Below, we look at Jerome Powell’s recent capitulation to Wall Street, inflation reality, the danger of trusting the Fed and its empirical history of serving stock markets rather than citizens.

Surface Shine

Back in 1983, the J.P. Getty Museum was about to fork out $ 10M for a Roman statue of a handsome, muscular boy called a Kouroi. They brought in experts with X-ray diffraction/fluorescence tools and electron microprobes to do a glorified autopsy on this, rare, shiny white statue of a naked Roman dating, allegedly, back some 2600 years to the marble quarries of Thasos.

All was in order; even the lawyers assured the museum curators of this rare find. Break out the checkbooks!

There was only one problem. The statue was a complete fake. Rather than purchase a 6th century BC statue, they now had a shiny forgery made circa 1980…How did they finally know?

Well, the experts, in fact, didn’t know.

Despite all the science, paper-work and fancy degrees in art history and expert testimony on calcite layers, the simple truth was this: nobody in the official circles at The Getty really knew what they were doing.

Instead, a couple of Italians who had spent a lifetime sifting through the rubble of Sicily for bits and pieces of Roman art took one look at the shiny white masterpiece and knew—alas even felt the truth.

In fact, the first words out of their mouths when seeing the perfect, shiny white specimen were: “It inspired an intuitive repulsion.”

Intuitive Repulsion

Well, as someone who has spent a career investing, analyzing and sifting through the rubble of capital markets, I get that same “intuitive repulsion” every time the Fed or MSM spits out another spin-piece on how great the economy is and how safe our markets are…

You see, the years teach us things the days don’t notice. When you truly know something about a certain field, be it the markets, art, basket-weaving, surfing, heavy-equipment, or Sanskrit, you acquire a certain, well… “intuition,” or what Hemingway more bluntly described as a “B.S. detector.”

As for my intuitive “BS-detector,” one glance at these markets and I see a “fake”…Let me share a few ideas that might trigger your own “intuition,” and common-sense meter.

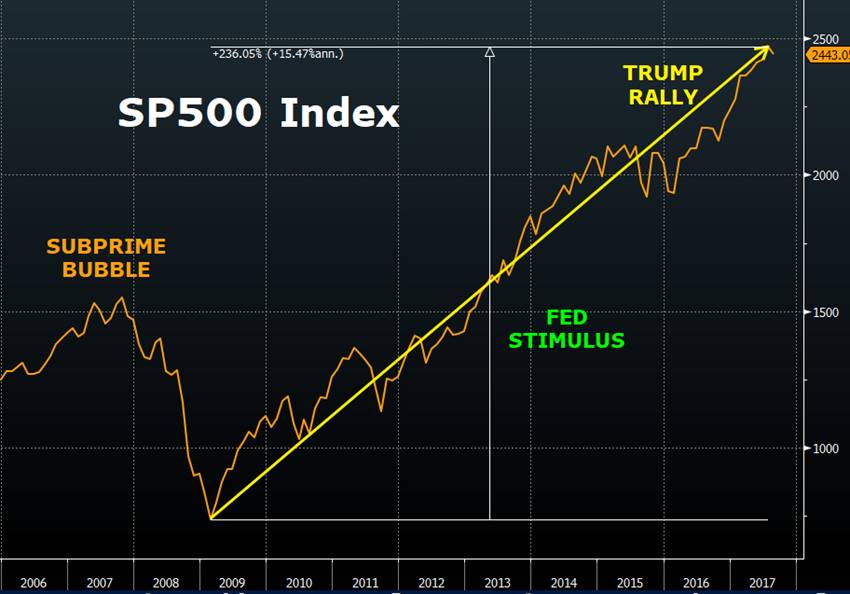

For example, when you see a stock market rise like this…

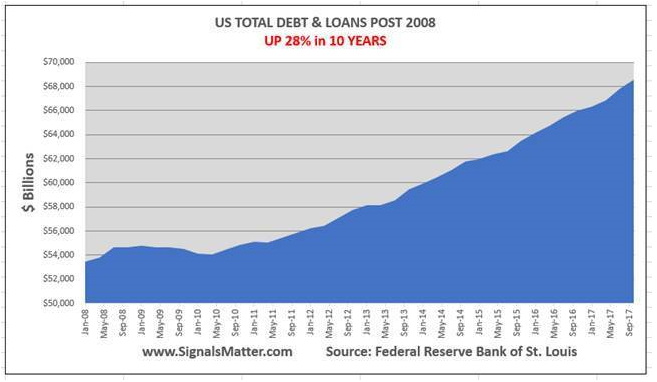

On debt levels that look like this…

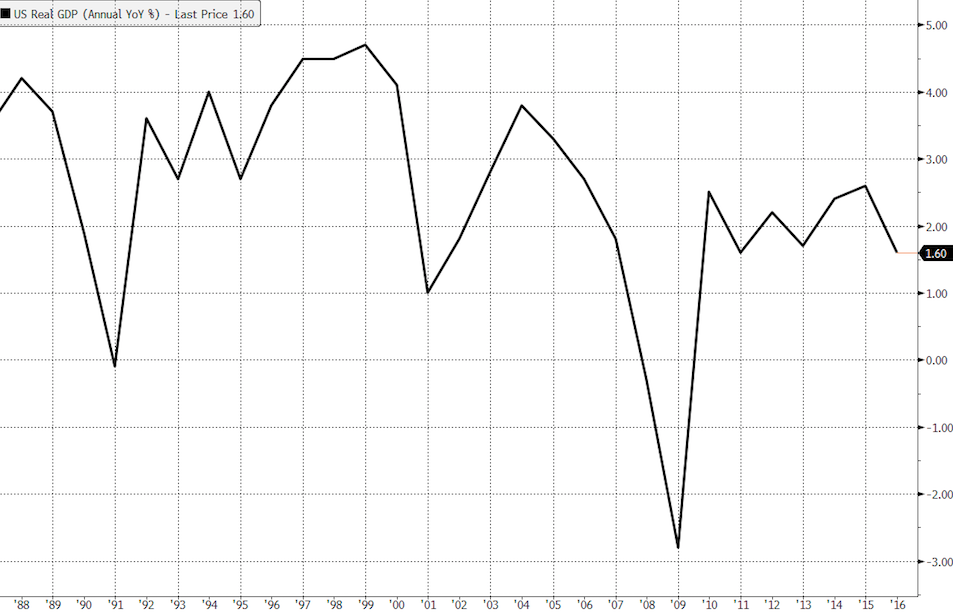

And yet see GDP flatlining like this….

Does your BS Detector kick in? Rising markets, record debt and no productivity. Do you need PhD’s from the Fed or prompt-readers from CNBC to tell you something is, well, amiss?

As I’ve argued many times, The Fed, much like the Getty “experts” really aren’t that, well…good at what they do… Sure, they can boast of fancy diplomas and blab positive spin for years about a “growing economy,” “target inflation,” “accommodation” and “peak employment” etc. etc.

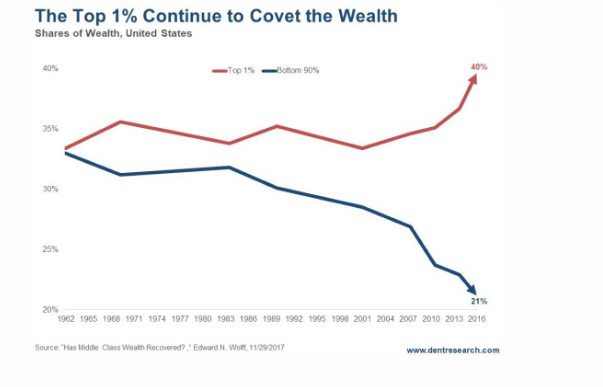

But as I’ve shown elsewhere, the only thing the Fed “accommodates” is Wall Street, not Main Street. Which is why the top 1-10% of Americans who can afford hedge funds, private equity schemes and stock risk have been enjoying the Fed (and its “stimulus”) while the rest of America is falling like a stone.

By the way, if you believe the Fed’s words that our economy is strong, then ask yourselves why our Balance Sheet at the Fed is still $4T ($3.5T of which is printed money) and the inflation-adjusted interest rates they are artificially setting is .1%?

Folks, those two data points are signs of an emergency measure at the Fed, not of a “strong economy.”

Powell Folds Like a Chair

You may have also noted that last week Jerome Powell (who is just another Janet Yellen in pants) folded like a chair to the pressures of Wall Street and the White House. Fearing more market panic (the kind we saw in December) from 25 basis points of rising rates, the bankers and politicians put the fear of God into Powell.

And Powell, like every Fed Chair since Greenspan (see below), immediately bowed to Wall Street and Washington.

He has suddenly gone from “possibly hawkish” to totally “dovish.” But the real adjective for Powell is “yellow”—as in coward…Rather than “forward guide” further rate hikes and detox our sick markets, he’s backing off and dispensing more drugs. And rather than tighten the Fed’s balance sheet, he’s hinting he may go the other way.

In other words, rather than offer tough medicine to Wall Street (aka Bill Martin or Paul Volker), Powell has decided to give more steroids to a market now fully addicted to artificial rather than natural price discovery.

Dip buying will thus continue, stock buy-backs will rise and market distortions will increase. This means the pain ahead, will be fatal rather than just brutal.

Yet the Powell Two-Step also means the Titanic bond bubble I warned of here and here may get some extra support, and be prolonged a bit more under “Fed-Guidance”—which is another term for can-kicking the inevitable moment of “Uh-Oh.”

This potential “reprieve” may seem like relief to you short-term top-chasers, but sadly, all Powell has done is make the recession ahead that much worse when it comes. He’ll have no rates to “lower” in the next crisis, and only money-printing as an option.

But more QE won’t have the same punch tomorrow as it had in 2009, as our country is now far broker than it was then, and our central bank is far too stretched. Today, the Fed may seem as strong as that Kouroi statue, but it’s all shine, no truth.

Don’t be Fooled by Surfaces

Folks, let me repeat, don’t ever confuse a rising stock market with the words “strong economy.”

For example, when you see the NASDAQ rise 200% (peak to peak) from its 2007 to 2018 highs, or the S&P rise by greater than 300% from its 2009 bottom to its 2018 peak, it’s important to keep this in mind as well:

As markets skyrocketed by greater than 300% in the last decade, US industrial production for the same period rose by only 3% and GDP annualized at just 1.7%.

Please read that last line again. It’s, well, terrifying… What we have is a totally doped stock market driven by suppressed interest rates and Fed support for Wall Street, not Main Street.

Since the S&P’s 2007 peak, the average share price has risen from $85 per share to $124/share. That’s a $39 share price growth.

Well…$30 of that $39 share growth is directly attributable to Fed “accommodation” –i.e. to artificially suppressed interest rates, aka: “cheap debt,” aka “faking it.”

Artificially cheap debt also means a Wall Street boon in which over $4T in stock buy backs since 2008 (purchased with borrowed money) has made executives (paid by share price metrics) rich while 40% of the American Middle Class can’t afford a $400.00 emergency without having to sell something…

In short, our stock market surge is as fake as that $10M statue which the Getty experts touted as “genuine.”

And if you think the Fed can keep rates suppressed forever or perpetually sustain a market bubble of greater than 300% supported by an industrial production rate of just 3%, then I have a Roman statue to sell you…

But rather than dive deeper into the history of Roman art, let’s do a little reality check on the history of the Fed’s ability to “curate” the US economy…ooops, I meant the US markets.

A Little Fed History

Ah, “The Federal Reserve…” What a clever moniker (smokescreen?) for a private bank that is neither Federal nor a reserve.

Nevertheless, this façade of national economic stewardship (secretly conceived on Jeckyll Island by a cartel of financial insiders masquerading as “reformers”) has its hand on the centralized pulse (or throat) of trillions in asset pricing.

This means the Fed is directly responsible for the sad yet inevitable decline of a US economy heading toward a debt iceberg.

The ironies which surround this edifice of illusion just abound. Housed in the impressive walls of the Eccles Building off Washington’s Constitution Ave, this bastion of PhD’s and market lackeys is in fact un-constitutional (a clear violation of Art I, Section 8 of our founding document) and was only made “legal” by the December 1913 signature of President Wilson, who folded like a chair to a committee of powerful bankers.

In fact, Wilson later described the day he signed “the Fed” into law as not only the darkest day of his life, but in the entire history of the United States. Now that’s hardly an auspicious opening day.

But the feckless Wilson was not the only national leader to have misgivings about the notion of an independent cache of Fed “governors” centrally managing the price and supply of our now fiat currency and bloated securities market.

Over a century prior, Thomas Jefferson said the idea of a central bank controlling the supply and price of our currency scared him more than the prospect of a foreign army on our shores…

Not long after Jefferson, a more blunt-spoken Andrew Jackson described the very notion of such a central bank as the “prostitution of our government for the advancement of the few at the expense of the many.” Truer words were never spoken…

In short, I’m not the only one bothered (sickened) about the Fed. And once we trace the recent trajectory of its Main-Street-crushing policies in the 32 years since Alan Greenspan took the reins of this Wall-Street-concocted punch bowl, you’ll likely be a bit concerned as well. The Fed is little more than a monster cloaked in white marble.

Monster? How can that be?

After all, the Fed is reported as our savior, a superhero like bastion of brilliant economists, private bankers and highly educated Chairmen/women who bailed America (or at least its bankers) out of the great 2008 crisis. And now, 11 bullish years later, it has skillfully positioned (marketed) itself as able to dial inflation, markets and employment figures up and down as if part of an elaborate and magical thermostat.

Indeed, the markets, the main stream media and the majority of retail investors still believe the Fed “has their back” and that a new, post-08 era of stability and seemingly recession-free, debt-be-damned fantasy is here to stay.

The Blunt Truth

I, of course, disagree. And I mean totally disagree. As we’ll see below, the Fed of Greenspan and its subsequent chairpersons has done irreparable harm to our real economy while dishing out steroids to Wall Street at pace that would make Lance Armstrong blush.

Despite the mathematical myths behind the so called “full employment miracle” (based upon a scale that considers part-time burger flippers as breadwinners while ignoring the tens of millions who’ve dropped out the labor pool) and “inflation stability” for which the Fed has falsely taken credit, we need to face hard truths.

In fact, the harder data confirms we are far from “peak employment” and that the CPI—our official scale for measuring cost inflation—is as fake as a Getty Kouroi. (Our CPI scale reminds me of a fat-camp where the more pizza and beer you drink, the lower the weightings are…)

Folks, in a country where our census bureau confirms that 25% of the population lives below the poverty line and where more than half our children under the age of 18 live in Welfare-assisted households, I’d hardly call that a booming economy or surging Main Street.

I mean, let’s do the math and talk facts, not hype. According to the Social Security Administration, 50% of all American workers made less than $30,500 dollars last year. As for inflation, since Greenspan, college tuition is up 197%, childcare is up 122%, medical care is up 105% and housing and food expenses are up by 61% and 64% respectively.

Yet despite these empirical, objective facts, the Fed is telling us—you and me—that the average rate of inflation is 2% per year. In short, the Fed is doing a little “fudging of the numbers” to make fiction trump reality.

Making Bubbles While Blowing Smoke

Meanwhile, our stock market has, of course, been ripping up and to the right ever since Greenspan (and then Bernanke and Yellen in tow) agreed to give a post-08 Wall Street $3.5T in money printed out of thin air under the guise of “accommodation”—i.e. “Tarp,” “QE1-3” and “Operation Twist/ed.”

In addition to bailing out the very banks that gave us the Great Recession of 2008, that same Fed has been suppressing short-term interest rates to the zero bound (“ZIRP”) for years, thereby encouraging Wall Street to borrow on the cheap, unleashing the greatest debt spree in our nation’s history, with combined private, business and corporate debt now at $70T (!).

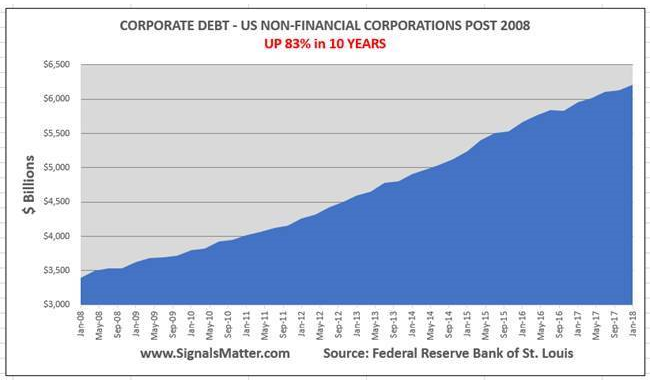

Of course, when there’s lots of cheap, low-rate debt, we see a corporate credit bubble like this:

This causes companies to borrow and buy back stocks at unprecedented levels which is an un-natural (fowl-scented) tailwind that causes the stock markets to climb.

Wall Street, of course loves a party, especially one paid for by its rich Uncle Fed using a credit card paid by tax-payers. Unfortunately, most hard-working Americans don’t work for banks and hedge funds, which might explain why the bottom 50% of American households are sinking, and the top 1% are rising.

The Fed Doesn’t Have Your Back

Meanwhile, the same Fed that tells us we have 2% inflation while our actual living costs are rising by double and triple digits, is continuing to blow smoke, telling us they have “our back.” But whose back does the Fed really have?

As a guy reared on Wall Street, let me tell you a little secret: it’s not Main Street. In fact, whenever Wall Street has a sniffle, cough or a flu, only then will you see the Fed get really busy, because the Fed, born out a Wall Street beach club, serves only one master.

A Recent, Sordid History of the Wall Street Fed

In October of 1987, when the stock market flash crash of Black Monday sent the stock index and futures pits down 29% –double the 13% declines on the worst day of the 1929 Crash—ol Mr. Greenspan got to work.

That is, rather than allow a painful correction (i.e. a natural market hangover) to teach Wall Street a lesson about derivatives, leverage and other landmines dotting the S&P markets and futures pits, Greenspan came in with buckets of un-natural cheap money (slashing short-term rates) and thus destroyed any chance for the cleansing, tough-love of naturally correcting markets.

This pattern of Wall Street “accommodation” only got worse, not better. Just take the example of the 1998 collapse of Long Term Capital Management (LTCM)—a hedge fund leveraging over $125B (yes, $125B) at the height of its drunken splendor.

In 1998, when the Russian default sent the S&P down 12% and LTCM to the hedge-fund grave yard, this was an acceptable pullback rather than grounds for a “Fed-to-the-rescue” panic.

Nevertheless, the Fed, fearing that the loss of one bad mega-hedge fund was too much for natural markets to handle, intervened and did what its spoiled nephews on Wall Street had grown to expect: they once again cut the Fed Funds rate and bailed out Wall Street with more cheap/easy debt.

That cheap, easy debt, compliments of Mr. Greenspan, then became the next tailwind for the colossal dot.com speculation of the late 1990’s, a bubble which saw the NASDAQ trading at 100X earnings at its March 2000 peak.

And by this point, a fairly clear pattern was formed. Easy Fed-supplied (“engineered”) leverage (low-rate credit policies) lead to peak market valuations and hence asset bubble creation followed by asset bubble implosion.

The dot.com champagne party of the 1990’s, like its predecessor in the dapper 1920’s, ended in ruins, with the S&P down 45% and the wild-child NASDAQ off 80% by 2003.

But, no worries, as Greenspan had a plan for Wall Street. Solution? Cut rates even more and create yet another asset bubble. That is, solve a debt crisis with more debt. Enter the era of Fannie Mae, Freddy Mac, sub-prime debt, a massive stock rise and then, alas, The Big Short…

As for 2008, all of us remember it well. By the year’s close, $5 trillion of stock value had disappeared… By 2008, the Fed supported markets had also invented even more complex and pernicious tools of leverage and speculation –namely an unregulated derivatives market, which gives entirely new meaning to the expression “form over substance” as veritable leverage monsters which Warren Buffet aptly described as “weapons of mass destruction.”

Today, the notional value of these derivative instruments exceeds 9X global GDP. That number alone is simply astounding. Staggering. It is the off-balance-sheet Ebola market virus no one wishes to discuss or consider. The implications of such leverage cannot be stressed enough, and yet 9 out of 10 market professionals aren’t even aware of the statistic or able to explain what it means.

Bernanke to the Rescue?

As for 2008 and the Fed, by the time Wall Street was looking into its own market rubble, a new Chairman, Ben Bernanke, came to town, and like Greenspan, Wall Street was more than happy to see him.

The Bernanke Fed (taking its cue from a Treasury Secretary who once led Goldman Sachs) chose the less free-marketed and hence less natural approach to the 2008 debt crisis. Rather than throw a rose on the graves of busted banks, Bernanke opted to bail them out, thus giving new life to the very foxes who had just raided the Wall Street henhouse.

In many ways, Bernanke’s reaction to the popping 2008 bubble was the darkest period of American free markets, which were –and remain to this day– un-free and guided by a centralized rather than free market that consistently fails to accept the pattern of the Fed’s glaring mis-management, i.e.: 1) creating market bubbles doesn’t create GDP growth for Main Street and 2) that preventing free markets from punishing Wall Street debt parties merely encourages more speculation, more dangerous schemes and thus more disastrous consequences.

Standing in the wreckage of the popped bubble of 2008, Uncle Bernanke responded once again to his spoiled nephews on Wall Street with more money, this time much, much, much more money.

Bernanke, and then Aunt Yellen, expanded/quintupled the Fed’s balance sheet by 5X, printing more money in the span of six years than in the entire history of our nation and setting interest rates to near zero.

The fancy lads call this “Quantitative Easing.” Blunt speakers call this “faking it.”

Net result? We are currently staring down the barrel of the biggest market bubble in the history of capital markets. I mean look at this market—does it look like a bubble to you?

Fed Double-Speak

But, as usual, the Fed tells us not to worry. According to them, there’s no trouble ahead. Keep in mind, however, that the Fed’s record for transparency is a bit thin, and their record for forecasting recessions is a literally 0-for-9. Read that again.

I for one haven’t forgotten Bernanke’s famous declaration in 2007, for example, that the real estate crisis was “contained.” He said this just one year before that very same market imploded. In the spring of 2018, Yellen then arrogantly declared: “You will never see another financial crisis in your lifetime.” Yet by the Fall of that very same year she announced: “I do worry that we could have another financial crisis. ″

As for the new Fed Sheriff in town, Jerome Powell, his words and skills (like his rate policies) flip and flop in typical Fed fashion, like a fish on the dock.

He recently boasted that: “There’s no reason to think this (bullish) cycle can’t continue for quite some time, effectively indefinitely.” Yet that same Powell said elsewhere, “The US is on an unsustainable fiscal path; there’s no hiding from it.”

Folks, let me be blunt. Don’t trust the Fed to have your back or steer our economy and Main Street toward a safe future with candor and courage. The Fed serves the markets, not your back. In the same way the Fed was born, so too shall it end and be remembered: badly.

What’s Ahead?

And sure, these markets have been surging in early February, lead by the Powell Two-Step and over-valued stocks like the FANGs whose real fangs will only come out when they drop in price like rocks. But for now, the party slowly limps on. That’s what decades of cheap debt handed down by the Fed can do—buy (borrow) a market party.

But here’s another little secret that Washington and the Fed won’t tell you: The bond market, and not the Fed, ultimately determines interest rates, and when rising rates (i.e. bond sell-offs) collide with our $70T debt bubble, Powell’s headline-making decisions regarding 25-bip rate moves won’t mean squat.

In short, there’s nothing natural about this monster…And when rising rates meet our historically unprecedented and unsustainable debt bubble, the party is over. Full stop. What’s most tragic and unfair, however, is that the looming hangover that will hit an innocent Main Street will be equally unprecedented. The monster will fall from grace, but it will take Main Street with it.