Below we look at all the problems in Italian markets and what that means for all investors.

51 shares

Italian yields have recently lost their minds and will directly impact the sanity of U.S. wallets if you’re not paying attention right now to Italian markets.

Bonds are our thing. We’ve traded and tracked them for decades, as they are the true signposts of market direction. Period.

In case you needed more proof of a rigged to fail market in general and a now transparently broken bond market in particular, let’s look where the media is absent but the evidence is now overwhelming: Italian markets.

Yep, Italian markets.

Let’s dig in…

Flying Over the Cuckoo’s Nest

Why does Italian markets matter?

Italy’s bond market has officially been committed to an insane asylum, to which the U.S. bond market will eventually be booking a room.

Last June, I discussed the tragic demise of the Italian political and economic experiment within the equally tragic and political experiment otherwise known as the European Union.

The same things then are still true now for Italian markets: Social populism and economic desperation have hit their breaking points in the Eurozone’s third-ranking economy. Banks are on the verge of implosion, borders are overrun by unwanted immigrant waves, and a political shell game in Rome has reached transparent levels of a comical farce.

But a year ago, unlike now, money was naturally fleeing out of Italian bonds and Italian markets and thus sending bond prices down and yields up.

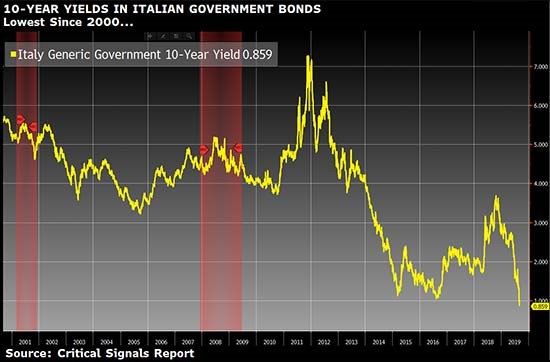

In a matter of just 20 trading days, Italian 10-year bonds saw yields skyrocket from 1% to 3%. This was bad for Italian markets…but good for yields.

In short, investors were at least getting a risk premium for a blatantly risky bond.

Today, however, those same bonds are even riskier, but the return/yield for such risk has recently fallen to below 1%, a number that is simply insane, as it makes Italian markets and Italian bonds appear sound. Take a look:

In short, investors are paying top prices for a bottom-of-the-barrel bond. In fact, when adjusted for inflation, they are paying to lose money.

Again, it’s insane. As are Italian markets.

It’s like paying sticker price for a Ferrari but one without an engine or tires.

It’s shocking but sadly predictable because the E.U., like the U.S., is rigging bond yields to the floor to pay their otherwise unpayable sovereign debts.

Who wins? Broke governments. Who loses? Investors.

Stupid Is as Stupid Does

When I addressed the Italian markets, and Italian bonds, last summer, I warned that the only way to keep Italian yields (and hence rates) from making Italian debt unpayable (and hence Italy’s place in the E.U. possible) would be a fake bailout from the European Central Bank (ECB), which would be an open admission of a totally rigged and failed market and economic union.

After all, what else can anyone call an economy that survives by printing money out of thin air to then purchase “engineless” sovereign bonds that otherwise have no natural buyers?

You call that a rigged market and a desperate (and now open) failure.

And presto. That’s where we are right now. Italian markets are a Ferrari with no engine or gas, just an ECB drive-train.

The rigged and failing European Union has no choice but to fail going forward, for it has no choice but to keep bond yields/rates artificially low.

Why?

Because, like nearly every major economy in the world, Italy in particular and the E.U. in general, survive exclusively off artificially suppressed/low interest rates to pay its otherwise unpayable government debt. This, of course, is pad for by printed money, not economic growth.

Europe is now at the leading edge of a debt cliff (and tired money printer) and hanging on by only the thin thread of a central bank that can’t print money forever and whose credibility and currency is now reaching the end of an equally fragile rope. The Germans, more over, are getting tired of this.

The ECB has murdered natural bond markets and replaced them with a centralized monetary policy that is nothing more than “faking it.” The Italian markets are one of the most obvious examples of this.

And by now, the template of this fake Italian job and Italian markets should be as obvious as it is familiar, namely:

A government 1) drowning in debt rather than productivity, 2) whose bonds are supported (bought) by a central bank in order to keep 3) bond yields and rates compressed to the floor of time so that 4) an otherwise broke economy can afford increasingly unpayable debt obligations.

Does this template look familiar?

What we see in European bond yields is now embarrassingly obvious evidence of bond market rigged to fail.

When yields on otherwise patently bad bonds fall this low on rigged bond price surges, it’s like a highly dangerous spring being coiled to a breaking point.

Italian markets are now ground zero for this coiled spring of repressed yields about to burst and send bond prices to their natural floor and hence bond yields and rates to fatal highs, thus rendering European debt impossible to pay and officially dead on arrival. This further explains the UK decision to seek a Brexit–aka a divorce–from the EU.

In short, the party ends when currently compressed yields and rates suddenly rise.

Should what’s happening in Italian markets therefore worry American investors?

Heck yeah.

A Global Template for a Global Bond Implosion

You see, what’s happening in Europe and Italian markets, by example, is the template of, and precursor to, the very same rigged bond game playing out within our own rigged shores.

Yields on the U.S. 10-Year Treasury are only 22 basis points from hitting an all-time low based upon artificial Fed support.

The current E.U. bond disaster is no less alarming (or rigged) than ours; it will just likely be the first to rot.

In short, Italy and Italian markets survive only as long as central bank “faking it” survives. That’s how distorted the bond markets have become.

In the near term, the tragic disaster playing out in the E.U. can actually be bullish for our own already massively overvalued bond market, as Europeans seeking even a sliver of “safer yield” will have no choice but send their money into our equally bogus bond market. This tailwind could add to the melt-up to come in later 2019.

But there’s a hidden danger in this bullish twist. As more money flees to U.S. bonds, it further compresses U.S. yields to the basement of history, eventually rendering our yields equally useless.

We’ll rot too… but we will just rot last.

The global markets now stand before the highest debt levels ($250 trillion) ever seen in human history at the very same time that the major economies of the world are crawling toward a recession.

Stated otherwise, never have bonds been riskier, yet ironically, and thanks to the profoundly distorting impact of global central banks, more overpriced.

This disconnect between risk and price is simply insane,as are Italian markets.

In past markets, sovereign bonds like the U.S. 10-Year Treasury, the German 10-Year Bund, or (once upon a time) the 10-Year Italian Bond were perceived and issued solely as premium, inflation-beating instruments. That was their entire purpose.

But today, in the post-’08 “new abnormal,” not one of these sovereign bonds beats their respective rates of inflation, which means the moment you purchase any of these “safe-haven bonds,” you are literally losing money.

In fact, you are paying to lose money.

Does that seem like a normal bond market to you? Does that seem like a sustainable bond market to you? Instead of getting risk-free-return, you are just getting return-free-risk.

Or does that seem like a bond market rigged to fail?

Bond Markets: Failing at Record Highs?

Frankly, and based on the negative real return for these bonds, it looks more like a bond market that has already failed.

Sadly, this is only the beginning of the crazy pain that awaits the bond markets in general and bond investors in particular.

When these artificially supported and record-high bond markets, and hence compressed bond yields, can no longer be sustained by central banks like the ECB or Fed, prices will tank and rates will skyrocket.

Rising rates, in turn, will kill the global securities market, which is little more than a global debt bubble.

In other words, everything now hinges upon artificially low rates, which means everything hinges upon an artificially rigged central banking system.

There’s a lot at stake here. In fact, everything is at stake here.

The trillion-dollar question is this: How long can central banks keep faking it?

If I gave you a precise timeline, then I, too, (like the Fed or ECB or even the Italian markets) would have no credibility. Given how much is at stake, and given how powerful money printing, rate suppression and forces of delusion can be, it’s hard to time such insanity.

In short, it’s dangerous to time or “fight the Fed,” despite how rigged and broken its policies may otherwise be.

Normal market indicators like the CAPE multiple for stocks or natural yields for bonds, including yield curves, are simply not as effective anymore in measuring market direction when normal markets have been completely replaced by centralized-markets.

Uncharted Waters

This is both sad and dangerous. Like the Italian markets, we are now in totally uncharted waters.

The Fed, after all, has a printing press, and can (as Modern Monetary Theory comically reminds us) print money to infinity to purchase unwanted government bonds and hence keep bond yields and rates artificially low forever.

In fact, the Fed literally has no choice but to perpetually game the bond market via a printing press and zero-bound rate policy, for it knows the U.S. Treasury Department cannot mathematically afford to pay our nation’s $22 trillion deficit unless yields and rates (i.e. the cost of that debt) are stapled to the floor.

That is, if rates floated naturally, we’d already be in open default and a much delayed recession.

Instead, we live in a world of veiled defaults, as any bond that produces a negative return is technically a defaulting bond.

Thus, and without a lot of fanfare, the majority of the world’s sovereign bonds are now in default, without any headlines, of course, as the financial media isn’t very keen on transparency or blunt-speak.

Re-read that last paragraph. This should be as scary as it is tragic to anyone who has traded markets. Never have I seen such a slow death of what were once real and natural markets.

This game of rigging global bond markets to pay sovereign debt only ends when the central banks lose credibility and bond markets lose their buyers of last resort.

That’s hard to time.

Meanwhile, the Inflation Ruse Continues

For now, central banks falsely wring their hands at their inability to reach target inflation, which is the excuse (lie) they then use to keep gaming (“stimulating”) otherwise Frankenstein markets.

But this target inflation meme is a pure lie, plain and simple.

The jig is slowly coming up, however, for central bank credibility. Bond buyers who see absolute nonsense like what we’ve seen in Austria and now in Italian markets is glaring proof that bond buyers are getting nothing for their money, time (100 years in Austria…), or risk.

Again, with central banks so distorting inflation-adjusted yields on the bonds of even the most “trusted” nations, investors are seeing that not even those bonds can beat inflation.

In even the “safest” corners of the globe, real as well as well nominal yields are dropping below zero.

That is insane. Insane like Italian markets…

Back to Gold

But there’s one asset that does beat inflation, and which has been rising steadily as bond yields slowly race to the bottom of history, and that’s gold. It is poised to be the best investment for the next decade.

Again, we are not gold bugs. Never have been. But when facts and signals from broken and insane bond markets like these present themselves as openly as they now are, we have no choice but to call it like we see it.

And this fact is this: The great nations of the world are now issuing what are essentially junk bonds with no yield, which means you take on risk for no reward, and in most cases, are literally paying to lose money.

The same is not true of gold, which you can read more about here.

As faith in central banks (and hence the bonds they artificially support) dies, so too does the price of bonds here and abroad, such as in broken Italian markets. Such a slow death, however, is hard to time, especially given the massive support from those powerful, yet monstrous central banks.

To track this slow death, and hence keep us from getting slaughtered when the bond scam ends, our Storm Tracker is watching the bond markets like a hawk; but for now (and the decade to come) we are full-on bulls when it comes to gold.

Stay tuned for Friday’s piece – then, we’ll talk U.S. pension funds because the sad truth is that they’re broke, too…

Sincerely,

Matt Piepenburg

Comments

5 responses to “No One’s Looking at Italy – Here’s Why That’s a Mistake”

- JohnUTorontosays:

Matt,

You are bang on! I could not agree more !

- Kevinsays:

Excellent description of reality. Negative yielding bonds are technically already in default. Couldn’t be said any better than that. I suppose that next the central bank’s will just ‘print’ money and hand it to governments without the pretext of creating bonds.

- James Stevenssays:

I totally agree, the foundations are very very unstable. The most critical question now is, when that item (that we call money) which forms the very basis of our society and almost everything we do, becomes a mere illusion in terms of what it’s value is based on, have we created an artificial economy with no solid foundations. Where do we go from here, something is going to rock that false foundation and when it does, it won’t be pleasant?

- Marksays:

Awesome column…..keep up the great work…..

- mikesays:

Look at the UK, Europe, America. Donkeys led by Donkeys. We voted them in, we got what we dese

rved. We are all in deniall.