As we at Signals Matter continue to out-perform this market bubble while simultaneously marveling at the market uncertainty and distortions surrounding it, we feel it’s worth pausing to question the wisdom of trading at such market highs. In short, is the reward worth the market risk, or better yet, can the risks be managed?

The Investor Mindset & The Trader Mindset—A Case in Bipolarity

There are investors, and there are traders. The first tend to look at value and price and history, the second tend to look nervously at daily charts and their checking accounts. The former are traditionally portrayed as long-term thinkers, the latter as short-term, trade by trade.

Here at Signals Matter, we exhibit the characteristics of both and thus speak to both.

This, of course, raises certain moments of paradox, that is a kind of market bi-polarity, for as value thinking investors with a respect for macros and the lessons of market history, the current indicators point to an obvious set of looming problems, enough to bring emotion into the discussion. You know: the kind of emotion that questions the sanity of today’s clearly over-valued markets.

On the flip side—or the other “pole” of this bi-polarity—is the trader mindset, a mindset all of us can recognize. It wants to find opportunity every day, regardless of macro sunshine or clouds, regardless of bulls or bears, and regardless of emotional opinions and sell side pundits flapping about on the TV or the radio.

So which voice should you listen to? The Investor or the trader? The bear or the bull? Do you tilt toward the harsh macro facts and walk away from these market risks, or lean instead toward the signals on today’s trading screen?

Not surprisingly, we feel the answer lies in both voices, or more importantly: your voice. As the great value investor, Howard Marks, often remarks: “We may not know where we’re going, but we ought to know where we stand.”

Each of us, in short, needs to know where he or she stands.

There is validity to thinking like an investor as well as like a trader. There is, in short, a certain advantage to a certain kind of market bipolarity.

In this current market Twilight Zone, and depending on your own views, it might make sense to invest as per normal, yet expect lower returns. Similarly, others might choose to reduce risk and prepare for a correction or place money into special niches or scour the sectors for true value. Others may decide to go heavily or even completely to cash.

We understand and support any of these choices.

The Investor’s Mind

As an investor, I look at pundits like David Stockman who describe today’s markets as ”pure lunacy;” even the big banks, including analysts at Deutsche Bank, portray stocks and bonds as perhaps at the most elevated and over-valued in history. Others, like Peter Schiff et al (Rogers, Gross, Faber) are calling for a total market collapse ahead.

What do do? Howard Marks says a collapse or crash is less likely than a correction. He says banks are less levered than 07 and that today’s markets, though risky, aren’t contaminated by sub-prime mortgages or other dangerous structured products.

Perhaps.

Yet with an S&P trading at over 24X reported earnings 100+ months and counting, with stocks like Netflix trading at 220 multiples, a looming tax and budget crisis ahead, over $7T in negative yielding sovereign bonds in a single index, a broke national balance sheet, a VIX (or fear index) at record lows against markets at record highs, dangerous levels of complacency, dramatic under-employment numbers and criminally misreported inflation—all in the backdrop of a staggering global debt level of +$240T– there seems an obvious risk of a storm scenario ahead.

I mean let’s be blunt: no reasonable trader or investor can call this market anything even close to normal, fundamental or safe. It rises on pure hopium compliments of low interest rates and a faith in further Fed “guidance.” Nothing rational—like FCF, Net Income, the yield curve, national debt levels, geopolitics or even the threat of nuclear war slows it down.

North Korea (no problem). A historical equity bubble fattened by stock-buy-backs and bogus accounting rather than profits (no problem). The biggest bond bubble in history (no problem). The world’s leading portfolio managers (including an ex-Fed Chairman) increasingly warning of market collapse ahead (no problem). Record breaking investor arrogance and low VIX data (no problem). Trump (no problem). Hurricaines (no problem). Brexit (no problem). Terrorist attacks in Paris, London, Barcelona…(No problem). In short, this market doesn’t flinch or even twitch, it just seems to keep rising past anything and everything.

It’s the most hated bull market I’ve ever seen. Completely distorted by conditions (i.e. central bank policies) which have no precedence in history and thus no clear way to measure/time going forward.

We are left staring into an unknown timeline with known consequences: this market (with more central bank steroids) could climb for years to come, crash by month’s end, or just limp along or slowly decline and decline and decline—anything is possible.

In short, there are plenty of solid reasons to stay the course, change the course, or just leave this market altogether as a prudent investor standing before a storm.

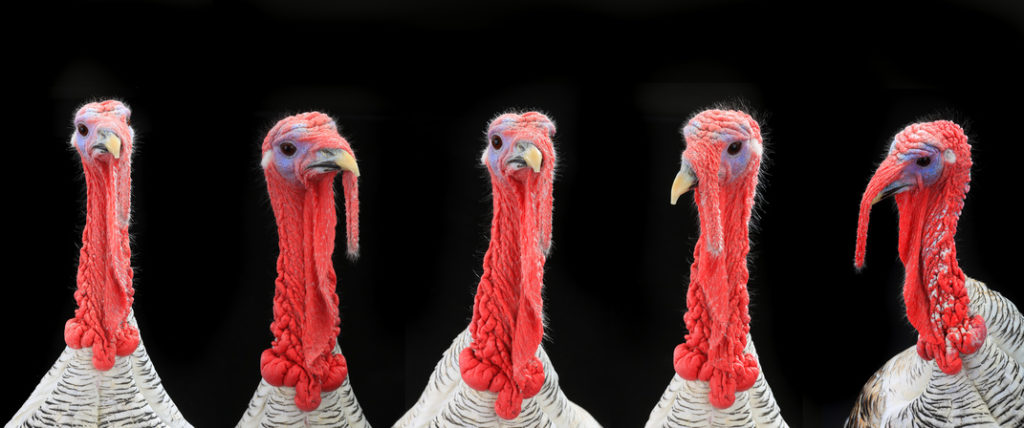

The Turkey Mind?

The problem is just how far ahead is this so-called storm? Without some guidance there, most traders tire of hearing about the gloomy macros.

Can you blame them?

The investor side of my brain has been warning about these macro conditions for over four years now, but had you left the markets four years ago, as I’m often reminded, you would have missed out on one hell of a bull run and market return.

On the surface, such criticism makes sense. Clearly too much knowledge-backed uncertainty can cost you money. But in the backdrop of the largest credit, equity, currency, real estate, and central bank drinking binge/bubble in recorded history, caution isn’t as comical as one would think—at least-to the investor mind with a genuine fear of the uncertainty ahead.

Take the example of a turkey on a farm. Imagine if you could tell him in January that he’s got a big problem ahead; imagine if you could warn him that the farmer who feeds him all that grain every day isn’t really his friend. Imagine if you could warn him that an axe is very likely coming his way sometime that year. Imagine if you could clearly set forth the risks ahead, risks greater than 50%.

And yet the turkey stayed put. Took the free food.

If the evidence you gave that turkey was fairly clear and he chose to assume undue risk, he’d happily fatten himself for months and months on end, basking in the glow of that generous farmer’s daily food delivery. In fact, as month after month went by without the axe you warned of, that turkey would probably grow more and more arrogant, and make you feel more and more ridiculous.

Of course some time (i.e. in November), that ol friendly farmer comes with the axe, and that smug little risk-blind turkey gets the last yelp while you get the last, dark laugh. In other words: trying to get as much of a good thing as possible, isn’t always a good thing…

In so many ways, today’s “risk-be-damned” bulls are a lot like that farmer’s arrogant turkey. The Fed and these fat markets are no more a friend to them than Farmer John was to Mr. Gobble Gobble…

In short, some kind of axe really is out there.

So for those who mock caution, or use the old excuse of “had I listened to you, I’d have missed out …”, my sympathies, as well as logic, just don’t agree.

And yet, I continue to trade. I must be a turkey, no?

A Trader’s Rebuttal.

The problem is that we often find ourselves in a bit of a catch-22 as markets get weird.

That is, I couldn’t be much more bearish as an investor today, yet I’m still on the farm, with one eye on that axe and the other on that bucket of grain…

The conditions out there are pretty poor. And I haven’t even begun to talk about China, the engine of global growth upon which 40% of world GDP is reliant, and which is nothing more than a debt-driven Ponzi scheme (from $500B of debt to $40T in two decades) which folks like Kyle Bass predict will likely impload by next, well…November.

Yet despite this view of global and national markets, we at Signals Matter continue to trade these markets, whose upside is seemingly much less than its downside.

What gives? How do we do it? Are we crazy? Bi-polar? (Turkeys?)

Actually—and hopefully—we are neither.

Risk vs. Uncertainty

In fact, we think the answer lies in this: we treat risk differently than uncertainty.

What the hell does that mean?

The simple answer is this: Risk we can manage, uncertainty we avoid.

In a nutshell, risk, unlike uncertainty, is something one can identify, measure and either accept or reject. We all know, for example, the risk of getting heads rather than tails when flipping a coin is much easier to measure than the uncertainty as to whether playing football will definitively lead to brain damage.

Stated otherwise: The more you drift from risk to uncertainty, the more difficult it is to make decisions, trades or investments.

So having a cautious view, even a bearish view, doesn’t mean you have to stop trading—it just means you need to re-evaluate risk and trade according to the tools and experience you have.

Take the turkey on the farm—the one who lost his head on Thanksgiving. He obviously mis-measured the risk of becoming dinner. Had he known he had an 85% chance of getting the axe, he might have exited the farm rather than chased after the free food.

Good traders are no different. Bad traders, however, either mis-read or ignore risk and chase returns rather than prudence when the market risk is either too high or their ability to manage it, too poor. If you had told a Turkey, for example, that there was only a 1 in 10,000 risk of getting the axe, he (like you or I) may have assumed that risk. Fine. Turkeys, like traders, each have their own tolerance for risk.

If, however, you tell a turkey that you didn’t know for sure—i.e. you were uncertain—but that there was an undefinable chance of getting the axe, such risk is hard to measure and thus not worth assuming. Logically then, any smart turkey faced with uncertainty, would be wise to re-adjust his behavior around that farm.

Today’s Global Market “Farm”

The question facing today’s markets –from the bloated US security market to the bloated global markets—is therefore this:

“Are the conditions we are facing today a matter of risk or a matter of uncertainty?”

The answer will depend on whether you are informed or uninformed as to market risk.

A more informed turkey (like you and I, for example…) looks at the market risk, looks at the data (from FCF and earnings to yield curves and sovereign debt levels) and sees fairly clear indicators of risk.

Each of us must then determine our own private tolerance for that risk and act accordingly. Not all of us, however, will act the same. That is fine.

For some, you may decide to go to cash, to leave the farm. This is not a misunderstanding of risk, but simply a lower tolerance for risk, which varies from person to person.

Others, even those with extremely bearish views, may choose to assume certain risks, primarily because they are confident as to what securities to buy, sell or short in such risk conditions.

And finally, there are those who see the current markets as something for which risk can not be managed at all. For them, there is only uncertainty. That is, the markets seem beyond any measure of risk, and as such, are not worth any attention at all.

This too, is an entirely valid approach—depending on one’s own views of risk and uncertainty.

Signals Matter—For Those Who Accept Risk and the Ways to Trade it.

At Signals Matter, we understand those who simply wish to leave the markets for now—either because the risk is too great or because they see markets as beyond risk and as purely uncertain.

For such individuals, the adage of “better safe than sorry” is truer to their temperament. After all, missing years of upside is never as foolish as getting caught unprepared or uncertain in one day of historical downside… And the risk of looming downside is very real.

We, however, also recognize that for those comfortable with the tools used for measuring and assessing risk (as we do through filtering hundreds of market indicators), uncertainty is less a concern and risk more manageable.

For example, we are not at all “uncertain” about the inevitable consequences of these market bubbles. They will pop—either all at once, or gradually. Either way, reversion to the mean is as predicatable to us as gravity to Newton.

We thus see risk ahead, not market uncertainty, and are responding according to our own tolerance for that risk, a tolerance that is higher due to a higher confidence in our tools and systems which allow us to manage that risk. That’s precisely why we created the Signals Matter trading system (going public in, well…November.)

Predicting just how or when these market bubbles pop, however, is not something any risk tool can guarantee. The best we can do today and tomorrow is monitor probabilities, flows and the waters ahead, keeping a vigilant eye for the first sign of an iceberg. Why? Because we know the risks. We measure them day, after day, after day.

In short, because we accept the risk of security and economic downturns, we (and many of our subscribers) trade that risk differently, and so far, profitably.

As a result, we are bears trading in a bull market without acting like turkeys…

We think it’s a balanced form of market bipolarity…yet, like any approach to markets, not without risk.

Each of us must therefore respect our own measure of (and tolerance for) risk, as well as our own capacity for managing/trading it.

What’s your take on risk? On these markets? On Market Uncertainty ?

Cheers—and “gobble, gobble…”