Signals Matters News Letter: The Signals THAT Matter

Broadly, the core and timeless principles behind the infrastructure of Signals Matter Portfolio Construction are carefully discussed here and here.

As for WHAT’S HAPPENING NOW…

Turning the Corner

With the first half of 2024 now firmly in the rearview mirror, what’s next is the question du jour. The variables are many. Economic growth is decelerating as high interest rates prevail.

While the hiking cycle is assumed to be over, the Fed seems determined to keep rates on hold until later this year and next. Post-pandemic tailwinds are fading. US fiscal deficits doubled last year with no end in sight to borrow and spend in 2024 and beyond.

After all, with interest expenses on DC debt surpassing $1.6T per annum at the current rates, the options going forward are very limited, regardless of who wins the next election. The bottom line is that America is tapped out.

If the Fed cuts rates: That’s inflationary.

If the Fed keeps rates high: That’s ultimately inflationary, as the only way to pay the bill will be QE to the moon.

A recession or market implosion, of course, can be deflationary—but the end-game is simple: DC will inflate its way out of debt, and the QE required to do so can be a tailwind for equities and credits, but not for the purchasing power of the dollar measuring your return percentages.

Glass Half Empty

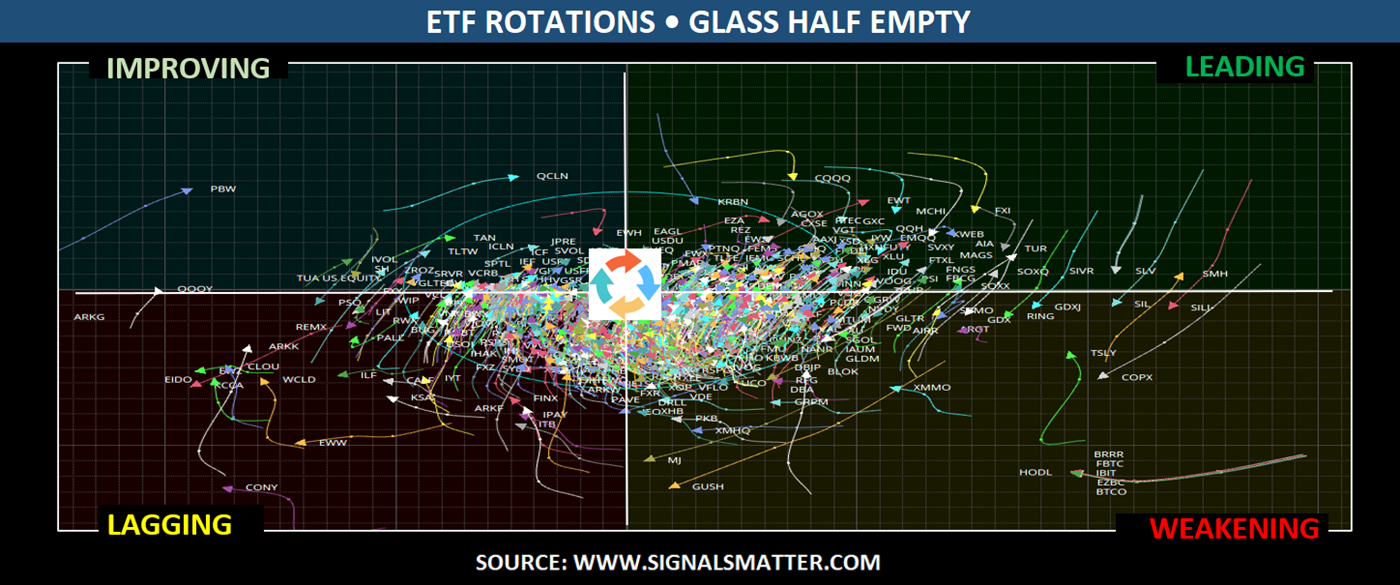

According to Relative Rotation Graphs (RRGs), the markets appear tired from a technical viewpoint. RRGs provide a unique visualization tool for relative strength analysis, measuring the relative strength trend of securities against a standard benchmark and each other.

Displaying the cyclical rotation of exchange-traded funds (ETFs) against a benchmark can help investors spot trends, compare multiple securities simultaneously, and make informed decisions when rebalancing portfolios.

RRGs plot securities in a quadrant chart like the one below, where the x-axis (vertical) represents relative momentum, and the y-axis (horizontal) represents relative strength.

Plotted securities move along paths (arcs) based on their relative performance across four Quadrants: Leading (securities with strong relative strength and momentum that are outperforming the benchmark; Weakening (securities that are losing momentum but still have relative strength); Lagging (securities that have weak relative strength and momentum); and Improving (securities that are gaining momentum but still display weak relative strength.

We have plotted the RRG chart below to measure the relative rotation of approximately 1,400 US-domiciled ETFs with assets under management above $250 million. This worrisome chart depicts a US-based ETF universe struggling for traction as the vast majority of ETFs rotate from Leading to Weakening and from Weakening to Lagging on a weekly basis. This glass is half empty.

Glass Half Full

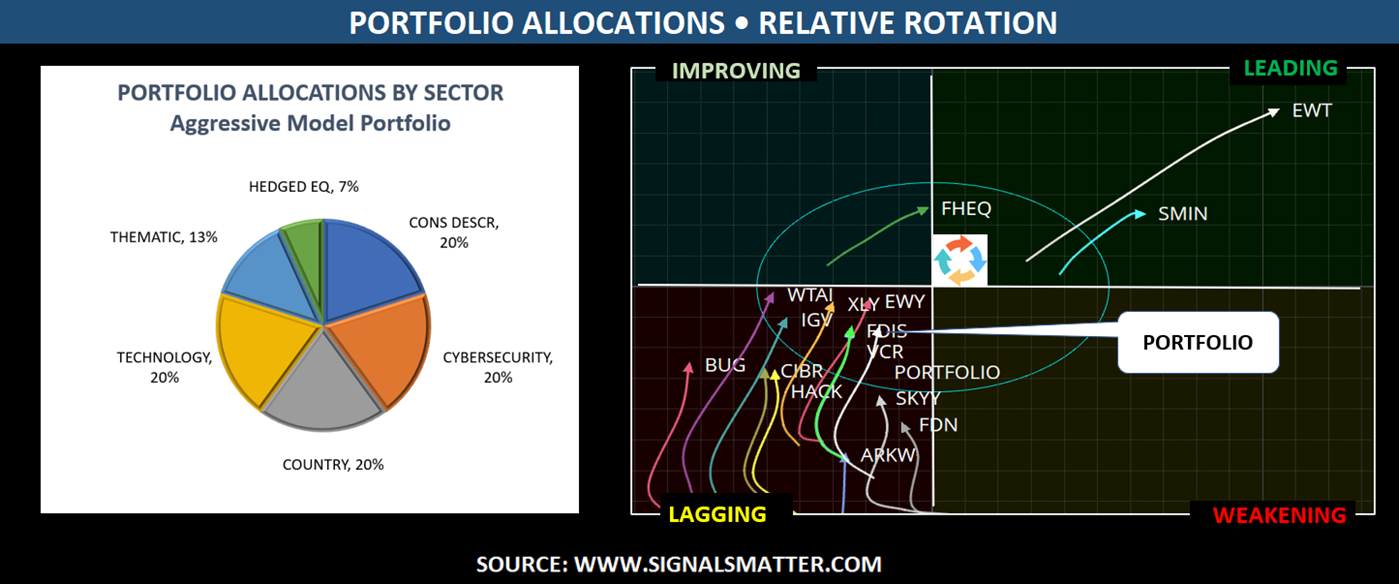

However, by selectively choosing among the US ETF universe, that glass can rapidly rotate from half full to overflowing by buying low and selling high.

Using actively managed tools and picking the right benchmark can make all the difference. By avoiding the crowd (in essence, by avoiding traditional 60/40 stock/bond portfolios), Signals Matter navigates the marketplace by assembling portfolios that participate in trends that are underway but young.

To define trends, we use a myriad of technical indicators, including volatility levels, price channels, trend convergence and divergence, moving averages and moving average crossovers, momentum, price patterns, relative rotation, price strength, support and resistance, volume, size, liquidity, money flows, and more – all of which rhyme with our macro view.

For example, here’s a recent portfolio allocation that is not your ordinary stock/bond portfolio, that embraces ETFs in sectors that are working, including a wide variety of alternative ETFs, including so-called inverse ETFs, that short equities, bonds, US treasuries, commodities, and more.

Markets go up, and markets go down. Investment managers like Signals Matter, who are agnostic to direction, double the investable universe across all market conditions.

The Holy Grail

“Holy Grail” in investing refers to the ideal strategy or approach consistently producing successful trades and profits. The Holy Grail is not a magic formula that guarantees success. It is, however, a formula that can yield consistent returns in all market conditions, challenging or not.

A well-thought-out plan, simplicity, and diversification can lead to better investment outcomes, as long as you know how to let profits run and cut the losses short.

Trading requires constant attention to daily signals and direction changes, many of which are divorced from the larger macro-economic realities which investors often refuse to understand. That said, one has to always keep on eye on the broader direction of markets, economies and currents in which specific allocations are made at the trading level.

Even More

Signals Matter Market Reports reflect the company’s long-term macro views and are posted free of charge at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Portfolio Solutions are geared to shorter timeframes and may differ from our longer-term perspectives. Our actively managed Portfolios are available to Subscribers who Join Here and to Accredited Investors who directly invest in Signals Matter Partners, LP. For further information, click Direct Invest or Book a Meeting with us.