Below we list a number of fact-confirmed reasons why this market, currently enjoying a bull-run based on central bank support, is ultimately and historically a rigged to fail market.

98 shares

American investors have never experienced such a profitable run…

The bull market in stocks, now in its 11th year, is officially the longest on record. Some shareholders have doubled their money since 2009. This bull market has created more U.S. millionaires than ever before. Households with a net worth exceeding $1 million have increased to 11.8 million in 2018 – that’s more than the population of Greece or Portugal…

There’s just a couple of problems: 1) More than half of all this new wealth is set to vanish in the next recession and 2) only about 14% of the U.S. population has enjoyed this inflated market bubble.

The rest of Main Street America is drowning in debt.

That’s why we’re getting this message out to as many people as possible right now.

Because while the losses could start at any moment (as you’ll see today) or even be postponed for years (DC is capable of pushing deficits and money printing to the limits of reason), you don’t have to go through this all over again – not when you can get and stay prepared.

If you make the moves we’re going to recommend today, you can emerge on the other side even better off than you are right now.

But first, it’s important to understand all seven ways this market is – without a doubt – a rigged to fail market.

- Rigged to Fail Market: Investors Addicted to Stimulus

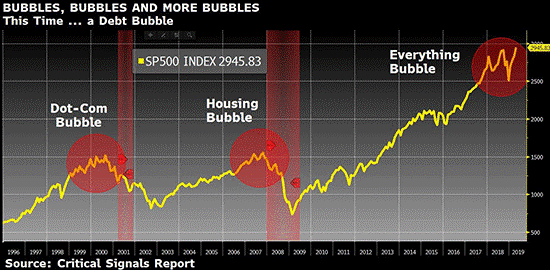

The easiest way to introduce obvious signs of a rigged to fail market is to simply trace the events that brought us into – and then allegedly helped us to “recover” from – the Great Financial Crisis of 2008.

The rapid resolution of the 2008 crisis, which was unleashed by the very banks that the U.S. taxpayers and government later bailed out, was an obvious sign of a system that values banks, the ultra-wealthy, and grossly over-stimulated markets more than economic reality and Main Street fairness.

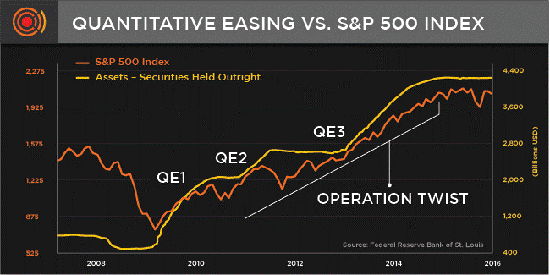

In 2008 and 2009, for example, we saw how the “temporary emergency measure” of QE1 (money printing) and ZIRP (zero interest-rate policy) slowly morphed into years of QE1-4, Operation Twist, and a permanent low-rate “keg party” for Wall Street.

In short, what began as a temporary measure became a chronic, decades-plus addiction; one intentionally rigged to provide cheap money for historically unprecedented debt levels created to support the exploits of a “stimulus”-addicted Wall Street.

The direct correlation between the market’s rise and this artificial “stimulus” (i.e., addiction) is now undeniable.

With this rigged “stimulus” comes all the attendant symptoms and behaviors of “addiction:” insider support, lies, delusions, desperation, and ultimately, death by slow overdose.

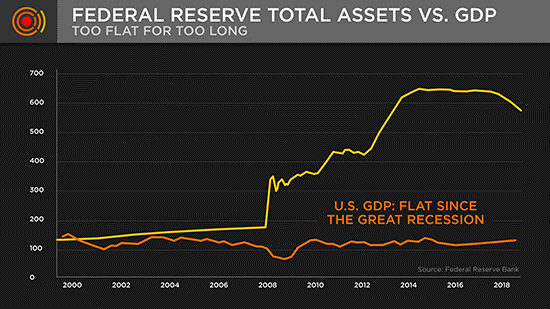

Following the 2008 crisis, the Fed was literally the artificial buyer of greater than 70% of the U.S. Treasury and mortgage-backed bond market. Folks, that’s not a real bond market, but a Fed market…

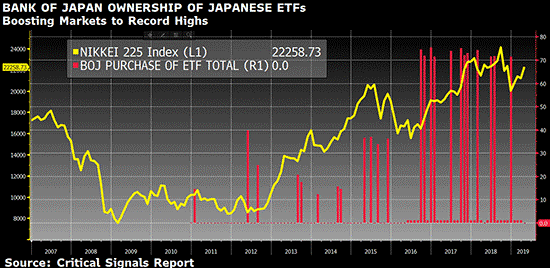

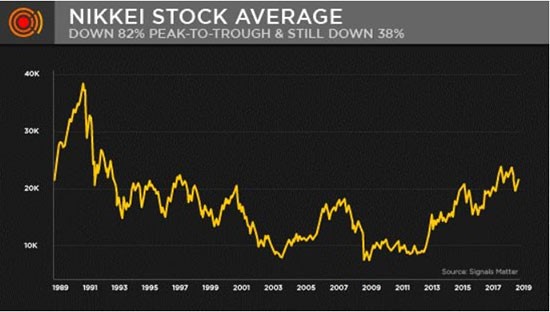

In Japan, its QE/ZIRP drug-pushing central bank still owns over 50% of its entire sovereign bond market and has become the personal lender and shareholder to over a stunning 70% of the country’s publicly traded stocks following record ETF purchases and is now the majority shareholder in over 40% of its listed companies.

No wonder the Nikkei is up by 150% since November 2012.

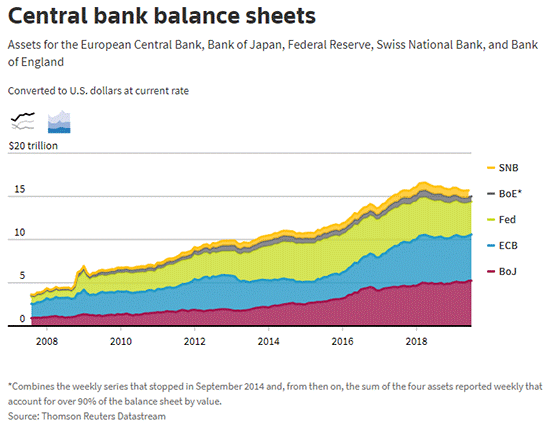

Folks, these are not stock markets, but rather “central bank markets.” Between 1998 and today, the central banks of the WORLD have collectively printed over $21 trillion to scoop up their own (and otherwise unwanted) sovereign and corporate debts.

That’s $21 trillion with a “t.”

Of this $21 trillion, $15 trillion is split equally by JUST three Central Banks – the U.S. Fed, the European Central Bank, and the Bank of Japan – $15 trillion! By loading up on central bank debt to rig their respective stock markets, the Fed, ECB, and BOJ have rigged the central banking system to fail.

And the addiction does not stop there.

As anyone familiar with college frat parties knows, one binge follows another, and the decisions made while wearing beer goggles are rarely intelligent… People do silly things, like ignore common sense and go further and further out on the risk branch to get yield (in junkier bonds) or return (in grossly over-valued/high PE stocks).

But as long as rich uncles, like Uncle Fed, are paying the market’s bar tab (with printed money) or putting it on a national credit card (of suppressed rates), the party (as well as the drunken behavior) continues well past the 2:00 a.m. cutoff.

The Fed’s QE and ZIRP policies/addictions are no different, and they have binged way past the 2010 “emergency measure” deadline – morphing into a full-on debt addiction.

Since 2009, the perverse, 10-plus-year extension of “Fed stimulus” (i.e., free-market beer) caused markets to become fully dependent upon cheap debt and free money.

This rigged “keg party” has lasted so long that companies, governments, and individuals went into the largest debt and spending binge in the history of U.S. markets – $72 trillion!

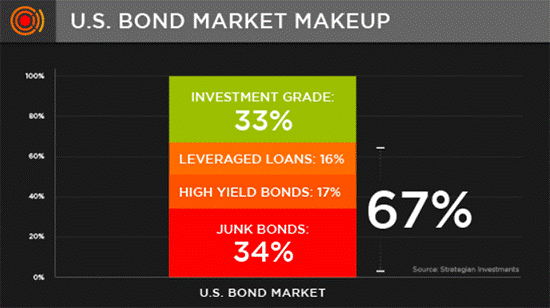

Today, over 60% of our entire corporate bond market is rated as junk, high-yield, or levered loans – the very D- students of the credit class – and yet no one notices, because everyone is enjoying the party. Again, beer goggles…

For those of you holding large amounts of “safe” corporate bonds in your standard pie chart portfolio, we’d highly suggest you rethink just how “safe” they really are.

Whenever this debt party ends, many of these debt-drunk bonds will be dead on arrival.

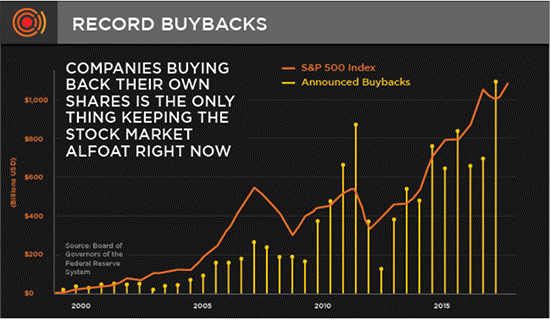

Such addictive low rates not only encouraged massive corporate debt levels, but equally massive stock buyback levels (>$5 trillion since 2008), all deliberately rigged to send DUI markets way past normal valuation multiples or the principles of sane (i.e., sober) risk management.

Instead, such a rigged, low-rate environment has allowed over 15% of U.S. companies to exist as otherwise dead broke “zombie companies” – i.e., companies that survive only by taking on just enough new debt to pay interest (rather than principal) on existing debt to stay alive.

Such debt rollover schemes/scams are of obvious benefit to company board members, yet they exist to the extreme detriment/risk of their long-term shareholders (i.e., YOU) once this debt can no longer be paid.

But as Richard Russel famously said, the market – and companies like these – won’t go down until it has sucked everyone in.

We are not there yet, but getting closer…

By the way, we’ve done the math, and if one were to take away the rigged influence of stock buybacks (which many claim should be outlawed) from 2010 to today, the S&P would be 20% lower than it is now.

Next, let’s look deeper at the “insider support” that helped make this rigged to fail market– and debt addiction – possible…

- Rigged to Fail Market: Wall Street in Bed with Washington

It’s important to know that the very gang of insiders (Paulson, Geithner, Summers, Bernanke, etc.) who helped design and then trade this rigged to fail market system has done so to their own advantage.

The very bankers who caused the 2008 crisis became the foxes guarding the hen-house of their own ill-gotten financial “recovery.” Alas, since 2008, everything has changed into a centralized, pro-Wall Street market that rises every year while the real economy and wages on Main Street stagnate.

For example, let’s keep in mind that the Secretary of the Treasury in 2008 who authored the “bailout” was himself a former (and highly controversial) Goldman CEO who helped convince Congress and the White House that the only way to save America was to save the TBTF (too big to fail) banks like Goldman Sachs.

Real shocker there, eh?

And as for the heroic bank “regulators” that D.C. subsequently put in place to “monitor” those foxy banks, they were themselves just bankers (i.e., insiders), with a vested interest in keeping banks and the risk-on markets they serve a priority over the real U.S. economy.

But if you are hoping that our Congress has their eyes on protecting you from these insider priorities with an objective eye, it’s worth pointing out that for every member of the U.S. Congress, there are five financial lobbyists attached to them.

Now ask yourself this: Can such a rigged to fail market system of financial “influence” over lending and budget regulations possibly lead to fair and objective financial stewardship from D.C.? The obvious answer is… nope.

Sadly, one must consider the evidence that our Congressional and regulatory process is largely rigged in favor of a singular and powerful class of influence-buying Wall Street and bank executives (and the bought-and-paid-for legislators who support their high-risk survival).

Henry Ford once observed that if Americans actually knew how banks operated, there would be a revolution in the streets. Unfortunately, very few understand how banks create money out of nothing and then lend it at interest (via the fractional-reserve system of the private, TBTF banks and the QE system of the central bank).

As former Morgan Stanley, Dresdner Bank, IMF, and World Bank veterans, however, we at Signals Matter know all too well how the sausage is made…

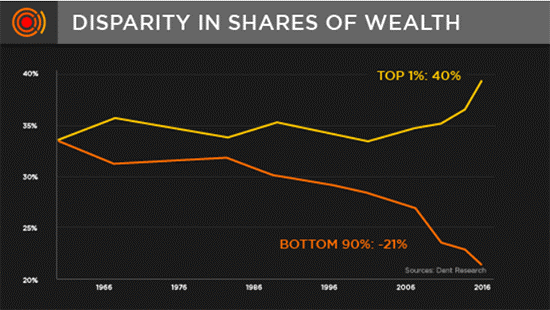

But worst of all, if we just focus on facts and math, rather than rants or partisan bias, we quickly discover that as markets, Wall Street, and the top 10% reap the benefits of this entirely rigged “bailout,” the U.S. middle class has been sold out.

Today, we have historically unprecedented wealth disparity in America. 52% of American children live in welfare-assisted homes, and 40% of U.S. households can’t afford a $400 emergency without having to sell something.

According to the U.S. Social Security Administration, 50% of all U.S. workers made less than $30,500 last year. Over seven million Americans are defaulting on car loans; there’s greater than $164 billion in student loan defaults; and with 480 million credit cards in circulation, the average American carries three credit cards to juggle over $1 trillion in credit card debt.

How could things be this lopsided?

The answer is both sad and simple. By the time the markets began their “recovery” in 2009, 80% of the nation’s stock market wealth was in the hands of just the top 10% of the country’s wealthiest families.

By 2016, this percentage climbed to 86% of all stocks. In short, the vast majority of 401(k), hard-working America was not reaping the rewards of the post-’08 melt-up.

Instead, they were still licking their wounds from the 2008 disaster unleashed by the top 1% of American wealth – the very banking class that is rigging the current melt-up and best prepared to hedge against the inevitable meltdown to follow…

Needless to say, the wealthiest Americans could not only stomach the risks better, but were also better advised and thus able to ride the obvious (and record-breaking) melt-up handed to them by the Fed.

According to a Gallup survey, 45% of Americans had no money in the post-’08 markets, and of those that did, 43% were in passive index funds tracking the market with no advice as to risk management, key sector growth, or the importance of active management.

Sadly, these “buy-and-hold” retail investors were, and will be again, the ones who suffer the greatest losses when markets fail.

Again, this is because the financial system is a rigged system that favors one segment – rather than all segments – of the real economy.

Of course, the key to sustaining such a debt-spiked and rigged securities market today is to ensure that interest rates never get so high that those grotesquely rising corporate debts (today’s new “subprime”) become otherwise unpayable.

That’s the next way the markets are rigged…

- Rigged to Fail Market: Interest Rates Determine Everything

Indeed, record-breaking debt levels, which push stocks to nosebleed highs today, are so massive that any genuine or natural bump in interest rates would immediately kill the markets and the economy.

Such unnatural repression of rates (allegedly needed to hit a fictional “target inflation”) is thus a further and obvious sign of a rigged market.

In a fair, just, and natural market backdrop, for example, investors would be aware of these risks and thus be able to monitor and trade them by tracking equally fair and accurately reported levels of inflation.

But in a rigged system, such reporting is intentionally distorted to keep the rigged fantasy of low inflation (and by extension low rates) going, as low rates are the key to keeping a massive debt bubble from popping.

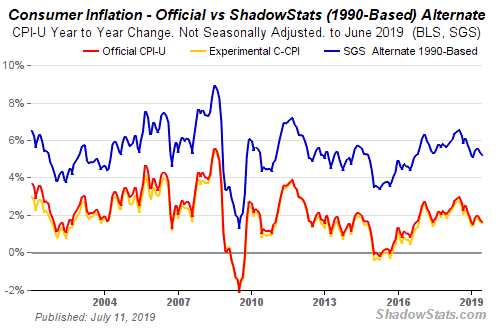

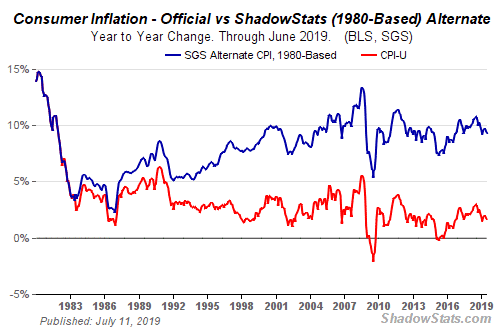

Toward this end, the math makes it objectively clear that we are being lied to about real inflation (much closer to 10% than 2%) so that the Fed can artificially suppress rates to keep debt-soaked markets rising rather than naturally allowing bond markets and true supply and demand forces to set the rates – and thus the rules – of a fair and sustainable system.

To rig inflation reporting, the U.S. government periodically shifts its reporting methodology, as it did in 1980 and again in 1990, to artificially depress the number. Consumer inflation is triple to quadruple today’s reported number using original methodologies.

Here’s what inflation (the top line) today looks like, vs. 1990s-based figures…

Courtesy of ShadowStats.com

And here’s what it looks like (top line), vs. 1980s based figures…

Courtesy of ShadowStats.com

If honest inflation was accurately reported, rates would be naturally higher and we would already be in the mother of all market disasters – right now. But again, lies keep this rigged game not only going, but at all-time highs.

But markets, like anything supported by lies, are hardly safe: The truth eventually gets the last word.

Today, instead of natural market-driven rates (and hence market-driven valuations and risk decisions), we now have entirely unnatural, central bank-manipulated (i.e., rigged) interest rates.

The Fed, for example, knows that interest rates need to reach at least 4-5% in order for it to have rates high enough to meaningfully reduce in the next recession – but at this dangerous stage in the rigged game, if the Fed tries to raise rates in the very debt bubble of its own creation, the markets panic and turn fatal.

The Fed has literally rigged itself into a corner. The ironies do abound.

And as we all saw in December of 2018, when the Fed tried to nudge rates up by even a quarter of one percent, the debt-addicted markets nearly died and immediately sought an unnatural “new life” from the Fed.

In this rigged to fail market scenario of complicity with Wall Street, the Fed in Q1 famously paused further rate hikes to give new breath to this otherwise dying, but now Frankenstein-like, market.

And now, despite “Fed-Speak” that says all is “reasonably good” for the U.S., we are looking at rates going further down – a desperate emergency measure masquerading as “support.”

This is a dangerous game, and it’s ultimately rigged to fail.

In a normal, fair, and accurate market, such market downturns like we saw in Q4 of 2018 are to be expected, even welcomed, as they naturally dilute the “alcohol content” of otherwise over-valued/drunk markets and allow sober investors to consider risk management rather than drunken speculation.

But in totally debt-driven, low-rate, and rigged markets, such drawdowns are artificially revived via central bank rate manipulation that sends markets toward unsustainable highs that only buy time and rising markets at the expense of far greater pain (and crashing prices) down the road.

But, folks, all you need to know now is this: By lying about inflation and hence artificially suppressing/pausing interest rates, the Fed and D.C. have shown us that the markets are rigged rather than “recovered.”

Again, we literally trade in a Frankenstein market, and such monsters bode danger ahead.

The trouble is, everything is masked in lies…

- Rigged to Fail Market: The Real Statistics are Buried in Lies

As to such lies, nothing reveals a rigged to fail market system more clearly than the intentional distortion of facts. Sadly, we are seeing record-high examples of deliberate myth creation from the agencies and institutions along the D.C./New York City corridor.

Given today’s record-high corporate, sovereign, and household debt, the market rigging Fed and its masters on Wall Street are quite aware that the stakes and dangers have never been higher.

That is, today we are no longer in just a tech bubble (like 2000) or a real estate bubble (like 2008) but rather an “everything bubble.”

In other words, everything (stocks, bonds, real estate, private equity deals, tech, retail…) is at stake today, which means D.C. and Wall Street will desperately seek to do whatever it takes to prevent an equally record-breaking and historic catastrophe as markets and asset classes reach record peaks founded upon the sandy foundation of unsustainable debt.

Unfortunately, such sandy foundations ensure that the very markets upon which they are built are equally rigged to fail.

But for now, one of the easiest ways to keep rigged markets alive despite such realities is to intentionally influence a false perception of strength through the intentional delivery of bullish hype.

The better word for this hype, however, is blatant dishonesty -you know, lies.

That’s why the Fed and Bureau of Labor Statistics (BLS) have deliberately lied to us for years about “roaring GDP growth” and “contained inflation.”

But with markets skyrocketing on debt, our actual GDP since the 2008 crisis has only annualized at a pathetic rate of 2%.

Thus, we have debt (and hence markets) skyrocketing, while GDP flatlines – a classic sign of a rigged to fail market.

And as for inflation lies, again, we all know that costs (inflation) are rising in education, energy, health care, and housing. Just walk out your door and open your wallet: The proof is everywhere.

In order to get around this open lie, however, the BLS simply ignores/under-weighs these data points. Equally dishonest are the clever ways the SEC allows public companies to exploit ex-items accounting tricks to make their profits and earnings reports look far better than GAAP reality – effectively and legally allowing companies to use clever bookkeeping schemes to bypass overhead costs to “cook” their adjusted profits and earnings statements.

Such ex-items schemes are essentially the equivalent to a lemonade stand where the beverage sales are reported but not the cost of the lemons. Again, this is an SEC-sanctioned earnings scam totally unknown by most, yet totally rigged by the Street.

Yet perhaps the most brazen yet open lie that we’ve been sold for years is our “record low” U3 and U6 unemployment figures. Like the other myths coming out of the BLS, the unemployment lie is largely one of omissions.

That is, when calculating the number of unemployed, the BLS measures it as a percentage of a clever sample pool known as the “civilian labor force.” What they omit telling you, however, is that this “civilian labor force” does not include the tens of millions of Americans who’ve totally given up looking for work.

In essence, D.C. thus measures the “low” number of unemployed workers with the same distortive conclusions as if measuring the number of short people in America, but using the NBA as the sample pool. It really is this crazy, this rigged.

Taken individually as well as together, these extraordinary lies as to GDP, inflation, earnings, and unemployment can be proven mathematically, empirically, and apolitically.

They are clear indications of a rigged rather than transparent market.

A less direct form of market rigging comes from the actual nature by which the majority of wealth advisors provide consensus-driven (safety in numbers) market advice.

- Rigged to Fail Market: Today’s “Advisory System” is Totally Rigged – and Not in Your Favor

For generations, wealth advisors, banks, and other financial advisory shops have traditionally argued that the best way to make money is to diversify your assets within a pie-chart portfolio of stocks and bonds.

These portfolios take about five minutes to construct by any first-year bank or advisory employee…

Advisors today almost uniformly recommend that you essentially stay “all in” and “at all times” to ride out highs and lows by simply “buying and holding” such cookie-cutter portfolios.

They say (and even believe) this is because history confirms that such an approach is the best way to compound returns and avoid “market timing” mistakes.

But in the current market backdrop of rigged highs and artificially sustained debt risks, such traditional thinking will get you slaughtered, like bringing a traditional muzzle-loading musket of 1776 to the D-Day landing at Normandy.

In short, what worked yesterday won’t work tomorrow. Here’s the truth behind this rigged game…

- Advisors are paid a percentage of what you have invested in markets – thus it’s in their own best interest to keep you nearly permanently invested all the time. Needless to say, Wall Street loves this, too.

- The government also wants you to be all in the markets all the time because the government makes money on capital gains taxes provided by a stock market filled with permanent buyers and hence longer highs.

- IRAs and 401(k)s are equally rigged to keep you in the markets all the time, regardless of dangerous market conditions. Early withdrawals before retirement age are thus heavily penalized.

The smart money, however, knows that since 2008, the game is more rigged than ever. A historical bubble is forming, and all bubbles eventually pop.

The smart money (including most insiders of this “rigged game”) therefore avoids bubbles, go deeper into cash at hyped market tops, and then buy at signaled market bottoms.

That is why those in the top 10% who can afford the high-end advisors at places like UBS, Morgan Stanley, and Bank of America are currently going to cash allocations of 25% or greater even as markets break all-time highs.

Unfortunately, today’s “advisory system” for the rest of America is rigged to criticize such “active portfolio management” or cash positions. Instead, they seduce average investors to chase tops rather than patiently manage risk by exiting dangerous peaks before returning later to buy at market bottoms.

That is, most experts will tell average retail investors that markets are impossible to time and that the number of days responsible for the bulk of your gains as well as losses in any given ten-year period is so few that you can’t predict them and thus you just need to “stay in” all the time with proper diversification.

They’ll also tell you that “all markets eventually recover,” so just wait out the pain.

To some extent, we agree. No one can time a market, even a rigged to fail market. No one knows precisely when it could turn. Halloween? Christmas? This year? Next year? Impossible to say.

But while no one can predict the precise time of the first raindrop of a rigged to fail market storm, most smart folks can predict the rain is coming by simply looking at the color of the clouds.

When market clouds (indicators) turn stormy, you don’t need to be a meteorologist to know it’s time for an umbrella. And sure, all markets do recover eventually.

But ask the Japanese what happened to them in 1989. Like us, their equally obvious (yet ignored) rigged to fail market was thriving for years on happy debt – and then they tanked, big time – by over 80%. A classic rigged to fail market that failed big time.

And guess what, it’s now 30 years later and their market has yet to recover…

When our rigged to fail market tanks next, how many of you can afford to wait 30+ years to “recover” your losses? Please, please, please do not make the traditional assumption that riding out storms is historically confirmed to work, or that markets will quickly recoup your losses.

As Japan’s example reminds us, some debt binges and market parties are simply too decadent, too extreme, and too absurd – and thus can’t be solved with a central bank aspirin the morning after.

If you lose 50%, 60%, or even more in the next crash to hit the U.S. markets, one driven by historically unprecedented debt (falsely described as “stimulus,” “support,” or “accommodation”), you will not see it (or your losses) come back in one or two years…

Instead of the V-shaped “recovery” we saw in 2009 (driven by astronomical money printing and debt), the next L-shaped recession to hit the U.S. will last much, much longer, because even our arrogant Fed can’t just print money to infinity and outlaw recessions – despite every effort to do so in the last 11 disturbing years of “keg party” markets.

Riding out the storm in a “set it and forget it” portfolio of inflated and highly correlated (and rotten) bonds and equally inflated stocks will not save you.

The pain ahead can last for decades, not years. But, and of course, the folks at the Fed, Wall Street, and the advisory shop down the block will likely tell you not to worry. To them, history, debt, math, and even candor just don’t apply…

- :Rigged to Fail Market: Caution, Realism, and Common Sense are Ignored

Given that both stock and bond markets in the U.S. are now at historically unprecedented bubble levels, the risks have never been higher for both the markets and the otherwise ignored real economy.

And given such desperate (yet glossed-over) conditions, D.C. and Wall Street are increasingly forced to seek odd and blatantly desperate measures that are otherwise cloaked as “recovery plans” or “central bank-supported stimulus.”

In fact, such “recoveries” or “stimulus solutions” are merely further evidence of totally rigged measures to keep equally rigged markets alive on hype well past points of natural and realistic sustainability.

For now, however, the party rages on. It’s fun. We’re riding part of this free-beer high ourselves. We know that the Fed will continue to suppress or even lower interest rates to “buy more time” and thus try to solve grotesque debt problems by, alas… encouraging more debt.

If that offends you, then you ought to trust your common sense…

The most extreme example of such rigged support is the growing popularity of insane ideas like Modern Monetary Theory (MMT), by which D.C. and Wall Street are theoretically prepping to print trillions more dollars and effectively double current debt levels without, as they “promise,” causing any inflationary harm.

This is pure, desperate fantasy.

But in rigged markets, fantasy is often disguised as policy and is given reassuring titles like “stimulus,” “easing,” or “accommodation.” Moreover, fantasy works – even for a long time. Until it doesn’t.

And if more money printing doesn’t fly, then the Fed will certainly consider lowering rates into negative territory (like Europe and Japan), an equally desperate (and futile) measure that does buy time but is absolutely useless when it comes to solving systemic economic cancers like our current debt levels.

Today, there’s even increased talk of a potential “miracle solution” or great big debt “reset” by which the government passes measures to forgive large swaths of U.S. debt. If this sounds too good to be true, that’s because it is.

But in a rigged game and rigged to fail market, no one in public office (or from a bank being interviewed on TV) will admit to this or speak the plain truth.

But we will.

Folks, a debt-forgiveness “jubilee” may seem like a simple solution, but what happens to markets, pension funds, banks, insurance companies, and countless other institutions that hold those magically forgiven debts as investments? They tank, that’s what. And so will your portfolio, savings, and faith in fairytales.

There’s also plenty of hype now about how blockchain, artificial intelligence, and the Internet of Everything are about to be the next mega “revolutions” for markets, possibly sending the Dow to 50,000 or more.

We certainly agree that tech is the future, but it’s not a future that just goes straight up. It is essential to remember that mega-tech stocks like Microsoft, Cisco, and others can (and did) lose 50% or more in a market crash (think 2000-2003) despite being leaders in an otherwise revolutionary tech sector melt-up.

In short, even if you rightly believe that the future of technology will result in extreme stock price increases, don’t believe the rigged hype that such moves don’t come without dramatic volatility and price decreases along the way.

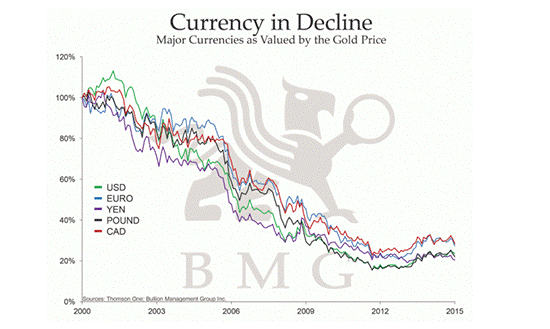

Already, the staggering levels of debt and money creation around the globe have objectively destroyed the purchasing power of the major global currencies when measured against traditional stores of value like gold.

Just imagine what further “stimulus” would do to the already crippled purchasing power of your currency.

But again, in a rigged game desperate to keep investors fully invested in all conditions and at all times, such caution, facts, and common sense are deliberately ignored. Instead, hype and evidence-suppression are king.

- Rigged to Fail Market: A Debt Crisis Can NEVER Be Solved by More Debt

As per all the data above, it’s clear that today’s market is indeed a rigged to fail market.

Throughout the history of U.S. markets, from 1929 to today, every debt binge rigged by desperate, over-extended monetary policies (FDR in the ’30s, the post-Nixon ’70s, the dot.com late ’90s of Greenspan, and the sub-prime fiasco of the Bernanke 2000s) always ends in failure.

The most that the central bank and its Wall Street cronies can do now is seek to postpone this failure.

But in doing so, they only make the conditions worse down the road.

To help this sink in, think of an even more extreme example like the French revolution…

In 1790, France was the strongest economy in the world, but it had a debt problem…

Solution? Easy. Print a gob of money and throw a low-rate debt party.

Result? Fun for a while, followed by total collapse and over 40,000 folks losing their heads…

But, and of course, 2019 America is not the same thing as 1790 France… Unlike the French of 1790, the U.S. currently has the extra help of having its Petro-Dollar also serve as the world’s reserve currency. This gives us significantly more power to buy significantly more time as the best patient in the global ICU of debt-sick markets.

But despite the relative strength of our currency and place in history, this relative strength – which we are tracking daily – only delays (but does not prevent) a massive market selloff.

That is, throughout the history of markets, from first-century Rome to today, a debt crisis can never be solved by more debt. Never. Not ever. Period.

Since the days of Nero, there have been 54 recorded examples of countries attempting to solve one debt crisis via the creation of a new debt bubble. And in each of those 54 cases, the net result was a massive economic disaster.

Folks, that’s 54 examples, and 54 failures. Do you really think “this time is different”? The Fed wants you to think so. They are relying on your faith/ignorance. But now, you know better…

In the end, such rigged and desperate measures to enrich one class and/or industry can merely buy time, not offer a permanent solution. These very measures are historically rigged to fail.

But just because we live in a period of dangerously rigged markets doesn’t mean that informed investors can’t prevail in such otherwise sad conditions.

Three Ways to Prepare for the Worst (and Make a Small Fortune at the Same Time)

While economic conditions appear well and good on the surface, you know now, after reading through the seven ways the markets are completely rigged to fail, that an ultimate day of reckoning (i.e., failure) is coming.

There are a number of sound ways to navigate a bear market – carefully signaled inverse indexes, put options, gold, etc. – but what’s coming will not be like any bear market we’ve ever seen before.

And to combat these conditions, we highly recommend you take these actions immediately.

- Raise Cash

Protect yourself from losing half your money in these “everything bubble” markets, as too many investors did before. Raise cash (we currently recommend around 40%–this percentage can and will change depending upon expected Fed stimulus down the road); reduce or eliminate margin debt; and re-balance your allocation to equities if it has become inflated compared to whatever else is in your portfolio.

Going nearly 40% to cash may seem bold, or even absurd. Yes, you could miss possibly years of upside. But you’ll thank us later… when you’re the only person in your neighborhood who’s able to even buy stocks when this rigged to fail market all goes down.

So why cash? Simple: (a) cash significantly manages the market risks described, while (b) providing you with the dry powder to make a fortune by buying at the bottoms when these markets do what all debt-driven and rigged to fail markets eventually do: Revert to the mean.

Folks, mean reversion is the most powerful and historically confirmed market force in history, and current technical data would put a mean-reversion loss on the S&P at a minimum drawdown of 56% in the next recession.

Buying at bottoms is where the greatest fortunes have always been made – and it’s the one strategy to extreme wealth that almost no one does or truly understands.

- Trade Like a Pro by Monitoring the FANG Spread

Consider this simple outlier strategy that could actually double your money once these markets begin to fail: Look at the FANG stocks as a group.

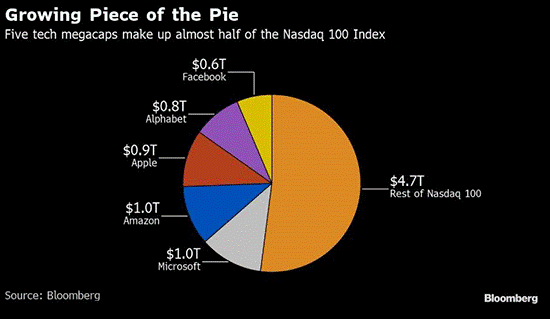

Today, just these five stocks make up almost 50% of the Nasdaq. Sound familiar… as in the dot.com bubble? 50% is a scary amount of concentration heading into uncharted waters.

Next, have a look at the NYSE FANG+ Index, an equal dollar weighted index designed to represent a segment of the ripping technology and consumer discretionary sectors consisting of highly traded technology growth stocks and tech-enabled companies such as, again, Facebook, Apple, Amazon, Netflix, and Alphabet’s Google.

The FANGs are super sexy, but they are poised for an epic fall and a BIG short.

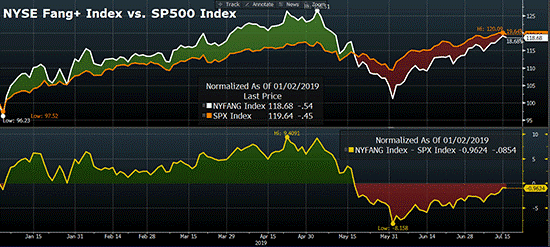

In the chart below, we’ve plotted the FANG+ Index against the SP500 Index (as of July 16, 2019). Notice how the FANGs (which comprise over 15% of the S&P’s total market cap) have been leading the SP500 Index up until May 2019.

Then, in relative terms, they began to underperform, as a host of market-related indicators shared in Critical Signals Report began to crumble, setting up a short play that could last a very long time.

Here’s the setup: When the negative spread between the FANG+ Index and the SP500 Index (that red area) begins to reliably widen again, AND (2) both the SP500 Index and the FANG+ Index begin to fall in unison, consider selling the FANGs short. For those who follow us, we’ll let you know when to pull that trigger.

Once the criteria are met, you could short the FANGs by buying one of three inverse Exchange-Traded Notes (ETNs) sponsored by BMO Global Asset Management, namely the MicroSectors FANG Index 1x (GNAF), the MicroSectors FANG Index 2x (FNGZ), or the MicroSectors FANG Index 3x (FNGD) for added horsepower.

Why use an ETN? Because it’s safer to play the FANGs as a group, rather than pick one or two included stocks individually.

Finally, for an even higher pop likely to more than double your money, you could consider put options on the NYSE FANG+ Index itself. Place protective stops in line with your risk tolerance levels.

But if you think the FANGs won’t show their teeth and just keep ripping north, we remember hearing the same thing during the dot.com bubble about otherwise legendary names like Cisco, Microsoft, and Yahoo.

Well, when that absurd bubble popped, they lost 54%, 65%, and 87%, respectively. In short, don’t be fooled by the sexy…

In a totally rigged game, investors simply need to understand the facts, manage risk, track real signals (rather than hype), and know which signals matter and which specific strategies are needed as these rigged markets gyrate up and down toward their doom.

- Put Your Dry Powder to Work (When It’s Time)

Finally, when the market bottom is in place, get back in the markets – aggressively – with the cash you have put aside. Again, we’ll be here to show you the way.

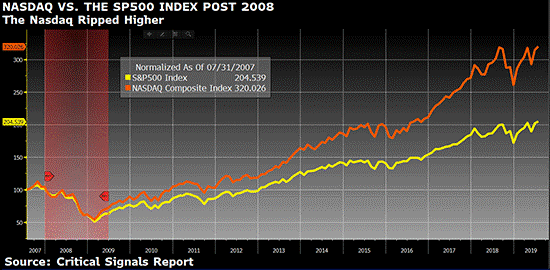

What would we do at a bottom? Well, past performance is no indication of future results, but cycles do rhyme. Sticking with the technology theme, tech ripped upwards after 2008/09, with the Nasdaq soaring higher by multiples of the SP500 Index.

When the meltdown crashes and stabilizes, we’ll be informing YOU on when to get back in these markets big time, and we’ll probably be suggesting not just ETFs and ETNs, but individual stocks as well… But a different genre of tech because tech will look different even a year or two out.

In 2001, Cisco, Yahoo, and Microsoft were the rage. In 2019, the FANGs have been the rage. But come 2020/2021, it’s going to be a whole new tech that rips higher – namely blockchain, fintech, and the internet of everything, including cyber security …

We are already working on these swing-for-the-fences names to buy, when others will be there sell, sell, selling and bleed, bleed, bleeding.

Signals Matter Report

Signals Matter, unmatched by any comparative service online today, was created specifically to guide you through this rigged to fail market. We are here to help ALL investors, not just the fancy lads.

We are not bears nor bulls—just realists focusing on managing risk and profits in a background rife with distortion facing an epic recession which no one can truly time given all the central bank intervention in modern markets.

But whenever this storm hits… you’re going to need someone on your side who is going to give you the blunt truth that no one else can (or will). Again, whether the storm hits landfall tomorrow, next year, or even much later, the key is not whether you were too early, but whether you were a day too late.

We’ve given you our most honest assessment of the facts and data. It’s up to you how much you wish to consider.

As for what we’ve learned over the decades as hedge fund managers, family office leaders, and ex-bankers, the path is clear: Patience, knowledge, and signals are what matter today.

You can now consider yourself among the informed few… Stick with us, and we’ll keep you informed, safe, and profitable.

Comments

24 responses to “RIGGED TO FAIL”

- David Kalicharansays:

July 24, 2019

Very informative supported with good analysis and data

- Riverman 86says:

July 24, 2019

Great article. I agree that putting 40-50% cash aside now would be a smart move. If the market crashes, you will be in a position to buy stocks at rock bottom prices. The market will crash as it has in the past. Crashes run in cycles. Be prepared. Stay away from high flying stocks. Follow Warren Buffet and other wise investors.

- Bob Weekssays:

July 24, 2019

What a dynamic analysis. Thank you.

- george W Anstadtsays:

July 24, 2019

Japan has run up huge debts repeatedly over the centuries- always culminating in a devaluation of the currency so the government debt is largely wiped out.

Will devaluation of currencies be at play?

- Barry Yagersays:

July 24, 2019

Very well written

- Gary Dohnersays:

July 25, 2019

I have rarely seen commentary of the effect of the fraudulent inflation rate in the GDP calcs. But buy simply lying about the inflation rate (in this case lowering the rate) the reported GDP figures are effectively higher than they really are. If they were actually adjusted for the correct inflation rates the GDP would be negative and would better explain why so many seem to be unable to get by today and have such increased debt levels or lower standards of living.

- Cory C. says:

July 25, 2019

Hi Matt,

During this upcoming recession in equities…do you think cannabis stocks will buck the downward trend (as a sector) and hold or even increase market cap? Or will we just see a lesser sell-off?

- Neil Guerrerosays:

July 25, 2019

I have been shouting from the rooftops about the impending disaster you speak of. How can there be economic growth when the only thing keeping this economy alive is/was massive infusions of fake money? I personally got mauled back in 2008 but that was when I still was employed and I am referring to my 401k at the time. I swore that I would never let anyone manage my meager funds again, except for myself. After all who cares more about my money than me? I know obviously, but it’s worth stating because as you stated all those gurus and financial advisors only care about getting their commissions selling you junk Mutual Funds and ETFs, that isn’t involving active management. So in short go short on those overpriced fang stocks because they were all built on this massive money printing scheme, and as you have stated it really is best to have at least 45-50% cash ready to pounce on the great companies that too will be pulled back down to the mean. And it isn’t a bad idea to have gold and silver hanging around. Most pundits say at least 10%, well I say more bur I’m a self admitted gold bug but I firmly believe that the dollar is going to take the biggest hit of all. The U.S. has been lucky in that we helped win WWII, but it was only because after that disaster our country was the only one standing with it’s industries in tact to revert back to an economy that quickly re-tooled from making tanks, artillery, bombs, aircraft for war as well as warships, to a consumer economy making washers, dryers, refrigerators, automobiles, things that helped build a solid middle class. It also didn’t hurt that our currency became the worlds reserve currency, so all trading was basically done in dollars rather than francs,marks, lira, pesos, you get my drift. But like all great powers turned empires, we f’d up and blew it by getting greedy, we helped those very countries we turned into ruble ie: Japan and Germany, to name a few into economic rivals. And now come the Chinese who are stockpiling gold as well as the Russians. What do Americans think is going to happen when all those dollars come home to roost in the good old USA? I’ll tell you what inflation like you have never seen before or worse deflation into stagflation, so I just love your e-mail when I stumbled across it today. Please keep it coming it is a breath of fresh air even though it is gloomy and doomy, but as they say the truth is never pretty yet cleansing . For the truth. Neil Guerrero

- Melsays:

July 25, 2019

Thank you!

- Terry cassjdysays:

July 24, 2019

You say go to cash 45% but where should you put it?

- ROGERsays:

July 24, 2019

Very insightful!!!!

- M Sorichsays:

July 25, 2019

While I agree, nothing last for ever – but this market has way too many conflicting elements that is non-traditional and using traditional metrics may not produce the outcomes that is typical.

So while it is important to be vigilant and practice conservative management of one’s portfolio- to make such a striking statement about the market’s potential future is wizary

- thompsonsays:

July 25, 2019

good stuff

- Lewis Newmansays:

July 25, 2019

Will your advice cost me and how much?

- Mary St Johnsays:

July 26, 2019

Thank you for this information. My questions are: Can returning to the Gold Standard solve any of the problems facing the world and the USA?

When you say to have 45% in cash what is this 45% of? Is it your total net worth, or just the money you actually have in the markets?

- Neil says:

July 26, 2019

In downturn of rigged markets why not use precious metals as protection?

- Neilsays:

July 26, 2019

Why not use precious metals in a down market and cash for stocks in an up market?

- Katie Powerssays:

July 27, 2019 at 9:24 am

Have moved my investments to Canada

- Richard Comansays:

July 27, 2019

How can your cash be safe in a brokers or bank account ?

Should you trust gold or US Tresuries. Is anything safe?

- Darwin Turnersays:

July 29, 2019

You mentioned 54 recorded examples of Countries having a recorded debt crisis , What are some of the most recent in the last 20 or 30 years ?

- B. WARRENsays:

August 13, 2019

10 YEARS AGO I RESEARCHED & WROTE MY OWN REPORT, AS I WANTED TO KNOW WHATS WRONG WITH OUR COUNTRY. AS YOU DETAILED THE ENEMY IS THE BIG BANKS ON WALL STREET AND THE CENTRAL BANKS. IN FACT MY DAD WAS A BANKER. JULIUS CAESAR, LINCOLN, AND JFK ALL TRIED TO STOP THE MONEY POWER. ANDREW JACKSON WAS SUCCESSFUL BUT IN 1913 ALL WAS LOST AGAIN. WHAT IS ABOUT TO HAPPEN WILL BE FAR WORSE THAN 1929. IN THAT DAY PEOPLE WERE RURAL, AND KNEW HOW TO GET BY. THERE ARE SO MANY MORE PEOPLE NOW CONCENTRATED IN CENTRALIZED LOCATIONS. NOTHING WE CAN DO WILL ALLOW US TO ESCAPE IT.

TRUMP SHOULD BEGIN ENFORCING JFK EXEC. ORDER 11110, AND OR NATIONALIZE THE FED. ANY FURTHER MONEY CREATED OUT OF THIN AIR WILL NOT HAVE A DEBT ATTACHED TO IT, AND WILL NOT HAVE THE HARMFUL INFLATIONARY EFFECTS THE “DEBT MONEY” IE “FEDERAL RESERVE NOTES” HAVE.

- W. Gleasonsays:

August 22, 2019

I like what D.B Warren wrote! We lost the Fed. In 1913 & the Press in 1921. Same Ppl. Or bankers own both! So our News & Money r RIGGED!

- stan lajicsays:

August 27, 2019

Very-very informative Thank you

- Mark Stubergsays:

September 24, 2019

That reminds me…….I haven’t heard anything from Christine LaGuarde and the IMF lately ! They were yakking about devaluing all countries currencies,then,mums the word ? Not of course ,she/they could be trusted one way or another.However beware ,a very bold yet quiet contender could enter the ring and make a U S market melt down look like a well deserved turn of events,while embracing the copy cat (and other nice words for disgusting crooks) Chinese. EEEyyuue !

Don’t forget to tell us when it is the time 🙂