Real estate problems loom in the backdrop, as always… and it’s due to cheap debt, low rates and a mis-match in supply and demand.

24 shares

You’ve seen me list a number of reasons for a melt-up leading to an epic market fall from grace thereafter.

As we’ll see below, we are seeing early warning signs (i.e. bearish growling) regarding real estate problems .

In the coming days, I’ll be providing even more signals and tailwind reports to capture and track the current bull run while also preparing you and your portfolios for the return of a very angry bear thereafter.

But speaking of falling from grace and major market disasters, today I wanted to share yet another example of guilty “elites” trying to play at being good guys.

This time you’re going to see the reality of real estate problems and the coming crisis for all Americans.

One Man’s Risky Business Is Our Nation’s Financial Turmoil

Recently, I’ve noticed that those directly responsible for causing prior recessions are increasingly seeking to redeem themselves by warning of the next recession.

There’s an ex-president of Harvard, for example, that I like to poke fun at.

In his political days, he helped deregulate the very derivatives market that unleashed the 2008 disaster.

But now he spends his time endorsing books warning of “risk.”

The ironies do abound…

Such self-serving anti-heroes are almost too many to count.

But today I’m reading about a certain sub-prime mortgage tycoon (the veritable face of the housing disaster) warning of yet another real estate crisis.

Whatever one may think of such “good guys,” I’ll at least admit that real estate problems and a housing crisis is among just one of the many triggers to come when the eventual meltdown hits the U.S. markets and economy.

In the current example, this former mortgage executive is at least correct in predicting real estate problems and a massive fall in real estate values, especially in the high-end coastal regions of the Northeast and West Coast.

This former sub-prime peddler partly blames current real estate problems and the next crisis on the loss of special deductions in the 2017 tax overhaul which has made high-end homes harder to afford.

The other reason for falling housing prices is just a matter of simple supply and demand-i.e. too much supply (“inventory”) and not enough demand (cash-rich buyers). When such supply and demand forces collide, prices fall like rocks.

Of course, not all of you own $10 million homes in Malibu or Nantucket, so a loss of 40% of more of value in the high-end space may not seem to be a primary concern.

But the larger picture of real estate problems affects us all, and the larger picture is this: Things are falling apart within the U.S., from the middle class to the coastal class.

I’ve shown elsewhere how the U.S. middle class has been crushed by the Fed and Wall Street.

I’ve also shown the truth behind the great unemployment lie.

But soon even the rich will start to sweat.

Come One, Come All to the Crippling Debt Show

Indeed, it may be hard to sympathize with those uber-wealthy folks who have been trading and profiting like drunk teenagers in a Fed-supported market.

But folks, when even the uber wealthy (many of whom are just living off massive debt) suffer, everyone suffers.

As Americans of every stripe, middle-class to upper-class, start feeling more and more pain, the economy rots from within despite markets climbing on a “supportive” Fed and a surging U.S. Dollar.

This “internal rotting” accelerates when more and more Americans can no longer meet their debt obligations, which leads to real estate problems…

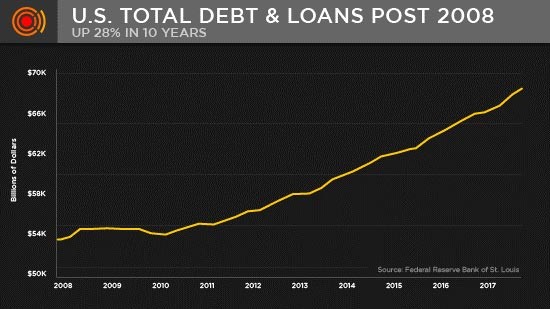

Toward this end, we already know that household debt is a big part of total U.S. debt, which is off the charts higher than ever:

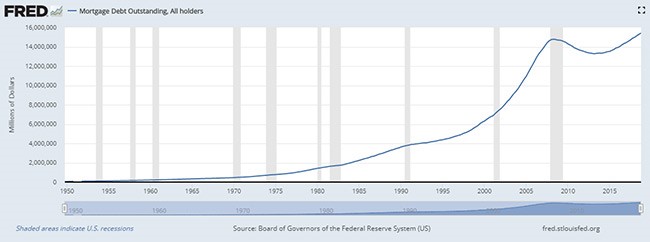

As for mortgage debt, well it’s just one more classic example of consumer debt rising toward a historical tipping point and yet another “Uh-Oh” moment and more real estate problems down the road.

Stick with Signals Matter as we track this debt-driven market storm through its rising and falling stages.

We’ll not only keep you informed, but armed, prepared and profitable as the weather patterns change.

In the interim, be careful, be smart, and be on the lookout for more to come.

Comments

10 responses to “How Today’s Real Estate Crisis Could Shake Your Lifetime Wealth Potential”

- Phillipp Jasonsays:

May 9, 2019 at 8:22 PM

What do think about gold as a safety net?

- Thomas Starnessays:

May 9, 2019 at 8:25 PM

Great short article. Keeps you thinking and aware.

- RLG, Canadasays:

May 9, 2019 at 8:32 PM

Are these debt figures adjusted for inflation?

Perhaps better, how do these numbers compare to income — and thus ability to pay?

- ronald sonjusays:

May 9, 2019 at 8:55 PM

If you want an example of government corrupt behavior, you may want to consider your county tax assessor. People who fall behind on their property taxes end up having to go through a tax sale, losing their home.

The big issue is the fact that the tax assessor does not inform these ex-homeowners that they are entitled to the overages, or excess funds. For example, assume your home is sold for $300,000 and you owe $50,000. Your overage is $250,000.

The tax assessor takes these funds and places them in some fund for a period of time, say from one to three years. After the time has passed, the funds are taken by the county and cannot be returned to the ex-homeowners.

You can check this out by contacting your county tax assessor and ask for a list of tax sale overages or excess funds. You may encounter some resistance from your tax assessor as they do not want people to know about this situation. You can also go to a website “Hooked On Overages”. There is a lot of hype but it does go through the process.

The person who owns this website runs a course for “finders” who offer to find this money for ex-homeowners for a fee. Because this program has had some success, many county tax assessors have changed their procedures to make it harder for these “finders” to do their business, making sure that the ex-homeowners do not find about the excess funds that are owed to them.

What really bugs me is that the government workers in these tax assessor offices are being paid by us – taxpayers.

If you have lost your home due to a tax sale, contact your county tax assessor office NOW!

- Franksays:

May 9, 2019 at 9:32 PM

Just one more reason why things are not as they seem and a lot of people who have gotten rich in the last 10 years (and they shouldn’t have) are going to pay the price in the next couple of years. This includes Warren Buffett who is a guru like no other guru. The only reason he has been successful is because he has a rising market since he started. Yes he is an excellent analyst at picking good value companies to invest in but Berkshire is a mutual fund, nothing more, nothing less. When the market declines 70-80% Berkshire will go right along with the crowd and he will no longer be as famous as he is today.

- Clarksays:

May 9, 2019 at 10:53 PM

Hello,

When do you anticipate this mortgage crisis’s?

Any idea how much values will fall?

What would trigger wages falling?

Should people sell their rental properties who have at 15 years left to pay or is there a recommendation to refi to the lowest interest rate possible and keep rental property?

Marvin Reynolds

- Ceola McClendonsays:

May 10, 2019 at 2:55 AM

they are building everyplace what’s going on in Los Angeles, Ca real estate

- Mikesays:

May 10, 2019 at 3:39 AM

I disagree with you. The west coast will continue to increase in price at

the normal rate (5%-10%) per year. for the foreseeable future because there

has been no over residential construction.

- Jeffrey Craig Schneidersays:

May 11, 2019 at 9:45 AM

Name names, I want the names of the scumbags in case I run into them at a cocktail party or better yet in a dark alley!!!!!

- Spataro says:

May 12, 2019 at 11:10 PM

I have learned from John Murphy,Carl Swenlin,Lance Roberts and others Charts driven knowledge.Excellent.

I

say Your Writing are Super Excellent .

Thank You!