Is deliberate inflation the Fed’s real aim?

As repeated in numerous articles and interviews, global central banks in general, and the Fed in particular, have placed themselves and the global markets and economy in a trap from which there is no escape short of biting off their own feet, as they’ve had a foot in their mouths for years.

Or as Mohamed El-Erian said best: “The Fed has no good scenarios left.”

This blunt point simply can’t be repeated enough.

Candor (and Debt) Matters

With global debt at $300T+, and combined U.S. corporate, household and public debt well past $90T, the Fed’s “face-saving” attempt to raise rates (even to the unsustainable level of say 4%-5%) as a weapon against 9+% reported (i.e., under-rated) CPI inflation is a failed strategy from the start.

In fact, it is delusional at best, and more likely dishonest at worst. Full stop.

Simply stated, an historically debt-soaked market, economy and government addicted to years of artificially repressed free money can’t suddenly afford a meaningful rate hike (i.e., expensive money) without a fatal string of credit defaults, from investment grade to sovereign bonds.

In short, if the Fed continues to raise rates, markets and Main Street crumble; if they pause the QT and revert to more money printing, inflation worsens. Hence the trap.

Facts Portend the Future

Toward this end, we’ve dedicated years to fact checking, candor-speaking and calmly disclosing a long string of open rigging and errors masquerading as policy which have poured from the lips and policies of figures like Greenspan, Bernanke, Yellen and Powell.

Despite the stubborn honesty of such facts and the consistent dishonesty of our bankers, many FOMO investors have clung to the cognitive dissonance of believing central banks had their backs—and their markets and currencies in eternally safe hands.

Now, as the transitory inflation myth has broken the credibility of these lost shepherds and the faith of their sheep, the financial word is facing the first chapters of a global “uh-oh moment” (i.e., geopolitical risk, falling markets, debased currencies, failing leadership, and increasing social unrest), the inevitability of which we’ve warned in two published books and countless reports.

Most reading this, of course, are not among the sheep nor the surprised. Yet even for you and us, the continued hubris, ignorance and open desperation of our so-called central bank “leadership” never fails to astonish.

Let’s see why.

Apparently, Powell is afraid of going down in history as the next Arthur Burns.

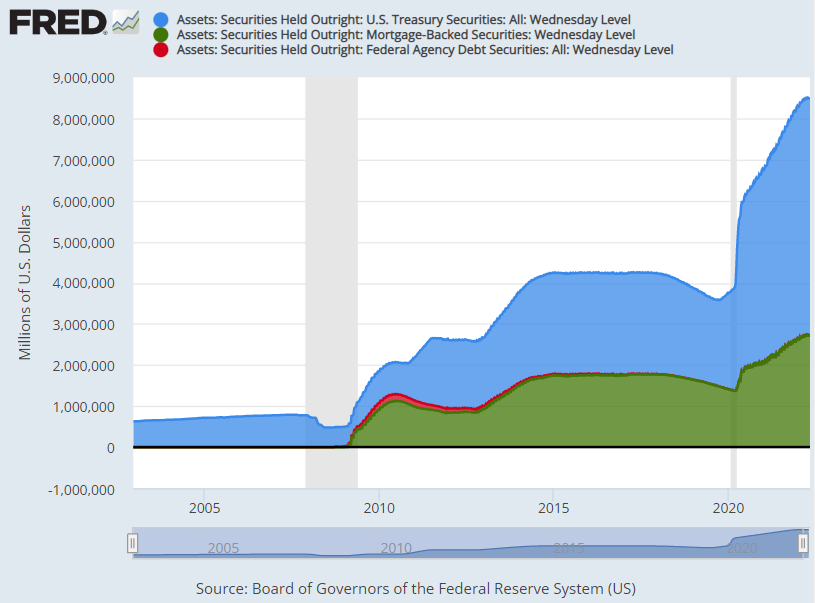

Not surprisingly, he appears more concerned about his personal legacy than the embarrassing legacy he and his predecessors have left an inflation sick nation after deliberate inflation of the Fed balance sheet from $800B pre-08 to over $9T today.

Despite the obvious and direct inflationary consequences of such balance-sheet expansion, everyone in a DC office (from Biden to Powell) wants to save their reputational behinds and blame the consequences of decades of their openly inflationary monetary policies on a virus and a bad guy in Russia.

How’s that for profiles in courage?

And even now, Powell still thinks he can emerge as the next Paul Volcker by raising rates to fight the inflation he helped create.

Well, the ironies do abound.

Folks, Powell is no Volcker.

A Lesson for Mr. Powell: Debt Matters

Mr. Powell, if you are reading this, let us remind you that when Paul Volcker was raising rates, the US public debt was below $900B, not the current $30 TRILLION debt level which the Greenspan generation (i.e., that includes YOU) directly created.

Let us also remind you that the “Volcker era” U.S. debt-to-GDP ratio between 1979 and 1981 was 31% and our deficit-to-GDP level was only 2%.

TODAY, our debt-to-GDP ratio is over 125% and our deficit ratio is approaching 7%.

Math, facts and debt are stubborn things, no?

This far less cancerous debt level, Mr. Powell, explains why Volcker was able to raise the Fed Funds Rate (FFR) by over 1000 basis points to fight inflation, and this is further why even a pathetic 300 basis point rate hike under your debt-soaked watch by 2024 will be as ineffective to fight inflation as a submarine with screen doors.

Even a meek 3% FFR as you so “hawkishly” propose would leave our FFR rate lower than it has been for 98% of the last 67 years.

In short, if you are honestly pretending to fight inflation with a wimpy little rate hike like this (because 300 bps is about all that the gasoline-debt-soaked USA can afford thanks to you, Yellen, Bernanke and Greenspan making us debt broke), you are effectively bringing a knife to a gun fight.

In other words: You’re gonna lose the inflation fight.

Furthermore, your proposed rate hikes (far too little, far too late) will raise the cost of Uncle Sam’s embarrassing bar tab level from 7% to over 11% of our ever-dwindling GDP.

In short, Mr. Powell, you’re dreams of Volcker glory, or even Volcker efficacy, are only that: Dreams.

Dreams to Nightmare

For the rest of us, however, the nightmare you’ve unleashed and the “solution” you’re proposing is rigged/doomed to fail.

Your FFR rate hike will create debt pains that will last for years, as the government’s average debt maturity is greater than 4 years.

Even these meager yet higher rates will (and already have) disrupted financial markets, strangled GDP growth, augmented welfare spending and shrunk U.S. tax receipts by 16% YoY in May and likely by 30% in June.

Ouch.

Mr. Powell, while crunching numbers in school, did you ever bother to read Hume or von Mises?

They would have shown you (with numbers not hard words) that GDP growth is mathematically impossible once debt levels are greater than 100%.

Or just ask Kuroda, as you can no longer ask Abe.

Although you will never be the next Volcker, you may want to purchase a biography of Benjamin Strong, the first Fed Chair to trigger a depression by not allowing inflation to run hot as mandated by the rules then in place (i.e., when the USD was tied to gold) …

Powell’s Real Plan? Deliberate Inflation

But then again, Strong’s mistake of not allowing inflation to run hot enough to “inflate away” U.S. debt may not be your mistake, but deep down your real plan?

In short, I’m guessing that more rather than less inflation (i.e., deliberate inflation) is your only real option and plan, despite headlines (and rate hikes) to the contrary.

I’m guessing you’re only raising rates now so that you’ll have something, anything at all, to cut when markets truly tank, and we both know they will tank much further, unless…unless…

More Mouse-Click Money

…unless you are waiting for markets to break so that you can grab a coffee and doughnut, walk into that dark room at the Eccles Building with all those glowing screens and start adding magical 0’s to your balance sheet (i.e., mouse-clicking more fake money), which we both know is deliberate INFLATION.

Sure, your ol’ Pal Yellen (who slithered from the private Federal Reserve to the Treasury Secretary’s desk a few blocks away) has tried to push the USD (and DXY to 110+) to fight Putin’s inflation (?), but that too was just another knife in a gun fight…

Yellen believed she’d pull a Reagan-era 2.0 with a stronger USD and hence attract foreign money to make a stronger market.

But as revealed above, our debt levels (thanks to folks like you and Janet) aren’t the same as the 1980’s or even 2014, and her strong USD “plan” was a whisper rather than swan song for the markets.

This “strong USD” plan has crippled just about every asset class but the USD, and only managed to lure a few foreign suckers into a tanking US market.

So, Mr. Powell, you’re in a debt corner of your own (and Janet’s, Ben’s and Alan’s) making, and I’ll say what you won’t, namely: You want more not less inflation to get Uncle Sam out of debt in the same way every broke regime from Rome to Paris to Tokyo to Ankara to DC has done and will do again–by inflating away their debt, crushing the (angry) man on the street and blaming the inflation (i.e., currency debasement) on anyone but themselves?

Mr. Powell, why not just say it out loud? Your policy is one of deliberate inflation. Truth may be a rare political tool, but it is an equally stubborn thing.

Waiting for Gold

Meanwhile, and it the midst of so much political, cultural, financial, military and social chaos in 2022, gold’s performance has been less than favorable.

Retail investors are getting out of gold ETF’s ($1.7B last month) at the wrong time, which sadly, is what retail investors often do.

Ironically, and not surprisingly, the biggest buyers of gold of late are the central banks themselves, who having colluded to paper squeeze the gold price down before buying, are reaping the rewards of their manipulation games.

Foreign central banks are seeking gold as an alternative to a USD whose days of hegemony are slowly coming to end.

As argued, US attempts to lure foreign money into tanking US markets via a stronger dollar and rising rates are both unsustainable and backfiring, but these forces have certainly put a temporary dent in the gold price trading in the 1700 range.

Of course, when measured against other currencies outside the USD, gold has done far, far better.

It’s fair, of course, to also remind that gold has suffered far less than bonds (S&P bond index down 9%), cryptos (down 75%) and stocks (S&P down 20%), but patient gold investors already know that.

Higher rates are a gold headwind, but not forever. Gold soared between 1971 and 74, and again between 1977 and 1980, as rates in the US were rising not falling.

Remember: Gold is a monetary metal, a store of value. It’s not a tech or growth stock. It’s loyal, and as such, it consistently surpasses its prior peaks, especially in the backdrop of rising inflation.

Stated simply, its bull market has yet to begin.

Market Volatility

As previously written, some of the biggest daily market rallies occur in bear markets, so investors seeking to short the headlines or just assume a straight line down will be squeezed.

When market sentiment is as low as it currently is by almost every indicator, from cash positions to liquidity concerns, markets can rip north on almost any piece of good news, as we saw as recently as yesterday.

That is, even a trickle of hope from the energy market (i.e., Nord Stream 1 promising gas deliveries to Europe, or a weaking USD on hopes of an ECB rate hike) can send otherwise “capitulating” markets surging upwards.

Such volatility, even optimism amidst pessimism, is all too common in periods of macro strain and debt-driven market corrections, and requires the kind of hands-on active management and macro-tracking we do here at Signals Matter.

Signals Matter’s Blogs & Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly by Signing Up Here. Signals Matter’s Portfolio Solutions Made Simple are geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here.

The record demonstrates the dynamics defining the building of this global debt pyre, began,

…. with the uptake of the neoliberal scam of economic rationalism.

Its outcome of comprehensive debt destruction, as common of the dynamic record all the way back to Methusaleh, defines its debt pursuit as entirely predictable – ‘if it looks to good to be true, it probably is.’

It’s why I have taken the opportunity to add to my investment in gold.

And I would appreciate your analysis Matt, of the comparative value of GLD, and PHYS, defined in the article written by Power Hedge, published in Seeking Alpha, on 8 Apr, 2019, titled;

“Sprott Physical Gold Trust: The Best Gold Bullion Fund To Put Into Your Portfolio.”

Specifically, I would be interested to know if GLD is potentially suspect as a gold bullion ETF, in the event of a ‘bone-rattling’ economic debt deflation crash?

Cheers!

The following article by Egon von Greyerz addresses the risks of owning gold via an ETF structure like GLD and PHYS.

https://goldswitzerland.com/buyer-beware-gold-etfs-like-gld-own-no-gold/