This week, the bipolar Fed proved it can be a hawk and a dove at the same time as the US slides into a recession on the heels of inflation.

That is, the Fed raised the Fed Funds Rate by 75 bps to the 2.25-2.50 level in one breath, while in the next breath confessed that “softening growth” (i.e., tanking GDP and a recession) might mean a future of less aggressive rate hikes—which is just “Fed speak” for signaling a pivot from tightening to easing.

In other words, and once again: Bad news (a looming recession) is good news (more Fed “accommodation” for an otherwise Frankenstein market.

Markets, already grotesquely over-valued and bouncing week to week like a fish on the dock, instantly rallied despite the reality of inflation, rising rates, the pain of recession and the weight of historically unpayable debt.

How is such madness possible?

It’s simple, the markets follow the Fed, which means the blind are leading the blind.

In addition to blind (desperate) policy talk, we are seeing rapid changes in the currency markets, the gold market and the rates market, all forces which impact portfolios, and all forces which will be profoundly influenced by the recession off our bow.

Gold Signals

Many are asking about the gold price.

Toward this end, cold data in the face of historical facts and current recessionary realities will make gold’s rise easier to grasp.

Let’s start with the cold data, which centers around officially reported real rates and relative USD dollar strength, two current and key headwinds to gold’s rise.

Cold Data Point 1: Real Rates

As we’ve written previously, there is a clear inverse relationship (95% correlation) to real (inflation-adjusted) rates and the gold price.

Stated simply, when inflation outpaces the yield on the 10 UST, the net result is a negative real rate environment. Conversely, when rates (as defined by the yield on the 10Y UST) are above inflation, we have positive real rates.

Gold, as a real asset that produces no yields or dividends, shines brightest when real yields/rates are negative.

After all, when bonds produce negative returns, investors look more favorably toward real assets like precious metals.

Today, one would think that soaring Year-over-Year (YoY) inflation in the U.S. at 9.1% (and closer to 18% using the more honest 1980’s CPI scale) against a 2.89% nominal yield on the 10Y UST would seem to be a screaming indicator of negative real rates and thus a profound tailwind for gold, right?

And as to inflation, we said over a year ago it would skyrocket while Powell promised it was “transitory.”

After all, when a nation expands its money supply by 40% in a two-year period prior to COVID and Putin, one can’t just blame inflation (or a later Fed Balance Sheet expansion from $4.2T to $8.7T) on a virus or Russian bully.

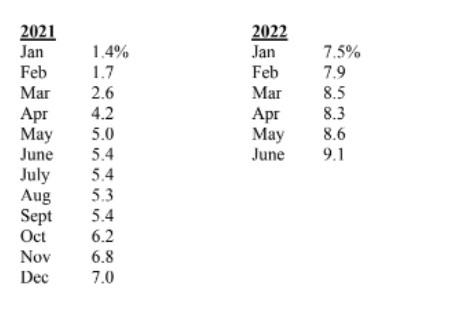

Based on these cold facts and the subsequent (and monthly YoY) CPI figures, who was more candid (and accurate) about transitory inflation? See a trend?

Getting back to real rates, a 2.9% nominal yield minus the above 9.1% inflation rate = negative 6.21% real yields.

Easy-peasy and good for gold’s rise, right?

Well, nothing is that simple in our new central bank normal…

Fudged Math

Whether you believe in central banks or “official” inflation data (and we certainly do not), this doesn’t change the equally cold fact that central banks (or central controllers) are nevertheless always right, even when they are empirically wrong.

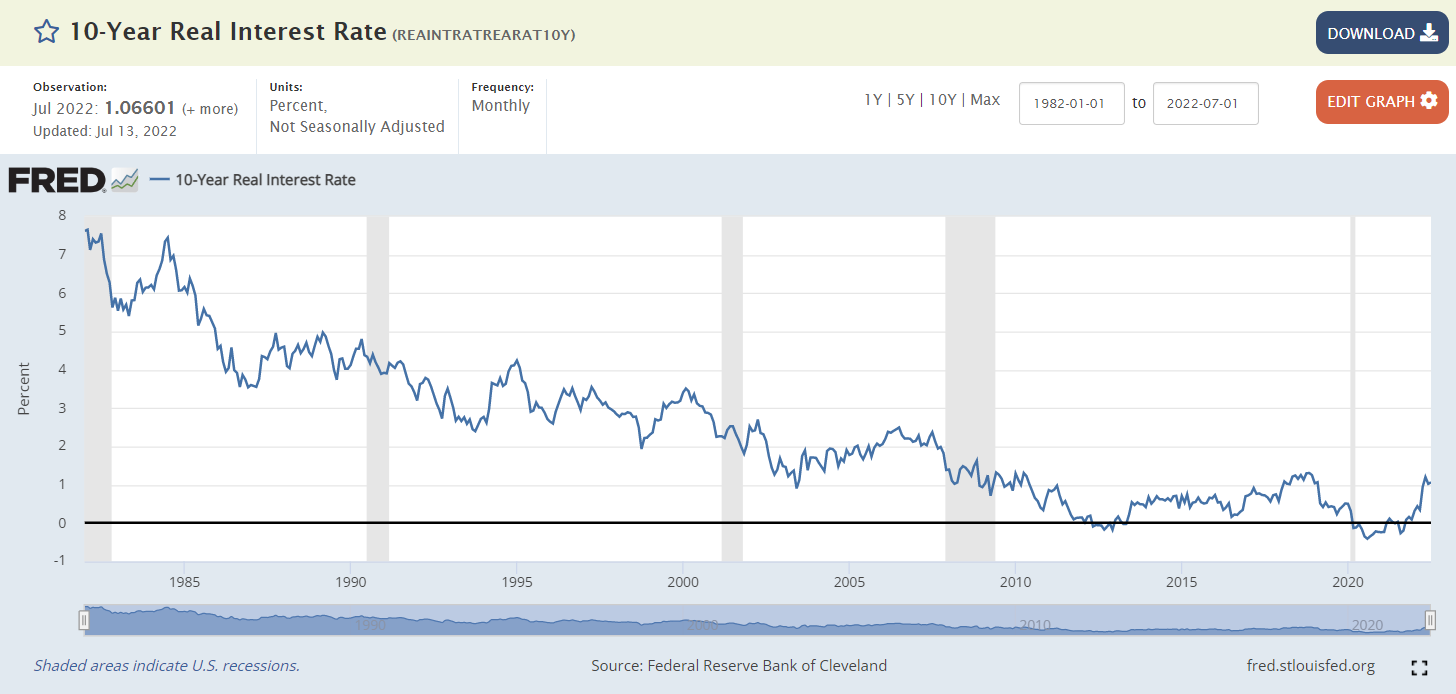

According to the Fed, for example, the Real Rate on the US 10Y UST is +1.06%.

See for yourself.

Huh?

How does a negative 6% become a positive 1%?

Short answer: Clever Fed math (mixed with deflationary expectations priced into the duration of the bond).

Huh?

As indicated in many prior reports, the Fed, much like Al Capone’s accountants, are masters at manipulating, downplaying, obfuscating or just flat-out non-reporting embarrassing facts, including severe inflation realities, to create fictional calm.

Thus, when publicly charting otherwise embarrassing real rate data, they employ a spiders-web of clever math and proprietary models to come up with a downplayed inflation rate against which they measure nominal rates to derive a fictional “inflation-adjusted” real rate.

In other words, they fudge the numbers.

In the example above, rather than using the otherwise simple 9.1% YoY inflation rate, the Federal Reserve Bank of Cleveland offers us an official mash of “expectations”, “risk premiums,” “real risk premiums,” the “real interest rate,” as well as a “model” that mixes “data, inflation swaps” and even “surveys” just to avoid stating what is already abundantly clear: Real rates today are -6.21 not +1.06.

In essence, the foregoing Fed math hides the blunt reality of current inflation by saying they foresee deflation ahead over the duration of the 10Y UST.

And as we discuss below, they may ironically be correct but for all the wrong reasons…

For now, and given the “official facts” as presented by the never-wrong Fed, current real rates on the 10Y UST are often mis-presented as slightly positive rather than honestly reported as deeply negative.

And as stated above, this fiction has been a clear, deliberate (and temporary) headwind for gold’s rise.

Cold Data Point No 2: Rising (but Short-Lived) U.S. Dollar Strength

The USD, of course, has been rising at astronomical levels (7% in Q2), and this too is often a headwind to gold’s rise, as a rising dollar appears/appeals to many investors (foreign and domestic) as a safer haven than precious metals.

In fact, a rising USD and rising rate environment was immediately (and predictably) bad for just about every asset class, though far less so for gold’s rise. There were few places to hide.

Percentage declines across asset classes for 1H 2022 proved this point:

NASDAQ 100 Down 29.3%

S&P 500 Down 20.0%

Emerging Markets Down 17.2%

US Govt Bonds (TLT) Down 21.9%

Real Estate (XLRE) Down 20.1%

HY Bonds (HYG) Down 13.8%

Muni Bonds (MUB) Down 7.8%

Gold Bullion Down 1.2%

We’ve explained this dollar rise in prior reports as a desperate yet explicable attempt by Yellen and Powell (and Biden and Summers) to attract foreign inflows into U.S. markets wherein the USD is seen as a relatively superior “safe haven” when compared against other global currencies, like the Euro, whose debt levels (and non-reserve currency status) can’t endure equally hawkish rate hikes.

That is, by pursuing deliberate and well-telegraphed rate hikes (50 bps in May, 75 bps in June and potentially more to come in July), the Fed, for now, has made the USD the best currency horse in the international fiat glue factory.

This deliberate policy to make the USD stronger is a temporary tool to “fight” inflation, as it reduces the cost of import prices within the U.S.

A German toaster, after all, costs less when the USD reaches parity with the Euro.

But a stronger USD also strangles U.S. export competitivity and adds to increased U.S. trade deficits longer term, which is one (but not the main) reason the strong USD policy will be short-lived (see below).

Why short-lived?

Because as indicated above, historical facts and current realities all converge toward a recessionary landscape in which weaker currencies and lower rates are the only path forward.

What makes us think so?

The Historical Facts and Cold Math of Recessions

Despite the post-2008 Fed’s valiant yet vain (really vain) attempts to convince the world that recessions have been made extinct by mouse-click monetary policies, the simple yet common-sense reality is that recessions have not been outlawed (but merely postponed) by such fantasy fiat dollars.

Deep down, we all know this, even the market bulls: You can’t solve a debt crisis with more debt paid for with money created by a computer rather than GDP.

The other simple yet common-sense and historical reality is that no recession (not one, not ever) can be defeated in a backdrop of high rates and a strong currency, the very policies which the US is currently and temporarily pursuing.

Despite the fatal hubris and immense power of the Fed, the U.S. will be no exception to these recessionary realities and consequent policy shifts.

The markets (from the NASDAQ to Muni-bonds) can’t afford rising rates and will continue to fall as Powell pretends to be a rate-hiking Volcker despite forgetting that Volcker was facing a 30% debt to GDP in 1980, not 125% ratios in 2022.

Powell may want to believe he’s a Volcker, and I’d like to ride a horse like Adolfo Cambiaso or throw a fast ball like Nolan Ryan, but it ain’t gonna happen.

In short: Powell will pivot as the grotesquely over-heated bubble markets the Fed created start tanking further.

In fact, we’d contend that this week’s FOMC meeting was an early sign of precisely such a dovish pivot, as discussed above.

Tech stocks are and were uniquely poised for further pain…

But as the Fed talks more dovish, over-heated tech stocks saw a rally.

Like the Q1-Q4 2018 rate-hikes to the predictable 2018 Q4 market beat-down (and hence 2019 pivot), the Fed soon be pivoting from talking dovish to acting dovish, which means they will reduce rates and the USD will weaken in a QT to QE pivot once the recession off (or already under) our bow slams into our debt-soaked and sinking Titanic economy and markets.

Current Realities: Recession Ahead (or Already Here?)

Recessions become official (and lagging) once the number-crunchers (i.e., fiction writers) in DC officially tell us so, namely, once they report 2 consecutive quarters of negative GDP (i.e., too late for most retail investors who still trust the Fed).

Thankfully, there’s no need to hold our breath. Despite already feeling like we are in a recession, the Atlanta Fed GDPNow data has confirmed a negative Q1 GDP (-1.5) and foreshadowed a 0 to negative Q2 GDP.

In short, we are already in recession despite comical attempts by the central bankers and political leaders to re-define the definition of “recession” with as much dishonesty as they report the real nature of inflation.

As for our current recession, this neither bothers nor surprises the Fed. After all, the same bankers who built the inflationary bubble have triggered the deflationary recession that now follows.

Stated more simply, and when it comes to market bubbles, the Fed giveth and the Fed taketh away.

The Fed’s Real Anti-Inflation Weapon: A Deflationary Recession

Despite pretending to fight inflation with rising rates, the Fed knows its nervous rate hikes (be they at 50, 75 or even a 100 bps) won’t defeat current inflation, which is considerably much higher than officially reported. (See above).

Negative rather than positive real rates are already (albeit unofficially) in play to deliberately “inflate away” some of Uncle Sam’s embarrassing debt.

By lying about (i.e., “fudging”) the inflation data, the Fed therefore gets to have its cake and eat it too; namely it can privately exploit extreme inflation while publicly pretending/reporting it lower than it actually is, even at these embarrassing levels.

(Of course, another way to calm inflation fears is to intentionally repress the paper price of gold on the COMEX, of which we’ve written extensively.)

Yet looking ahead, the historically most accurate tool for fighting inflation (and crushing Main Street), of course, is a recession, wherein economic growth and consumer demand weakens and hence prices (and inflation) fall—i.e., deflationary forces.

The Fed knows this too. Nothing fights a Fed-created inflation like a Fed-induced recession. Thanks Mr. Powell.

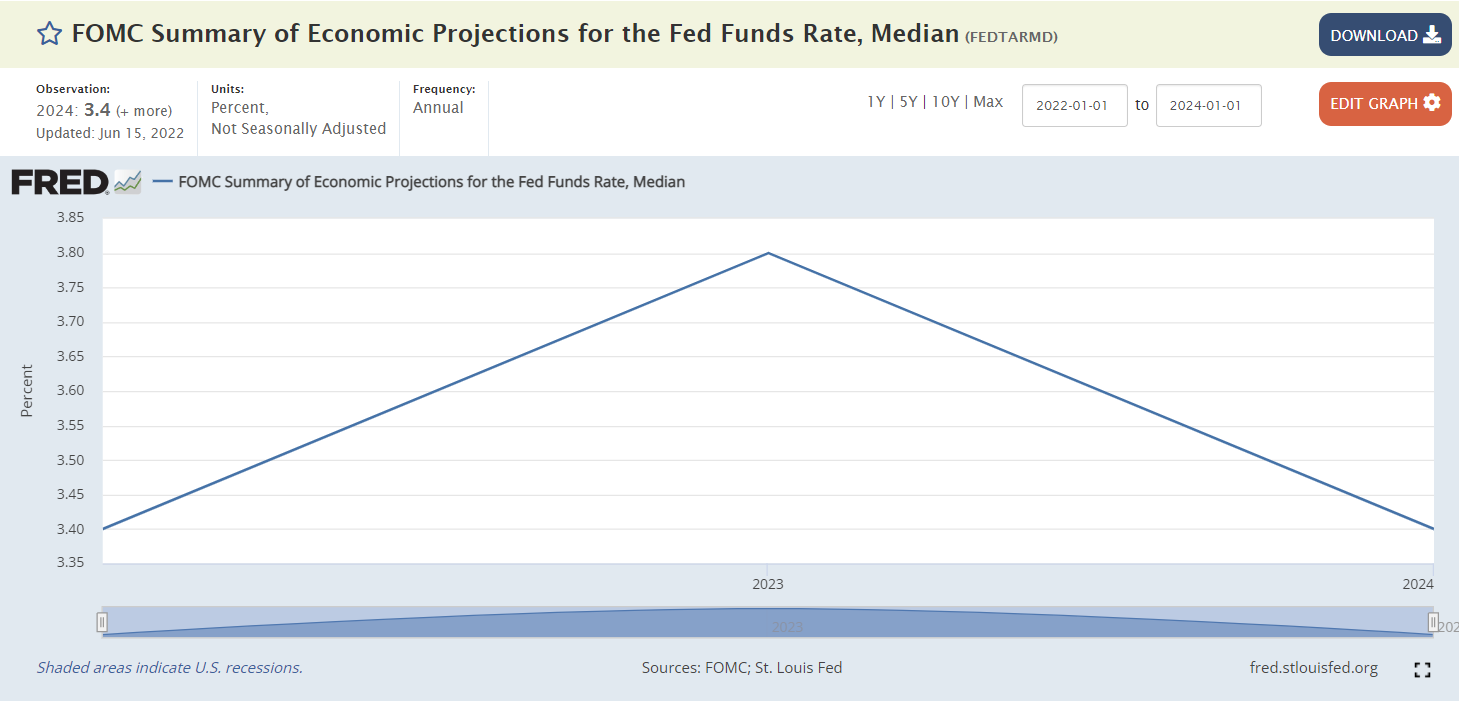

The prior chest-puffing claims by the Fed to send the Fed Funds Rate to a “projected” 3.8% by 2023 is, in my opinion, just another Fed ruse, as nearly all its “projections” have been in the past. The Fed will pivot long before we get to a 3.8% rate norm.

At $30T+ in public debt, Uncle Sam (or Mr. Market) can’t afford such “projections.”

For every 1% rise in rates, the cost of servicing Uncle Sam’s bar tab rises by $27 million per day.

And WHEN not IF the recession hits the U.S., the Fed knows all too well that there is no way out of that dis-inflationary (and long-term) recession other than lower rates and a weaker USD—all good for gold’s rise.

As Ronni Stöferle recently observed: “The current cycle of interest rate hikes could go down in history as the shortest and weakest in recent decades.”

Why?

Because, 1) economic activity and growth is slowing (and has been for years), 2) indebted nations can’t afford meaningfully higher rate hikes, 3) inflationary debt relief is counter-acted by increased government spending, and 4) markets are already pricing-in inevitable rate cuts.

The Return of the Money Printers—Just a Recession Away

And what’s the best method to 1) cap or cut rates (as Japan’s current YCC confirms), 2) weaken the currency and 3) spur “growth” in a recession?

Easy: A money printer to artificially suppress bond yields and weaken (debase) the currency.

Again, this means the inevitable pivot from current hawkish tightening to future dovish easing is just a recession away.

For now, and as stated elsewhere, the Fed’s (and Canada’s) hawkish rate hikes today have been engineered not to fight inflation, but simply to have room to cut rates tomorrow when the recession our central banks have been postponing with mouse-click dollars comes painfully home to roost.

Gold Price Reaction, Gold’s Rise

This inevitable shift from a rising dollar and rising rate setting to a falling dollar and repressed (but still negative) rate reality in a recession will be an extreme catalyst for gold’s rise, now currently and intentionally suppressed by: 1) an openly-rigged COMEX market, 2) a dishonest “anti-inflationary rate hike policy and 3) a short-term strong dollar policy to fight mis-reported (i.e., much higher) inflation.

There’s More to Gold’s Rise than a USD

Furthermore, and as anyone owning gold in currencies other than the USD already knows, gold’s rise has been considerably stronger against currencies who don’t have the bullying power of the USD—namely the power to export inflation or pivot from Hawk to Dove to Hawk because of a world reserve currency status.

The EU and its central bank, for example, are so thoroughly debt-strapped and dependent upon USD-based markets, debts and settlement policies that even an ECB rate hike move from 25 bps to 50 bps has LaGarde shaking in her designer boots.

France, from where I sit, has a total debt to GDP ratio of over 350% and Italy, whose debt and political coalition confusions are no mystery to European citizens, is an early warning sign of future economic and political fracturing in the EU.

Germany, meanwhile, will soon (2023) have to pay the bill for the inflation-adjusted bonds it issued in prior years, the cost of which will be 25% of the nation’s total debt.

And as for Japan and its dying Yen (at 50-year lows and down 24% in dollar terms in the first half of 2022 after decades of mouse-click money madness/QE), this nation is effectively a financial zombie.

Again, these are just cold facts.

Not Even the USD Can Avoid Nature

Despite the slow, very slow process of de-dollarization set in motion by openly failed/backfiring sanctions against an energy-rich Putin, the USD remains uniquely positioned (via its petrodollar, its SWIFT pre-eminence and its post-war reserve currency status) to sin deeper and longer with its centralized money printers, fictional CPI authors and disingenuous rate policies.

But not even the USD and an artificially engineered and controlled market economy can escape the inevitable and natural consequences of over-expansion, over-dilution/debasement and over-indebtedness.

Regardless of how the Fed and other central banks misreport inflation, recessionary realities will make the genuine nature and future of negative real rates a reported reality, which will create an optimal setting for gold’s rise.

As I, Ronni Stöferle and many others have argued for well over a year, the developed economies (which are in fact little more than debt-soaked banana republics on paper) cannot endure (ertragen) the reality of an international debt crisis which would surely follow any prolonged policy of rate hikes into a global debt swamp of over $300T.

Gold owners will benefit most from these inevitable changes and realities, as all currencies and all central banks are running out of tools, options and excuses.

As in hockey, polo or asset prices, the best players look to where the puck or ball is headed, not where it currently sits.

The forces discussed above (recessionary, rate and currency) collectively, historically, empirically and common-sensically point toward new highs for gold, whose bull market, which began to stretch its legs after the 2016 bottom of $1050, has yet to sprint ahead.

But gold will sprint fast and higher north, even if it does not feel like it today.

Market Volatility

As for risk assets, the markets are as confused and bi-polar as the central bank which sadly, is now the unofficial yet real “market maker.”

More investors are seeing the sickness of inflation, recession and Fed confusion. Despite rallies and dips, investors are losing confidence in the economy and markets at record levels.

Such confusion mixed with lowering faith leads to extreme market volatility which demands far more attention than blind faith in risk parity portfolios or traditional stock and bond allocations.

The broader US economy in general and the US markets in particular are walking toward a road of genuine disorder which neither the White House nor the Fed are fully equipped to solve nor blunt enough to confess.

That’s why we are here to help investors through the worst macro setting we have seen in our combined careers.

Signals Matter’s Blogs & Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly by Signing Up Here. Signals Matter’s Portfolio Solutions Made Simple are geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here.