Below we look at some key market signals with open eyes and full transparency.

A Sample of the Market Signals We Are Tracking Today

Rather than our normal “big picture” from 30,000 feet reports, we thought we’d focus today more on those market signals indicating what’s happening at the ground floor right now in these deteriorating market conditions.

Many of the market signals we track on the back-end of the Signals Matter service are indicating a noticeable shift in market sentiment toward heightened concern and further declining leading indicators as we head toward the close of Q2.

Flow to Safety Assets and Tanking Yields

First, we are seeing a marked increase in investor flows toward safety assets like fixed income and commodities, suggesting increased distrust in equities.

Furthermore, with the Fed’s direct support of the credit markets, the flow toward bonds is a natural “front-run” allocation.

Given this flow into bonds, prices are rising and yields are tanking.

Yield on the 10-Year US Treasury has seen record-breaking average lows, which is a clear sign of rising investor distrust in the stock market, which spent most of last week in a tight, low-volatility trading range, consistently below a classic technical “island top.”

Alarming GDP Warnings

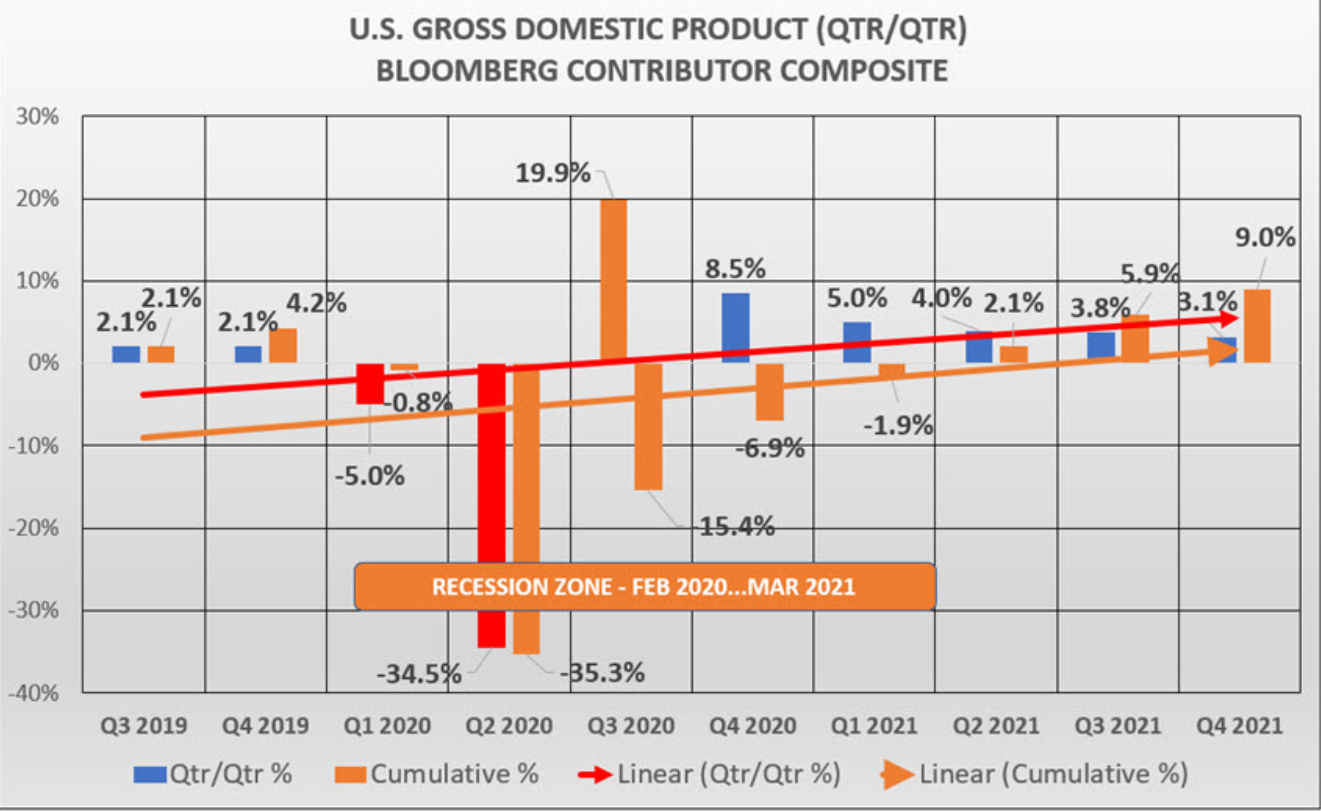

Also, worth reminding our readers is that GDP for Q1 officially tallied in at negative 5% and the projected numbers for Q2 GDP are expected to tally in at around negative 30%.

This projected Q2 GDP figure is simply staggering, as GDP effectively represents our national “income statement”—that is: The money flowing into our national balance sheet is literally nosediving while our debt levels are sky-rocketing.

Such a scenario is anything but bullish…For all you need to know about rising debt and tanking income, just click here.

Again folks: common sense here. Debts are rising as national income is tanking. This is no time for full-faith in the Fed or fighting the natural laws of economics.

Note as well that the above Bloomberg projections have a wildly optimistic view of a sudden GDP recovery for 2021.

As risk managers, we simply can’t be so sure of such a rebound. Remember: Trust but verify. For now, we must play the cards we are dealt, and these markets are full of Jokers…

Navigating a Twilight Zone

For stocks to see a noticeable rise in such an embarrassing and mathematically objective macro backdrop would simply defy any remnant of normal asset behavior, but then again, there’s nothing normal at all anymore in the current Fed-assisted life support in which risk assets now trade.

Despite this Twilight Zone scenario, informed investors simply cannot afford to gamble their portfolios in such an environment, and hence our subscriber portfolio recommendations on the back-end are carefully set up with specific allocations to hedge risk and capture some alpha in a safe manner.

Sectors Pause for a Moment of Reflection

As to additional technical signals, the recent move of numerous sectors into the improving and leading quads has come to a grinding halt, suggesting more uncertainty/doubts as to the market’s future optimism and direction.

As always, we place our bets on these and other market signals rather than just more Fed magic. We have to, for all the reasons outlined in greater detail here.

Performance Matters (and Confirms)

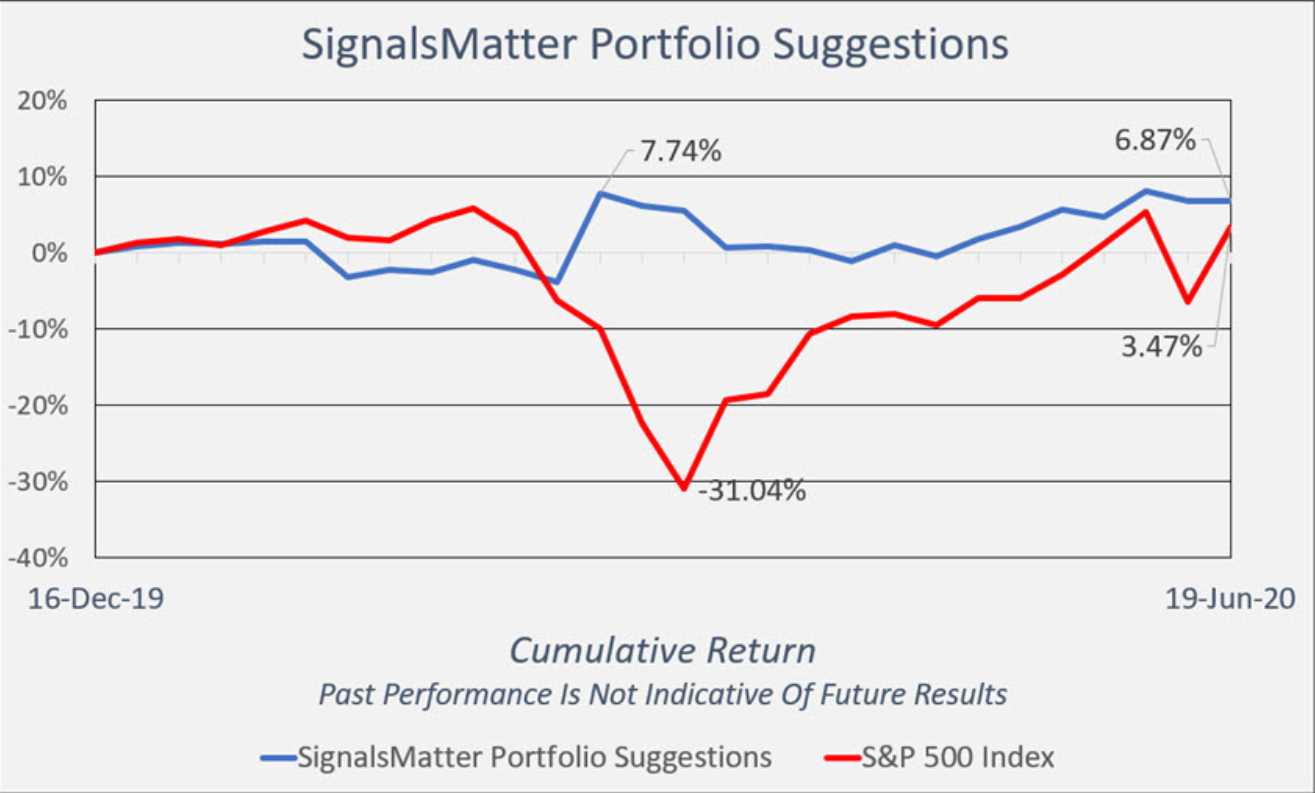

In short, we track market signals not just Fed-speak. By doing so, our portfolios have provided twice the return of the S&P with none of the sea-sick volatility (and net losses) most investors endured for 2020.

Watching the Gold Flows

As for gold, remember that we see gold as a unique investment for long term insurance against deteriorating currencies, not as a speculative trade. Those who agree, hold gold for the long-term outside of their normal portfolio management/allocation model.

Nevertheless, we also track market signals from the precious metal sector and use gold ETF’s within the portfolio model when actively managing risk and opportunity as conditions warrant.

Currently, such market signals like investor flows into gold have been unmistakable as global market concerns heighten and the flight toward safe-haven assets increases.

The Right Market Signals Means the Right Portfolio

The foregoing is just a brief sample of the market signals, flows and indicators we track daily to inform our portfolio for Signals Matter subscribers.

To learn more about what our subscribers are saying, we invite you to scroll through the hundreds of testimonials we’ve posted on our website.

If what we’re reporting—and how we’re performing– makes sense to you as well, we’d love to share more with you as a subscriber by signing up here.

One click and you’re in the know rather than in the dark.

As always, stay informed, stay safe and back at you soon.

Sincerely,

Matt & Tom