Signals Matters News Letter: The Signals THAT Matter

Broadly, the core and timeless principles behind the infrastructure of Signals Matter Portfolio Construction are carefully discussed here and here.

As for WHAT’S HAPPENING NOW…

Markets continue to anticipate a dovish Fed move in 2024 with only a handful of mega-cap stocks pushing indexes toward all-time highs in June despite disappointing labor trends and an Atlanta Fed projecting declining rather than improving GDP growth. This disconnect between rising markets and a falling economy is nothing new, but it underscores the need to manage risk rather than chase a potentially dangerous euphoria.

Bloomberg reports suggest the ECB and Bank of England may be the first to cut rates, and many analysts are speculating on a Fed cut in September as we approach election headlines.

Rate cuts are typical tailwinds for equities, and until now, the precariously narrow US markets have been rising on just the anticipation/ “promise” of such hikes. This makes the Fed the most important market force to date, which raises all kinds of concerns.

Target 2% inflation, of course, has yet to be touched but talk of rate cuts continue despite this failed target. Powell has effectively promised the cuts in 2024, but has not forgotten the “Volcker Mistake” of 1980 when the Fed cut too soon after declaring victory over inflation—thereafter, inflation spiked.

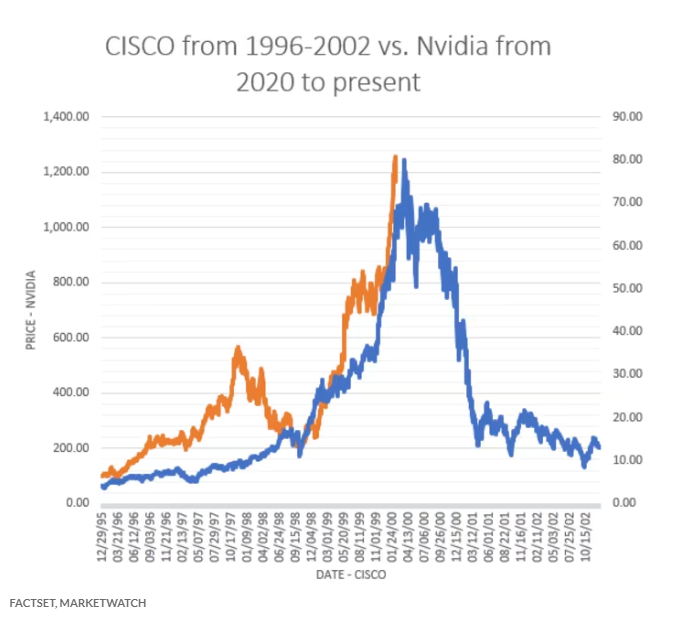

Meanwhile, the US yield curve remains inverted, with 2Y USTs delivering 490 basis points against the 10Y UST coming under at 450. This is a clear leading indicator of a recession, but more pertinent to portfolio matters, it’s also critical to recall that markets tend to tank fast once an inverted yield-curve “re-inverts”—which is what brought the markets down in 2000 and 2008. The similarities to the current Nvidia-driven tech bubble look quite similar to the CISCO-driven rise-and-fall of 2000, when rate cuts made headlines just prior to inverted yield curves “straightening.” What followed was ugly.

Thus, the rate cut and yield curve signals send mixed messages of short-term glory and longer-term danger.

As to rates and bonds, a rate cut will likely be a temporary tailwind for credits (and send yields and the USD lower). And with the US looking at $1.6T in interest expense payments alone at current rates, such a cut does seem likely—but deciphering Fed promises from Fed actions is never a clear or predictable process.

In short, 2024 hints at greater rather than less volatility ahead with trillions still sitting in the money-market sidelines. Will new money come pouring into equities at a rate cut, or will a re-inverting yield curve send us into ugly weather? We watch the signals and trends to act on either scenario, but the risks hiding beneath these highs are compelling.

Even More

Signals Matter Market Reports reflect the company’s long-term macro views and are posted free of charge at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Portfolio Solutions are geared to shorter timeframes and may differ from our longer-term perspectives. Our actively managed Portfolios are available to Subscribers who Join Here and to Accredited Investors who directly invest in Signals Matter Partners, LP. For further information, click Direct Invest or Book a Meeting with us.