Signals Matters News Letter: The Signals THAT Matter

Is it time to party on or hunker down?

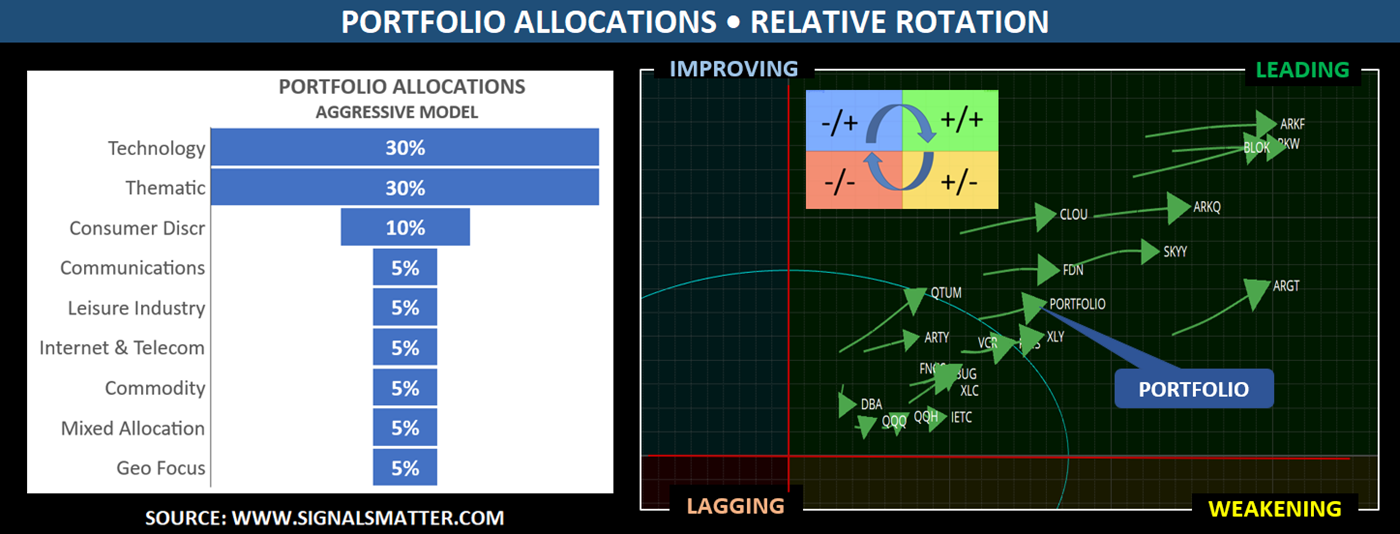

Signals Matter portfolios rotate and invest toward absolute returns rather than relative performance.

Broadly, the core and timeless principles behind the infrastructure of Signals Matter Portfolio Construction are carefully discussed here and here.

As for WHAT’S HAPPENING NOW…

Understanding Market Risk

Understanding market risk guides portfolio construction here at Signals Matter. Crafted internally over decades of investing, we’ve developed tools that track the probability of potential and significant loss due to external factors that could upend the financial markets.

To understand market risk, you have to be able to measure it. To measure it, you need to assemble a wide swath of indicators, as we do weekly for our Subscribers.

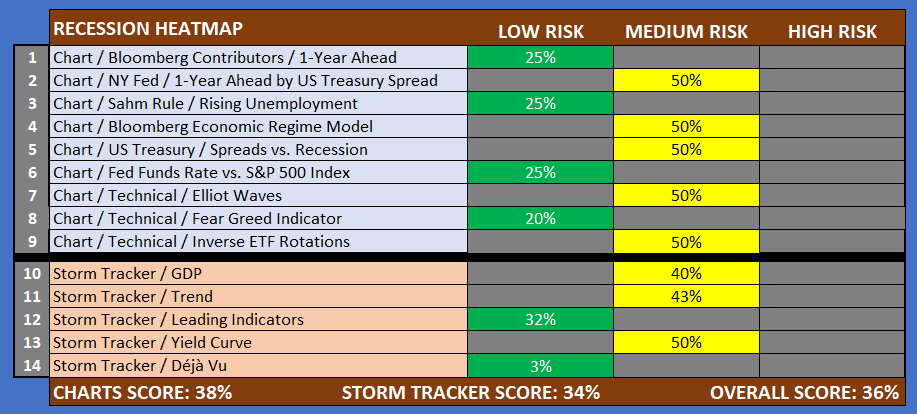

For example, we track recession forecasts by Bloomberg and the New York Fed, the Sahm Rule, Bloomberg Economic Regime Models, US Treasury Spreads, Federal Funds rates vs. stocks, Elliot Waves, Fear/Greed indicators, and our own Storm Tracker, which tracks fluctuations in GDP, Trends, Leading Indicators, Yield Curves, and more.

In other words, we’re all over the subject so that our Subscribers know what to expect. And we handicap our five Model Portfolio solutions accordingly. Low risk scores permit a more aggressive portfolio solution, while high risk scores suggest a more conservative approach.

Tracking Recession Indicators

If you are new to Signals Matter, we make it simple for our Subscribers and Hedge Fund followers to understand and track market risk across fourteen Recession Indicators, summarized below.

In October, Storm Tracker projected a 29% chance of a recession in the coming 12 months. Today, that number has advanced to 36%, begging the question of what’s going on and how to prepare.

We’ve Seen this Movie Before

With equities soaring in 2023 and 2024, few investors see the possibility of a recession in 2025. But we’ve seen this movie before: The Fed raises interest rates too far/too fast to kill inflation, and then takes them back down too little/too late to avoid a recession.

With year-end around the corner, we have more data to ponder: A new White House in 2025, an interest rate cutting cycle now in motion, stubborn inflation, and plenty of worries/debate over US tariffs.

Here’s What’s Worrisome

Many policy decisions were put on hold in October pending the US elections. Fast-forward to year-end, and the Fed has embarked upon a rate-cutting cycle despite failing to hit the target 2% CPI rate and lacking any officially recognized economic or market distress. The lowest GDP growth estimates are consolidating around 1.9% for Q4|2024 and Q1|2025, higher than in October.

Nonetheless, the US government’s mushrooming interest bill ($1.1 trillion annually) is receiving less attention than it should, for sovereign debt can lead to a fiscal crisis if allowed to continue unchecked. Our country’s sovereign debt-to-GDP ratio is approximately 121% as of Q3|2024, way too high and is likely to get worse before it gets better.

Already, Uncle Sam’s fiscal year, which began in October, is already showing a budget deficit of greater than $600B. This $200B more than we saw for the same period of 2020, in the heart of the pandemic. But what’s the crisis in 2024-25?

With US tariffs likely to rise in 2025 and taxes likely to fall, we could see a toxic cocktail of rising inflation and higher levels of sovereign debt (to offset lower taxes), a recipe for recession and stagflation.

Recession Hedging

Thus, hedging against potential recessions and market downturns is increasingly becoming a hot topic. Surprisingly, it’s not all that hard if you know how to track them.

When recessions take hold, stocks fall. What to do? Sell them and then repurchase them back at a lower price. Sound difficult? Well, it wasn’t easy until inverse Exchange Traded Funds (ETFs) became popular.

Inverse ETFs are a simplified and valuable tool for investors looking to hedge against market downturns, or to profit from short-term declines in the market simply.

Inverse ETFs

An inverse ETF is a type of exchange-traded fund designed to perform inversely to the performance of a specific index or benchmark. Essentially, the inverse ETF goes up when the index goes down, aiming to deliver the opposite return of its target index.

For example, ProShares Short S&P 500 ETF (SH) seeks to deliver the inverse performance of the S&P 500 Index (SPX). If you expect a downturn in tech stocks from today’s lofty levels, you could buy Proshares Short QQQ ETF (PSQ) that trades the inverse of the Nasdaq-100 Index (QQQ). Same with the Dow Jones and Russell indexes.

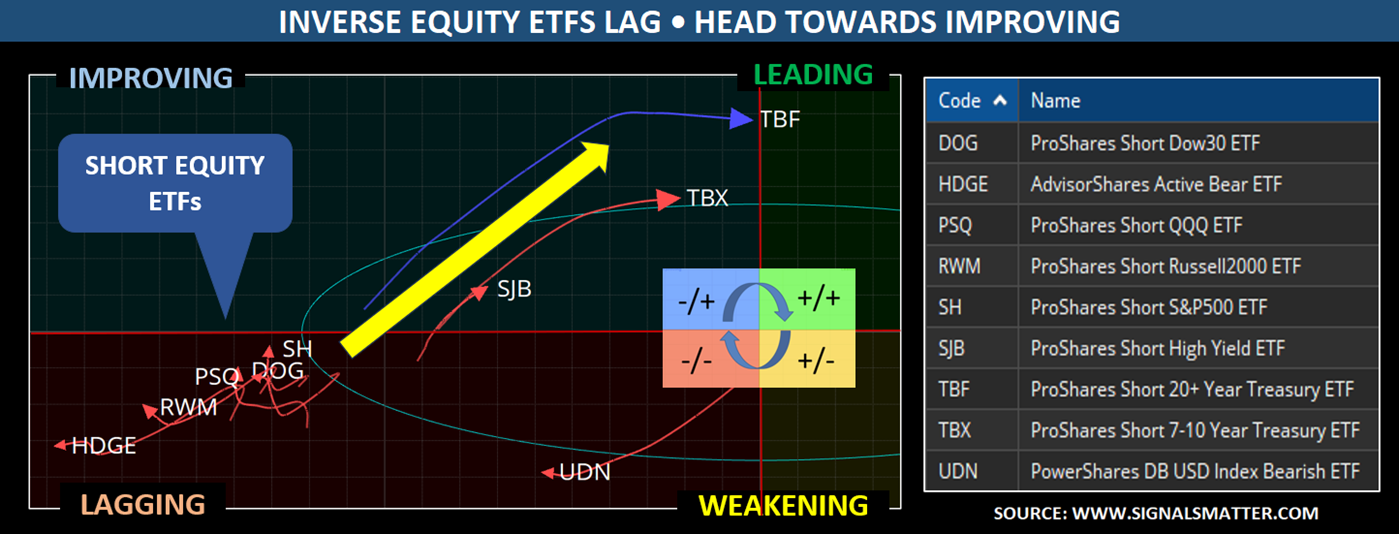

Below are nine inverse ETFs that fare well when interest rates or the US dollar fall. Take note that four stock ETFs for the Dow-30 (DOG), the S&P 500 (SH), Nasdaq (PSQ), and Russel Indexes (RWM) are currently rotating from the Lagging Quad to the Improving Quad (yellow arrow refers). That suggests that buying inverse ETFs (selling stocks) may well be more profitable than buying them in the weeks and months ahead.

Inverse ETFs are currently positioned in the worst quadrant (Lagging) but are beginning to improve. While it’s too early to take a position, it’s never too early to tracking their movement.

Keeping It Simple

Inverse ETFs are essential tools for hedging portfolios against market downturns or to profit from declining markets when the timing is right. As recession risk rises, we expect inverse equity ETFs to profit when and should stocks tumble. It’s that simple.

Risks

There are risks to deploying inverse ETFs. They can be volatile, especially those that apply 2x and 3x leverage, meaning they aim to deliver twice or three times the inverse performance of the index they track. If you’re new or need help with how to integrate them into your portfolio, consider consulting a financial advisor.

Our Portfolio Solutions

At Signals Matter, we publish five Portfolios that range from Conservative to Moderately Conservative, Moderate, Moderately Aggressive, and Aggressive. Each Portfolio allocates to 20-25 carefully selected ETFs in proportions that vary with the economic outlook and personal risk tolerances. As risks rise and stocks fall, allocations increasingly include inverse ETFs. As risks fall, it’s party-on with up to 100% of allocations to winning equity sector ETFs. The idea is to make money in any investing environments, recessionary or not.

Bottom Line

The takeaway from all these charts and narratives is that, according to our tea leaves, there is a 34% risk of a recession occurring within the next 12 months, up from 29% last October. Write this down: Recession bells generally toll only one to three months in advance.

Our Subscribers keep an eye out each week for refreshed signals and when it may be time buy or to hunker down for just $97/month. That’s $1,164 annually, or 1.16% on a $100,000 portfolio.

Portfolios generally move 1-2% in a day – more than an annual Subscription to Signals Matter. Other Subscribers put all this on automatic by subscribing to our hedge fund, Signals Matter Partners LP, a hedge fund launched earlier this year by Signals Matter Advisors.

As we wrap up our final Market Report for 2024, we leave you with this thought: While we all hope for the best in 2025, it’s wise to prepare for the worst. Hope alone is not an investment strategy. Complacency is widespread, with few anticipating a recession, and even fewer having a plan—unlike Signals Matter.

Wishing everyone a joyous holiday season and a prosperous New Year!

Even More

Signals Matter Market Reports reflect the company’s long-term macro views and are posted free of charge at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Portfolio Solutions are geared to shorter timeframes and may differ from our longer-term perspectives. Our actively managed Portfolios are available to Subscribers who Join Here and to Accredited Investors who directly invest in Signals Matter Partners, LP. For further information, click Direct Invest or Book a Meeting with us.