In this latest report, we look at the dangers behind the fall of Deutsche Bank, flattening yield curves, and the many other detailed cracks beneath the melting ice of a global system overheating in debt.

Very soon, we’ll be sharing a critically important report on precisely why and how the U.S. markets are rigged to fail.

The supporting evidence that we will present is based on data, not opinion.

Does this mean these rigged markets will crash tomorrow? That investors should run for the hills, buy guns and rice, and hug their knees?

Not at all.

Yes, the Fed-driven markets are rigged to fail, but we also know that for the near-term, they won’t go down without a fight – and you don’t want to fight the Fed right now, as they still have a little bit of monetary punch left.

Markets can climb even higher before the jig is up and they tank – all at once like the Hindenburg, or slow and steady, like the Titanic.

Either way, the game ends badly for both the economy and the markets…The fall of Deutsche Bank is but one of many signs of the slow decay and danger ahead.

The Fed Still Has Some Punch

Any number of triggers can send markets down – from a crisis in Australia to a failing bank in Germany (discussed below).

We’ll look at these and other potential triggers here and in the coming weeks.

But for now, the Fed can continue to cram down rates and thus encourage debt, which is the last desperate measure of every failed market and economy from the Romans to the French.

As you already know, the Fed has sadly become the key market factor in the post-’08 “recovery.” Like it or not, our stock market has now morphed into a central bank driven market.

By the way, that’s not free market capitalism.

Back in 2010, the Fed promised that the “emergency measure” money printing (QE1) and zero-rate “punch bowl” policy would end that year.

Well, they lied. Of course, it didn’t end at all. QE2-4 and Operation Twist followed over the next five years.

And as of today, over a decade since the 2008 Crisis, the Fed is still driving the markets by keeping (and sending) rates to historical lows as debt levels surpass historical highs.

That’s a very powerful punch bowl…

And such historically high debt leads to historically confirmed economic disasters. Every time. Period.

In a rigged game, the best that central banks can do now is postpone the disaster, not prevent it.

Investors must therefore prepare intelligently for the inevitable without losing their perspective or site of the opportunities that come from being realistic and informed rather than duped or dreamy.

Without such Fed support, our markets and economy would have naturally crashed long ago. In fact, there was no natural “recovery” at all after 2008.

Instead, the rigged markets simply survived on Fed support (i.e., more and more QE and rate suppression “debt punch”).

Unnatural Monetary Support and the Art of Can-Kicking

As recently as 2017, the markets were ripe for a fall, but tax cuts gave them a temporary boost.

Meanwhile, U.S. debt continued to rise as tax revenues fell, thereby adding more dynamite to the ticking debt timebomb beneath our markets.

By late 2018, the Fed gingerly and nervously tried to prepare for this debt explosion by slowly reducing its balance sheet (“monetary tightening“) and raising rates in tiny increments.

They did this so that they would have some dry powder to use in the next major recession.

But as we all know, the Fed’s attempts to raise rates and reduce its balance sheet immediately sent markets into a Q4 tailspin that would have fallen to a full-on disaster had the Fed not immediately intervened early in 2019 to stop the bleeding by pausing further rate hikes and thus keeping the debt “steroids” flowing.

Now, rates will go lower, not higher, which means the Fed will have very few magical steroids left when the next recession comes.

They are literally running out of tools in their own rigged game.

Gold, Treasuries, and the Yield Curve Indicate Investors Are Losing Faith

The world, however, is catching on.

Despite central bank support here and around the globe, more folks are turning to gold and other currency hedges. They are slowly seeing that this rigged game can’t last, and thus gold has just passed its $1,360 line of resistance.

Also, the additional rush to U.S. Treasury bonds (safety) has gotten so serious that yields on the 10-year U.S. Treasury don’t even beat current inflation. This is further (and sad) evidence of a rigged game running out of tricks.

Meanwhile, the yield curve is flattening, as long-term rates are little better than short-term rates. The only way to “fix” this dangerously flat curve is for the Fed to artificially lower rates toward zero to negative.

Again, more evidence of a rigged game.

This too is crazy, and a classic precursor/sign of a pending recession.

In short, the Fed, which helped stage this rigged game, has, in turn, rigged itself into a corner. The ironies do abound…

With rates falling in the U.S., global and domestic investors are increasingly aware the Fed is running out of cards to play.

Relative Strength Is All We Have Left

But in the near-term, even our pathetically low Treasury yields are still better than anything available in Europe or Asia. Thus, global money will flow here and keep our Titanic markets afloat a bit longer – likely well into 2020.

Think about it, folks: In Germany, the yield on its 10-year bonds is negative… Where else can security investors go but to the U.S. markets?

But Germany in particular and Europe in general have more pressing concerns, including the disastrous decline of its 149-year-old national behemoth, Deutsche Bank. So let’s look at the fall of Deutsche Bank.

Warning Signs: The Fall of Deutsche Bank

Failing banks are something to think about. Remember Bear Sterns? Lehman Brothers? Remember 2008? In short, banks matter.

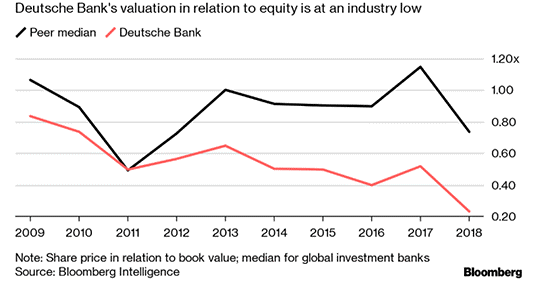

Today, the fall of Deutsche Bank is evident, its stock having fallen by 90% from its pre-Crisis highs.

Loaded to the teeth with bad loans and risky derivative exposure, its stock price has been tanking. Many analysts believe that if its price drops below $6.40, the ultimate fall of Deutsche Bank will come swiftly.

Currently, its beleaguered CEO, Christian Sewing, is making tough cuts to try and keep the ship afloat after a string of failed turn-around attempts, including a recently botched merger with Commerzbank AG, who left him at the altar.

As of today, the fall of Deutsche Bank confirms that is the worst horse in the banking “glue house.”

In 1998, Deutsche Bank bought Bankers Trust, which was contaminated with significant derivatives exposure.

Defenders of this risky acquisition said not to worry, because derivatives contracts have counter-parties.

But what if the very “counter-party” that is Deutsche Bank itself goes down? What happens when the fall of Deutsche Bank impacts this market?

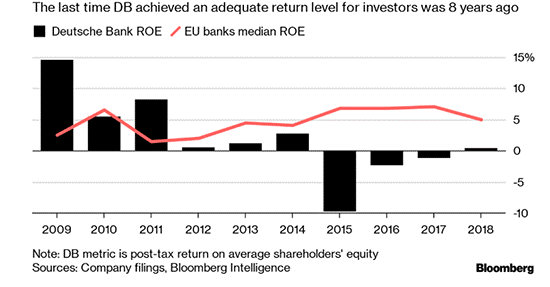

Its track record for misconduct and lax risk controls (and even televised police raids in Frankfurt) have raised genuine doubts about its viability. Profits there are all but a distant memory:

The fall of Deutsche Bank would send “Lehman-like” shock waves through the global financial markets and prompt some version of another ECB bailout.

Unlike 2008, however, folks around the world are getting tired of bailing out banks. In other words, that ship has sailed (sunk?).

If Deutsche Bank hits an iceberg, the fall of Deutsche Bank could make the Lehman crisis feel like a tugboat collision by comparison.

Keep in mind as well that 90% of today’s trading is done by algorithms (i.e. computers), not humans. If the fall of Deutsche Bank and a bank failure in Germany sets off a red button sell signal, the “terminators” that essentially trade global stocks will be meaner than any Schwarzenegger character…

How it Ends? Fast or Slow?

Hemmingway famously described poverty as something that starts slowly and then happens all at once.

Will the same be true of U.S. and global markets? Will we have a singular “Lehman Moment” or will we simply experience a slow “frog boil” of increasing decline once markets can no longer be rigged up by increasingly less credible central banks or fantasy (debt) solutions like modern monetary theory (MMT)?

As for U.S. markets, they are already well past their natural expiration date, but in a rigged game, they can continue to climb ahead of other dying markets as the best patient in the global I.C.U.

In the near-term, the U.S. still has a few tricks up its sleeve in this rigged game. We listed a bunch of them here. But let’s list a few more now:

- The U.S. Dollar is the global bully and will rot last – not first. The entire world is tied to U.S. Dollar-denominated debt, and as such demand for our dollars will continue for a while, keeping our heads above inflationary water relative to other smaller nations/currencies. In Essence, the U.S. has weaponized its dollar by 1) forcing the world to use its SWIFT banking/currency system (or face sanctions), and 2) by equally forcing the world (thanks to a Saudi Petro-Dollar agreement in the 70s) to buy oil in U.S. Dollars.These two forces greatly support global demand (and hence strength) for U.S. Dollars.

Thus, if you’re wondering why the U.S. can print trillions of Dollars without seeing “Weimar-like” inflation, part of the answer lies in the power of our highly demanded currency.

Of course, the other part of the answer lies in, well… lies.

As I’ve shown elsewhere, the U.S. simply makes up its own inflation numbers in a rigged con to keep our Dollars and bonds more attractive than they actually are.

- Our bonds may just be lipstick on an inflationary pig, but they are still prettier than everyone else’s.As the rest of the dollar-bullied world represses its currencies to pay dollar-denominated debt, their central banks will continue to suppress rates at home, sending them to zero and below zero across Europe and Asia. Again, investors overseas have no choice but to reach for the minimally better yields found in U.S. Treasuries.

Such demand keeps our yields and rates from spiking, and hence inflation from exploding – for now.

How a Rigged Game Eventually Ends

We’ve listed a number of scenarios/triggers that could send markets crashing here. In addition, we need to consider what could happen if demand for U.S. Dollars and Treasuries slowly dries up?

There are a number of ways this can happen:

- Lost Faith. If another major bank failure (i.e., if the fall of Deutsche Bank) were to occur, subsequent measures by central banks to contain the recklessness of the big banks can easily trigger a global outrage and loss of confidence in central bank support.When faith in central banks dies, the whole riggedmarket system (driven by these banks) dies with it.

- A Dollar Mutiny. Countries like Brazil, Russia, China, and India are increasingly seeking to make unilateral deals in which the currency of choice is not the U.S. Dollar. The trade war with China is only accelerating this trend.If more countries seek non-Dollar trade deals or seek to get off the Petro Dollar train (as only Iraq, Libya, and Iran have dangerously sought to do…) such a trend could weaken the Dollar’s reign. This is very unlikely, however, in the near-term.

- Main Street Rots. Despite our rigged and increasingly inflated stock market, our Main Street economy is empirically rotting away outside of the financial headlines.In addition to declining real wages, increasing debt burdens and record-breaking wealth disparity, the staggering homeless numbers in places like L.A., San Francisco, New York, Portland, Seattle (>50,000 per city), and elsewhere are getting increasingly harder to ignore, as are the tent cities reminiscent of the Great Depression popping up across the country.As our citizens slowly struggle from the bottom up, such economic realities create a slow drag (rather than singular “Lehman-like” event) which eventually leads to populist and political turmoil, which is hard to predict/time but quick to surface, as history confirms.

The Signals Matter Solution

Despite all the undeniable risks facing markets, there are sensible ways to stay ahead of (and beat) a rigged system.

The fundamentals of natural price discovery and normal market cycles left the building years ago. The Fed can print, borrow, and steal for days, months, or even years to come, keeping our markets on steroids that will eventually turn into poison.

But (for now) there’s no point in fighting the Fed or this rigged market.

Instead, informed investors have to walk a careful line of risk management and market opportunity, however distorted that market may be.

At Signals Matter, we know this rigged game, because we hail from the banks, hedge funds and offices that played it.

We therefore created a signals-based (rather than opinion-based) Storm Tracker to gauge the real-time market indicators so that we know how much to tactically invest, and how much to strategically protect.

This means we can trade/invest like bulls in certain sectors despite the otherwise obvious bearish risks facing our markets.

By using the Storm Tracker to also determine cash allocations, we protect risk while hunting down signaled opportunities.

Some may argue that our cash views are too defensive. That we are “missing out.” We fully disagree.

Cash not only reduces risk in these debt-mined markets, but it loads our guns for the best-kept secret to making a fortune in the markets: Buying at the bottom when everyone else has no money to spend.

Nor are we alone in this simple, patient wisdom. Did you know that the biggest allocations currently held by Druckenmiller, Buffet, and many of the biggest family offices and PE players is cash?

That’s because the smart money builds brick houses while the dumb money chases tops from behind straw and mud houses.

But when the big bad debt wolf huffs, puffs, and blows these rigged markets away, those in the straw and mud portfolios get slaughtered.

That’s why we will be introducing our Rigged to Fail report in the coming days, as well as our five-part, All-Weather Portfolio Series, so that YOU will be investing from behind a brick rather than mud portfolio.

So, stay tuned, stay informed, and keep your eyes on the inbox. There’s much, much more to come.

Comments

13 responses to “Deutsche Bank, Punch Bowls, and the Big Bad Wolf”

- Cecil Lawsays:

June 27, 2019

I am blown away with this information

Should I sell everything I own so I can have some cash when it all falls apart

- Carltonsays:

June 27, 2019

Interesting. Tell me more.

- Larry R. Andersonsays:

June 27, 2019

excellent!!!

- Dan Walsh says:

June 27, 2019

Excellent…..

- Franksays:

June 27, 2019

Thanks a bunch. Always great common sense thinking.

- FENNER R WELLER JR.says:

June 27, 2019

You are spot on

- rolandsays:

June 28, 2019

sober and realistic, in short: excellent

- Timsays:

June 28, 2019

What are the Swiss doing about this situation?

- Peter Trydesays:

June 28, 2019

Maybe the trigger that pops the US stock market bubble is not Deutsche Bank but China which shows serious cracks in its economy. For starters, the rate of corporate defaults in China has soared more than 300% in 2018 from 2017 and is still accelerating. According to Bloomberg upto US$500 billion (3.5 trillion yuan) worth of bonds issued by mainland firms are due to mature in 2019. How much of this debt will be in default by the end of the year? Secondly, local governments and provinces have issued $6 trillion of off-the-books debt that was not accounted for in previous financial analyses. To put that in perspective, $6 trillion is equal to almost 30% of the entire U.S. national debt. Thirdly, according to Bloomberg, roughly $600 billion of shares (4.18 trillion yuan) has been pledged as collateral for loans, amounting to 11% of China’s market capitalization. That makes 11% of China’s market susceptible to forced selling should a perfect storm of bad news grip the country. The effects of the trade war on the Chinese economy may be much greater than realized in the West and could lead to a meltdown in Chinese equities and debt markets later in 2019 with repercussions around the world.

- Anthony Gallegossays:

June 28, 2019