Below we look at stock markets, debt indicators, currency facts, precious metals and portfolio solutions in plain-speak.

In short: You are 1585 words closer to being an informed investor.

Keeping You Selfishly Informed

Tom and I created SignalsMatter.com to offer realistic and out-performing portfolio solutions in the backdrop of extremely unrealistic stock markets.

But rather than just tell investors what to do, we set out to do what most advisors and banks fail to do, namely: Explain what we do.

Why?

It’s simple and selfish. Informed investors make for better clients.

Toward this end, we are once again condensing reams of data and years of market experience into a simple report which will make all of you, well: Super informed.

Modern Stock Markets–Everything Begins with a Four-Letter Word: Debt

Debt is what makes today’s horse-crap stock markets go round.

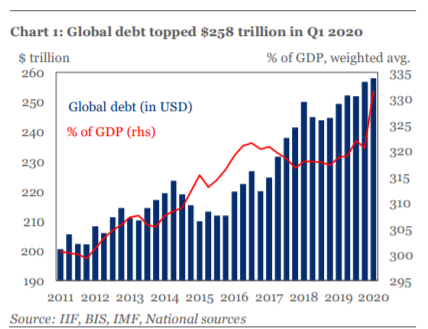

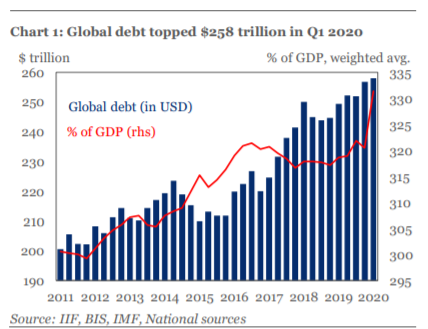

As of this writing, global debt is now at a staggering $260 trillion—that’s a tall pile of debt-crap:

Tanking GDP Is What Makes the World Go Crazy

In healthy and sane economies and stock markets, productivity, rather than debt, is what makes the world go round.

Unfortunately, global GDP is at embarrassing historical lows, hovering at the $88 trillion level, which means global debt exceeds global income by a ratio of 3 to 1.

Given such low GDP (i.e. productivity), governments have no choice but to borrow—i.e. issue more national “IOU’s” (aka sovereign bonds) to keep economies afloat.

This, of course, makes governments a bit, well desperate, which leads to behavior that is a bit, well: CRAZY.

Given the debt tidal wave of government IOU’s (bonds) being issued, there are simply not enough buyers to absorb the amount of debt washing over us.

That’s a problem.

Replacing Natural Markets with Artificial Demand

In sane, free-market economies driven by natural forces of supply and demand, any gross over-supply of bonds would go un-loved and un-bought.

This would force natural recessions and natural re-calibrations of excessive debt and spending.

That is, economies and stock markets who partied on too much debt would get the butt-kicking they deserved.

Recessions and declines in stock markets would serve as urgent and necessary reminders to focus on sound productivity and growth initiatives.

Such moments of brief yet honest pain are the hallmarks of true capitalism, which died years ago.

After all, what better way to learn, than from one’s mistakes? Mistakes are human, good and invaluable when heeded.

Unfortunately, modern stock markets, economies and policy makers hide from (rather than heed) their obvious mistakes.

Policy makers and economic leadership in the current environment lack such candor, accountability and free-market respect.

Instead, politicians historically respect one primary objective—namely the need to get or stay elected, not the profile in courage to put facts ahead of self-interest, be it red, blue or other.

Profiles in Faking It

Thus, rather than take the time to grasp and even confess basic economic lessons openly and clearly, most policy makers whistle past the debt graveyard and promise more good times ahead, all of which can be temporarily provided by—you guessed it: More debt.

Thus, to prolong a dangerous façade of successes, governments issue more and more of those infamous IOU’s to keep their so-called “recovery” and emotionally-satisfying (and vote-grabbing) stock markets going.

And if there aren’t enough real and natural buyers for those bonds/IOU’s, well there’s a simple policy solution…

The Magical Money Maker

That is, each nation’s central bank can literally create trillions out of thin air to purchase those otherwise un-wanted debt instruments—effectively borrowing from themselves with fake money.

Abra-cadabra!

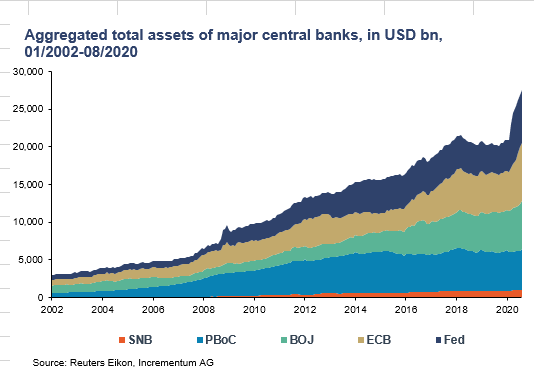

This explains why central banks around the world are creating fiat currencies faster than a policy-maker can fib on T.V.

As of 2020, there’s over $30 trillion of fiat currencies on the balance sheets of the major central banks, from Australia to Washington, Tokyo to Brussels.

Given all this printed money to buy otherwise un-loved bonds, what we now have is an artificially supported bond market driven by artificial demand paid for with artificial money created by global central banks.

Sound absurd? Too good to be true? Almost comical? The opposite of capitalism?

Yep.

It’s All About Yields and Rates—So Learn How They Work!

This artificial demand, in turn, pushes bond prices un-naturally higher.

And as bond prices rise, bond yields fall, because bond price and yield move in inverse directions.

Folks: this is a critical concept to understand. Memorize it.

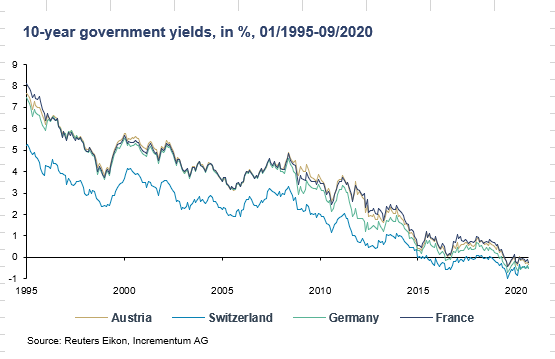

The staggering level of artificial price support for bonds from central banks has gotten so totally out of control in recent years that bonds have risen so high in price their yields have reached lows never seen before in the entire history of capital markets.

Read that last line again.

This, folks, is appalling—or just plain stupid. What we are now seeing are negative yields around the globe. Just look for yourself, for I swear I can’t make this crap up:

Why is this important?

Simple: bond yields determine interest rates. If yields are low, rates are low. It’s just that simple.

And why are low interest rates important?

Equally simple: Interest rates represent the cost of debt.

And if the cost of debt is stapled to the floor, debt levels sky-rocket, which brings us back to the first chart….

How Low Yields and Rates Support Otherwise Weak Stock Markets

Governments, of course, are not the only one’s addicted to low-rate debt binges.

Companies are as well, and are now equally addicted to cheap debt ($11 trillion here in the US) to cover-up their otherwise ignored profits and earnings losses.

This is what I call “putting lipstick on a pig.” Or what spies call a covert-op…

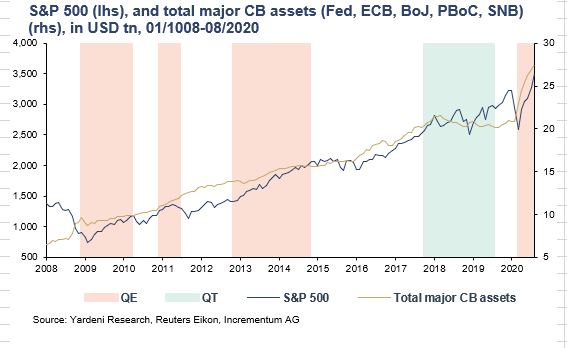

Today, we can plainly see a direct correlation between extreme central bank support (i.e. printed fiat currencies and low rates) and the simultaneous inflation/rise in the stock market:

In short, if folks wonder why we haven’t seen “inflation” in the real economy despite such massive levels of artificial money creation, it’s plain to see where the real inflation went—straight into grotesquely over-valued stock markets.

This gross and destructive policy over-reach by market-focused central banks to boost stock markets via low-rate debt explains the equally disgraceful disconnect between the real economy (tanking) and the stock markets (rising).

Fun Until the Party Ends

Of course, such disconnects and central bank support are not a sustainable solution.

Yes, markets will and can continue to melt-upwards on the artificial tailwind of central bank support, but the law of diminishing returns indicates that this artificial support will slowly lose its Viagra-like effect going forward.

Furthermore, rates stapled to the floor rise to the sky when real inflation returns, for reasons discussed here and elsewhere.

Stated more simply, markets and risk assets—from real estate to bonds—are poised for an inevitable and dramatic day of reckoning when yields and interest rise.

That’s when the party in the stock markets ends and the hangover now on Main Street leads to an equal hangover on the stock markets, which this video explains.

Dying Currencies—The Most Ignored Reality in the World

In the meantime, of course, global currencies are already suffering the effects of such artificial money creation and central bank support as the stock markets continue their drunken party of debt and unlimited money creation.

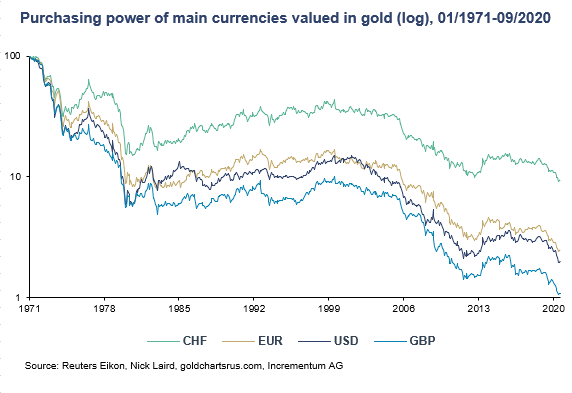

The pundits love to talk about the rising dollar etc., but wheat is deliberately overlooked is that the relative strength of one currency vis-à-vis another currency is largely irrelevant.

Instead, what really matters is the inherent purchasing power of one’s currency, be it the dollar, the yen, the euro etc.

Such paper money is not backed by any real collateral and is effectively, well…a worthless relic.

What is not a worthless relic, however, is gold (sorry Mr. Buffet)—history’s timeless currency.

I’ve written about gold manifold times, but the bottom-line reality is that gold, unlike paper money, holds its value.

Speculators wrongly focus on the price of gold or the strength of gold.

But the ironic truth is not that gold is getting stronger, but rather, that every major currency in the world is getting weaker.

In case you still don’t want to see or believe this, simply point your eyes at the chart below and the obvious (and lengthy) decline in currency power when measured against gold:

Summing It Up

So, there you have it folks: The global economy and markets in a nutshell—or 5 nutshells.

The chain of cause and effect between debt, central banks, bond yields, interest rates, market bubbles and currency-devaluation are inter-linked and openly alarming once you simply know where to look.

The 5 charts above confirm this with facts not “Matt-think.”

The above graphs, as well as our best-selling book, Rigged to Fail, make the complex simple by keeping investors out of the fog of media gibberish and sell-side hype.

Instead, we point our clients toward the light-house of crystal-clear facts and forces like those graphed for you above.

Why?

Again: Because all investors deserve candor, not fantasy.

The blunt market risks which the foregoing facts point towards are equally clear to informed investors.

Fortunately, We Offer Solutions Rather Than Just Describe Problems

As always, we seek to not only simplify the obvious problems we face, but more importantly, to offer equally obvious solutions.

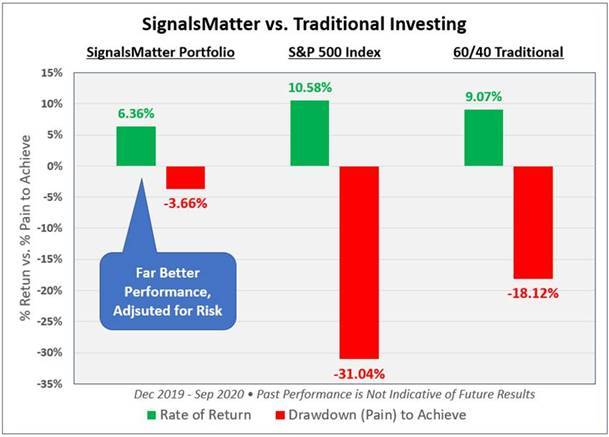

Our portfolio service, explained in detail here, keeps investors safe and profitable despite the above warnings/indicators.

Remember: money is made in the stock markets by not losing money in the stock markets.

In other words, money is made by managing risk, not chasing artificial tops.

As easy as this is, it’s not simple to do.

Successful portfolio management is both an art and science, but the results are smooth returns which avoid losses regardless of market conditions:

Hint: Green is good. Red is bad. Lot’s of red is really, really bad.

We hate red.

We look forward to serving realistic investors, and invite you, as always, to join us here, where information rather than hype, hope or hucksters drives our performance.

Have a great weekend.

I’ve got horsies to ride and horse-crap to muck 😉

Matt & Tom

P.S, Happy Birthday Graziella –pour toujours, de toujours…