Below, we look at the historical parallels between prior military disasters and the current market calamity unfolding around us. Specifically, we trace how a misguided faith in otherwise arrogant and poor leadership leads to irrational carnage, the kind playing out in numerous market sectors, including US pension funds.

Facades vs. Facts

If you have ever stood before the Federal Reserve’s impressive HQ in Washington, or walked among or through the banking neighborhoods of Manhattan or Frankfurt, you’ve likely noticed they are built with impressive care, giving off all the confidence, prowess, strength, and even, hidden intimidation of a battleship.

After all, some of the best minds of the best schools find their way to these settings. Like generals marching with swagger sticks or admirals reviewing their fleets, our financial elite presents itself as a kind of bulwark against calamity, a special class of special folks trained to manage markets and economies with fiscal courage.

Many good folks, in turn, place their confidence in these places and persons. Economists, central bankers and pundits speak a special language, seemingly complex and almost magical, if not mysterious. Based on their diplomas, credentials and salaries, one is often compelled to assume that Wall Street’s finest must, well…know something inside those impressive walls.

Similar care is given to our political monuments and buildings, from the powerful domes of Congress to the equally imposing Department of Treasury, which from my drinking terrace at the W Hotel, I have gazed upon with a kind of awe more than once.

These places and institutions, in short, are great surfaces which present an architectural and human tradition of something special. But as one familiar with these buildings and humans, I have also learned, as we all do, that we are often wiser than our heroes.

All Form, Little Substance…

As the swamp (as well as shut-down) that is Washington DC continues, and as stocks like Apple (which held a grotesque market cap of greater than $1T in September–driven by 3 years and $85B worth of stock buy-backs) which lost $425B by January remind us, there is infinitely more form than substance to these otherwise “respectable” landscapes.

Stated otherwise, the wisdom we have ascribed to politics and finance is increasingly more of a façade than a reality.

As for the “elite” class that brought us here, be it Larry Summers, Elon Musk, Alan Greenspan or the many other personalities of DC and NYC, I have poked more than one or two holes into their façades on many occasions. I won’t repeat such “human, all-too-human” failings at length in these paragraphs, but if facts rather than facades interest you, take another look at this November article.

No Worries in a World of Spin

Folks, we need to pause and take stock of our, well, stocks…We need to look more carefully at an S&P, which having reached a 2941 peak in September, has inspired a dangerously false and unearned confidence. Even after the volatility of October through December 2018, the spin-artists are once again back on screen or making headlines, telling us all that the Fed has our back and that markets will be on track for more seemingly endless victories.

Such headlines and calm, of course, are needed to keep faith in a glorious yet ultimately failed market campaign, one that still holds an ounce of shine despite the fact that more than 60% of the S&P’s stocks are now in a technical bear market or that our bond market screams of a pending debt crisis the scope of which has never been seen before.

Trust the Fed, Trust Tech?

Ah, but why worry? Not only will the Fed save us, but tech, we are told, is stronger than ever.

Really? Remember, for example, the warning signs we saw in just the FANG stocks as recently as late 2017? At Signals Matter, we gave particular attention to the dangerous overvaluation of names like Amazon, Netflix and Facebook on more than one occasion, and then summed them up nicely here in June.

Netflix, for example, peaked at $180 billion in July, but by this month it has lost over $60 billion in market cap. As for Amazon, a company that pays no taxes, makes no profits nor does anything for Main Street America, its market cap had soared past $1T in September of 2018, only to give back over $260B as of this writing.

Meanwhile, that great online billboard otherwise known as Facebook lost over $130B in market cap in the same brief window of time.

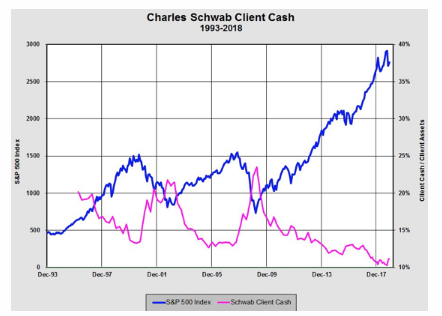

And yet despite such swings—which are the neon-flashing warning signs of frothy markets supported by hype rather than Free Cash Flow–investors, for the most part, remain fully-invested for 2019. As the blue line of stocks rise, the pink line of caution falls to the floor, as investors, like proud soldiers, march toward what seems like a glorious victory.

Such investor faith in surfaces is astounding. Almost nothing causes the army of faithful (and mostly passive) investors from questioning their “generals” or the financial “war” many are about to lose.

Goldman Sachs down by more than 30%? No worries. Deutsche Bank down nearly 60%? No worries. Ford off by 40%? No worries. Emerging markets are submerging by greater than 20%? No worries.

No worries, because our “leaders” in revered “juggernaut” buildings like Bank of America Merrill Lynch tell us stocks will surge and that investors “are the right kind of cautious.” Like generals miles from the trenches, our market “elect” ignore the blood in favor of the medals.

They tell us this despite the fact that Tobin’s Q ratio, which measures price-to-book values, is nearly 2X its mean, exceeded in absurdity only by the dot.com bubble of 2000…Meanwhile, the market cap-to-GDP indicator for the Wilshire 5000 has reached the 99th percentile, establishing a new world record for dangerously frothy…

But again, no worries. We are told the central banks, including the one built of such impressive marble in DC, has our backs. Collectively, and around the world, these commanding bankers have dumped over $20 trillion of printed money into the markets in the last decade to keep investors marching toward what feels like permanent victory.

And $20 trillion can certainly buy a lot of “victory” … Then again, we’ve never seen a strategy this big and impressive before in the history of capital markets. And no one at Signals Matter—or any bank, hedge fund or government office—had ever expected such a measure, nor can honestly compare it to any prior market “campaign.”

In short, nothing this brazen and reckless (a 5X money supply increase and decade of suppressed interest rates) has ever been attempted before.

But at least we know what did happen. We got a massive stock and bond bubble. More to the point, we got a debt bubble, and debt, while in the bubble phase, provides a lot of glory. It allows companies to borrow like teenagers at a mall with dad’s credit card.

In today’s markets, this “mall behavior” is made glaringly clear by the level of stock buy-backs that came in the wake of our central bank stimulus package. As analysts at SocGen recently announced, all net debt issuance in the twenty-first century has been used to pay for stock buybacks.

Read that last line again…

Folks, calling a market paid for by debt and stock buy-backs a “victory” is no different than calling a battle with an 80% death toll a “win.” The more brutal truth is this: stock buy-backs are just a legalized form of market fraud—an army of companies covertly conducting a leveraged buy-out of themselves…

Furthermore, when interest rise, this stock buy-back façade ends.

But, again, no worries. This “brazen and reckless” campaign unleashed by the central banks has investor confidence. Nothing so immense was ever attempted by prior generations, and as such it has won the blind and desperate faith of investors.

Such grand schemes, dangerous over-reach and blind support may not have any precedent in the history of markets, but in the equally absurd history of war, there is one example that comes to my mind as an almost perfect metaphor for today’s markets, and that is the ill-fated battle of Gallipoli…

Wall Street’s Gallipoli Moment

In a tiny corner of the Mediterranean Sea, above the North African coastline, past the island of Crete and the land of Greece, lies a convergence of seas, currents and seemingly forgotten history, known to almost no one of the Instagram/selfie generation. It’s called the Gallipoli Peninsula.

But between 1915 and 1916, the fate of the old Europe ended here. A great Allied army tried to blast its way through the Dardanelles. It too was a massive, brazen and reckless campaign lead by trusted elites and marked by glorious hopes, ships, weapons, and men.

If you were to stand today on the heights of Achi Baba and look down over the pristine waters of the Aegean Sea and the Gulf of Saros, it would be hard to imagine the slaughter that took place there, hard to imagine a coastline literally made red by the blood of thousands of young Australian, British and Kiwi boys who fought like lions against an equally fanatic and entrenched Turkish army.

But in 1915, the elite, well-educated generals (and the politicians which managed them from 10 Downing Street) who lead these lions underestimated the physics of machine guns entrenched on the high ground, and somehow believed that reputation, fanfare, shiny uniforms and plans alone –as well as a fleet of very impressive battleships and destroyers–could defy miles of well-placed machine guns.

So powerful was the reputation of these esteemed leaders and so blind was the faith of their innocent soldiers, that British generals convinced an entire generation to believe in a destiny that defied common sense and raw math.

Symbolic of this faith was the figure of Rupert Brooke, a young poet renowned for his prose, physique and athletic talents in the finest schools of England. In a famous set of lines indicative of this irrational exuberance, he famously wrote:

“If I should die think only this of me;

That there’s some corner of a foreign field

That is forever England.”

Well, not long after these lines were written, Brooke was burried near Gallipoli on a piece of ground that, at least for him, is forever England…

So where am I going with this?

Perhaps you may think this piece of geography and the horrific combat has little to do with the current state of our economic destiny? But if we dig a bit deeper into the lessons of men, arrogance and desperation, we see many parallels of how all that once was can change in a matter of months.

That is: What was true of great armies and empires is equally true of great economies, markets and banks: they can, and do, fall.

Off the Turkish shores of Gallipoli, hung the partial fates of all that was Tsarist Russia as well as the once unquestioned superiority of the former British, Ottoman and Austria-Hungarian empires. In 1914, these empires seemed immortal, by 1918, they were gone.

Doomed from the Start

What is so symbolically tragic about the slaughter and failed military campaign of Gallipoli was that many of its original planners (Admiral Fisher, Commander Hunter-Weston…) knew that it was a doomed experiment– dreamy and grand, yes, yet mathematically destined to fail.

The same is true of the failed financial campaign we ushered in 2008-09. Deep down, even our own central bankers know that solving the 2008 “debt crisis” with 11 years of more historically unmatched debt is axiomatically doomed to fail. Greenspan, and now even Yellen and Powell, have so much as confessed this:

“You will never see another financial crisis in your lifetime.”

-Janet Yellen, spring 2018

“I do worry that we could have another financial crisis. ″

-Janet Yellen, fall 2018

“There’s no reason to think this (bullish) cycle can’t continue for quite some time, effectively indefinitely.”

-Jerome Powell

“The US is on an unsustainable fiscal path; there’s no hiding from it.”

-Jerome Powell

Meanwhile, the markets and market-spinners tell us to march forward, to believe in our “victory” and even our FANGS… After all, the British had fancy battleships and Admirals, and we have fancy banks, bankers and tech gurus, surely this must mean something? Surely, they cannot fail?

But fail they have, and fail they will. It is mathematically inevitable.

The Psychology of Bad Policies

For this is where the psychology of desperation and hope, common to doomed markets and doomed armies, overlaps. As one historian (Alan Moorehead) of the Gallipoli fiasco described its slow and deadly unraveling: “The expedition began to develop a life of its own. However gloomy the commanders might be, a communal will for action had spread itself through the army. The more the evidence of failure, the greater the resolve to double down.”

In other words, a fanatic disregard for causalities, numbers, data and facts set in among the generals as their ships began to sink in the straights and as their men were mowed down like grass against an enemy entrenched in the high ground.

Slowly, generals and soldiers alike, were “caught up in the heat of the absurd,” and began replacing realism and empirical data with what that same historian described as “a delusional faith that paralyzes the mind.”

What better words could be used today to describe the pending slaughter to which our central banks have placed (and marched) our markets? We are, indeed, caught in a delusional faith that paralyzes the mind, ignoring obvious and objective facts in favor of fervor and hope.

In the last decade, for example, global debt has doubled to greater than $240T, a number that defies all reason and is as staggering and dangerous in its waste as thousands of Australian farmers marching uphill toward a row of MG09’s and certain death.

US debt alone, by the way, is nearly 1/3 of that global debt tally. Like machine gun spray, it’s a fact that cannot be wished away. Our GDP annualizes at less than 2%, our Main Street economy is broke, manufacturing, real employment, stock prices and earnings are trending downwards and interest rates–the very cost of supporting our dying and debt-driven economy–are rising upwards.

As we’ve said more than once—this combination of debt and rising rates is fatal. It”s math, not marketing.

Meanwhile, as the obvious failure of our central-bank “campaign” plays out in slow motion, our politicians are fighting over an $8B border wall? This is no different nor more sad than British generals arguing over red vs white wine safely tucked away in their battleships off shore while their armies fall on the fly-invested beaches less than 1 mile away…

History, indeed, is a sober thing—for it reminds us that insanity repeats itself in any number of contexts, eras and personalities.

By 1916, almost 50,000 young men from the farms, mines, beaches, plains, pubs, and villages of Australia, England, France and New Zealand were lost because of an innocent faith in an arrogant plan.

I am sadly convinced, that very soon, we shall write a similar epitaph for all that once was of our great economic “recovery” as well as our blind faith in the central banks and the governments who foolishly pushed forward this glorious but otherwise doomed campaign.

But if you still think the Fed and its legendary “generals” will pull off an amazing victory of recession-free fantasy, let me just leave you with one more (out of literally hundreds) of “casualty reports” otherwise ignored by most of the Wall Street propaganda machines which “paralyze the mind.” Namely, let’s just look at US Pension Funds.

The State of US Pension Funds

As for the broader US economy which serves our pension funds, I have written at length here and here about the objective (and sad) fact that Main Street has been crumbling during Wall Street’s artificial yet glorius rise following the 2008 “bail-out.”

The gap is astounding, yet perhaps not as astounding (or nauseating) as the simple fact that the combined wealth of Buffet, Bezos and Gates is greater than half the US population.

Folks, just pause and think about that for a moment…

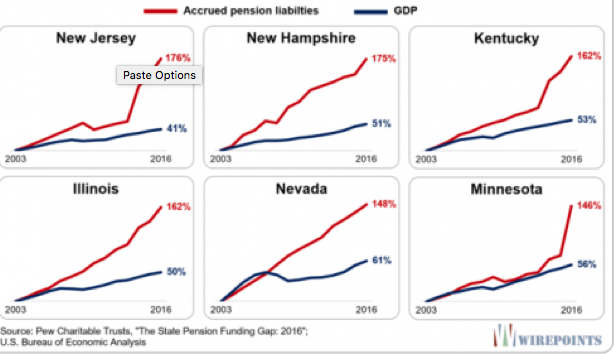

But if you need a little more evidence rather than anger, just consider the current state of US pensions…Across the majority of our 50 states, the pension payments due to hard-working Americans who don’t share the same tax bracket as Bezos, Buffet or Gates are simply, well, not there…These retirement accounts are grotesquely under-funded, as the below graphs make depressingly clear…

Our state, municipal, and corporate pension plans and private retirement accounts (i.e. 401Ks and IRAs) are riddled with landmines and marching straight into machine gun fire. Unfunded pension liabilities have grown by 6X since 2003, and currently exceed $1.4 trillion and are increasing by the day.

The underfunding is estimated to eventually impose massive surcharges on individual households. Kentucky, by way of example, has only 16% of the funding needed. California’s CalPERS is funded to less than 70%, which means every private citizen in California would have to cough up greater than $100,000 to meet its pension payments. Illinois owes over $100 billion to its pension funds, which is six times the state’s annual revenues… New Jersey has $80B to pay for $280B of future liabilities.

In fact, for 28 of our 50 states, accrued liabilities have grown by 50% since 2003, which, needless to say, is a liability rate that is far out-pacing their statewide GDPs. Meanwhile, over 100 million working-age Americans have a savings account of zero.

Desperate Battles, Desperate “Solutions”

So, what can and will our broke and clearly defeated states to do? Well, like the bloodied beaches of 1915 Gallipoli, their options and their results won’t be pretty…The California Supreme Court is deciding whether pensions can be cut on government employees. CalPERS voted to increase the amount cities must pay, causing some of them to consider Chapter 9 bankruptcies.

Indeed, desperate states, like desperate armies with machine guns facing them and water behind them, tend to do, well, desperate things. Illinois, for example, wants to borrow $100 billion to speculate on equities. That’s right: they think the stock market (which has reached a peak) is going to save them…

Kentucky is even more desperate. Between 2006 and 2017, their bond portfolio has grown from less than 1% junk bonds to 53% junk. Now, if you’ve read anything we’ve said about the junk bond market, or watched by video here, then you know how absurd and tragic a “junk bond solution” is going to be…

In short, and as David Hunt, the CEO of PGIM recently observed: “If you were going to look for what’s the possible real crack in the financial architecture for the next crisis, rather than looking in the rearview mirror, pension funds would be on our list.”

Back to History

Today, far from the lessons of philosophy, psychology or even military over-reach, we see a similar “Gallipoli moment” of dramatic change looming over the financial horizons of a world as naively certain of central bank and market stability in 2018 as the generals, armies and poets of 1914 were of their own military indomitability.

Again, I have written numerous pages already as to the arrogance, folly and pride of a collection of global central bankers and self-seeking financial “experts” who somehow convinced themselves, the media and hence the investing masses that a financial empire besotted by debt can somehow solve a debt crisis with yet more debt.

To me, this as tragic as thinking a hundred men or a thousand men, no matter how well-trained, dressed, or inspired can defy a battery of carefully aimed machine guns by marching straight into them…

But just as the Europe of old had its tragic Gallipoli moment, so too will our markets and post-08 central bank experiment go down in the annals of history as an epic and arrogant failure. And for that central bank, I too have an ode to offer:

“If my portfolio should die think only this of my zeroes;

That there’s some corner of a central bank

That is staffed by false heroes.”

This is brilliant. You write better than a novelist. Keep it coming.

Yet few are even hearing about the pension debacle, and fewer have an answer. The voters will get angry and demand retribution of politicians, for bankers and anyone perceived as rich (i.e. anyone with a million dollars or more). No one can seen to get the airtime to wake up the masses from their ignorant slumber…