Income inequality and polo matches are two concepts rarely found in the same sentence.

I’m playing three weekends of polo tournaments starting on Saturday. What the hell does that have to do with these markets, the US social contract or your portfolio?

Well, almost nothing. But then again, all this time cantering about like a silly cowboy has got me thinking….

….about the US markets and US tensions, even from a saddle across the ocean.

As my fellow Americans head into Labor-Day weekend with greater than 15% of them out of work and yet 75% of those making more money on unemployment than when actually employed, the entire notion and orthodoxy as to what constitutes “American labor” is perhaps in shift this weekend, even as I fall out of saddles.

In short, America, like my own mind, feels a bit divided.

Hmmmm.

How Did We Get Here?

The media, internet and large swaths of red, blue and purple politicians (who never took an econ, history or even basic philosophy course) will likely point to COVID, conveniently placing the blame there, and then get back to their primary goal of buying more ratings, click-bait headlines and electoral votes.

In other words, our “elites” and broken Fourth Estate will continue to ignore facts, history and math in favor of headlines, self-promotion, virtue-signaling and fantasy pushing as markets reach new highs in the backdrop of a tanking economy.

Fed Fantasy Pushing—Oh So Comforting, for Now…

As to this fantasy pushing, it has slowly become the bread and butter of political, informational and financial survival.

Fantasy, after-all, is like love; it’s a powerful force and cannot and should not be underestimated.

When it comes to markets, and hence portfolios, the greatest fantasy of all in the current, post-2008 (and post-COVID headline event) is the comforting notion that central banks in general, and the Fed in particular, can save us all.

Today, the arrogant and history-challenged proponents of MMT and unlimited debt paid for by the unlimited creation of fiat dollars is actually accepted as a kind of new orthodoxy, or new normal.

As I’ve written many times, however, this “new normal” is factually little more than an au courant illusion, or Twilight Zone, sustained by a dangerous and temporary (yet ever-waning) faith in official structures rather than the acceptance of hard facts.

But just because something—or some system–is a fantasy doesn’t mean it can’t be effective.

That is, fantasy can “work” —right up until the point where faith in that fantasy is lost and the fantasy phase gives way to the reality phase.

It’s a lot like moving from a dark age to (hopefully) a renaissance period—but not without some market pain in between.

With each passing day, and each new market melt-up lead by the Fed, the fantasy camp (and risk levels) gains a few more points, and why wouldn’t it? After all, fantasy is fun.

Fantasy Works

Think about the current Fed fantasy.

It’s fun to see markets rise on monopoly money created out of thin air and cheap debt.

How magnificent. The Fed can essentially create fake money to pay for real debts that the Treasury Department can then effectively lend to itself.

Not bad, eh?

In fact, this circular loop of debt without tears has led Paul Krugman to confidently conclude that debt doesn’t really matter.

Ahhhhh, such sagesse…

But here’s the rub: Debt does matter and Fed fantasy is dangerously changing the nature of our economy, our social contract and yes, heading into this holiday weekend, our labor pool as well.

For years, fantasy-pushers and self-deluded Fed Chairmen like Powell have pretended that the Fed’s policies have no real impact upon our social order other than keeping the economy stable.

For years, the Fed’s job was to theoretically 1) keep interest rates in and around the 5% level, up or down a bit depending on broader conditions, and 2) keep banks liquid in times of crisis.

Boy have the times (and interest rates) changed…

Central Banks at Center Stage

Today, and since 2008 in particular, the Fed has emerged from a mysterious and ignored backwoods to center stage.

The world now turns to the Fed to tackle (as well distort and manipulate) just about everything, from inflation to employment, markets to real estate—as if all of these systemic (and once natural) forces could be turned up and down like a thermostat dial.

Unfortunately, however, the Fed only has two tools—rate suppression and money printing.

Both are essentially just blunt hammers (rather than magic wands) and thus to a Fed now taking center stage, every problem looks like a nail to these Ivy-League PhD’s.

Thus, when COVID came and markets, jobs, and hope fell to the basement level, the Fed came in with its two trusty hammers and, you guessed it, started pounding away, printing gobs of money and slashing rates.

Abra Cadabra, right?

After-all, markets recovered from their March lows in record time. All good, right?

And unemployment checks flew out of DC at record speed. All good, right?

Not so fast.

What Lies Beneath Fed Fantasy—Income Inequality

You see, despite these currently fantastical “solutions,” a much deeper and cancerous reality (in addition to inflation and bond risk) is being masked, a harsh reality that lies at the core of our national identity and even national holiday this weekend.

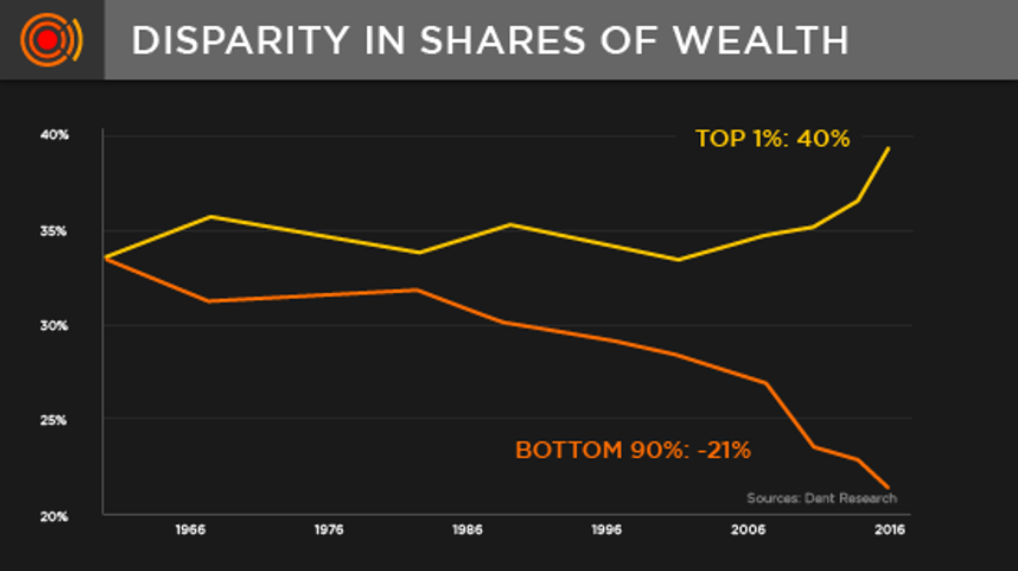

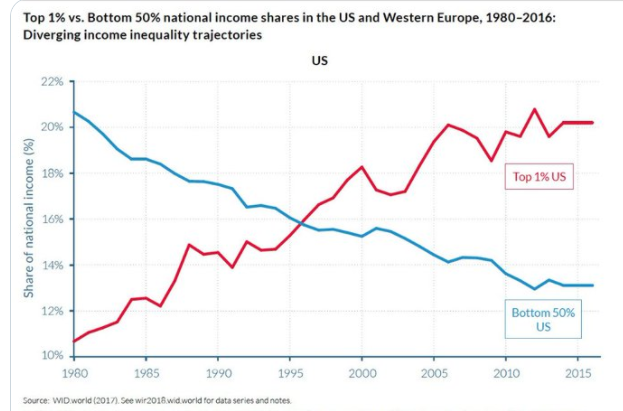

In short, thanks to these two Fed hammers, we are now seeing the greatest income inequality in our nation’s history.

And for any of you who respect, studied or understand history, then you’ll also know that income inequality is not just a footnote to an Econ text book.

Instead, and as stacks of ignored history books will remind, income inequality leads to dramatic and predominantly painful shifts in a nation’s soul and trajectory.

Don’t believe me? just ask Marie Antoinette, Nicholas Romanov, Fulgencio Batista, King George III, Paul von Hindenburg or Ngo Dinh Diem.

Yes, markets are hitting new highs on the direct tailwind created by Fed support, as are the bank accounts of the American top 10% (i.e. the polo playing class).

This 10% reaps 86% of the stock market’s benefits, as it holds 86% of the market’s wealth.

As for the remaining 90%, well look again….

Unfortunately, the Fed has ignored this income inequality, year after year, day after day.

Taking interest rates to zero and printing over $6 trillion dollars in just over a decade has been a boon to the top 10% and an absolute happy-pill for the top 1%.

But the fact that 3 American families own more US wealth than 50% of the US population should not be a sign of healthy capitalism, national pride (or violations of anti-trust laws…), but a psychopathic embarrassment and new form of hidden aristocracy.

As for our imperially dying middle class and COVID-displaced labor force, what is the Fed’s solution for them, as of just a week ago?

Well, the Fed’s answer effectively boils down to a kick in their groin, as the Fed’s “solution” is as simple this: We are going to encourage higher prices (i.e. “inflation”) yet reward those struggling Americans with the chance to go even deeper into debt by forcing rates to the floor.

In short, “let them eat cake,” just bill it to their Amex.

Absurd? Yes.

Actually true? You betchya.

Same Open “Solutions”—Same Buried Problems

Once again, the Fed hammer meets the middle-class nail and hence the Fed’s solution to yet another debt disaster comes down to simply encouraging more, well, you guessed it: DEBT.

Corporate debt is now at $10.5 trillion; household debt is now at $14.27 trillion, and the average middle-class American (what’s left of them) lives on 3 credit cards out of 480 million now circulation and less than $40,000 in income.

Furthermore, over 40% of Americans are unable to endure a $400 emergency without having to sell something and the vast majority of American families have less than a $1000 in their checking account.

Meanwhile, guys like me get to spend this weekend playing polo in Bordeaux?

Why?

In part because the top 10% have gotten richer off a nationalized stock market and national economy sustained by debt rather than productivity.

In the end, however, such policies, and social divisions are bad for everyone—top 10% or lower 90%. Thus, sitting on a polo pony doesn’t mean it’s safe up there.

Productivity? What’s that? But as Krugman suggests—who cares, so long as we can live on debt.

US debt to GDP ratios have climbed from 60% in 2005 to over 130% as of today, and GDP—our nation’s actual income statement–fell by greater than 30% last quarter.

That’s horrific. Unprecedented. And yet the markets are now reaching for new highs?

Still think this isn’t a rigged game? Still think this ends well for America—top or bottom percenters?

And do you still think your portfolios can ignore massive over-valuations in risk assets as well as massive risks of a bottom-up recession leading to a market disaster?

For now, the fantasy-Fed narrative is still working, despite the harsh realities of income inequality and factually unpayable debts lurking beneath our broken and one-sided façade of prosperity and American exceptionalism.

But as I recently wrote from Europe, over here America doesn’t look so exceptional…

What Will Break the Fantasy Loop?

As I said, fantasy and fantasy-narratives can work—until they are no longer believed, or until the facts become too hard to ignore, despite the main stream media’s valiant attempts to distract us.

Money printing and cheap debt works for now, but stops working when currencies sink and QE loses its appeal around the same time that low rates morph into high rates, causing bonds to fall like rocks.

For now, however, the fantasy is still in the 3rd chukka (period) of the market polo match, but our economic horses are looking tired and the champagne glasses on the side lines are only half-full, as deep down we all (players and spectators alike) feel a little silly.

Key to this fantasy narrative is that the U.S. dollar can remain pre-eminent as the world’s reserve currency despite its unlimited creation and inflation-exporting crimes, which I outlined here.

The Dollar—Not as All-Mighty as Before

Furthermore, and unbeknownst to just about 99% of those who don’t make their living on Wall Street, it’s becoming more than obvious to honest market veterans that the Fed is losing control over its all-mighty dollar.

This lack of control was made abundantly clear (yet 100% media-ignored) when the repo markets imploded last September or as the true facts behind the Fed’s lack of control of the Euro Dollars and shadow-banking systems slowly leaked out to more informed investors.

My job, of course, is to inform YOU of these stubborn yet ignored facts and leaks every chance I get, as I don’t spend all my time just prancing around on polo ponies…

My view is that the days of the dollar as a world reserve currency are numbered.

I’m not alone.

The head of the Bank of England, and good grief, even Goldman Sachs, has so much as stated the same thing.

Will the yuan replace the USD? Unlikely, though China would like to believe so.

More likely is that a new form of digital currency (like the one the desperate, debt-soaked and zombie-economy-creating Bank of Japan is experimenting with) will slowly rise to the surface as faith in fiat currencies like the USD slowly sinks to the ocean floor.

Whatever form this digital currency takes, it will be backed in part by some form of gold percentage, thus re-affirming my high conviction (as well has historical lesson in cycles) that precious metals aren’t just the stuff of click-bait hucksters, but an historically-confirmed store of actual value, which fiat currencies, by their very definition, are NOT.

Just take a moment to look at a dollar bill, if you still use them. It’s backed by the full faith and credit of the US Treasury.

But folks, faith in that “credit,” Treasury and currency (i.e. purchasing power) is declining by the minute as the artificial creation of that currency is skyrocketing by the second.

Labor Day with Less Labor and More Angst

For now, however, as you head into a US Labor Day weekend and I drive toward a French polo tournament (and the French Open for which I’ve trained all year), the country, currency and fantasy narrative of which I’ve written above (and for years) is slowly losing ground.

The baby-boomer generation in the US, which fed off the base of a nationalized pyramid scheme of debt and fiat currencies, is now giving way to a far angrier yet equally entitled Generation Z movement who feel screwed—and legitimately so, because they’ve been screwed by the Fed and DC (both parties) for years.

In short, that generation will be paying the bills and feeling the pain created by the generation that preceded them. They are frustrated, broke and angry.

This frustration and hence social unrest, is at root, financial unrest, as the income (as well as opportunity) inequality has never been higher in the US than it is today.

The marches, riots and anger we see every day in the US headlines has the surface appearance of appealing to race, gender, political divides and other anger clubs inherent to identity-politics, but history confirms that the real divide is always, and at root, one of income.

All Waving Fingers Point to the Fed

And for that, we can assign a large swath of the blame to a Fed who gave Wall Street far too much precedence over Main Street.

And as for me and my polo game, they say it’s the sport of kings.

But I’m neither a king nor prince. Frankly, I find the horses far more interesting than the vast majority of polo players and the crowds who ignore the matches while adjusting their hats.

I grew up in Michigan, not Malibu or Madison Ave., and certainly not on a polo field. But I’ve since come to know both sides of the great American income divide.

Unfortunately, the Fed still seems to have forgotten the America I hail from, the hard-working backbone of a nation whose jobs were sent to China and who neither understand, care about nor need another FMOC meeting or market report to answer their immediate needs.

What that America needs are less tales of market fantasy, debt and currency “solutions” and more honesty from DC, the Fed and macro-thinkers out of Wall Street.

What that America (my America) wants are blunt facts, real jobs and hopefully, less need for unemployment checks.

Portfolio Solutions

Tom and I can’t solve every political, social or systemic problem facing the world in general or the US in particular.

But as for our portfolios here at Signals Matter, they are built around the same need for honesty, blunt facts and allocation transparency, all found here.

At Signals Matter, our portfolio is designed to consider both 1) the big macro questions (i.e. the fissures, risks, fantasy and faith patterns discussed above) as well as 2) the micro market data that we track objectively each day.

For now, the market melt-up (and fantasy) continues, and we continue to track, trade and invest carefully based upon the flows, sectors and yields we track in real-time, with one eye on risk and the other on reward.

That said, it’s worth keeping in the back of all our minds that the risks outlined above will one day clash with the fantasy currently handed down from the Fed.

Tracking this collision of fantasy and risk is no easy task, but it’s one we also can’t ignore.

Neither Tom nor I can predict when the faith in the above fantasy will end, and with it, the current market run.

No one can time a market, especially a market devoid of natural forces.

What we can do, however, is prepare for, and signal the moment we see the shifts occur, and for now, as always, the best indicators and signals have been provided by the markets themselves, not the horse crap debt solutions handed to us by the Fed.

Speaking of horses, I got to go.

Have a great Labor Day weekend.

Sincerely,

Matt & Tom

Hi Matt,

Another great read — Thanks.

Through my uneducated lenses, there seems to be a lot of similarities between the current situation and Japan back in ’89. Huge debt, lots of zombie banks/corps.

Do you think there’s a real risk of the US economy, or even the world economy going through such a long span of stagnation?

As a relatively young person, this is horrifying.

Best regards,

Gustav

Gustav, you are more educated than you let on 😉 In fact, your observations and concerns regarding the Japan template are shared by me and many others. Take a look at my report on Japan (May, 2018) as well as the May 15, 2020 report on negative rates, where I end the report with a clear warning that we “are turning Japanese”–hopefully this might help.

Unfortunately, when the debt bomb does explode so will the anger of the poor and now poor middle class. The right would have us believe that rich should not pay and such their tax policies ensure corporations and the 1% continue to pay less than their fair share year after year. But the left’s plan is not much better wanting to spend money they don’t have on programs that will not truly address social inequality.

It is estimated that 3 trillion dollars has been spent over the past 5 years by corporation repurchasing their own shares. Meanwhile, real wage growth is barely able to keep up with inflation for the fortunate few that actually got a wage increase.

Imagine what it would be like if only half that money was spent by companies on creating new products, by rewarding their workers instead focusing their executives. What would the economy be like today if the American worker saw real wage growth, American innovation brought new and better products to the market place and American politicians actually worked for the people instead of the 1%.

While we may not be reliving the economic boom decades of the 1950’s and 1960’s I would wager that if the average American worker saw their wealth increase rather than decrease over the past few decades things would be a lot better today.

Ah Richard, such wise and sound observations. I wish more folks like you were running for office or steering the Fed 🙂