Below we look at the idea of “returning to a post-COVID normal” as COVID fatigue sets in.

Hope springs eternal as talk of a much-welcomed COVID vaccine makes headlines alongside record-breaking daily infection and death rates in the U.S.

Stock markets, of course, rarely react to any kind of news, good or bad, but just continue to reach new trending highs, give or take a dip-buying moment here and there.

This is because markets are driven entirely by unlimited liquidity from the central banks and real bond yields (i.e. rates) that are below zero.

Folks, when debt is basically free and money is printed on demand, risk assets in our bloated exchanges would continue to rise even if hostile invaders from outer space landed on Ellis Island.

Thus, I can’t help but smirk as the pundits keep alluding to tech sector miracles and vaccine-driven market rises.

As for the “tech” excuse/attribution for rising markets, I debunked that fantasy headline at length here.

But why let facts ruin a good story?

Now, the bubbleheads in the financial media are even suggesting a “return to a post-COVID normal” once COVID is effectively contained.

Well, we all want COVID to be effectively contained.

But what the heck are these prompt readers talking about when they speak of a “return to post-COVID normal”?

As we’ll see below, there’s nothing at all normal about the financial world today, and there was nothing at all normal about the financial world before COVID.

Let’s dig in…

Those Stubborn Facts

In case you think we just enjoy being bummers and bearish cynics, let’s just stick to facts rather adjectives or labels.

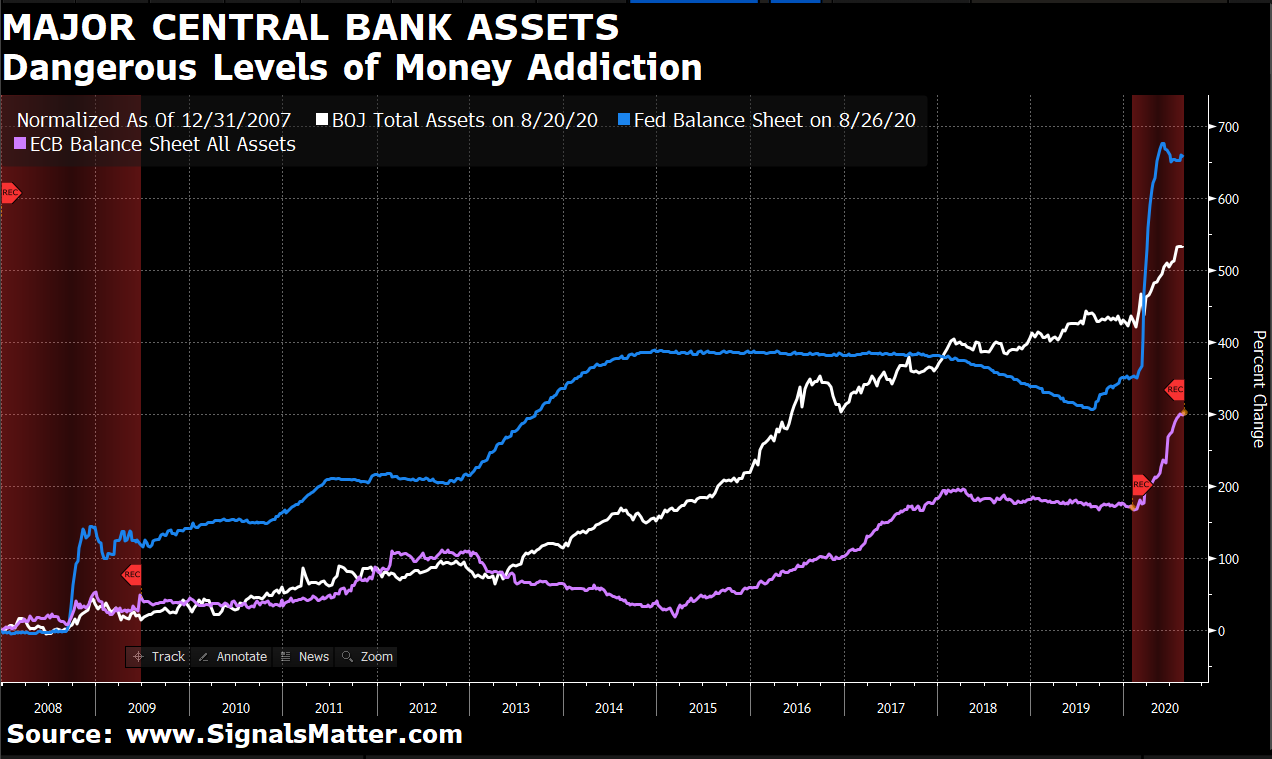

GDP—Abnormal, Then and Now…

Given that healthy nations run on income, productivity and growth, data points like GDP kind of, well…matter.

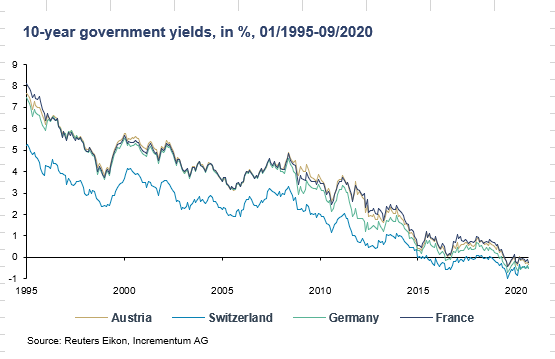

Whether you believe in the fictional GDP data presented by the U.S. Bureau of Labor Statistics or the far more honest measure reached by the SGS scale, we can all agree that U.S. GDP is an abnormal disaster today, and already an embarrassment pre-COVID:

Sovereign Debt—Abnormal Then and Now…

Of Course, when a country can’t produce natural income (i.e. GDP) to pay its way, there’s always debt (i.e. sovereign bonds) to fill in the gap…

Furthermore, if you can’t pay that IOU, what better solution than to print money out of thin air to cover the costs?

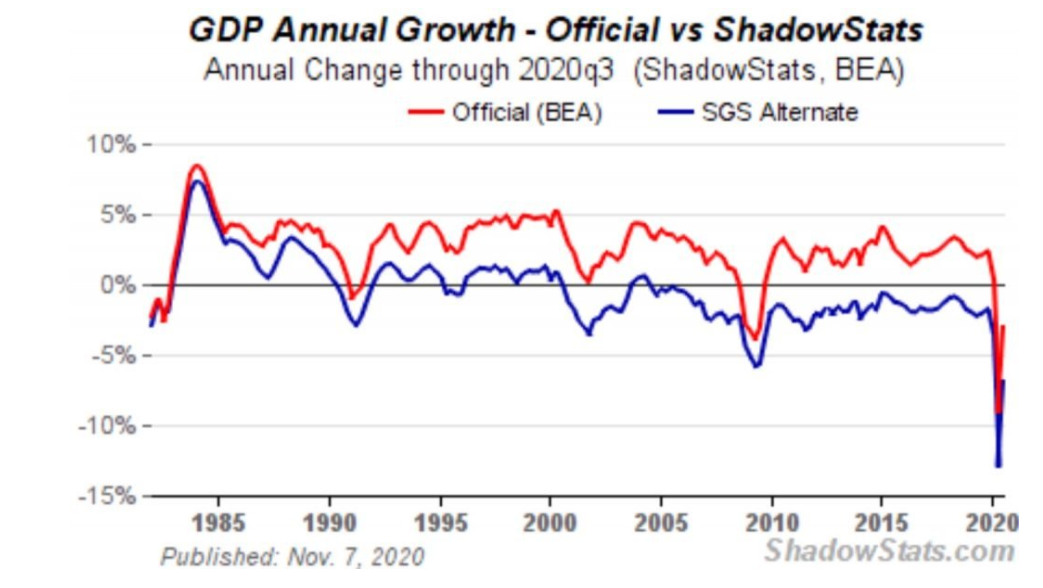

That would explain why 1) US government debt has gone from an horrific $11T in 2009 to even more horrific $28T today, and 2) that the Fed’s balance sheet (i.e. money printer) has gone from $2T to $7.5T in the same time period to pay those debts with magical money.

We expect more of this “abnormal” debt and fiat money creation to continue well into 2021…

Nor is the U.S. alone in its addiction to counterfeit fiat currencies to pay its otherwise unpayable debts, as the following graph of the European, Japanese and U.S. central banks “abnormally” confirms…

Folks, the Fed’s balance sheet (at $830 billion in 2008) has expanded by 8.5X to $7.1 trillion today, including a 90% exponential expansion since September of 2019.

Read that last sentence again. Let that sink in.

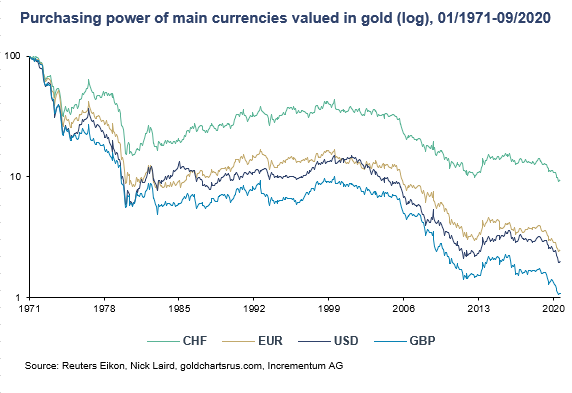

Of course, money printing like that kills currencies, which explains the rise in gold and silver prices, which despite paper-price pullbacks, will continue to trend massively higher in the years to come.

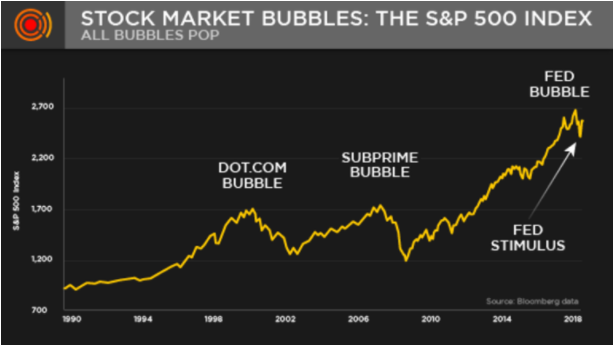

Market Bubbles—Abnormal Then and Now…

Furthermore, we also know what unlimited money printing does to stock prices.

Even pre-COVID the markets were clearly in bubble territory, as just the naked eye can confirm…

But if you thought the Pre-COVID equity bubble was abnormal at the 2700 level, today, as the global economy is in a nosedive, that same bubble is climbing toward 3600…

Seem “normal” to you?

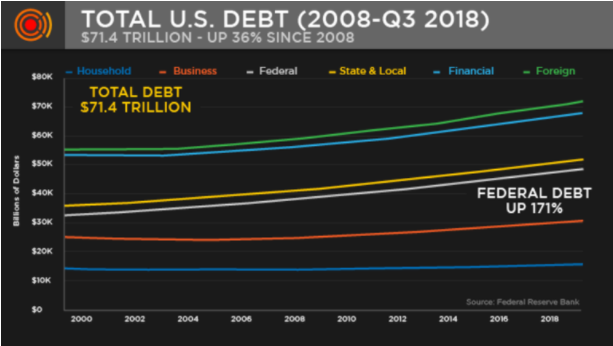

Total U.S. Debt—Abnormal Then and Now…

As the pundits talk about a “return to post-COVID normal,” let me further remind you that well before COVID hit the U.S., our combined government, corporate and household debt levels were at a staggering $71.4 trillion.

As of today, that same combined debt scale has climbed above $80 trillion…

Folks, I simply can’t emphasize enough how dangerous such debt levels are. They are 100% unsustainable, unpayable and cancerous.

And yet, we keep hearing about a “return to post-COVID normal.”

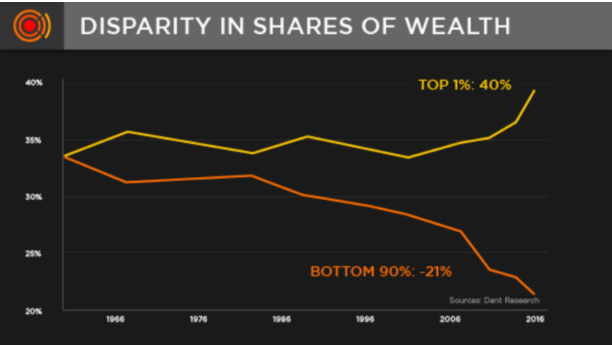

Wealth Disparity—Abnormal Then and Now

Perhaps most disgraceful (and abnormal) of all, is the continuing disconnect between the rich and the poor in the U.S., as one small percentage enjoys risk asset price inflation in the markets, and the vast majority of the rest are unable to pay a $400 emergency or even find a steady income stream today.

Such grotesque wealth disparity, which existed well before COVID and only made worse by COVID, never bodes well for any of us, rich or poor, market savvy or market absent.

The social and political polarization we’ve all seen in 2020 is thus no coincidence nor entirely due to COVID, headline violence, political discord or social justice.

Instead, social unrest historically boils down to financial stress, which was far from “normal” yesterday or today.

Even More Signs of Pre-COVID Abnormal

Let us also remind you that long before COVID, our markets were on the verge of implosion.

Remember that media-ignored little nuclear bomb that went off in the repo markets in September of 2019 and how the Fed tried to brush it off as a little “glitch in the plumbing”?

Well, that little “glitch” required hundreds of billions of weekly Fed “accommodation” to bail out the liquidity-dry money markets, which benefited just about no one on Main Street.

Or what about October of 2019, when the Fed slyly re-introduced QE to the tune of $60 billion a month in printed US dollars to bail out the T-Bill markets?

Remember my little October warning bell (and buy order) here?

So, you see folks, even before the “abnormal” financial pain of COVID, the U.S. financial markets were anything but “normal” and the Fed remains as desperate now as then.

Of course, then as now, the Fed’s primary master was the stock and bond markets, not the real economy, a tradition of rigged, insider support we made all too clear here and here.

In fact, I’ll go one step further and say out loud what everyone in Wall Street already says to themselves: COVID was a boon for Wall Street, as it allowed a secret little “bail-out 2.0” to sneak in behind the humanitarian crisis that COVID created.

In short, any talk of a “return to post-COVID normal” is a comical example of oxymoron-ish irony.

Normal died long ago, as did classic capitalism, which the Fed helped bury.

As for the current stock bubble rising ever-higher on Fed-repressed cheap debt/rates, it too will find a R.I.P. moment the moment that same volcano of debt confronts rising rather than falling rates, as we explained in detail here.

Until then, keep yourselves informed, manage risk not hype and don’t believe a word anyone says about “returning to post-COVID normal.”

And if you need help getting and staying prepared for more of the abnormal to come, take a look at how we do things by clicking here.

Best,

Matt & Tom

Hi Matt and Tom et. al.

I love your research and information. I have one request! Can you not make your charts with black background? I love to print things and it uses too much black ink!

That is my only complaint. Everything else I love!

Thank you

Thanks Bill–we’ll keep this in mind going forward 😉