Current recession denial requires a shift to recession preparation.

Once again, the US is facing a recession which Main Street feels, Wall Street whistles past, and DC simply denies.

Below, we look at these recessionary forces and delusional policy makers in the context of blunt-speak rather than Fed-speak so that we can best prepare for what’s already felt but rarely spoken from on high.

De-Coding the Latest Fed-Speak: Hawks, Doves or Both?

As expected, and as already priced-in by the markets, the Fed raised the Fed Funds Rate (FFR) last week by 75 bps in what superficially appeared to be a hawkish assault on inflation but what in reality was nothing more than another monetary bluff.

Alas, there’s far more hidden dove than public hawk emanating from Wednesday’s latest Fed “guidance.”

As we’ve consistently argued, the Fed has wanted to exploit (rather than defeat) inflation as a classic means of secretly “inflating away” chunks of its embarrassing debt pile while publicly pretending to “combat” inflation with anemic (6.75% y/y) rate hikes (and a 2.50% FFR) which will never catch up with (and therefore never defeat) current inflation rates above the 9% level.

Everyone, including Powell, knows that Uncle Sam can’t afford rising rates or a perpetually strong USD.

So why the public ruse to “fight” 9% inflation” with a 2.5% FFR?

Simple: The Fed, unlike Biden’s press secretary and political advisors, sees a recession coming and needs to raise rates today so they’ll have something—anything—to cut tomorrow.

Dovish Pivot Translated

Thus, and as consistently argued, the Fed’s hawkish July chest-puffing will eventually (i.e., when the recession becomes official and something breaks in the market and economy) lead to some dovish two-stepping.

Toward this end, Powell has effectively telegraphed a future rate hike pause by using the magic words “depending on the data.”

In short, we believe the Fed is looking for an eventual excuse to print more dollars and cap more yields/rates with more inflationary mouse-click magic money and hence more Main Street pain—all very bad for a debased yet relatively strong USD and all very good for real monetary metals like gold.

Stated simply, we feel last Wednesday was the first sign/hint of an inevitable Fed pivot from rising rates to pausing rates, and then eventually, falling (YCC) rates and a falling dollar.

Inevitable, however, does not mean immediate.

We’ll know more at the end of August when Powell scoots off to Jackson Hole as the rest of the US sinks deeper into a recessionary hole.

Recession Translated

And what’s the new excuse for the inevitable pivot to more artificial “accommodation” (i.e., QE) rather than the current and fake “inflation fighting” QT?

Powell described it in Fed-speak as “watching for a slowdown in economic activity.”

Translated into honest-speak, this just means that Powell’s narrative will be shifting from inflation semantics to recession realities, despite every current effort made from DC to deny a recession.

I’m always impressed by the Fed’s ability to pervert English, math and honesty in the name of fantasy, calm and policy.

As we’ve shown elsewhere with blunt math rather than sensational drama, the Fed, and its minions at the BLS, have literally invented a magical calculator which makes 2+2=1 on everything from CPI inflation, the M3 money supply, employment data and earnings reports to the current metrics used to falsely present negative real rates into publicly positive real rates.

With so much dishonesty from (and hence distrust of) the policy makers, it thus comes as no surprise that even the definition of a recession is now being perverted to supplant reality with fantasy and thus keep the masses comfortably numb from the consequences of the Fed’s increasingly failed monetary policies—namely a Fed-engineered recession to deflate Fed-made inflation.

But can any of us remember the last time a central banker stood up and confessed: “Boy, we really screwed that up, got that wrong, and are now facing years of self-inflicted stagflation; sorry about that”?

Or can any of us imagine a central banker saying: “OK, we’ve been lying to you for years about true inflation levels, which we actually need to pay down the debts we’ve helped create and which we will now use a recession to quell. Sorry about that.”

A Lesson in Recessionary Realism

Luckily, we’re not interested in the Faustian bargain required to work in DC, so we can all enjoy some honest math and cold data when it comes to discussing recessions.

As most already know, two consecutive quarters of declining real GDP are how recessions are defined and have been defined for years.

Powell, Yellen and Biden’s press secretary, however, will nevertheless assert that the real definition of a recession is suddenly not as simple as that. Toward that end, they keep reminding us that the labor markets are strong and getting stronger.

Hmmm.

Ok. So how about if we add the following facts (and leading indicators) to help our financial leadership in DC confess that a recession is precisely where we are headed and frankly already standing.

Toward this end, let’s share a few data points they might have overlooked when backpedaling on the “recession” question, namely:

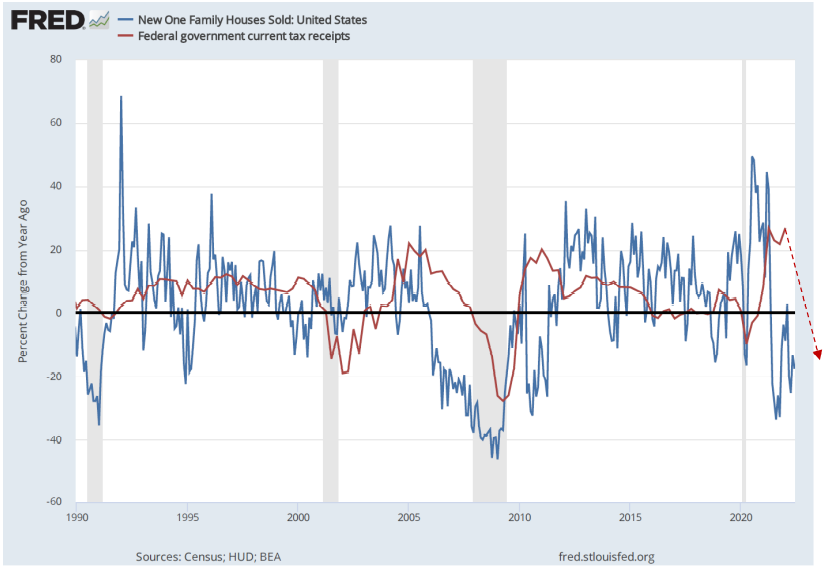

- U.S. New Home Inventories are at the highest levels since 2018 and pending homes sales (reeling under the weight of rising mortgage rates) fell y/y by 20% in June.

- Housing data is directly linked to tax receipt data. That is, both fall together, and as tax receipt income falls, this too is a recessionary indicator, as falling US tax receipts are equally correlated to falling US stock prices.

- Advertising spending is falling at places like Amazon, while inventories at places like Walmart are rising as their profits are falling, including names like Target whose stock price tanked by 24% on Q1 earnings misfires; and…

- Hawkish rate hikes and a strengthening USD are a poison to the earnings flows of such enterprises already in debt up to their ears after years of “free debt” expansion in the backdrop of repressed rates and post-08 unlimited money printing.

By the way, such ad-spend cuts, falling earnings, tanking profits, and new-hire slowdowns seen across the US at retailers like Walmart, Target and Amazon are typical and leading recessionary indicators which often precede/portend future labor layoffs—i.e., labor pains not growth.

- Consumer confidence among even the higher-income US population is sinking fast:

- Rising rates and the strong USD policy pursued by Yellen and Powell has made the cost of US entitlements (i.e., health, social security etc.) painfully worse and ultimately unsustainable.

When Yellen was drunk-driving as Fed Chair, for example, those entitlements were 54% of US tax receipts in 2015; today, as spending increases and inflationary 10% “cost of living adjustments” (COLA) are honestly applied, annual US entitlement payments will very soon reach 90% of US tax receipts.

In short, the current and “hawkish” rising-rate-strong-USD policy at the Eccles building will bankrupt the federal government unless an unavoidable pivot is made soon to fill the spending gaps and deficits with more fake fiat money—i.e., more dovish QE.

After all, that needed money is certainly not coming from an anemic GDP, a topping and tanking market and hence declining tax receipts.

- As to Uncle Sam’s embarrassing bar tab, he is facing $23T of outstanding IOU’s, 30% of which are poised to re-price at the end of this year at a higher (6.75%) rather than lower annual rate, which boils down to roughly $460B in additional spending (12% of tax receipts) just to cover those rising interest expenses.

Thus, unless the Fed hits the “QE-Stimulus-Button” very soon, Uncle Sam will be hiding from his creditors behind the Fed and its currently dim “happy hour” sign.

- At the global level, nearly every major “developed economy” is little more than a glorified banana republic mathematically staring down the barrel of a sovereign debt crisis as governmental rates (i.e., the cost of borrowing) are rising at the very same time that economic growth and new export orders are sinking:

Meanwhile the Pravda-Like Denial Continues

Despite each of the foregoing hard facts, US Treasury Secretary Yellen is leading the official DC chorus in a now openly pathetic effort to deny reality in ways reminiscent of the Soviet era circa 1963.

According to Yellen, and after back-to-back quarters of negative GDP growth, “there’s no evidence of a recession now.”

Such words once again confirm how central bankers are little more than word-smith politicians (propagandists?) dressed in banker clothing and broken (free-market) high heels.

Math and hard data are no longer the key focus of our central bankers. Like candor and ethics, they’ve replaced sincere numbers with political nouns and false narratives.

It seems today that along with science, culture, comedy, creativity and history, the very discipline of economics has itself been canceled.

What to Expect?

In such a distorted, desperate and frankly dishonest backdrop of form over substance and false narratives over honest math, what can the rest of us expect from our central planners on high and our real-world experience on the ground?

As we recently argued, the Fed knows it will not beat inflation (which it secretly needs) via rising rates alone.

Instead, Powell will centrally engineer a currently “deniable” recession (which is dis-inflationary) to publicly “combat” otherwise deliberately sought inflation.

Toward this end, these fork-tongued bankers will also pull out their usual tricks and magical calculators to convince the world and markets that officially reported inflation levels are honest (despite being at least 50% under-reported) while simultaneously and deliberately pursuing a policy of negative real rates (i.e., inflation rates above interest rates) as they publicly and dishonesty report them as positive.

So yes, a recession is here, and a longer and deeper one is coming.

The Fed will use words and dishonest math to calm the cognitively dissonant from an abrupt market sell-off or a collective wising up.

As we see it, the Fed can postulate and chest puff a hawkish and rising rate policy for now and perhaps even into the fall.

But unless the Fed in particular, and the major central banks in general, wish to “defeat” inflation by catapulting the world into a global recession whose depth, duration and pain will be extreme, they will have no mathematical nor even political choice but to lower rates, weaken their currencies and fight the recessions within their respective front yards.

As recently argued, no nation, regime nor system in history has conquered a recession by jacking up rates and strengthening their currency.

Given the evidence above, the US is heading straight into a recession and as such will be forced to confront that reality (however downplayed or officially postponed) by cranking out the mouse-click money in a way which will cap yields, debase the dollar and thus be a tailwind for precious metals across the board.

Unless, of course, you think all that data above is fake news and that the Fed has outlawed recessions, in which case all is fine and will always be fine, right?

Defense or Offense?

As the Fed continues a bi-polar toe-dip into hawkish rate hikes and recession-inducing pain, markets still see such bad news as good news, as they expect a sudden QE liquidity infusion to save Wall Street from a recession.

For this reason, markets actually rallied in response to a rate hike!

Unfortunately, the Fed is not a magical Oz, but more like an emperor with less and less clothes and hence less and less options.

That is, it cannot “save the S&P” forever with debased fiat dollars mouse-clicked out of DC without destroying the USD in moves similar to the QE-addicted BoJ and its dying Yen.

Given the extreme ramifications of recessionary forces on cyclical stocks, retail earnings and bond yields, now is the time for defensive rather than offensive portfolio allocations, and active rather than passive investing, all of which we provide subscribers to help navigate the worst macro backdrop we’ve ever witnessed in our collective careers.

Signals Matter’s Blogs & Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly by Signing Up Here. Signals Matter’s Portfolio Solutions Made Simple are geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here.

If you guys run a hedge fund that I could invest in – please let me know

we live in France but my bank and share holdings are in Switzerland

We will soon be launching an SEC registered and actively managed trading service 🙂