Below, we look at the October market volatility in the context of interest rate reality (as opposed to stock market spin). The bear market is not here yet, but he’s beginning to come out of his cave.

Ruminating in France

As October market volatility started to get predictably bloody, I went home to France to paint the windows and putter around with a broken water pump. I also drank lots of wine. In short, I wanted to enjoy a few days of calm as the rest of the world panicked.

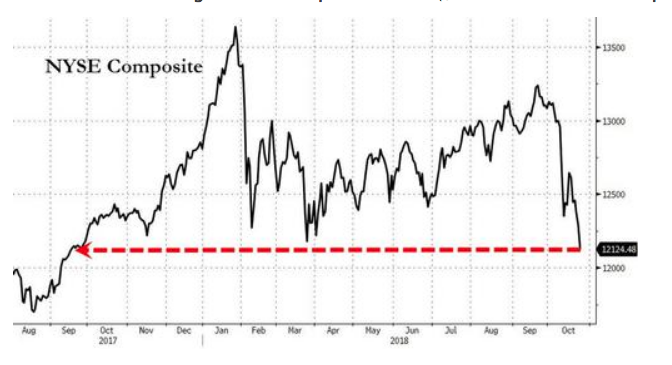

Rather than look at this:

I soaked in a little of this:

Returning to NYC and its craziness, and now closing up a personal loop in LA, I have had a few moments to ponder the obvious and look back, once more, upon the sobering implications of October 2018 in the backdrop of our post-08 bull “recovery.”

The Best of Times, The Worst of Times

Taking my literary allusions from England, rather than France, I see a Fed “rescue” which has created a market backdrop straight out of Dickens, namely: “It was the best of times, it was the worst of times.”

The Best of Times

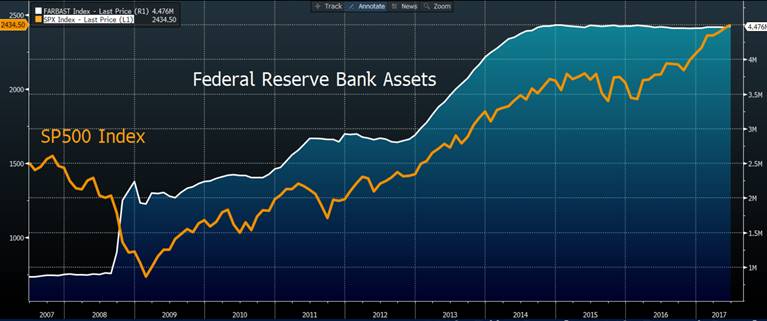

Certainly, in the rubble of the 08-banking crisis, $3.8T of printed money and 8+ years of near zero-percent interest rates (i.e.: “QE”) created those “best times.” By now, it is clear to any market observer that the correlation of central bank support and the astronomical rise in the equities market is undeniable.

The problem with that dangerous Fed support, however, is that it is unnatural, distortive and ultimately unsustainable. By the way—it wasn’t capitalism either. It was a government bailout paid for by tax-payers and printed dollars. Bogus.

But the Fed-induced waves of cash flowing into Wall Street sure gave the securities market training wheels. Since then, unfortunately, investors have lost the ability to ride a natural market bicycle without this support.

And those training wheels are starting to come off, as the October market volatility recently reminded us.

Debt is Fun, For a While…

Our stock market, addicted to central bank liquidity (i.e. printed money) and easy/low credit (i.e. debt-expansion), has lost sight of the forest through the trees.

That is, investors (and those who sell to them) have lost sight of the very simple fact that the so-called “recovery” we have been enjoying for almost a decade is nothing more than a credit-card binge –i.e. a record-breaking debt bubble $70T high and rising.

That figure (which combines US corporate, sovereign and individual debt), by the way, is not only appalling—it portends much danger ahead. The so-called “recovery” we’ve been enjoying is little more than a poison pill masquerading as “miracle.”

How did we get here?

Simple: Our short-sighted bubble-makers in DC (through the arrogant manipulation of short-term interest rates) created an historically unprecedented debt party which inebriated (i.e. distorted the vision of) every aspect of capital markets, from the traders to the banks, the White House to Main Street.

When cheap credit is easily available, it becomes as dangerous as too much tequila at a Freshman frat house—i.e. lots of fun at first, and then lots of wreckage the morning after…

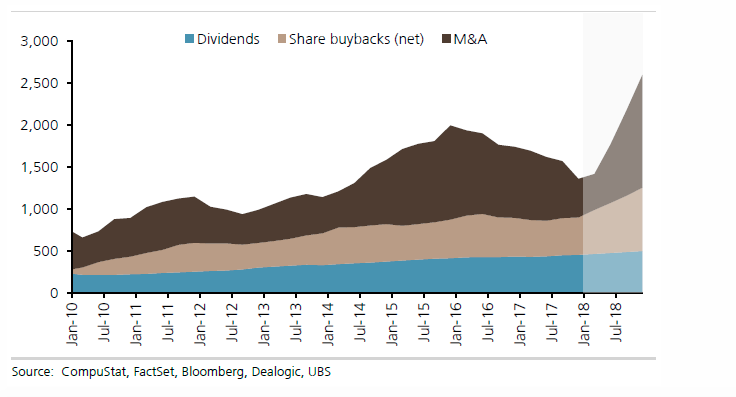

And this dangerously over-extended (10+ year) “credit expansion” created a party wherein nearly every publically traded company from the NASDAQ to the DOW collectively borrowed just shy of $9T to: 1) buy back their own shares at record levels, 2) pay dividends and 3) revel in bad, stock-boosting M&A deals and 4) predatory PE investments.

Good times indeed.

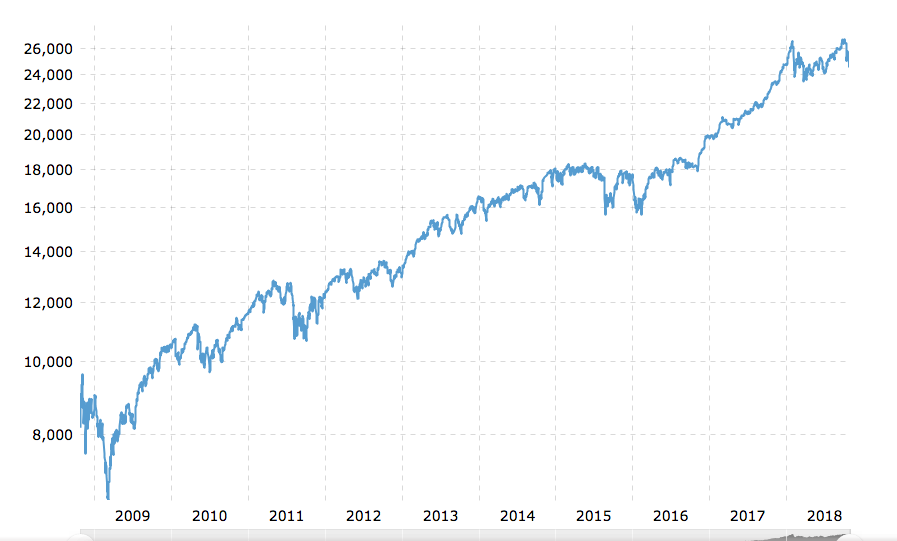

Markets, traded by as many computers as humans, joined this “good time” credit wave of low rates and Fed “stimulus,” effectively buying every dip (of a relatively dip-less market) from March of 09 till today as if they were hotdogs at a Yankee’s game.

After all, with a central bank at your back, why worry? As the chart below makes clear, the market just never stopped going up!

But such markets ought to make one pause. They look eerily too robust…They look, alas, un-natural.

And that’s because they are/were un-natural; in fact, they were high as a kite on central bank steroids. And as Lance Armstrong reminds us, steroids work—until, well, they end in disaster…

Add to this central-bank “steroid addiction,” a financial media of prompt-readers who churn out spin and sell-side memes of fiscal propaganda better than anything that ever came out of Soviet-era Pravda, and you have a helluva tailwind of investor euphoria.

Unfortunately, much of this euphoria is/was based upon years of DC and Wall Street faking it on every metric from banking reform, employment, GDP and inflation to earnings and profits.

After all, markets drunk on easy credit, Fed support and marketing alumni masquerading as financial journalists make it very hard to see the darker reality creeping beneath the debt time bomb at the securities party.

Besides, party-goers don’t like parties to end or bad news to spoil the mood. We get it.

But as von Mises warned us before the most recent Fed punch bowl hit the party in 08, the bigger the debt “fun” (10 years and counting), the greater the hangover that follows.

And the hangover looming over these “best of times” is gonna be a killer…

Of course, warnings like his (most of the talking heads at FOX or CNBC don’t even know who von Mises was…) are no fun, so they go un-headed. We get that too.

And so, the “best of times” euphoria churned straight past normal price discovery, GAAP accounting, CAPE indicator restraints and every other measure of common sense that once acted as the chaperone at the financial frat party in that bygone era of my father’s markets (when supply and demand rather than central bank steroids determined market pricing).

The Worst of Times

And then came the October market volatility…

Markets started to feel a bit, well, woozy.

But is this the end? Is the real puking about to start? Is the hangover (i.e. Bear) here?

Not yet, but soon enough.

What we are now seeing in October are those first signs that the party is about to end—you know, that queasy feeling just before you dash for the open toilet, hand–over-mouth as the other Freshmen race desperately for the same bathroom…

And what have we seen in these recent, stomach-churning days of October?

Well, as of this writing, the DOW tanked over 2300 points from its October 3rd high, erasing all its annual gains in a matter of days, as did the S&P.

The NASDAQ did some similar puking, losing 329 points in a single day, something we haven’t seen since 2011, falling more than 12% from its August highs.

Etc., Etc.

Meanwhile, the Ken and Barbie financial media has been scurrying like mad to explain these little “hiccups” and keep investors right where they, the bank-lead markets and the pie-chart financial advisory-industrial advisory complex wants them: fully invested.

As per usual, when things started to tank, the spin-doctors blamed it on surprisingly “weak earnings” from the “tech sector.”

Of course, as soon as the market bounced a bit (i.e. today), those same bubble-heads attributed the modest rebound to “improved earnings” on names like Twitter and yes, believe it or not, even Tesla…

(You already know what I think of Tesla. Elon’s wrist slap from the SEC, by the way, was shameful—but I digress…)

In any event, and despite the mind-numbing (and consistently stupid) cheerleading of the media, we knew long ago why October was gonna hurt, and said so here last September, here in February, here in June and just about everywhere else we had the chance in the last 12 months.

What Got Us Here?

And these easily foreseeable October gut spasms had nothing to do with “earnings” or the flip-flopping of company earnings (from Twitter to Tesla) tossed out by the financial media.

Nope. That’s not why the stock markets are beginning to look tipsy.

Borrowing now from Shakespeare rather than Dickens, let me make this perfectly clear:

“The bond market is the thing.”

The Bond Market

In short, if you want to know where stocks are headed (which in the long –term is decidedly SOUTH), the reason is simple: Rising equity markets emerging from the “08 recovery” were born from a distorted bond market—namely: easy credit and DEBT at low rates (nod to the Fed).

Needless to say, when debt is no longer cheap—i.e. when rates are rising—that debt party—i.e. “the best of times” dramatically morphs into, well, “the worst of times.

Stated even more simply: artificially low rates created this un-natural bull market, and naturally rising rates are going to kill it.

Full stop. Simple as that.

The Interest Rate Lighthouse in the Stock Market Fog

In the meantime, feel free to listen to all the pundits babbling (and fudging) about earnings, company profits or robust employment figures etc. etc. If you like media fog, there’s plenty of it on a daily basis. But if you prefer to keep things simple and true, just focus on the lighthouse.

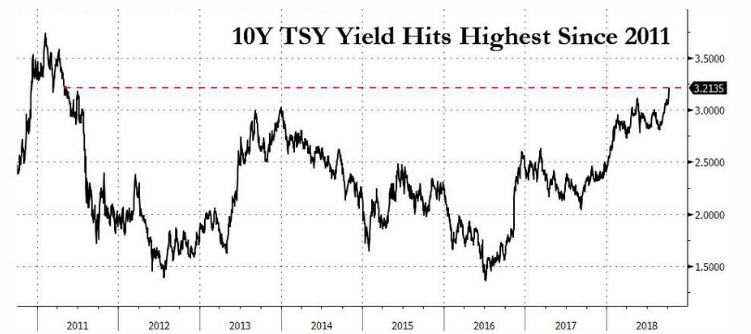

And the lighthouse is clear and visible: as bond prices fall, bond yields rise, and as bond yields rise, interest rates rise, and as interest rates rise, the debt party ends, and as the debt party ends, this stock bubble pops.

Read that again. And then twice more.

In short, it all starts when bond prices fall. And guess what: they are falling.

Why/how?

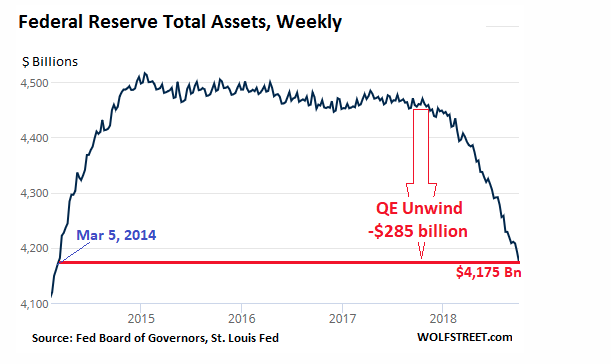

Equally simple: for over eight years, the Fed rather than the market, was buying US Treasuries and hence artificially supporting bond prices. This is QE—or Quantitative Easing.

But as of October 2018 (and as forecasted by the Fed itself), the Fed is pivoting from Easing (QE) to Tightening (QT). That is, rather than buying hundreds of billions worth of US bonds, they will essentially be selling them–$600B worth to be precise for the annual period starting in October of 2018.

And as we learned in high school econ, more supply (selling) means lower prices. Bond prices are hence falling. It’s simple market gravity folks. The Fed (after $3.8T in money printing and years of forced low rates) may have delayed this natural force, but they can’t defy it…

In addition to the Fed pivot from QE to QT (i.e. from easing/buying to tightening/selling), we have the US Department of the Treasury doing what it does best: taking the US into greater debt.

With a sovereign debt level of $21T and counting, the US is broke.

Tax revenues, moreover, have tanked thanks to a short-sighted, temporary and terribly-timed tax cut at the tail end of a business expansion cycle.

On top of that, US manufacturing and productivity, despite the media cheerleading, is feeble. Furthermore, a trade war with China is about to increase the price of 40% of the products on our store shelves by 25%… ($1.7T of the things we buy are made in China, because US company executives like their cheap labor…)

Don’t believe me: here are the numbers. Peak to peak from 2007 to today:

-US Industrial Production is up 2%, while the NASDAQ is up 200%…

-Annualized US Business Sector Growth is 1.1%, while the Russel 2000 trades at 51X reported earnings…

-US Manufacturing is down 3%

-US Industrial Production is up only 2%

-And US Total Labor Hours are up only 6% (which means the market is trading at 30X labor hours)

Boring data, right? But they scream toward a total disconnect between the US economy and the US stock market. Full Stop.

And so, given that the US economy (not to be confused with the US stock-market) has been stalling for years, the only way Uncle Sam knows how to keep the US party (recovery illusion) going is to keep, well…borrowing.

That is, keep going into debt—which means, issue more bonds…

The $1.8T Treasury Wave of Mass Destruction

Heading into 2019, the US Treasury Department must therefore issue another $1.2T in US 10-Year Treasuries (glorified “IOU’s”) into the market.

When you add that $1.2T with the other $600B of bonds which the Fed began dumping this month, that means we will see nearly $1.8T worth of more bond supply into the open market.

Again—keep it simple: that kind of massive bond supply means equally massive declines in bond prices—which means yields and rates have nowhere to go but up (yields and rates rise when bond prices fall).

And this means the debt/low-rate addicted stock market has nowhere to go but down…

All the rest, folks, is just noise, it’s just fog. The pundits can blame “geopolitical risk,” China, or Papa Smurf when this market turns south, but the fault in our country lies with us, our history of debt and our failure to face reality.

Sure, we’ll see more market gyrations, more short-term “recoveries” and lauded bounces here and there, and more talking heads squawking about remarkable earnings or short-term rate hikes at the Fed etc. etc.

But the larger trend, after nearly 10 years of artificial stimulus and artificial markets (and thus massive securities bubbles), is now turning from positive to negative.

Rates are rising, slow and steady, like a bear emerging from hibernation:

Very soon, likely into 2019 and beyond, that bear is gonna begin to stretch, take a deep breath and then, after years of central bank suppression, let out a terrifying roar as rising yields send this bull market to the slaughter house.

For now, entertain yourself with squawking and nonsense, if you have the patience for such noise. As I’ve written here, here and here—most of the noise isn’t even accurate…

Just saying…

Watching Trump blaming Powel for raising the short-term rates, for example, is just more noise and the grist of distraction and drama. Powel, even if he is just another Fed hack, can’t stop market forces any more than a sailor can control ocean forces.

The real skunk in the woodpile is the aforementioned $1.8T bond wave coming to the markets now and into 2019.

This wave is built from years of a debt-based (rather than production-driven) DC survival mode, and nothing Powel does (or does not do) as to the raising or lowering of short-term rates can stop this wave.

It’s comical, but also tragic, to see how misunderstood these facts are, even at the level of the White House.

Anyway…Our subscribers know better. They, like you, are watching the yield curve, the 10-Year Treasury auctions and the data, not the cheerleaders, prompt-readers, politicos and bankers who got us into this mess years ago.

Remember: watch the lighthouse, not the fog…and as always, be careful out there; the seas are starting to get rough.