Portfolio survival is a part of personal survival for any of us who recognize that our future, our families and ourselves require, well…money. Toward this end, we must navigate carefully through the many reefs and shoals of our times, economies and markets.

Below, we look at portfolio survival in the backdrop of increasing economic unrest, social unrest, and financial unrest—three legs that can break the American “stool” and with it, unprepared portfolios in a world increasingly awash in so many flavors of risk.

Economic Unrest: Debt and GDP Heading Toward an Historical Moment of “Uh-oh.”

Hypocrisy, ignorance, and greed are not merely the stuff of philosophical discourse, but are equally embarrassing components of financial history and markets, which alas, impacts your portfolio and thus the issue of portfolio survival.

As we watch the policy makers of the world scrambling about the hallways of power like headless chickens in a backwoods farmyard, it’s quite obvious that their only solution to a debt crisis (which they alone authored) is just, well…more debt.

In case you don’t believe me, just look at the following graph of global IOU’s being spat across the world by debt-soaked companies who survive off debt rather than profits:

Needless to say, the markets love cheap debt, and continue (for now) to rise with gravity-defying elan as the real economy, measured by such pesky little facts like GDP, tanks across that same global landscape.

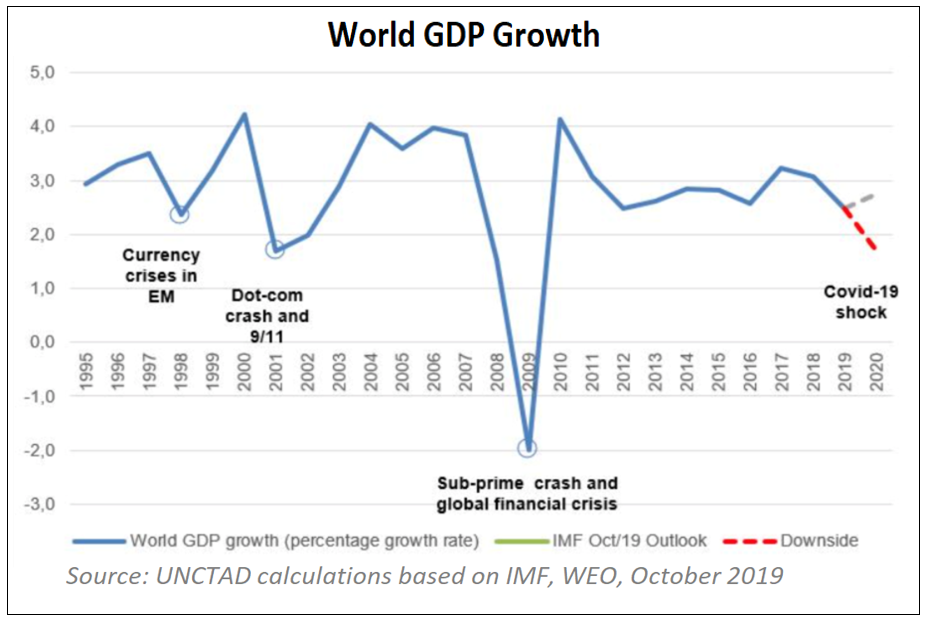

Again, if you don’t want to believe me, just take a gander at this stubborn little chart of anemic global GDP:

What’s even scarier is that on Thursday of this week, the official GDP report for Q2 is about to come out, and folks, it’s gonna be historical in its embarrassing decline.

In short, the horrific chart above is about to get even more horrific. Portfolios be warned…

Social Unrest: What the PPP Data Says About Haves and Have-Nots

As for other reality checks, it goes without saying that conditions in the United States are anything but united.

The bobbleheads from cable news networks to The NY Times would like to have you believe that what divides Americans today are just issues of political and racial tensions.

I’m not here to discuss race or politics, which do matter. I’m just no expert there. Yet those bobbleheads fanning fear on the media are no experts at all when it comes to economics or markets…

I am here simply to remind all those angry mobs, left or right, black or white, that they are likely channeling their anger at the wrong “ism”—for history confirms that an equally real divide in societies which take to the streets is often based on a struggle between those that have and those that don’t.

In short, and despite all the importance of race and politics, the data confirms that a real divide (touched by race and politics, of course), and hence real anger, brewing in the dis-united states, is one quite simply of rich vs. poor.

In short, it all sort of boils down to economics. I touched upon this briefly here.

Those marching and shouting are channeling legitimate anger about racial and political issues, but deep down, I’d wager that a key driver behind this sudden social unrest is that most Americans are simply going broke and don’t see any light at the end of their tunnel.

In such circumstances, all it takes is an incendiary headline, tweet, or event to set an otherwise financially fragile world upside down.

Unfortunately, the vast majority of Americans don’t have the time or economic backgrounds to see how much they have been financially played by a rigged economic system that favors a small percentage against a much larger majority of citizens who have been, well, “suckered.”

I’ve written about this rigged system and the ignored majority of un-deserving “suckers” here, here, here and again here and here and just about everywhere else.

So, in case you think I’m speaking “socially” without economic data, perspective or facts, please click above and see for yourself.

Jay Powel, for example, is speaking total and disgraceful nonsense when he pretends that what the Fed does has no bearing on class, wealth distribution, or economic inequality. For more facts on this front, just click here, here or here…

Unfortunately, those angry crowds don’t know much about the Fed, markets, or economic trends, as the system itself is deliberately made just complicated enough as to seem un-knowable to those whom they “sucker” on a daily basis.

But for those, like yourselves, who seek to stay informed, you know better how to channel your frustrations as well as prepare your portfolios for portfolio survival.

One area worth channeling a bit of that frustration is the PPP program, which despite its laudable intent, has done more to help those wealthier businesses with clever accountants than those with mom & pop shops across the street and across the county.

After the SBA released its list of loan recipients, those that bothered to look were a bit dismayed.

Country clubs, Santa Monica based financial advisors, private jet companies, hedge funds, Ruth’s Chris Steakhouse, Chipotle, Shake Shack and most embarrassing of all, my dear Harvard with its $41 Billion endowment, were on that list…

The hypocrisy got to be too much for some, and after a healthy dose of public shaming, many of those PPP and CARES Act recipients quietly gave their emergency money back…

It’s hypocrisy like this, greed like this, which makes me worry about the future of the U.S., and thus the future of portfolio survival.

People with nothing have nothing to lose, and civil unrest is a real possibility. The election in November will polarize this even more, regardless of who wins.

As Grant Williams recently discussed with Erik Townsend, civil unrest is a real possibility going forward, and in my view, a lot of this momentum toward “uh-oh” began when the Fed and Wall Street jumped in bed together, beginning specifically with Greenspan.

Since that time, free market Capitalism has been replaced with greedy CEO me-ism, exemplified by such tweet-happy celebrities like Elon Musk (and his disgraceful wrist-slap from the SEC ) and just plain morons like Adam Neuman of WeWork.

Financial Unrest—The Last Broken Leg Soon to Fall

I’ve warned for years that creating base money out of thin air to solve debt problems or fatten Wall Street creates a helluva party whose hangover will only be that much worse when the party ends, putting portfolio survival at great risk for uninformed investors.

As of now, the Fed and DC keep up the QE keg-party to bail out the top 10% in Wall Street and elsewhere while DC writes checks of $600/week to keep Main Street from grabbing pitchforks (or bothering to look for more work).

It’s all pretty crazy.

But when will it end? When will the hangover come and portfolio survival be challenged? In many ways, it’s already here.

Given that it takes a triad of political, social, AND financial unrest to fully destroy a system, it goes without saying that DC (left or right) and the Fed will continue to print, borrow, and spend to keep this financial leg of our broken American stool from breaking.

MMT, Modern Monetary Theory – the idea that we can just print our way out of any problem – is no longer just a stupid theory, but effectively a new (and stupid) reality today. The Fed’s balance sheet could easily hit $10 trillion by early 2021.

It’s fun while it lasts to spend, borrow, and counterfeit.

But here’s the historical rub folks: It won’t last forever—no one can drink forever without killing their liver, and no debt problem can be solved with more debt and printed currencies. Full stop.

Please don’t ask me to predict WHEN it ends; I can only speak with conviction as to HOW it ends, and as I’ve warned for years: It ends badly. Issues of portfolio survival have never been more important.

How We Help Subscribers

It’s one thing to look at the big picture—i.e. macro forces, like history lessons, trends, GDP and debt data.

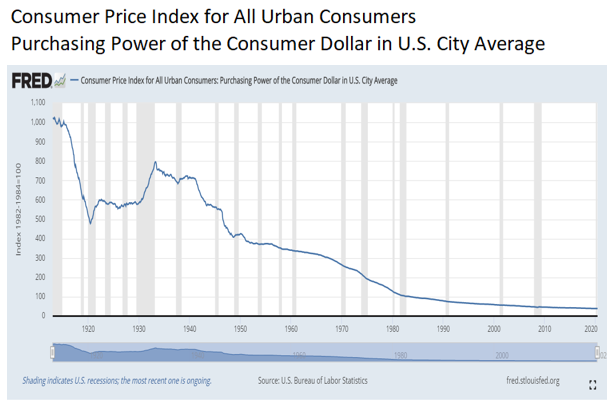

We know, for example, that printing trillions out of thin air kills the purchasing power of currencies, including the dollar. Don’t believe me?

Again, just look at the graph below, hidden in an obscure corner of a website provided by your own government. It shows you what happens to your dollar’s power when diluted by unlimited money printing:

That’s why, at a broad level, digital currencies and precious metals are entering a new bull trend for the long road ahead. And as for my take on this road, gold is the answer.

But there’s more than gold to consider when asking about portfolio survival, and our subscribers are and have been asking about how we will continue to help them tomorrow in the same way we helped them yesterday.

Well, as we’ve shown numerous times here, here and here, we build portfolios based around the right and careful balance of big picture facts and market-specific signals, focusing as much on risk management as we do on returns.

Keeping you safe in the midst of a surreal backdrop of social, political, and economic upheaval requires a keen understanding of portfolio management and portfolio survival. Our biggest tip: Selecting securities with low correlation makes all the difference.

Correlation Matters

It’s as simple as that. When it comes to building portfolios that can stand up in all weather conditions, including the horrific market conditions we face today, portfolios must be populated with securities that zig when the markets zag. Full stop. Here’s how we do it.

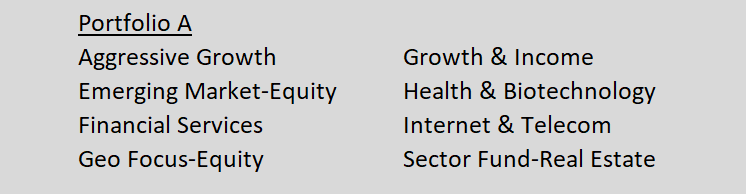

Raise your right hand if you believe that Portfolio A below makes sense, in any market environment.

Combining these equity selections in a single portfolio may lead you to believe that your financial advisor is doing a great job at “diversifying.” After all, your diversified across eight different sectors, with concentration to boot in sectors that are sizzling, like heath, biology, internet, and telecom.

Guess what. When global equity markets plunge over 30%, as they did in February/March of this year, so did all of these special equity picks. In short, diversification was merely “de-worsification.”

When the going gets rough, especially on a global basis, all equities everywhere move in synch. That’s because they are correlated with each other. As we’ve said time and again, rearranging the deck chairs on the Titanic is not going to ensure portfolio survival when this next debt iceberg unravels.

Here’s the math.

A correlation of +1 indicates a perfect positive correlation, meaning that all variables within a portfolio move in the same direction together (Portfolio A above).

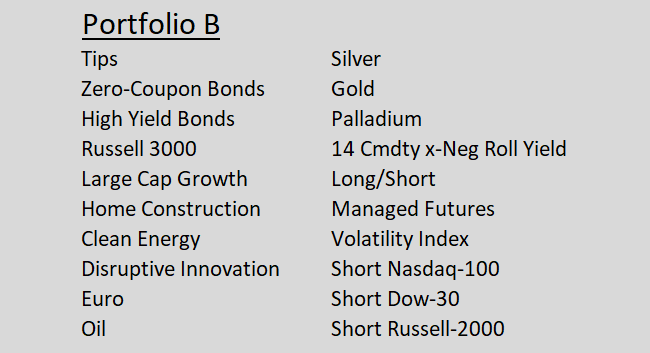

A correlation of –1 indicates a perfect negative correlation, meaning that as one variable goes up, the other goes down. That would include security selections like those in Portfolio B below.

When markets crash, we’d estimate that the correlation among the equity picks in Portfolio A is between 70-80%. That means you go down with the ship. With a Fed now plain out of life jackets this go-around, do not expect Portfolio A to pop back up. Portfolio survival is at risk.

Now take a look at Portfolio B:

Look a little different? We’d estimate that this portfolio would correlate less than 30% to the S&P 500 Index in a market crash. Actively managed, Portfolio B could have zero correlation to stocks.

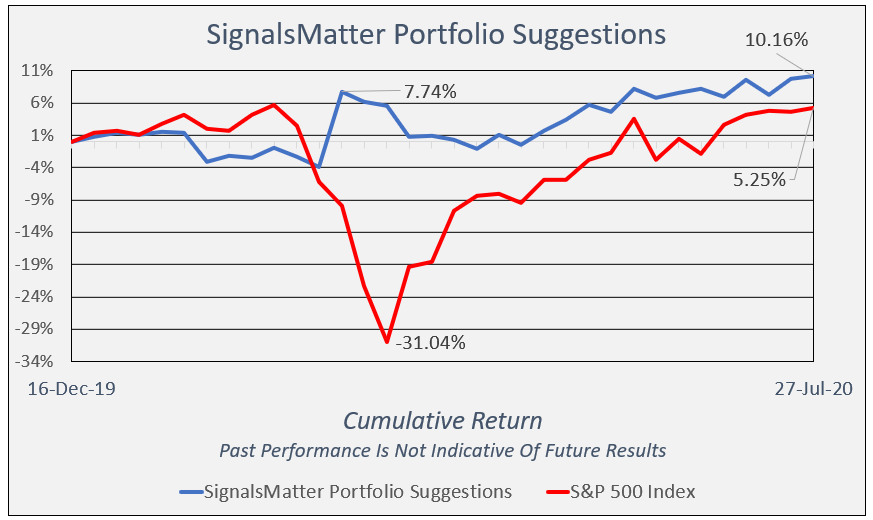

Imagine further even making money as markets crash. That would require that security selections are negatively correlated to the S&P 500 Index. Stocks dive, and you make money. Take a look at how Portfolio C below, our All-Weather Signals Matter Portfolio, fared when equities took that 30% dive back in March. Signals Matter made money, lots of it. How? By not losing it, in a portfolio that was negatively correlated with stocks.

It takes years upon years of experience under all manner of market conditions to build negatively correlated portfolios, and a fair amount of hedge fund experience to boot to ensure portfolio survival when you need it most.

Being up 10% since December, with no appreciable downside, is not just a science; it’s artful science that calls heavily upon combining alternative investments in a portfolio that zigs when stock markets zag.

With 10% returns under our belt in just 6-months, we aim to double that (to 20%) by December of this year, again with no appreciable downside.

And yes, if markets tank again as Fed stimulus runs thin and the pandemic endures, that would help.

Signals Matter

Here’s who we are: About Us. And this is what we do. We build portfolios that work. We know what to do, and when to do it, because we do our homework, described here, Investment Priming: Portfolio Management in a Changing World.

Risks are high. Portfolio survival is ever more important.

Here’s a plan we could suggest. First, protect your portfolio by investing in uncorrelated securities. Second, read about our Successful Subscribers. Third, Get Started with a Free 7-day trial. Protect yourself when the next storm hits. When and how to mix and match securities, and in what proportions, makes all the difference. It’s called active management. Leave timing, security selection and active portfolio management to the pros.

Be well. Stay safe.

Matt & Tom

Thanks for this heads up.