals Matter subscribers last March, rewarding Subscribers with a +8% gain when the S&P 500 tanked by 31%.

Expecting another plunge in stocks at some point, we’ve since refreshed the Hedged Portfolio to equally weight 10 Portfolio Suggestions that are geared (no guarantees) to zig when the equity markets zag.

The Hedged Portfolio embraces not just inverse stock ETFs (i.e. ETF’s which bet against the market) but also an array of plain-vanilla ETF Suggestions that favor volatility expansion, actively-managed ETFs that hedge, and currency solutions.

From an execution perspective, the Portfolio’s objective is to make money near market tops, when markets flip to the downside because the last buyer has left the room.

Ideally, we would then flip back to the long side with more traditional Suggestions, near the bottom when the last seller has sold, roughly doubling the gain we achieved last March.

In the chart below, we plot the S&P 500 Index alongside the Signals Matter Portfolio of Hedged Suggestions, as if the Portfolio been engaged when the S&P 500 dropped last March.

Everyone Needs a Plan

The key to investing at market tops in rigged, distorted, and even everyday markets is to have a plan.

With stock markets, Covid-19, and trillions of dollars of new corporate and sovereign debt all hitting higher highs, the possibility of a serious reversion to the mean (i.e. fall) in stocks is ever-present.

Over the years, we’ve asked multitudes of investors about their plan.

Most have none.

They just go along with their financial advisors and leave the driving to Goldman Sachs, Morgan Stanley, and other Main Street advisors.

Nor do these investors know what questions to ask or what constitutes a reasonable response.

When it comes to your portfolio, you need a plan, and you’re not going to get it from most financial advisors.

You see, in the end, they’re conflicted as they only get paid on the money they invest for you, not the money they sideline to keep you safe.

That, by the by, is why we established www.SignalsMatter.com, to inform and educate investors when it comes to smart investing.

Here at Signals Matter, we do the planning for you, by constantly educating and suggesting portfolio solutions intended to profit in all-weather conditions.

Our goal is to keep investors out of harm’s way over the long haul, through the market’s many peaks and valleys, providing answers to these kinds of market questions:

- What to do when the US Treasury and Federal Reserve Bank are at odds with each other;

- What to do in a lame-duck session;

- What to do as the virus spikes again, with vaccines not yet ready;

- What to do if the economy contracts rather than expands next quarter (Bloomberg GDP estimates are receding);

- What to do if negative-yielding debt continues to soar; and

- What to do as the US falls behind on trade?

For more on planning ahead when it comes to your portfolio, please download our recently revised Investment primer 2020, our FREE guide to building a truly diversified and uncorrelated portfolio.

What’s Sustainable and What’s Not

To close, we all need to consider what’s sustainable and what is not when it comes to markets of all kinds, especially these Fed-inspired markets.

Climate activist Greta Thunberg, empowered by Asperger’s syndrome, said it best: “We tend to overthink things.

Sometimes the simple answer is that, “it’s not sustainable to live like this.”

So too, when it comes to lofty markets. This market climate is built upon mountains of debt, at zero interest rates, that may be written off, but never repaid.

Let’s not overthink it. Nod to Greta, it’s not sustainable to live like this, especially in a fantasy world.

If you believe these markets are toppy, if you feel that the risk of a market reversal is at hand, or if you’d like our help to plan ahead, each and every day, please join us now at www.SignalsMatter.com, where all we care are about is offering you a sane rather than fantasy portfolio.

Be well. Stay safe. And stay diversified!

Matt & Tom