Signals Matter News Letter: Signals that Matter

Signals Matter Market Reports set forth a series of market and allocation ideas currently at the front of all our minds, while offering links to the latest macro-observations which help inform investor perspective and thinking amidst a precarious backdrop of unprecedented debt.

WHAT’S HAPPENING NOW…

Recession Postponed; Yes, or No?

Equity markets are ripping, giving rise to the notion that US recessions have been indefinitely postponed. The bears have thrown in the towel, a capitulation that has driven stock markets to ever-higher highs with shallow pullbacks over recent months. This newfound confidence is at odds with the Signals Matter tea leaves.

Peek Behind the Curtain

A peek behind the curtain is useful right now within the portfolios managed for subscribers and the hedge fund now managed for investors.

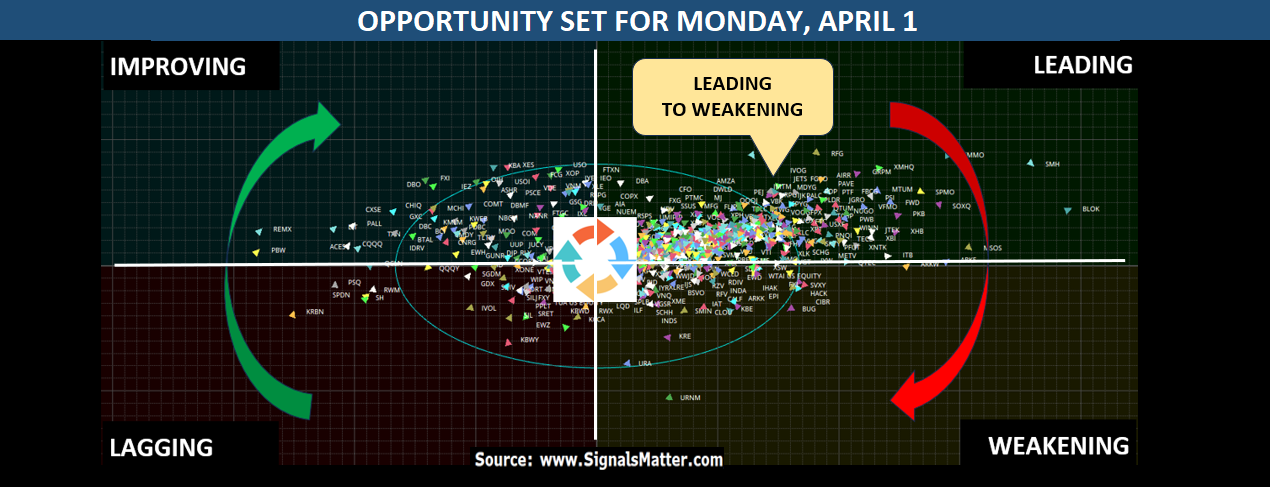

Here at Signals Matter, we parse over 1,000 ETFs to build an opportunity set for investing. Among our many tools, relative rotation graphs (RRGs) are especially useful for testing the performance and momentum of securities or asset classes against a benchmark.

RRGs provide a comprehensive market view, help investors spot trends, compare multiple securities simultaneously, and enable more informed decisions when rebalancing portfolios.

RRGs have four quadrants and track ETF momentum across four quadrants as they lag, improve, lead, and weaken repeatedly in various timeframes. The timeframe plotted is weekly and shows that the vast majority of ETFs are winning within the Leading Quad, enriching the bulls for now.

Fast Forward

It’s just a matter of time before these very same ETFs rotate to the Weakening Quad. While the ETFs have weeks, if not months, to arrive in the not-so-promising land, they will arrive, possibly in 2025, which is only nine months off, roundabout election time in the US.

Both micro and macro considerations apply. On the micro or technical side, a rotation to weakness is happening right before our eyes – that’s why our Portfolios and Hedge Fund currently allocate to energy, Asia (not the US), precious metals, commodities, managed futures, and continuing inflation (e.g., not your ordinary stock and bond portfolio).

On the macro side, how much debt can we put on the US sovereign balance sheet until the offshore folks lose faith in our US Treasuries? See links below from VON GREYERZ, AG.

Keeping It Simple

The most liquid, US-based ETFs are migrating from Leading to Lagging, with too many outliers beginning to pile up in the Leading Quad. The more the outliers (ETFs outside the oval circle in the Leading Quad), the harder they fall. Securities rotate. It’s that simple. It’s best to be prepared.

Even More

Signals Matter Market Reports reflect the company’s long-term macro views and are posted free of charge at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Portfolio Solutions are geared to shorter timeframes and may differ from our longer-term perspectives. Our actively managed Portfolios are available to Subscribers who Join Here and to Accredited Investors who directly invest in Signals Matter Partners, LP. For further information, click Direct Invest or Book a Meeting with us.