Negative Rates: The Fed vs. the White House

The White House is asking for negative rates, and the Fed is saying no way—at least for now. Both arguments are hard to believe, and below we show you why.

Fist, when it comes to double-speak, no one, and I mean no one, does it better than the Fed.

Powell says (rightly) that negative rates don’t work and are “unlikely” going forward, though debt-comfortable billionaires like Trump rightly enjoy a system in which banks pay you to borrow, and are thus clamoring for negative rates.

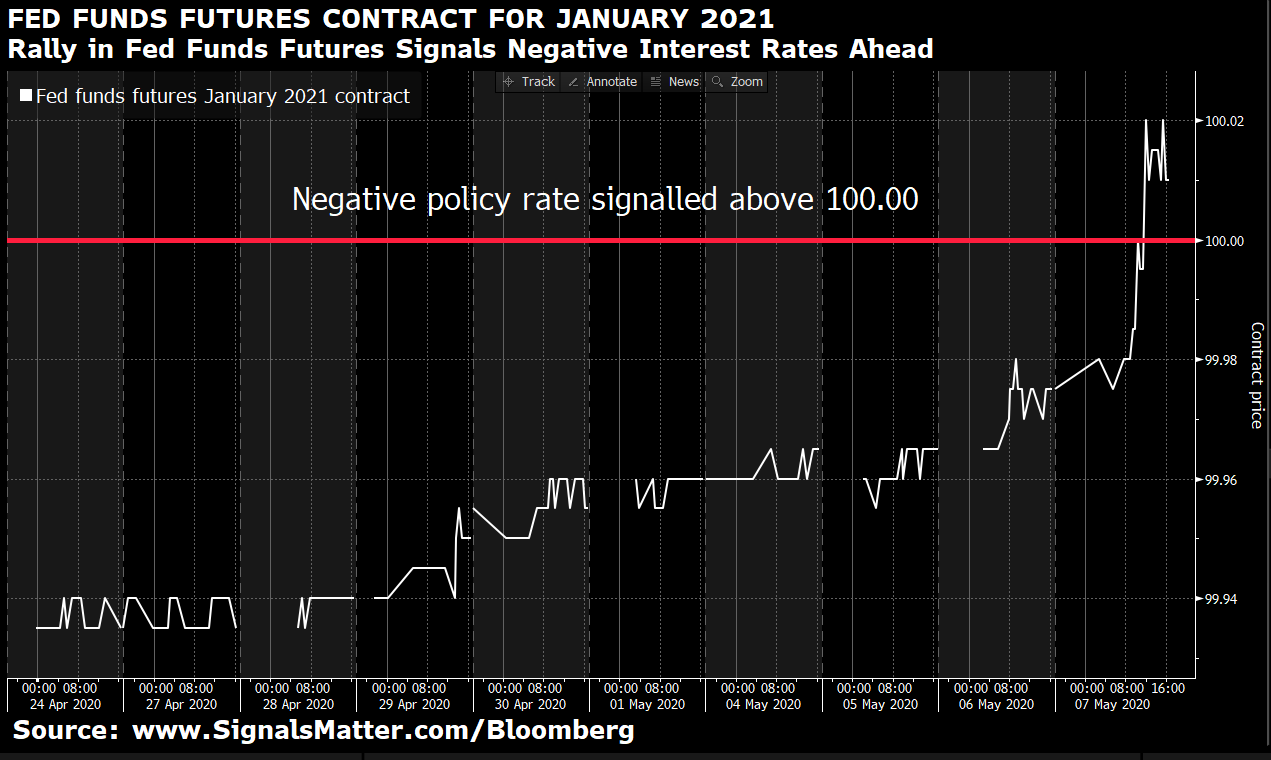

Despite Powell’s assurances that the Fed has a strong enough “tool kit” to avoid a policy of negative rates, the future’s market would beg to differ, and has recently priced in negative rates for the US by early 2021.

Looking Overseas

Our first cousins in the UK are equally bracing for sub-zero rates, which would also be a first in that nation’s much longer history, which included Cromwell, Waterloo, the Battle of the Somme, Messerschmitts over the Channel and the Reformation.

In short, if religious wars, Nazi invasion threats, or even Napoleon were scary for England, none of those historical moments did to Britain’s interest rates and economy what a pandemic global flu has already done.

This is despite a British COVID casualty figure (34,000 fatalities to date, the vast majority of which were older than 75) that is less than the death toll for a single day of combat at the Battles of the Somme (19,000), Operation Michael (8,000) and Ypres (7900), the vast majority of whom were aged 19.

In short, the group that needs and deserves absolute quarantine protection is fairly clear. The rest of the world could “stay calm and carry on.”

That alone makes one wonder just what the heck is really going on among the dark corners of market and policy insiders who can’t be found in a Google search.

But that’s not for Tom and I to speculate upon…

Yet whatever your personal views as to this COVID PSYOP, there’s no denying that it is, and has, destroyed the global economy in ways that not even the Wehrmacht might have imagined.

Hard Facts—Bad Options

GDP in the UK is about to hit lows unseen in three centuries, and here in the US, we are looking at a Q2 GDP of at least negative 25 to 30%. In short: Ouch.

Meanwhile, Americans are staring down the barrel of mass bankruptcies and unemployment levels not seen since the Great Depression. Again: Ouch.

That we saw an April sucker’s market rally in such a poisoned backdrop just strikes us as staggering, though in times, policies and rigged markets like these, just about everything staggers us.

Should the US pursue negative rate policies (just add one more log of stupid to the great policy pyre), the hope is that this will “stir more spending”—but the real word is borrowing to stir more spending.

In short, the clear plan forward is more debt to solve an already horrific and pre-COVID debt problem.

In all fairness, though, we do recognize that Congressional lawmakers and the White House have passed almost $3 trillion in economic relief measures, much of which is aimed at small businesses and families who (unlike BlackRock, Inc.) actually deserve it.

What remains unclear, amidst so many other sources of fog, is just how and why a virus with a clearly identifiable risk profile was allowed to shut down an entire global economy. Again, we won’t speculate or add opinions here.

What is clear for our subscribers is the data we are currently tracking as to GDP, earnings and employment, as well as yields, bond and stock trends.

If the US were to resort to a negative rate policy, the search for yield will require micro-scopes not more Fed “support.”

Should US rates go negative as they’ve done (to no avail) in Japan and Europe, the negative impact that could have on US banks and money markets is clear, leading long-term to more pain than pleasure for the real economy.

COVID Hall Pass for a Long History of Bad

But in a post-war America where great minds like Eisenhower and Martin have been replaced by lesser leadership in Wall Street, DC and at the Fed, the short-sighted aims are always the same: Hide current reality behind more debt and continue to extend and pretend until it’s just too late, at which point officials of every partisan stripe can collectively blame a virus rather than decades of their own economic profligacy.

As for liquidity (i.e. dollars) there’s just not enough of them available in the current liquidity crisis, which despite recent and extreme money printing as well as direct Fed ETF purchases, is not a sustainable solution to the massive dollar shortage problem of which we explicitly warned well BEFORE the COVID outbreak, HERE.

I highly recommend you re-read that report.

Alternative to Negative Rates?

If Powell, however, sticks to his current stance to avoid negative rates, the only tool left is “yield curve control,” a term used by the fancy lads to justify the Fed fully intervening into long-term Treasury bonds, which will entail QE to Infinity—i.e. just more money out of thin air.

This is the “solution” Japan chose, and as we’ll see below, that’s no solution at all.

As of now, the Fed has already “printed” $1.5 trillion since mid-March to buy Uncle Sam’s debt in order to “restore liquidity,” but folks, there just isn’t a big enough liquidity fire hose to put out the “illiquid” fire which the US has created for itself in the preceding decades, let alone Covid-related shortfalls.

Wall Street will tell you that such “liquidity measures” (i.e. money out of thin air) are needed to avoid another March investor “panic,” which is a nice way of blaming investors rather than Wall Street itself for the Danger Zone in which we now rightfully find our nation.

Meanwhile Powel, with all the calm of Captain Smith on the deck of a sinking Titanic, feels such “forward guidance” (i.e. Fed manipulation of credit markets) will only be necessary “until [he] is confident that the economy has weathered recent events and is [back] on track…”

But folks, back on track to what? As we’ve pointed out with math rather than opinion, our economy was already sick long before the pandemic became the final straw on this camel’s back.

Hard Facts, Real Portfolio Advice

If you prefer candor over fantasy, what lies ahead is not a Japan-like “solution,” but a Japan-like stagnation, as we unpack below.

In the near-term, markets will see more volatility, just as we warned, as April’s “surge” is already being tempered by this month’s fall.

At Signals Matter, our portfolio solutions operate off candor and data, not political double-speak or Wall Street’s sell-side propaganda. If you prefer the former over the latter, then simply join us by clicking HERE.

For now, let’s turn to a question which so many of our subscribers have been asking.

The Great Inflation Question

For those asking the obvious question about inflation—namely, how can central banks in general, and the US Fed in particular, print trillions of dollars without creating dangerous inflation?

Let me address this as succinctly as possible by combining the insights of prior reports posted here at Signals Matter.

First, actual inflation, as opposed to the fictional 2% levels of inflation reported by the BLS, is much closer to 10% based on the CPI inflation metrics used in the 1980’s and 1990’s.

To better understand the facts as well as reasons for such flagrant misreporting of inflation, simply click HERE.

In short, we already do feel the inflation (tuition, health care, housing etc.), even if the BLS choses to lie to us. Sad but true.

Secondly, for inflation to rear its ugly head, the trillions of dollars printed by the Fed must flow into the real economy (what the fancy lads call the “velocity of money”) rather than be held up in reserves behind the dam/mote-like walls of the Fed. For more on how this works, simply click HERE.

Thirdly, Despite the massive amounts of US Dollars in circulation today, many of those dollars are tangled-up (and hence unavailable) in grotesquely complex derivatives instruments in over-seas channels known as Euro-Dollar transactions, again explained by us in greater detail HERE.

Turning Japanese, I really Think So

Fourthly, let’s look at Japan.

I wrote at length about its economic zombie status HERE and warned in 2019 that the US would eventually “turn Japanese” by pursuing equally desperate policies of 1) unlimited money printing, 2) direct security purchases by the central bank and 3) flirt with negative interest rates, all of which are now happening as if right on que.

But when it comes to the question of inflation, Japan’s staggering level of money printing yet low inflation offers some guidance.

For years, Japan’s central bank has been printing Yen to buy up government bonds as fast as the government can issue them.

It has also been buying corporate debt, stock ETF’s and REITS. In short, Japan’s central bank is the market—it prints money out of thin air and effectively buys everything.

Crazy? Desperate? Yep.

And yet Japan has low inflation? How? Rates and inflation there are at the zero bound. What gives?

First, and as anyone who lives in Japan knows, wages and prices there have basically not moved up since its NIKEI tanked in 1989. It’s as if time (along with growth, wages, and hope) stopped in 1989.

Sound good to you? Well, get ready for it.

For our readers in the US and elsewhere, get ready for the same zombie economies coming your way in which wages, growth and hope stagnate. Wonderful…Thank Mr. Powell.

Japan, like the US, is essentially on a course of QE to infinity (i.e. the complete death of capitalism).

But here’s the rub: That’s a fantasy solution.

The balance sheet for the Japanese central bank is already 100% of its GDP, which means it produces nothing but debt and fake money. Wonderful again…

More to the point, it’s not sustainable, yet uncontained Fed and ECB money printing is the new “plan.”

Defenders of QE to Infinity would argue that such grotesque levels of money printed out of thin air is a nonsensical measure, as the printed money just sits as liabilities (debts) on a balance sheet that never has to be paid from national income.

In such a scenario, the only problem Japan’s central bank would face is running out of Yen-denominated assets to buy. Then, like some hedge fund, the bank could incur FX risk and start buying assets around the world like a glorified asset manager.

Furthermore, there’s the additional risk that the assets the bank does hold just become worthless, making Japan effectively insolvent. In that case, hyper-inflation would follow.

This, however, is unlikely, especially in Japan where nearly all of its citizens own Japanese bonds and are thus unlikely to reject their own savings in the form of JGB’s (Japanese Government Bonds).

Instead, hyper-inflation comes when a population simply rejects (loses faith in) its currency, as the French did in 1793.

Which means rather than risk hyper-inflation, the Japanese today, like the US and Europeans tomorrow, can expect tanking growth, tanking wages and zombie-land economic reality, all thanks to our central banks and the private bankers they support, most of whom are in the top 1% and frankly don’t give a hoot about Main Street or the real economy.

That’s why their plan is to simply buy (print) more time, rather than bluntly address facts. That’s called can-kicking.

That’s also why we entitled our latest book, “Rigged to Fail,” as the world we are inheriting from Wall Street and DC is a grotesque, insider’s game played (rigged) at YOUR expense.

Furthermore, and regardless of how inflation is reported, I can assure you that the purchasing power of whatever currency you hold today is getting weaker by the second—hence my profound gold conviction, reported at greater length HERE.

Meanwhile, central bankers in Japan, the US and elsewhere will continue to tell the world they are targeting higher inflation, which is basically a lie, because if inflation were to rise, so would interest rates, and with debt to GDP ratios well past 120% in the US and 230% in Japan, those countries simply could not handle rising debt costs.

In short, you’re being lied to, and have been for years. The facts are hiding right beneath your eyes, and we simply wish to point them out.

At least at Signals Matter we’ll tell you plainly what our signals and experience are telling us.

Sincerely,

Matt & Tom