Below we look at precious metals, risk assets and the critical importance of negative real yields and the Fed’s unenviable position between a currency-killing rock or market-destroying hard place.

I’ve often joked that fretting over delusional price moves in individual stock names in a market Twilight Zone is akin to fretting over the desert choices on the Titanic’s dinner menu.

In short, the real issue is the obvious iceberg ahead, not chocolate vs. vanilla eclairs, Amazon vs. Tesla or even Bitcoin vs. gold.

Today, the big questions, and the big variables as well as icebergs, all hinge upon the “macros”—you know, boring things like historically unpresented (as well as unpayable) debt levels, openly absurd risk-asset bubbles and the artificial measures central bankers and politicos will and must employ to postpone the inevitable.

What to Watch

Toward this end, central banks and fiscal deficits are the big forces/variable to watch, as are rising or falling bond yields and inflation rates.

Whatever one’s view of the COVID pandemic and the relief policies which followed, there are 10 million less folks employed in the U.S. today than last year, despite massive fiscal support.

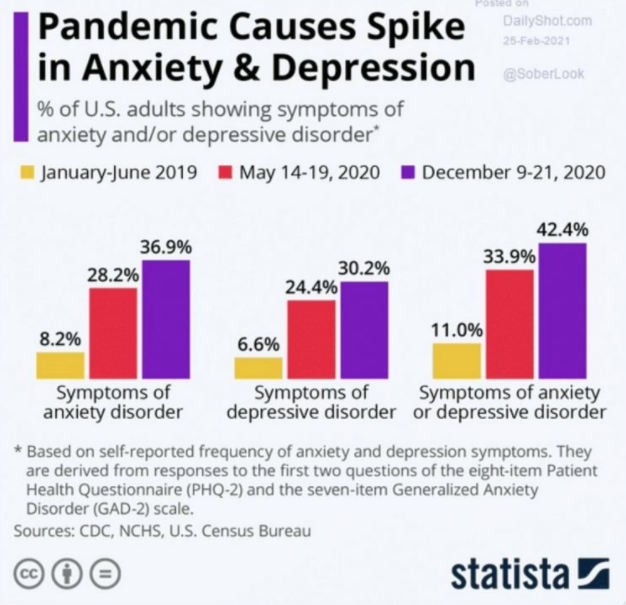

The stress is real—literally real—out there, as the COVID lockdowns have dramatically impacted personal wellbeing as well as mental health, with anxiety and depression levels skyrocketing in the US:

All this Main Street stress means we can expect even more aid, and hence more debt ahead, especially with a Biden-supported Congress.

More aid, whether greater or larger than the last administration’s, also means more money supply creation as well as more money supply inflation to “pay” for the aid.

In just one year, we saw a massive increase in the broad money supply (printed money, currency already in circulation, checking & saving accounts etc.), and we can expect more this year.

It’s thus rational to anticipate a base case of large aid packages ahead and hence a Fed continuing to purchase the bonds issued to pay for that aid, currently at a rate of $120B per month, which means we can expect at least another $1T+ in deficits.

Why Deficits Matter

Deficits, of course, matter. They are like credit ice cubes which turn into debt icebergs.

We can also assume, quite confidently, that the money printing needed to purchase those otherwise unloved sovereign bonds will continue.

Why?

The answer is as simple as it is tragic: If the Fed didn’t buy those Treasuries, their yields would rise, which means rates (i.e. the cost of debt) would rise too.

But here’s the rub: Our cornered Fed and Treasury Dept. can’t afford rising rates. Not even one tiny bit of them.

Thus, to keep rates and yields artificially low, desperate Yield Curve Control (YCC) is inevitable.

The Fed has NO CHOICE but to continue its pattern (think Q4 of 2018 & 2019) of rushing to Wall Street’s rescue by printing more money (QE) whenever markets tank in order to purchase otherwise demand-less bonds and thus artificially repress yields and rates (YCC).

Alas: More “Uh-Oh” moments are inevitable, as is more QE and YCC, at least until even that rigged game implodes…

Revisiting Inflation

So, what can we rationally expect going forward? What key indicator, as well as key asset, are the logical choices?

History, as usual, gives us some credible maps to follow.

As always, this involves a deeper dive into seemingly “boring” topics like inflation, Treasury yields and desperate bankers.

Fortunately, the 20th century gives us two inflationary case studies—the 1940’s and 1970’s—to make the future clearer, with no need for tarot cards.

1940’s Inflation

The 1940’s, very much like today, saw inflation in the backdrop of massive fiscal deficits (coming out of the Second World War).

In the 1940’s, as today, government debt to GDP had climbed above the critical 100% marker.

Of course, that’s a lot of debt, too much debt. And if rates (or Treasury yields) ever climbed too high, Uncle Sam would be standing naked at low tide.

To cover those deficits, the Fed then, like today, opted to buy lots and lots of U.S. Treasuries to keep yields and rates artificially low.

Thus, the Uncle Fed of the 1940’s deliberately kept yields (and hence rates) no higher than 2.5% across the entire duration of the yield curve, short-term to long-term Treasuries.

This was a classic case (as well as mix) of massive debt, high inflation and low rates compliments of YCC.

Fortunately for the Fed of the 1940’s, the US was a leading manufacturer and global bright spot compared to the rest of the post-War world.

That, of course, is not true today.

1970’s Inflation

The 1970’s inflation offered an entirely different inflationary flavor and “solution.”

Unlike the 1940’s, the nation’s debt to GDP ratio (at the government, corporate and household level) in the 1970’s was much smaller.

Thus, when inflation reared its ugly (and Post-Nixon) head, Volker’s Fed was able (unlike today) to allow yields and rates to skyrocket in order to stem the inflation.

2020’s Inflation

Needless to say, we are entering into an inflationary period far more like the 1940’s (yet without the global leadership) than the 1970’s. In short, we will never see a Volker rate hike anytime soon.

Today, if Treasury yields and/or interest rates went to even 4% or 5%, the debt cost would be fatal. Our nation and markets of Titanic debt would hit a rising-rate iceberg. Party over.

That’s why more Yield Curve Control (artificial rate repression) is as inevitable as a fibbing politician.

But as for inflation in the 2020’s, it’s not here yet—or at least not as reported by the comically downplayed CPI data, a charade we will fully reveal (and revisit) next week.

Thus, you might be asking why I’d compare the 2020’s to the inflationary 1940’s? After all: Where’s the inflation?

Well, inflation is coming, and here’s why.

Inflation & the Velocity of Money?

Many deflationary proponents say there won’t be inflation without an increase in the velocity (i.e. circulation) of money within the real economy.

But inflation is more complex than just rising money velocity.

History, in fact, confirms that inflation doesn’t require the velocity of money to increase, it just requires it to keep from falling.

During the inflationary period of the 1970’s, for example, the velocity of money was significantly lower than the non-inflationary decade of the 1950’s.

Inflation & Money Supply

Instead, the safest and surest measure of inflation has always been its correlation to an increase in the broad money supply.

In short: When broad money supply increases, that, by definition, IS inflation.

Inflation & Rising Commodity Prices

But in order for our current era to see rising CPI inflation, we’d have to see two forces in motion, namely 1) non-falling money velocity alongside broad money supply increases and 2) a scarcity (and hence price increase) in commodities.

And guess what? These forces are slowly converging today.

Notwithstanding the over-supplied energy sector, we are witnessing this commodity scarcity (and hence price rise) in the broader commodities market—from copper and lumber to beef and corn.

This cyclical shift toward commodity price inflation is a neon-flashing sign of consumer price inflation felt in the wallet and measured by the CPI scale, however broken that entirely fictitious indicator may otherwise be.

Prior to commodity scarcity, the broader money supply, as well as printed dollars, went straight into grossly inflated stocks, bonds and real estate, each of which are in classic bubble territory today.

But as we near the later months of 2021, such commodity scarcity (and hence commodity driven inflation in the CPI) will become more apparent, increasing in the coming years as even the openly fraudulent CPI inflation scale has no choice but to move noticeably upwards.

Inflation and Precious Metal Direction

Of course, the knee-jerk response of most precious metal owners is that inflation is always a tailwind for gold.

This is largely true, but the inflation-to-gold issue, like all things, is not always that black and white. Many inflationary forces are at play, and we’ve written at length elsewhere.

Gold, for example, had been rising throughout 2019 and 2020 in openly deflationary conditions, so the gold discussion is not simply one of inflation alone, but inflation when measured against yields/rates.

A Major Gold Indicator

Thus, there is a far more accurate forecaster of gold price, one not ordinary making the headlines or reading lists of retail investors.

Drumroll please…….

The Inverse Relationship Between Negative Real Yields and Gold

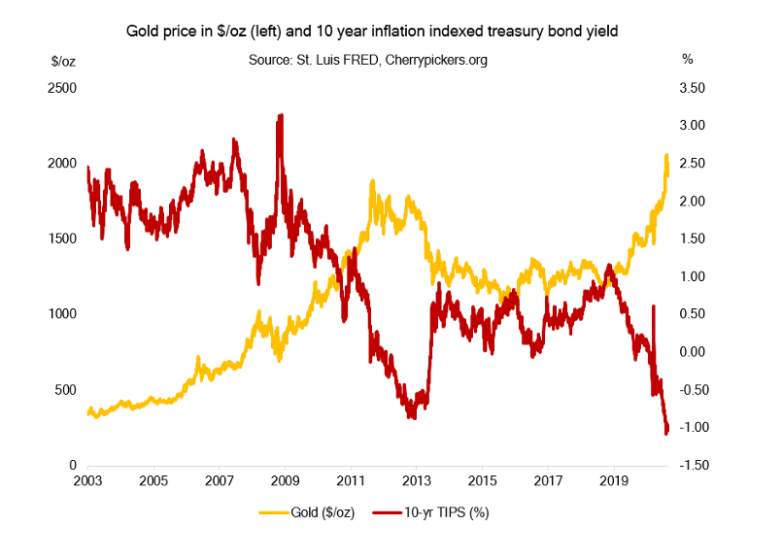

It may sound complex, or even boring, but a key variable for gold forecasting is negative real yields—that is, the 10-Year Treasury yield minus the official CPI inflation rate.

More simply stated: Gold has a very close inverse relationship with negative real yields: Gold’s price rises as real (i.e. inflation-adjusted) yields fall deeper and faster into negative territory.

In the 1970’s, for example, we saw this interplay of sinking negative real yields and rising gold prices; the big gold spikes during that decade occurred when negative real yields sank to as low as -4%.

More recently, from mid-2018 to mid-2020, gold was once again rising dramatically because real yields were collapsing from +1% to negative 1%.

This rapid rate of change toward negative real yields was a clear tailwind for gold.

By late 2020, however, the nominal yields on the 10Y Treasury began to rise faster than official (and still anemic) CPI inflation rate.

As a result, the real yields weren’t as dramatically negative as in the past. Not surprisingly, gold’s dramatic price rise came to a halt.

As for now, gold’s lackluster price action is no surprise, as real yields continue to churn rather than trend further downwards.

Consequently, gold prices are biding their time, yawning in the short term, but stretching their legs for a sprint upward.

Very soon (as discussed below), real yields will again break below -1%, and thus gold and silver will revisit their price climb to much, much higher valuations in the coming 5+ years.

Why do I think negative real yields will sink further and gold will rise higher?

Back to the Future—or At Least the 1940’s

Well…History, as well as embarrassingly fat debt levels and openly desperate central bankers, is one reason.

For example, we all can be fairly certain of this fact: U.S. Government debt to GDP will increase over the coming years, for all the reasons discussed above.

And toward this end, the inflationary case study of the 1940’s is helpful.

As commodity-driven CPI inflation increases, alongside the obvious and text-book money supply definition of inflation, the central banks, politicos and nervous markets will get scared. Real scared.

Just like the 1940’s.

Central banks will thus have NO CHOICE but to artificially control/repress bond yields and rates at the same time that CPI inflation pushes inexorably northward.

This means inflation rates will rise higher than artificially repressed/controlled bond yields—at least for as long as the Fed can print enough money to control rates and yields.

And by pure high-school math (Treasury yields-CPI), this also means real (inflation-adjusted) yields will go deeper into the negative—a confirmed tailwind for gold.

History Lessons

Why else am I so confident inflation will rise despite the Fed’s lying CPI scale?

Just like in the 1940’s, the money-printing Fed of the 2020’s will “solve” their otherwise unsustainable debt nightmare by devaluing the currency to partially inflate their way out of debt.

In the 1940’s, cash lost 1/3 of its purchasing power and debt only went “down” because inflation and devalued dollars pushed it down with debased greenbacks.

In short, debt was not really paid back, it was inflated away.

Get ready for more of this type of inflation in the 2020’s.

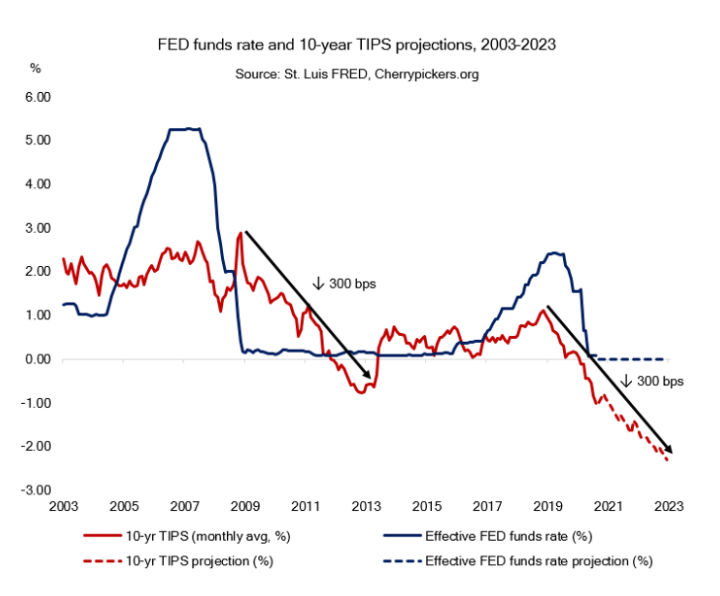

Ironically, another source of my confidence in declining rates comes from the Fed itself…

A key proxy for declining yields and rates comes from the Fed’s own, “forward-guided” projections on declining 10-year TIPS:

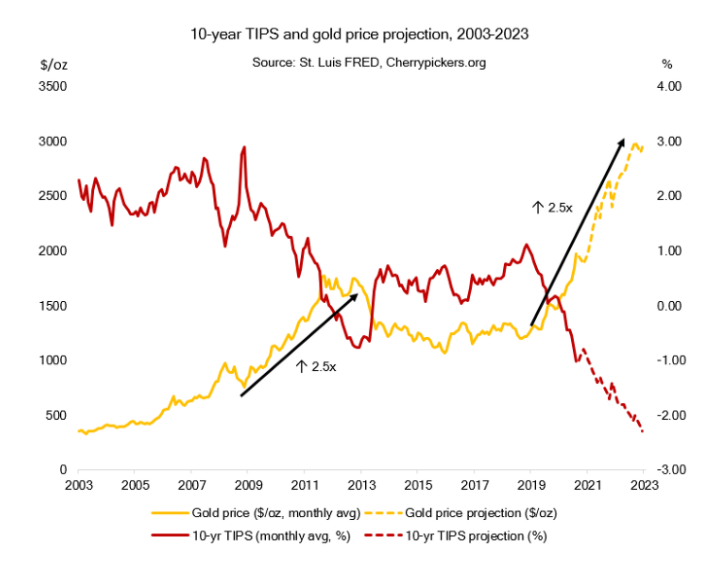

Putting It All Together

The golden case for gold boils down to this: Gold rises when inflation adjusted Treasury yields sink into negative territory with increasing speed.

This happens whenever the inflation rate is greater than Treasury yields, and can certainly occur when rising inflation collides with increased yield suppression. Of course, all of this boils down to the fatal impact of rising inflation, which is why the Fed tries so hard to under-report it, again a shameless as well as shameful topic for next week,

I think the near-term conditions are ripe for this type of iceberg-like collision, namely rising inflation and repressed yields.

As for inflation, the Fed is deliberately targeting more of the same; furthermore, commodity price inflation from “Bitcorn” to beef suggests the CPI inflation rate will be rising well into 2021 and beyond.

In short: Inflation will rise, and prolonged inflation lies ahead.

As for 10-Year Treasury yields, they are headed south for the simple reason that the Fed can’t and won’t allow them to go north, and for now at least, why fight the Fed?

With U.S. debt to GDP passing the 100% waterline, such a debt iceberg simply can’t stomach rising yields.

In short: YCC will equally ensure further yield suppression.

When you place rising inflation against artificially suppressed (i.e. falling) yields, by definition you get negative real (inflation-adjusted) yields.

And again: Gold loves negative real yields.

Looking forward five years out and more, this trend of negative real yields will likely increase, and to see gold double in price from its recent highs in the 2020’s would be far less of a surprise than the multiples we’ve already seen in far more hysterical price moves in names like Tesla or BTC.

In sum: Golden days are ahead for gold as real yields sink, Titanic-like, below the waterline.

But What About the Case for Spiking Yields?

Many, of course, can make an equally valid case for rising rather than sinking yields when (not if) the extreme and fantasy-like money printing so critical to YCC simply gets too crazy and blows apart.

In such a scenario, un-supported bond prices would tank, sending Treasury yields and rates to the moon rather than below the waterline.

This, of course, would be a disaster for risk assets like stocks and bonds, which would fall at the same time in dramatic fashion.

We recognize the very real possibility of such a correlated price fall, and for that reason build portfolios that prepare for, rather than ignore, all such potentialities.

The good news for gold, however, is that such a scenario doesn’t change the end result for precious metals or the aforementioned case for negative real yields.

That is, if YCC fails or collapses under its own weight, and thus yields skyrocket rather than sink, the foregoing scenario just expands rather than unwinds.

Stated otherwise, if the Fed were to ever lose control of YCC and thus yields spiked, interest rates and inflation would also spike, up to and including a setting for hyper-inflation.

But so long as inflation rises higher than rising yields, which it would in such a super-inflationary scenario, we still get the same result: negative real yields.

Thus, the Fed is now in a deadly trap of its own making.

It can print more money to repress rates and keep risk asset bubbles alive, but in doing so kills the currency’s purchasing power. Alternatively, it can stop printing money and watch markets tank.

Either option is bad, and thus portfolios need to be prepared for both. Here at Signals Matter, we are prepared, and invite you to see why by clicking here.

Best,

Matt & Tom

Dear All,

This piece is as well put regarding the topic at hand, as anyone could put it. Having been in the Financial Services Industry for 34 years now and specializing in gold, silver and commodity issues, I welcome any “food for thought” that attempts to advise, educate and warn investors what kind of market we are truly in.

Feel free to reach out!

Sincerely,

CHRISTOPHER LICATA

Financial Advisor, SA Stone Wealth Mgmt. Inc.

Thanks Christopher, we try our best to make these themes accessible to as many investors as possible who don’t otherwise work professionally in the markets. I’d love to connect sometime and mine your thoughts. Best, Matt