Below, we discuss the need for smart portfolios in a backdrop of increasingly crazy markets.

The data and analysis below are emblematic of the macro insights, market indicators and portfolio suggestions our paid subscribers receive every Sunday evening to prepare them for the week ahead.

Putting It All Together

Each week, we put the key and most critical market signals–macro to micro, bullish to bearish—together, expressed in model portfolios which appeal to all investor types.

Let’s dig in…

Looking Ahead

With yearend just ahead and the Fed and U.S. Treasury scrambling for solutions to “curbing” (?) inflation, we’re focusing this week’s Market Report on the triage that may lay ahead by virtue of: (1) historic U.S. Government borrowing and spending that (2) has dramatically raised inflation, is (3) about to precipitate interest rate hikes ahead (4) during a period of falling U.S. GDP.

Tapering into dollar illiquidity and a rising yet increasingly volatile and over-valued market doesn’t bode well heading into 2022.

In short: The traditional 60/40 stock/bond portfolio is about get hit. We have solutions, because that’s what we do, regardless of headwinds or tailwinds.

Historic Sums Borrowed & Spent

Our friends at Tree Rings sent us down the road on this last week by illustrating the historic sums that the U.S. government has spent to support the U.S. economy during the pandemic.

If that was not perilous enough, Uncle Sam has footed the bill by massively increasing the Federal debt, mostly bought by our own U.S. Fed.

Our federal debt bought by/owned by foreign governments pales in comparison with the U.S. Treasuries which the Fed has purchased to keep the economy alive. Investors are the exposed party.

Inflation is Back–Bigtime

All this fiscal spending and monetary excess has triggered inflation to the fastest pace since 1982 as of last month, reminiscent of the Volcker Fed’s economy-crushing era. Headline inflation sped up to 6.8% from 6.2%, while the core component hit 4.9% versus 4.6%, adding to the case for the Fed to announce accelerated tapering next week at its Wednesday meeting.

As warned all year, inflation, once transitory, has grown into a persistent trend.

Bloomberg’s inflation imaging by John Authers is especially informative. John’s upper-left heat map below displays squares that darken as inflation indicators rise increasingly above their norm, compared to the previous decade when inflation was under control.

Note that the entire map darkens as the year goes by. John’s Core and Trimmed CPI Mean Indexes drill down on the inflation dynamic.

“Core” inflation (core CPI) includes the whole basket of goods in the CPI, subtracting food and fuel whose fluctuating prices are driven by factors largely beyond the reach of economic policymakers.

Alternatively, “trimmed mean” inflation (trimmed CPI excludes the most significant outliers in both directions, taking an average of the rest). The idea is to trim away goods whose prices have moved sharply for some specific reason unconnected to the broader economy, proving a more precise measure of underlying inflationary pressure.

John’s trimmed (and exponential) CPI chart (lower-right) says it all.

Is This a Good Idea?

With inflation ripping, never mind the debt, a range of forecasts from various economists and banks show interest rates are heading up.

Needless to say, rising rates are shark fins to a debt-soaked market and economy…

Morgan Stanley updated its rate path last week by forecasting the Fed will raise rates twice in 2022, a pretty dramatic uptick from their previous prediction for no change next year. Morgan Stanley sees the first hike in September, followed by December, then three more rate hikes in March, June, and December 2023.

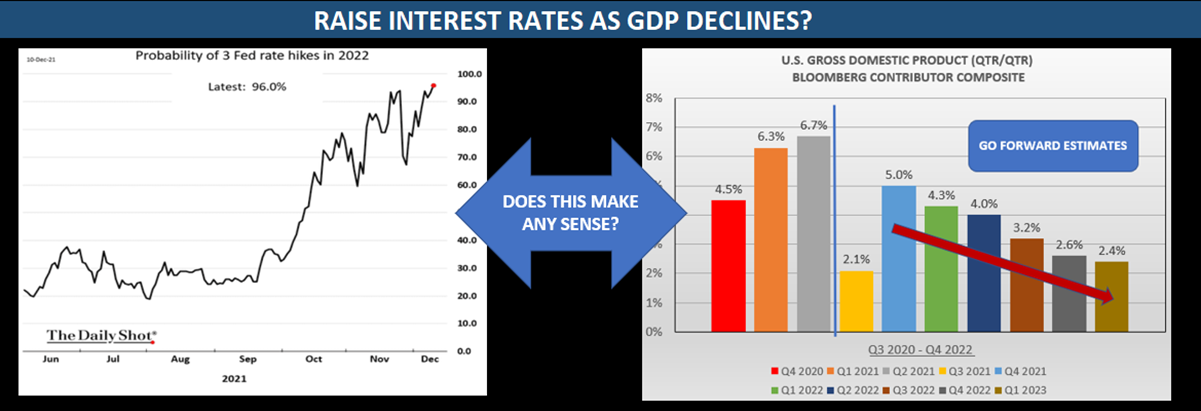

JPMorgan sees the first hike coming in June, compared to its September target. The Daily Shot (lower-left) is calling for three rate hikes in 2022. Take your pick. The clear consensus is that rates are going up.

Our guess, however, is that rates won’t surpass inflation, thereby remaining negative in real terms, which means bonds will give you zilch for inflation-protection.

Zilch.

Now take a look at the lower-right chart of GDP forecasts frequently updated by Bloomberg contributors. The Fed is poised to raise rates precisely as GDP is forecast to tumble.

Rising GDP helps pay for higher rates, lowering the debt/GDP ratio. Falling GDP does not, which is at the crux of a potential Fed policy error in the making (raising interest aggressively and relatively soon).

Does this make any sense? It’s certainly a warning to bondholders.

Model Portfolios

Inflation and rising interest rates are also a warning to 60/40 stock/bond portfolio holders, especially threatening popular retirement asset-allocation strategies as the Fed signals a hawkish shift.

Wall Street likes to warn that past performance doesn’t guarantee future results, and they are right.

When it comes to the traditional 60/40 mix of stocks and bonds, persistent inflation could bring past performance to an end. For decades, investors (mainly retirees) have plowed trillions into this mix because it offers growth with a layer of safety.

Finding an alternative to 60/40 can prove challenging, but that’s what we do here at Signals Matter, using liquid strategies that are readily available to retail investors saving for retirement.

There are plenty of folks that believe the 60/40 stellar run is coming to a close, thanks to inflation.

We agree.

A glance below at this week’s Model Portfolios feature technology and growth to the tune of 50%. But that 50% is (1) hedged by volatility and inverse ETFs across stocks and bonds, and (2) to investments in in carbon credits, energy, real estate, and infrastructure.

Plus, it’s all actively managed. Now that’s different, as investors can’t afford to be passive with all the “activity” going on in these markets now.

Seeking a Different Solution?

Come join us here at Signals Matter.com to see what we do beyond penning our free Market Reports each week.

See for yourselves how our portfolio signals can improve your portfolio, how we educate, how Signals Matter works, what makes us different, and what our fast-growing flock of subscribers are saying.

At $97.00 per month, Signals Matter subscribers enjoy access to Conservative, Moderate, and Aggressive Model Portfolios constructed to zig when stocks and bonds zag, thus providing a layer of protection in the coming inflationary, rising interest rate environment.

Tom & Matt

The future does not look good for currencies.

Most currencies or all currencies?

Currencies like NOK, CHF and DKK will do better?

Just better horses in the same glue factory…