Below we look at the foreboding implications behind Elon Musk’s recent tweet to take his cash-burning Tesla enterprise private and what that says about the broader market in general.

Truth Matters

It’s rare when a headline makes me wince. In a world where opinions, spin, and journalistic bravado (from the post-modernist “relativism” of the far-left to the sanctimonious certainty of the neocon far-right) have essentially replaced facts, it’s hard to find one’s compass bearings in everything from politics to markets.

When yesterday’s WSJ headlined Elon Musk’s recent tweet (the modern-day canon of mediocre communication, attention spans and eloquence) to take TESLA private, I literally swore out loud.

Then Tesla’s stock rose by 11%…

Why? A single tweet.

The next day, it fell.

Why?

Reality stepped in for a minute.

Musings…

Sometimes hypocrisy and dishonesty are so blatantly clear you can just feel it in your core, and like a rotten piece of food, your body intuitively rejects it.

Musk’s alleged “decision” to consider taking Tesla private (with “financing secured”) in order to avoid what he described as the disruptive volatility of market forces (i.e. short-sellers), is such a disingenuous pile of horse-droppings that it compelled me to pen this admittedly lengthy blog.

And what I wish to share below is not only an economic musing on the metaphorical dishonesty and distortion of Tesla and the broader markets in general, but also as a reminder to us all that objective truth (including balance sheets, cash flow and LBO requirements) still matters in an era (and market) of increasing “truth decay.”

Michiku Kakutani recently wrote of the “Death of Truth” in the contexts of politics, media, and culture.

Whatever your politics may be, her literary, historical, and philosophical approach to this theme is indisputably sound and equally applicable to our world of market assessments.

Anyone who reads her latest work cannot deny the seriousness of her concerns and the broader importance, of, well: truth.

But these paragraphs are not intended to be a book review. What matters here, as in Kakutani’s pages, is that truth matters.

We need it like water, yet find ourselves increasingly thirsty for it in everything from personal relationships and personal politics to personal finance.

None of us, of course, are perfect. We all drift from truth at some points in life. But if we are accountable, wise and decent, we eventually learn that without truth, there is no happiness, no authentic progress, connection or meaning to anything we do. Full stop.

And as for our current markets, truth—namely objective facts, data and figures—are essential to authentic investing.

But today, objective facts are woefully ignored as markets and tickers move northward on tweets, adjectives, declarations and headlines more often rather than upon realty—i.e. profits, sound management and natural supply and demand.

Of course, I’ve written about distortions in markets and the seemingly insane disregard today for common sense in everything from the share-prices of Facebook, Netflix and Amazon to the bond bubble, CAPE index, CPI and Ex-Items accounting to the pure insanity of the Federal Reserve.

But today, if I had to sum up what’s wrong in the current “everything bubble” of debt-driven crazy markets, I feel like the contemporary example of Tesla—and its impending doom—is the ultimate metaphor for the absurdity (and “truth-lessness”) of our post-08 market “recovery.”

In other words: let’s look at TESLA…

TESLA

Interestingly enough, my very first blog for Signals Matter, “Investing Under the Influence,” written back in May of 2017, was dedicated to this stock. It bothered me then, and bothers me even more today.

Why?

Because Tesla, and its mercurial founder, Elon Musk, is a screaming homage to form over substance, spin over facts, debt over profits, words over math and lies over truth.

I also feel that the massive rise–and inevitably massive fall—of Tesla mirrors the rise and equally inevitable fall of the broader markets in general.

And to bring this point home, let’s move from words to numbers. In short, let’s do the math, because at least in math, we can all agree that 2 + 2 still equals 4, right?

First: The Hype

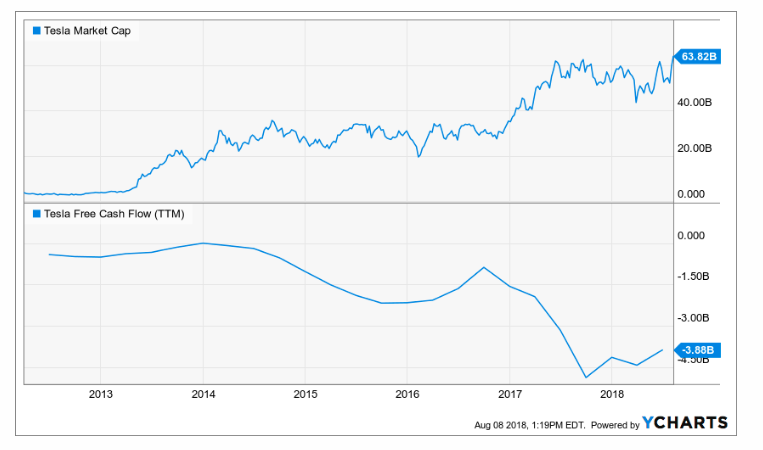

In the last six years, Tesla’s market cap has skyrocketed by 8X from $3.5B to a whopping $63B.

Such stock-price growth intuitively implies that its mysteriously brilliant founder embodies a new breed of creative-thinking genius, spawned by millennial élan and courage to revolutionize—and eventually even conquer–the massive and intricately nuanced, $2T/year global auto market.

That, and Elon is helping the world turn “greener” with his unique battery-powered vision to make the world a cleaner place—i.e. “great again” …

Indeed, Tesla, it has been headlined over and over again, will do for cars what the IPhone did for telecom.

With such astronomical market cap growth, Tesla is also widely presumed to be selling cars like water to desert-dwellers.

Productivity, after all, must be amazing with such a share-price climb. And with every earnings call, its founder—some mythic combination of Henry Ford and Howard Hughes—keeps promising/forecasting more and more “growth” and “productivity.”

And with every promise, announcement, tweet, magazine cover shot and hope-selling forecast from the banks that underwrite, trade or sell Tesla securities, investors keep buying and buying shares, all excited about the “story” that is Tesla.

Indeed, never has so much Kool Aide been consumed by such a wide swath of eager speculators and momentum traders.

The Math

There’s hype. There’s market cap. And then there’s math. Here at Signals Matter, we have a thing for math…

And here’s some math we’d like to share. As Tesla’s stock price was soaring, it’s cash-burn has been a staggering $11B. And since Q2 of 2012, the company consumed an additional $10B in debt, with a burn rate that has increased consecutively, quarter after quarter after quarter.

Stated more simply: instead of producing and selling automobiles to justify record share prices, Tesla has done little more than borrow and burn.

Its free cash flow is in the negative to the tune of billions, and yet its market cap keeps heading north…

A picture, of course, is often worth a thousand words. To let this sink in, I recommend you take a long gander at the following picture, which compares Tesla’s cash-flow (tanking) to its market cap (sky-rocketing):

There once was a time when facts—you know, pesky little things like profits and free cash flow–mattered.

In that logical era, stocks rose because their exceptional management, productivity, debt-levels and sales mirrored their equally exceptional market caps.

But as the graph above plainly reveals, today facts have almost nothing to do with investing…

And what about that other pesky little fact of math that investors once relied upon to reward companies with their investable dollars—do you remember gross margins?

Once upon a time, investors who traded on facts rather than hype, used to measure a manufacturer’s growth, sales and productivity by an equally growing metric known as gross margins—i.e. the spread between revenues and the cost of goods.

After all, if Tesla was actually reaching critical mass in productivity, one would normally assume its gross margins were rising as Tesla’s sales grew from $2B/year to $14B/year.

Instead, the company’s gross margins since 2014 have dropped dramatically from 26% to 14%–meaning its costs have been rising and revenues have been slipping while its stock price has been ripping north.

This is just silly folks. And I ask you this: Do you need an MBA from a fancy school to see how dangerous this TESLA hype really is?

In sum: The Tesla myth is precisely that—a myth.

And as for productivity… Well, all I can say is, “what productivity?”

For years, Mr. Musk has been declaring that Tesla is building critical mass in production capacity, a meme which he oft repeats to justify the company’s long-term prospects and short-term debt obligations as Tesla marches forward to take its rightful place in the global auto market.

But here’s the rub: not one word of this is true.

Tesla’s financial statements (for those who bother/ed to read balance sheets rather than headlines) makes it factually obvious that Tesla is not even close to growing toward that funny little thing called “profitability.”

In fact, Tesla (and Mr. Musk) have utterly failed to achieve anything even close to volume production on its Model 3 (rhyming ironically with the much nobler story of Ford’s Model T).

I can’t even imagine what the under-sung executives at “dinosaurs” like Toyota, GM, VW, BMW and Honda must be thinking as Musk pockets personal billions and they get ignored by the momentum traders.

The great auto makers have been perfecting productivity (and even electronic cars/hybrids) for decades, yet there are no magazine cover shots or sky-rocketing market caps for them…

As I wrote in May of 2017:

“Tesla loses more than $4,000 on every car it sells, and burns through more than $350M per quarter, yet trades higher than Ford while selling only 50,000 cars a year against Ford’s 9 million+/year. Meanwhile, Tesla blows through debt and FCF faster than a frat-boy can crush a Coors Light.”

As the great car makers of Detroit, Tokyo and Bavaria silently plod forward doing what they do quite well, the arrogant Musk “superman” has been selling tickets to the moon (Space Exploration Technologies Corp) while scrambling like a JV-player (wearing a fake Varsity jacket) to grossly under-produce his hand-built vanity cars beneath a make-shift production tent.

Do readers also realize that there are now over 17,000 Tesla vehicles still awaiting completion, re-work and delivery in Tesla’s inflated storage lots which will not be in saleable condition to meet Elon’s Q3 profitability promises?

So, what does Mr. Musk have to say about that? Well, to be honest: he just invents fancy phrases to sneak around facts.

For example, Musk recently announced that these broken cars were in fact “factory gated” to meet productivity targets. The market loved this phrase, and the stock price rose.

Unfortunately, “factory gated” is just a term Musk pulled out of his tail-pipe…It literally means nothing.

So again, I ask: Do any of these facts matter anymore? Has truth left the building/markets? Have promises, invented words, and spoken projections replaced actual profits, gross margins, production levels, PE multiples, debt-levels and balance sheet facts?

For the last six years, the answer given by most investors has been an embarrassing (albeit profitable) “yes.”

The Great Con: Taking Tesla Private?

But even the hype-smothered facts as outlined above did not bother me as much as the recent twist/tweet in the Tesla myth/story.

As I mentioned at the onset, yesterday’s WSJ headline had me swearing out loud. What finally pushed my temper into the red?

The simple answer is market experience.

As someone who has analyzed companies and traded the same for years (including the pre-08 era of Enron, AIG and the infamous dot.com mania of 2000), I could see right through the guise of Mr. Musk’s dishonesty (and the TESLA myth) like a dentist sees a cavity.

The Hype

First, of course, it all began with Elon’s cryptic Tuesday tweet: “Am considering taking Tesla private at $420. Funding secured.”

For veteran investors who know balance sheets, there are so many things wrong with this transparently misleading, desperate and disingenuous tweet that it’s hard to know where to begin…

First, there’s Elon’s nauseating, and absolutely absurd justification for the proposed pivot from public to private, namely that doing so would protect him and his company from the “wild swings in our stock price that can be a major distraction for everyone working at Tesla.”

He further whined on about how going private would take away the short-sellers’ “incentive to attack” his poor little enterprise.

Has this man lost his mind?

That very same “public market” that so “distracts” and “attacks” him today is responsible for pocketing him billions of dollars in personal wealth during the “good times” (i.e. the hype period since Tesla went public in 2010).

Poor little Elon. The times are changing.

The same public market that drank his Kool Aide post 2010 is actually starting to question—at long last—the fact that his company has crappy cash flow.

That means the markets are supposed to do what all fair market participants accept: punish (i.e. “attack’) losers—in other words: SHORT TESLA.

Unfortunately, Mr. Musk thinks shorting (or has he puts it: “attacking”) negative cash-flowing enterprises like Tesla is unfair…Does he not know what a stock market is?

Elon, here’s a reminder: shorting Tesla is not only fair—it’s entirely over-due and for billions and billions of reasons: completely justified.

And he knows it.

He knows the cash flow is not rising; he knows that even his “factory gated” production achievements are dishonest at worst and unsustainable at best; he knows his debt levels are extreme and profits embarrassing; he knows that eventually the myth will end and the same market that went “long” to make him a hero, will go “short” and reveal him for the goat he really is.

In such a scenario, rats leave sinking ships—or in Elon’s desperate case—rats “go private” before the short-sellers can catch him.

Stated otherwise, Mr. Musk knows his company, which is heading toward Chapter 11 rather than the acme of the auto industry, is a lie.

And his tweet is no less so.

Why the Tweet is, well… a Lie

Let’s turn, once again to math rather than tweets in this brave new world where facts mean less than glorified text messages. Let’s look mathematically at Elon’s proposed privatization escape.

Elon’s tweet references a few, shall we say, “exaggerations.”

First, he says he’s considering taking Tesla private “at $420.”

Ok folks, that means to proffer Tesla up at $420 a share, a private “buyer” is gonna need to cough up $81B ($71B for the stock and $10B for the debt)) to buy a negative cash-flowing lemon, which, btw, would be the greatest LBO in history (for one of the biggest lemons in history).

But as ol Forest Gump reminds us, stupid is as stupid does, and maybe there really are buyers in this new world of hype-over-facts stupid enough to bite/buy this lemon, which is now more of “brand” than a company.

Keep in mind, that Tesla’s debt component is protected by a change-of-control put clause that means the debt buyer would have to pay for Tesla’s bonds at 101% of par.

In other words, the buyer would have to pay a premium for the debt of a company that in my mind is little more than a junk bond.

Crazy.

But for those of you who trade bonds, perhaps you also noticed that the bond market didn’t take the bait this time…After the infamous tweet, Tesla’s debt was under water at 91%, not the needed 101%…

Stated otherwise, the bond jockeys aren’t buying the Tesla mule…

And for those of you who are otherwise unfamiliar with what a levered-buy-out, or “LBO,” involves in order to buy Tesla in the private sector, such transactions require a small percentage of equity and then the help of a lender to “lever” (borrow) the remaining money to close the purchase.

I’m scratching my head to think of any lender under the Sun stupid enough to lend to any Tesla buyer at a $420 per share valuation. But no worries. Mr. Musk has already promised: “Funding secured.”

But as Kakutani might say: “that’s probably just not true.”

After all, bankers who do LBO’s typically look to lend against companies with large and predictable cash flows. Tesla, as we factually know, doesn’t “flow” any cash at all.

Instead: it burns cash.

And another foreboding FYI: the biggest LBO ever done was with Energy Future Holdings Corp on the eve of the 08-market crash for $32B—which is far less than ½ the size of Elon’s fantasy tweet.

And guess what happened to the buyers of that record-breaking LBO? Seven years later, the Texas utility filed for bankruptcy. Prophetic.

Just saying…

My Take on Tesla’s Future

So, what do I think? Based on common sense and math (rather than tea leaves or Tarot cards), I bluntly feel that Musk’s absurd privatization tweet has rendered Tesla an epic disaster waiting to happen.

This LBO simply can’t be financed by any lender with even a modicum of an IQ or a breathing pulse rate.

Instead, and as per his usual practice, Musk’s tweet is little more than another lame attempt to use words rather than facts to fog the fact that he is not going to meet his otherwise promised obligation in the July earnings call to make Tesla profitable in Q3 and Q4.

And in a culture and market where lies and excuses (i.e. Musk’s wimpy declaration that “distracting” and “attacking” short-sellers are picking on him) are used to hide failures and accountability for a company in the red, this, sadly, is nothing new.

Furthermore, for Tesla to actually embark on such a complex, $81B (!!!!) LBO (assuming there’s a lender dumb enough to underwrite it), the company would have to file an 8-K with the SEC, and lawyers will then be crawling all over Tesla’s financial statements, which will give an entirely new meaning to opening “Pandora’s Box.”

At which—or some—point, Elon’s pledge to make Tesla cash-flow positive will be seen for what it is: hype –like the company itself.

Thereafter, Tesla’s $60+B market cap will get the short-sale spanking of a lifetime (and me the biggest short trade I’ve known since 2001).

Why? Because the facts and the math are clear: Tesla is a debt-driven, sham bubble with no productivity and supported primarily by the thin air of hype, and promised rather than actual growth.

Tesla as Metaphor

If we pause to re-read that last assessment, perhaps it may sound eerily familiar?

“A debt-driven, sham bubble with no productivity and supported primarily by the thin air of hype, and promised rather than actual growth.”

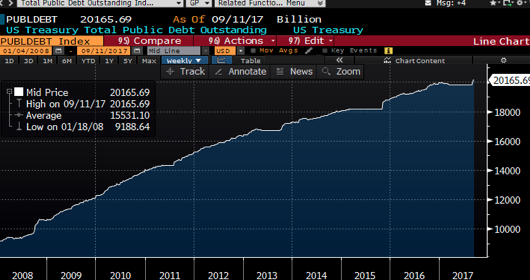

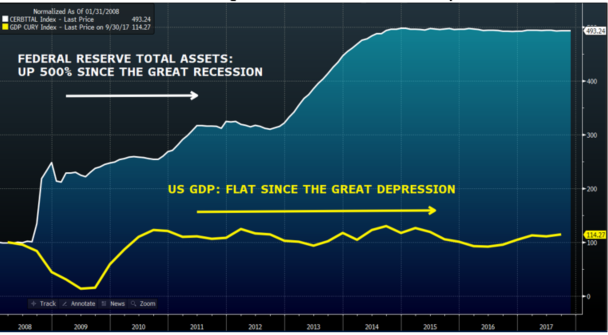

One look at the US debt market, the promised “fantasy-growth” out of DC and Wall Street, and actual flat-lined GDP growth (despite trillions in central bank support), and we see that the current over-all market bubble/” recovery” is really nothing more than a Tesla waiting to happen…

Again, a picture is worth a thousand words:

“A debt driven …”

“Sham bubble…”

“With no productivity…”

Look familiar? Rising prices? Massive debt? And no productivity (GDP)?

Like Tesla, US and global markets are running on borrowed time and hope—not facts. Gosh, even this month’s cover of Fortune Magazine (“The End is Near”) is finally catching on…

How It All Ends?

How long before it all ends? And what keeps markets from falling?

Well, we are effectively dealing with many of the very same forces that kept Tesla unfairly above water for longer than it deserves: hype vs facts.

Today’s crazy markets are grotesquely (nearly of 70% of their volume) supported by trend-following (rather than truth following) momentum trades passing through ETFs, CTA funds, indexed mutual funds and other passive strategies whose volume and size rise slowly but surely in hype cycles and then fall like bricks when reality kicks in.

For years, the power of these momentum and hope/hype/greed-based trends have been punishing otherwise logical short-sellers because these waves of passive inflows have made stock prices (like Tesla, Amazon, Facebook and hundreds of lesser known lemons) surge to unprecedented and unearned extremes.

The simple fact, as we see it from our screens and math here at Signals Matter, is that Wall Street is infected with momentum stocks rising on little more than thin air.

At some point (and we are watching the flows, not the blogs or headlines), such fast money infusions and trend-following fantasies will push securities to an unsustainable high.

But how high can they go before they run out of oxygen?

Our Recession Watch is the best (though by no means perfect) tool we know in the industry to gauge these highs and prepare for the suffocating lows to come.

And at some point—at some signal–when the broad market crash finally arrives, names like Tesla will fall like rocks into a deep ocean.

And I’ll be shorting the H.-E.-Double-Touthpicks out of em.

In the interim, be careful out there—and stick to facts not words, numbers not spin.

Great discussion, and I completely agree with you. It is not whether it will happen, the question is when.

Steve