Below we look at the Fed, the budget of the Warfare State and the post-08 Wall Street bailout to better understand the growing disconnect between the US stock market and the US economy.

Keeping It Real—A Baller?

The other day, sitting dockside in Marina del Rey among the casually comfortable of Los Angeles, someone I adore quite mistakenly described me as a “baller.”

It made me wince.

With two kids and countless tuition bills behind me, and the mounting medical costs of their irreplaceable mother ahead of me, I hardly feel like a Rockefeller. Thoughts of property taxes, credit cards, legal bills and countless other expenses rang through my mind.

Baller? Hell no…

Then again, traveling between NYC, LA and France in a span of weeks, it equally occurred to me that I do live in a bubble of my own relativism. It’s true that my sense of reality, like many who read blogs on stock markets, may be, well… occasionally, skewed.

That said, I hail from Michigan, which like many fly-over states, has seen better days, and I’ve never once forgotten or neglected the reality of what it’s like to struggle financially.

Two Americas

I also know, as we all know, that there is a massive and growing disconnect between what happens on the S&P and what happens in the daily lives of most Americans—because I am that American, and always will be—even from France or some fancy table in Marina del Rey…

And it got me to thinking of how the United States has slowly turned into two Americas; a land in which a smaller minority has significantly more (in education, housing, opportunity, income, and financial freedom) than a larger majority.

And as one who navigates markets, histories, countries, personalities and economies for part of my living, it got me to thinking of how we became a land that confuses what happens on Wall Street with the reality of our Main Street.

It bothers me. A lot.

Below, I therefore offer some broad answers to that far more complex question.

Wall Street—The Temporary Fantasy Land

For over a decade now, the fantasy continues. No fear, the markets are here! Everything is rosy, at least if you listen to the financial media. And gosh knows the numbers and 10+ years of only rising markets seem to confirm it.

At the September peaks, for example, the S&P (2900+) was blissfully cruising well above its 50-day (by 2%), 200-day (by 6%) and 350-day (by 11%) DMA’s (or “daily moving averages”).

In such cruise-control bliss, it’s hard to worry about America, right?

Well… two trading weeks from its highs, the S&P tanked through those same support levels like a dropped bowling ball, falling, by way of example, 8% below its 50 DMA.

I wrote about how this happened in last week’s blog on October Market Volatility.

I then received a number of comments on how unfair I might otherwise have been to the good work of Trump and the “Trump Bubble.” I was reminded, again, of our low unemployment (3.9%) and how high (4.2%) GDP figures.

America, after all, feels “great again.”

And most assume that even October’s market fall is just another chance to buy a dip and bounce back into fantasy land. I can’t say I blame them. There’s so much distortion in the securities markets today that anything is possible, including more faith-driven market highs to come.

Perhaps the politico’s in DC have a master plan. Perhaps everything will be “great again.”

But I look at market data more than I look at political babble, regardless of who is in the White House. My observations below are about facts, not political bias.

The Main Street Facts

And the fact is, America is hurting, regardless of what the markets (and pundits) are telling you.

As for unemployment and GDP, I’ve written ad nausea as to why this so-called “good news” is just fantasy news.

I won’t go into more detail here—but suffice it to say, GDP is up only temporarily now because for the last two quarters, US exporters have been scurrying like rats on a sinking ship to get products sold before the trade war tariffs kick in.

Notwithstanding this “panic high,” underlying private sector output for the US has actually shrunk, not climbed during this so-called GDP “surge.”

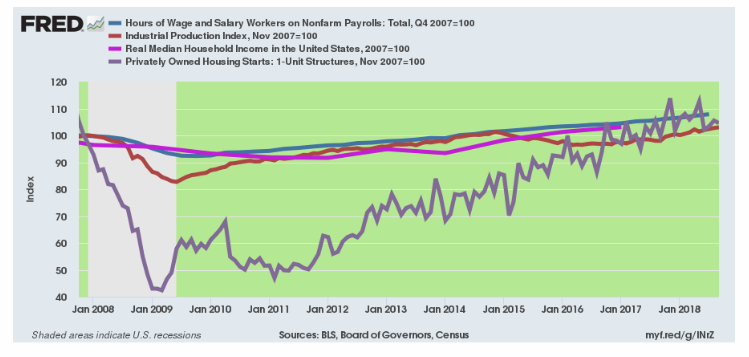

Taking a graph recently highlighted by David Stockman (from my hometown in Michigan), it’s fairly plain to see that, well…nothing is great at all.

In fact, in the last eleven years, the key metrics of the US economy have shown a cumulative (largely flat) gain of only 1%, which is evidence of failure, not “greatness” as to the US Main Street (i.e. real) economy.

The above data shows all too clearly that by the four key historical standards (namely industrial production, total labor hours (which is top-heavy on retail and temp jobs), median household income and single-family housing starts (weak despite the lowest mortgage rates ever) that America may have hit record market highs in September, but its actual economy is sadder than a Nicholas Sparks love story.

What Happened to America?

How the heck did this happen to us? How did the once greatest creditor nation and producing country in the world become the greatest debtor nation with a trade deficit?

How did we get so broke, so slow, and so, well pathetic?

- The Fed

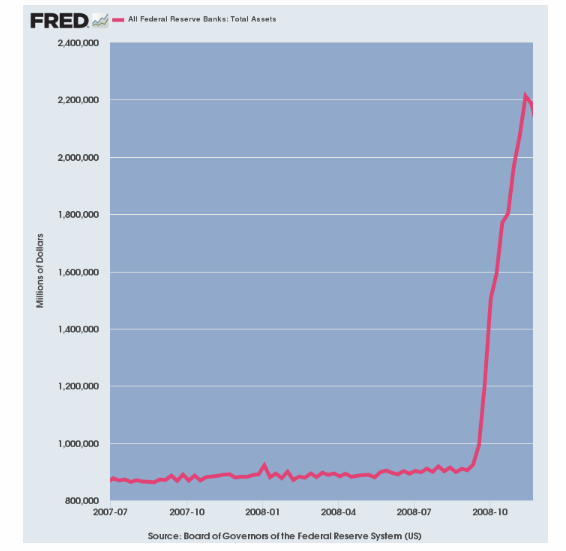

The Fed, of course, is a primary culprit. I’ve certainly written hundreds of pages lambasting that bastion of false prophets…It bought us a fake recovery by every metric, but that’s what printing money like this can do:

Of course, the consequence of post-08 money printing on steroids and 112+ months of artificially low rates (and hence astronomical borrowing, from Wall Street to DC to Main Street) buys lots of time—and a helluva market party:

But markets rising on the tailwind of the world’s greatest debt bubble is just a set-up for the world’s greatest recession.

In short, there’s a lot of rocks just beneath this dangerous market wave.

But let’s look at the two other skunks in America’s economic woodpile, namely: a) our absurd (and massively lobbied) Military/Intelligence Industrial Complex—or The Warfare State– and b) the banking scam (i.e. the Wall Street bailout) we got suckered into in 2008-2009.

- The Warfare State

As for our ONE TRILLION-dollar annual military waste/budget, forgive me if I’m fairly convinced that Jihadists are no threat to invading the US coastline anytime soon.

Even the soldiers I know (and I know many) are scratching their heads as to just what threat Syria, Yemen, Iran, Iraq or Afghanistan actually pose to US security.

And if it’s revenge for 9-11 that answers this question, then by the passports magically found in the rubble of flights 11 and 77, we should be occupying our corrupt (and monarchist) ally Saudi Arabia rather than Northern Syria.

But as I’ve written elsewhere, war is good for markets. Unfortunately, there’s much more to it than that, but this is a financial blog, and so I’ll keep my other intel points to my own spooky self…

For now, let me at least ask you to consider Eisenhower’s 1961 warning to keep these military hawks at bay. Since the days of Bill Clinton to today, the same names of the leading 50 national security officials (many of whom carry dual passports…) are giving the same advice, regardless of who’s in the Oval Office.

With folks like Haspel, Bolton, Mattis and Pompeo in the President’s ear, you can be sure that our increasingly skeptical soldiers (committing suicide at a rate of 21 per day) will be roaming that distant set of sandboxes for years and trillions of dollars to come.

Today, in inflation adjusted dollars, we are spending 70% more per year in the endless war on terror than we did fighting the cold war with the Soviets. And more aircraft carriers and F-16’s today won’t stop lone actors and dirty bombs any more than a cannon ball can take out a mosquito at 50 yards.

National security is important, but not the way we are flexing imperial muscle (we act more like Cornwallis’s Imperial England than George Washington’s ideal America) and not at the spending levels we’ve allowed to pass as normal.

Iran, whose military budget annualized at $15B, and Russia’s, which annualizes at $55B, are no threat to life in Cleveland or San Fran, and China wouldn’t last an economic month if we sank her export ships in the South China Sea.

In short, we don’t need to spend $1T per year to feel safe. Full stop.

Unfortunately, the K-street lobbyists, militant think-tanks, NGO’s and C-suit fat-cats from Raytheon to Boeing have more to say than you or I do when it comes to the warfare state spending agenda (waste)…

- The Wall Street Industrial Complex

Speaking of waste…

In September of 2009, in the weeks after our wonderful banks got caught swimming naked in the low tide of sub-prime ABS exposure and credit-default-swaps that had no credit, Hank Paulson and Ben Bernanke, crying the “end is near” scared the DC yes-sayers into bailing out (rather than letting fry) an entire cadre of wayward banks (Citi, Morgan Stanley, Goldman, Merrill Lynch, Washington Mutual, Wachovia et al).

In a matter of weeks, the Fed took its balance sheet from $800B to $2.4T, doing more damage to its balance sheet in 94 days than it had done in the previous 94 years of its entire existence.

And then, year, after year, after year…the Fed kept printing money and the banks got richer as the securities markets skyrocketed into recession-pending bubbles who will one day soon do what all bubble do: “pop.”

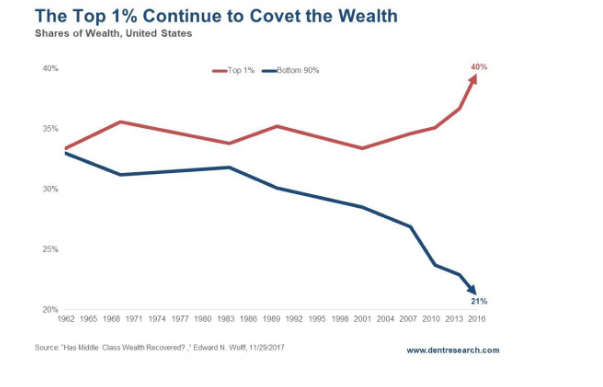

Meanwhile, the top 1% (who hold 40% of household net worth) got richer, and the bottom 90% (who hold only 20% of household net worth) got poorer.

The following image may help this fact sink in:

At the same time, fly-over/Main Street America got the short end of the Wall Street bailout stick.

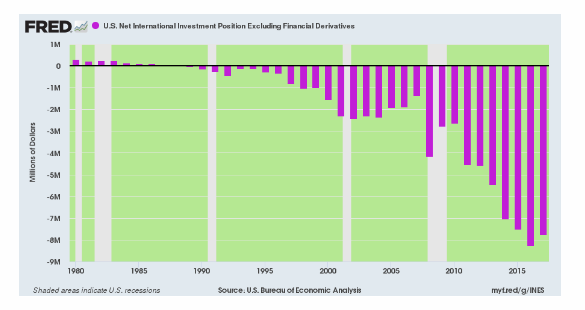

This is because US corporate executives (high on an artificially stimulated/Fed-created market bubble) focused more on share-price-driven compensation than US job-creation. As such, they continued outsourcing jobs and manufacturing to cheaper, over-seas zip codes (think China…).

We can make political hay all day long blaming China for exporting more goods than we do, but we only have ourselves to blame for sending our own manufacturing and labor capacity into their far cheaper backyard.

As the graph below makes abundantly clear, we did this to ourselves. Each of the sinking bars highlighted here represents the sickening levels of productivity migration from the US to places outside our shores.

Still think the raging US securities market has anything to do with the Main Street and the US economy? Still think an endless war on terror and bailing out the banks has made America great again?

All we have to show for Post-08 America is a market bubble—and that won’t last, for as arrogant as the Fed has been, they can’t outlaw market forces and recessionary cycles. They can’t prevent the bond wave from eventually drowning our markets.

Instead, they can simply buy time and debt in the way a binge drinker buys more martini’s—hoping/pretending to postpone the hangover which deep down, we all know can’t be done.

Folks, be careful out there. Don’t binge on these markets.