Our Weekly Update

This Week's Update on Favored Sectors and Your Portfolio

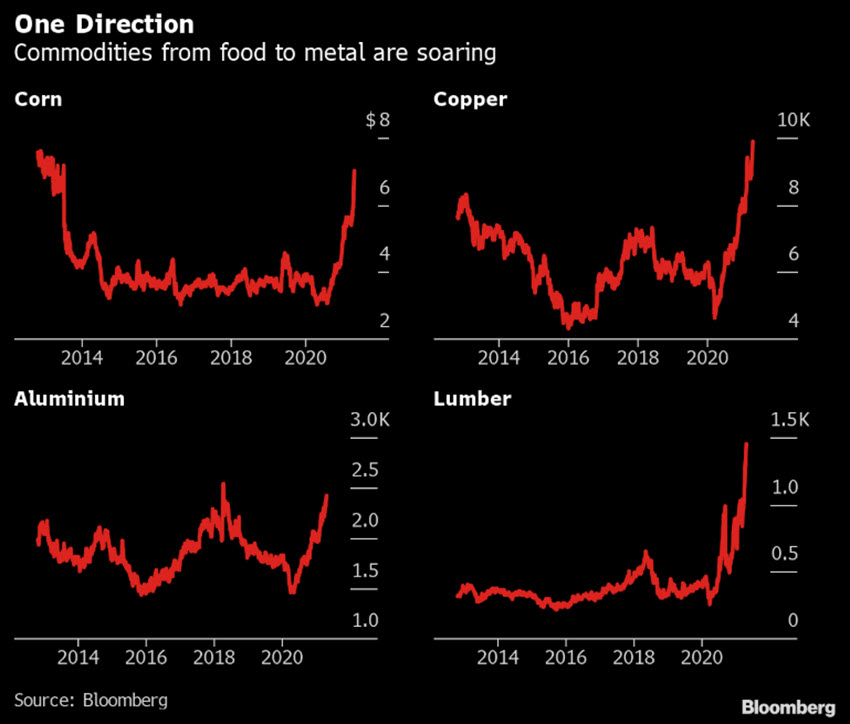

Commodities Soar

As the global economy roars back to life, commodity prices have surged from steel to copper to corn, lumber, and beyond. Commodities represent the cost of goods, and when they soar, retail prices generally aren’t far behind, from food to home construction, autos, and everyday purchases. Rising commodity prices are foundational to the reflation trade this 2021 YTD. US stimulus, vaccine rollouts, Europe’s reopening, and rising commodity costs are accelerating.

By example in the chart below, the recent rise in the prices of corn, copper, aluminum, and lumber have been extraordinary. ESG bets for renewable energy, power grids, and electric vehicles are also booming. According to BloombergNEF (or BNEF, a Bloomberg strategic research provider), the price of copper alone is up more than 90% in the past year and is expected to nearly double by 2050, while demand for other low carbon technologies like electric vehicles and solar panels are expected to balloon as well.

We’re not into country bets, but if we were, we’d look to ETFs for countries like Australia, Chile, and Indonesia for their respective supplies of iron ore, copper, and palm oil – all in high demand. Here in the US, upcoming infrastructure investment in electricity grids, railways, new and refurbished buildings will up the demand curve for copper, steel, and other building materials. Coffee prices are rising too, with coffee futures up 33% in the past year. Wheat prices are the highest since 2013. Cash is pouring into US Treasury Inflation-Protected Securities, a critical bond-market proxy for inflation expectations into the future. Etc. Etc.

Yet, despite all of this, the Federal Reserve and other central banks remain calm about inflation, encouraging their economies to run hot, allowing demand to accelerate. The US Treasury Inflation-Indexed Curve (interest rates less inflation) remains negative out to 30-years. Our Storm Tracker calculus is tracking the potential for rising interest rates and the associated impact on GDP. Storm Tracker fell 2-percentage points last week but remains elevated at 37%.

Storm Tracker

Storm Tracker is our starting point for assessing global risk, the proximity of the next recession, and our recommended cash allocation in the Signals Matter Conservative and Moderate Portfolios. Storm Tracker tracks the probability of stormy weather ahead by monitoring growth in GDP, Sector Trends, Leading Indicators, Yield Curves, and Déjà Vu, each described and plotted below. Storm Tracker is updated weekly. Conservative Portfolios receive a cash allocation that mirrors Storm Tracker risk probabilities. Moderate Portfolios received a half allocation. Therefore, as risk rises, cash allocations rise. As risk falls, cash allocations diminish in favor of higher allocations to fixed income, equities, and alternative ETFs.

Take note that Storm Tracker calculus is currently tracking the potential for interest rates to rise and the associated impact rising rates could have on GDP growth. Hence, although Storm Tracker fell 2-percentage points last week, it remains elevated at 37%.

Portfolio Commentary

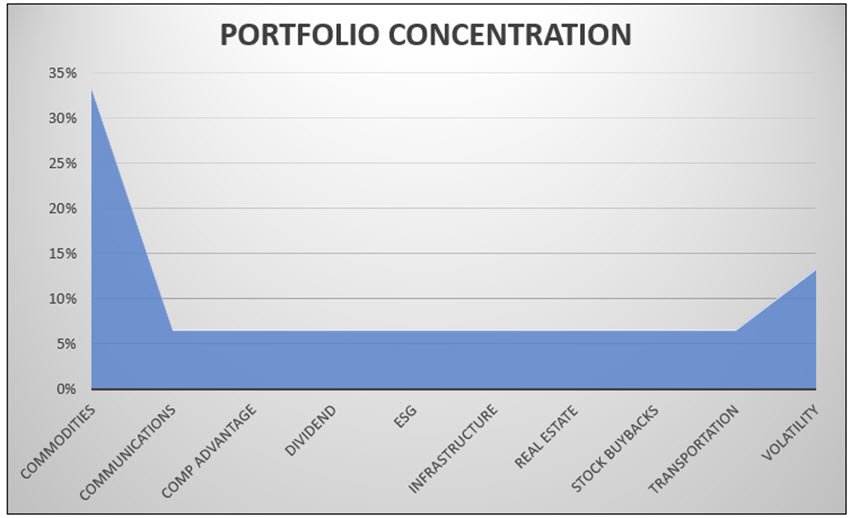

On the portfolio side, this week we adjusted our positions to favor the inflation trade by retiring iShares US Medical Devices (IHI) and Cambria Tail Risk (TAIL) in favor of iShares US Real Estate (IYR) and Global X Copper Miners (COPX) this Monday. All in, commodities generally (including individual allocations to metals and precious metal) enjoy our largest allocation, followed by volatility investing and of other currently favored ETFs.

Weekly Insight

Zero-Bound US Treasury Yields

To our comment in this week’s Macro Commentary, that real yields (inflation-adjusted yields) are at zero or below, the U.S. government’s $40 billion sales of four-week bills last Thursday went off with a yield of just that, 0%, and that’s before subtracting for inflation. The auction last touched levels this low in March 2020, when anxious investors poured cash into money-market funds at the pandemic’s outset. With inflation rising along with the rising demand for commodities, both unlikely to subside, it seems only a matter of time before interest rates increase.

Our Wednesday Market Report

Party-On or Hunker Down 6.0

By Developer Willetts |

About Our Blogs

Our hundreds of weekly Blogs and Market Reports are industry-leading for their candor, analysis, and market timeliness.