In the surreal backdrop of Fed-doped markets rising against the currents of an official 2020 recession, a once hidden yet rigged-to-fail financial system (of which we’ve been warning for years) is now getting harder to disguise, despite almost astounding levels of double-speak from the Fed “leadership.”

Watching Jay Powell dodge questions yesterday about the now undeniable wealth disparity in the US as stocks literally enjoy a bubble within a recession was almost too painful to watch, if it were not otherwise so comical.

Powell repeatedly voiced concern for the “economy,” despite every savvy Wall Street veteran’s secret knowledge that the Fed serves the markets, not Main Street.

The market’s recent “rise” (Fed steroid boost) in the now-declared 2020 Recession is evidence enough of this. Clearly, the Fed’s priority is the markets, which, since Greenspan’s reign, it has consistently confused with the economy.

But as explained so many times: The stock market is not the economy.

Tom and I can assure you that any experienced finance veteran has known of this rigged game between the Fed and the market. It has been playing for years, not just weeks or months.

And as we’ve also written for years, such a rigged system is understandably hard to see or define for those outside of this intentional opaque system, and even harder to kill, as the market’s rise despite the 2020 recession thus far confirms.

To make this secret plain to all, we authored the Amazon No#1 New Release, Rigged to Fail, essentially letting this cat out of its Gucci bag.

As we warned there and elsewhere, markets and stocks doped by free debt and unlimited money creation from the Fed can live long past their natural expiration dates.

Just ask the current (bailed-out) executives at Whiting Petroleum in the 2020 recession.

Again, such “accommodation” is not capitalism, but it IS the centralized world (and market) in which we find ourselves, and it will, one day, fail.

Although inevitable, waiting for a Fed-driven market as bogus as a 42nd Street Rolex to fail will try our patience and yours, even in the midst of the 2020 recession.

In simple speak: It’s hard to fight a dishonest Fed and fat money printer.

Bottoms-Up…

That’s why I’ve consistently suggested that the first signs of rot in our rigged market system would likely start from the bottom-up, rather than from the top-down.

In other words, while Wall Street drinks from a Fed punch bowl, the real economy (ignored by the Eccles Building for years) will continue to simply rot (and riot) from the bottom up.

The 2020 recession is proof of this as well.

I warned of this grass-roots pain (and 2020 recession) over a year ago in the following video, here.

While Wall Street Enjoys the Party, Main Street Rots from the Bottom Up

Hall-Passes for the Anti-Heroes

Fortunately for the bobble-head media and chronically dishonest Fed, the recent riots across the US, London, and Paris can be publicly ascribed to racial tensions, rather than rightfully credited to the deeply-rooted economic pain caused by years of central bank folly.

Furthermore, the tanking Q1 markets can all be blamed on a health pandemic rather than the decade+ viral debt infection within our financial system.

How convenient.

But look deeper.

One doesn’t need a tinfoil hat or a conspiracy bend to see past the media noise and face certain and ever-evolving economic facts.

Facing Facts—The Virus “Saved” an Unworthy Wall Street

The first fact, of course, is that long before the Coronavirus emerged, the global financial system was fundamentally rigged and broken, as we argued in 2019 here and of which we reminded our readers again in 2020, here.

When the Fed lost control of the repo markets in September of 2019, the media and Fed spokesmen sought to downplay what was otherwise a glaring warning sign that our cash-dry debt markets were about to blow apart.

Equally obvious to us then was this simple fact: Unless massive amounts of “liquidity” (i.e. trillions more in printed money) were quickly printed, the credit system would come to a screeching halt.

Of course, anyone who works outside of the financial sector would understandably not see such warnings.

However, for those who know how the game is played, the warning signs last September were as easy to see as a cavity to a dentist, even if the outbreak of a global virus was not.

Hence our September warning.

Then, of course, came the virus.

And after the virus, came the controversial lockdown.

And after the lockdown came the lop-sided “emergency measures”—the vast majority of which went straight to the bond markets, not Main Street.

To date, even more Fed support of this cancerous bond market is in play, from junk bonds to ETFs and now to corporate debt being monetized via the Fed.

No shocker there. Let the Powell steroids flow into our heroic bond market…

Does Main Street Care About Fed ETF Purchases?

For those in the real economy who lost their jobs in the last 3 months of the 2020 recession, do they really care that ETF’s are getting another free bailout from the Fed, along with the executives at Vanguard and Blackrock?

In other words, it doesn’t take a great stretch of deductive reasoning to realize how the COVID crisis was the perfect opportunity (and pretext) to sneak in a massive and unprecedented market bailout—just in the nick of time.

As I wrote in May, COVID-19 literally saved the global financial markets.

In this odd 2020 recession, the ironies just abound…Rather than blame themselves for such grotesque “steroid use,” the Fed can act like heroes in a health crisis.

But as I argued over a year ago, the facts tell otherwise—these are not heroes, they are anti-heroes hiding in plain site.

More Hard Facts—Economic Lives Matter Too

As to fact number two, it doesn’t take a degree in history, psychology, sociology or even economics to realize that the recent race riots across the country and EU were just as much about economic frustration, and an indefinable loss of faith in the “heroic experts,” as it was about the senseless police murder in Minnesota.

That event was a match that ignited a far deeper and wider set of frustrations.

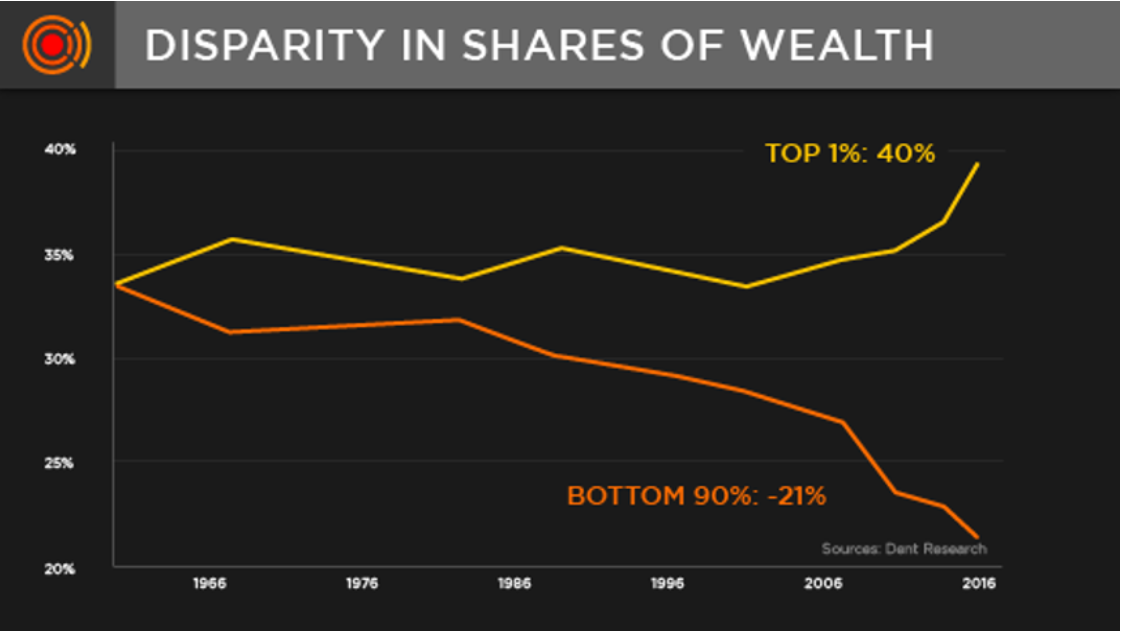

A wide range of boiling points have been brewing in the Main Streets of this nation for years, no doubt related to the following graph of the staggering gap between the “haves” and “have-nots,” a gap which is directly tied to years of a pro-Wall Street, central-bank policy focus.

In other words, a 2020 recession, emboldened by racial and political divisions, are now colliding at once.

For Tom and me, however, we will focus only upon the economic forces at play, as politics is not our focus.

The Fed’s idea, that bailing out the banks and markets would “trickle-down” to the middle class, is now an open and obvious head-fake, as that same dying middle class is now taking to the streets.

Why?

In part, this is because, in addition to being outraged by a headline police murder, millions of citizens are broke, stressed, and teetering on (or already experiencing) job-losses, and are in debt up to their ears.

Again, and as warned, the Fed can temporarily boost a rigged stock market, but it can’t print jobs, accountability, or honesty.

Those folks marching, rioting or just wringing their hands may not know who to point the finger (or rock) at, nor may they fully grasp how the financial and political game is played between Wall Street and DC, but they do know this much: They’ve been played.

Hence the outrage. Hence the social unrest. And for our purposes, hence the growing market uncertainty and market volatility.

Hard Times, Smart Portfolios

Here at Signals Matter, we neither romanticize nor demonize the angry crowds.

As in all crowds and mass movements, they are replete with visionaries and blind ignorance, the inspired and the merely angry. In London, a statue of Gandhi was vandalized? Crowds can be foolish…

But we’re not here to name names or talk political leanings.

We can simply confirm that the Fed’s lopsided and long-standing support for markets over Main Street, together with the rising political distrust from the neglected masses, is a telling (as well as leading) indicator of a financial system increasingly rotting from the inside.

This embarrassing and total disconnect between a tanking economy and a near-record high stock market is an insult to common sense, hard-working citizens, natural market forces, and financial Fed sobriety/leadership.

More to the point, such a disconnect serves as a source of economic uncertainty, which breeds market volatility.

Navigating portfolios in this blender of central bank manipulation, tanking economic signals, policy hypocrisy, angry mobs, and double-talking Fed governors is anything but simple.

At Signals Matter, however, we make the complex simple by tracking the market’s signals, not the media’s horse-crap.

To see the market, investment signals, and safe portfolios we share, day-after-day, with our happy (and safe) subscribers, please sign up here.

To learn more about subscribing to www.SignalsMatter.com, let’s schedule a call, or meet on Zoom. Just call 844-545-5050 to arrange. We’re both here to take any questions you may have.

Sincerely,

Matt & Tom