MMT, or “Modern Monetary Theory, is in vogue because desperation out of DC is reaching new highs. Below we deconstruct the fantasy embedded into the insane logic behind MMT–i.e. print money without pain. Too good to be true? Yep.

30shares

Desperate times call for desperate ideas, so it’s no surprise that MMT (Modern Monetary Theory) is getting increasing attention from the far left, the media bubbleheads, and a deeply divided and desperate America.

MMT: Money-Printing Heaven

In a nutshell, MMT is a heavenly new theory for dealing with the hellish fact that the U.S., like just about every other country on the globe, is in debt up to its ears, despite years of markets rising on QE “experimentation.”

MMT’s core idea is that any nation that prints its own currency can technically never go broke, and thus a country like the U.S. has a lot more room for deficit spending than normally thought – so long as interest rates and inflation stay low.

Ahhh. How perfectly wonderful! How simple! How obvious! Just print more money and spend with impunity, for if America should ever need more cash, it can just print it! Abracadabra, the magical solution for any debt-soaked superpower.

Student loan debt? No problem – just print away! Military spending? No problem – just print away! Opioid crisis costs? No problem – just print away! Failing roads and infrastructure crisis? No problem – just print away! Markets start to fall? No problem – just print away!

You get the drift: As per MMT, any national cost or debt can be magically resolved by simply printing more money and ignoring inflation because according to MMT proponents, inflation (conveniently) never goes up.

Pure Fantasy, Few Facts

Well, if MMT sounds a bit like fantasy, that’s because it is. But as we’ll soon discover, there’s nothing “modern” at all about MMT. In fact, the French tried it years ago. Net result? Well, about 40,000 heads literally rolled right off their shoulders.

But just in case you worry I’m being too smug or dismissive about the magical popularity of fantasy MMT, let’s get to the numbers and facts. After all, everyone is entitled to their own opinions – but not their own facts.

Once reminded of these facts, it’s easier to see why desperate ideas like MMT take hold as economies stall despite topping (and rigged) stock market spin.

Fact Number One: America Is Sitting upon the Greatest Debt Pile in Its History

The raw numbers speak for themselves. With a debt-to-GDP ratio now beyond 100% and a combined corporate, private, and household debt level of $272 trillion, the U.S. has reached a record-breaking level of absolute crazy.

And with annualized GDP flatlining at 2.4%, there’s simply no way to pay for this debt. Hence the desperate call for MMT – i.e. more money printing.

Fact Number Two: The So-Called “No-Inflation” Precondition for MMT Is a Myth

In the wake of the great financial crisis of 2008, Washington and the Fed bailed out the very banks and market villains that caused the crisis, printing nearly $4 trillion in fiat dollars with no apparent “inflationary effect.”

But as I’ve empirically shown in my free report on The Great Inflation Lie, actual rather than reported inflation in the U.S. is closer to 10%, not the reported 2.2% – a fact that those of us who pay bills already know anyway.

In other words, there was an inflationary “effect,” but we’ve just been conned by D.C. for over a decade to believe otherwise.

Fact Number Three: Fed-Rigged Markets Are Rising at the Expense of a Falling Middle Class

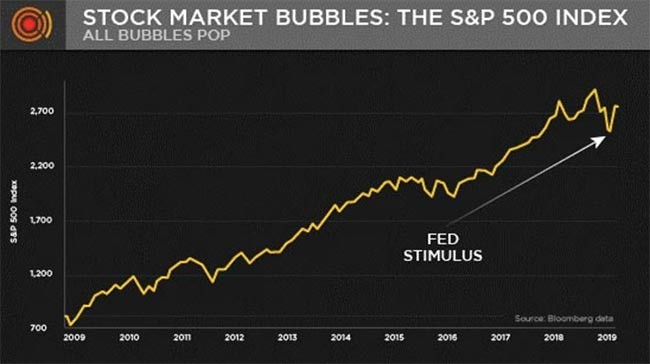

But if you want to know where this mysteriously “absent” inflation really went, one look at the grotesquely inflated S&P or Dow – up over 300% since 2008 – says it all.

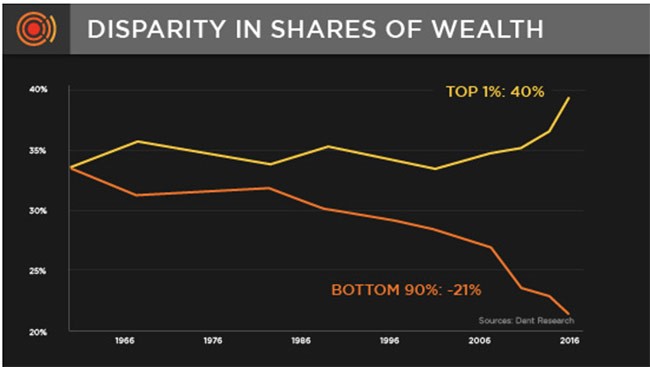

Unfortunately, most Americans don’t own the majority of stock market assets – only an exclusive percentage do.

As a result, the post-2008 “recovery” merely made the top 1-10% of America richer and the bottom 90% poorer.

Wealth disparity in America today is the highest on record and is frankly a national embarrassment in search of desperate, fantasy “solutions” like MMT.

Fact Number Four: Populist Tensions Are Rising Alongside Political Fantasy

As for the bitter reality of the dying U.S. Main Street against a skyrocketing Wall Street, I’ve written extensively of the facts behind this sad reality here at Signals Matter.

There’s no denying that America is rotting from the bottom up while Wall Street (and the markets) continue to rise on drunken, beer-goggle euphoria, compliments of a market now entirely supported by a low-rate bar tab set by the U.S. Fed.

Such wealth disparity, Main Street pain, and Fed-supported markets can certainly stir frustrations. Many Americans of all political stripes are genuinely, well… pissed off.

Such anger creates a perfect vacuum for smooth talkers and easy solutions, red or blue – including absolute fantasies like MMT.

Trump at one extreme and folks like Bernie Sanders and Alexandria Ocasio-Cortez (nickname AOC) on the other are rallying support by tapping into these frustrations and promising miracles.

On the right, we’re seeing exaggerated White House tweets of growth (despite deficits). On the left, we’re seeing Congressional Instagram posts of “tax the rich” rants.

History, unfortunately, confirms that neither of these fantasy solutions (i.e. debt-based “growth” or “hang the rich” tax measures) can solve a systemic debt crisis. Once debt levels like ours cross a critical Rubicon point of no return, a recession and market crisis are mathematically inevitable.

Nevertheless, such fantasies and personalities create political hype, and hype at the very least can buy time, as markets can often survive on hype far past their natural expiration dates.

Fact Number Five: All Debt Bubbles End in Economic Disaster

I’ve shown in many prior posts how both math and history confirm that every nation that gets over its skis in debt must eventually face recessionary pain and declining markets. Full stop. Period.

There’s just no such thing as a “free ride.” Unless, of course, you are peddling the MMT myth, which is the theoretical equivalent of a free ride.

Again, according to MMT and adherents like progressive Congresswoman Alexandria Ocasio-Cortez, who has floated increased deficit spending, a government can spend money without raising taxes by simply creating new money to pay its otherwise unpayable bills.

Abracadabra.

Of course, the key to the success of such a fantasy MMT solution is the assumption that no inflation ever results from increasing the money supply, an assumption that effectively defies every basic tenant of the very definition of inflation – namely, a rise in prices driven by rising money supply.

Ah, but who needs such pesky facts? MMT fans say there’s no need to worry about inflation tomorrow simply because there was such low inflation yesterday, a line of reasoning akin to saying it can’t rain tomorrow if the sun was out yesterday.

You really can’t make this stuff up.

Yet despite even such preschool-level logic, MMT’s reliance on a no-inflation backdrop is already dead on arrival because inflation, as any informed investor knows, is already much higher than the rate being reported by the fiction writers in D.C.

In sum, MMT is premised upon what is openly and mathematically proven to be a myth: It’s based on fantasy and sustained by lies.

How Did We Get This Desperate?

Let’s just pause and ask ourselves how any country could actually think it could just print money without consequence to solve a debt crisis?

I mean, if it were really that simple, why not just have every citizen in the country send their bills to Washington and have them paid in full by the state in one grand, magnificent gesture of sublime money printing?

The answer is simple – such fantastical money printing can buy time, but it can’t prevent fatal levels of inflation. Again, just ask the French.

Buying Time…

Nevertheless, and despite the French example, today’s currency markets in general, and the rise of the relative strength of the U.S. Dollar in particular, are much different in 2019 than in 1790 France.

The reason countries like the U.S. have “no inflation,” while others like Venezuela have fatal inflation, is simple: The U.S. Dollar (like the Euro and Yen) is rightly perceived as a relatively stronger currency. Banks hold a great deal of it, and thus its inflationary effect (measured by a fancy term called the “velocity of money”) has been muted for years.

Meanwhile, debt-soaked nations like the U.S. have run out of options. Over the years, we’ve reduced taxes and increased spending. We’ve deployed massive quantitiative easing – but still no reported inflation and wage increases.

Though we have recently seen more teamwork between the federal government and the Federal Reserve, they have only a few options left in their quiver. If the Fed raises rates, the market tanks. If D.C. increases taxes, elections are lost. Sadly, the baton is thus handed off from the central bank to the government in the form of politically driven MMT.

It’s sick, it’s sad, and it’s not going to work.

The So-Called “Experts”

Yet even former PIMCO economists like Paul McCulley and popular Congresswomen like Alexandria Ocasio-Cortez (who won a national biology prize in high school) still feel qualified to speak of MMT’s economic merits.

They argue that low inflation gives the U.S. an open ticket to keep printing money. As McCulley recently observed, “Last time I checked, the U.S. has missed its inflation target for 10 years running, of which seven or eight were at zero interest rates… let’s look at reality here.”

Mr. McCulley, the one clearly missing reality (and inflation facts) is YOU. May I suggest you read a math-based look at actual inflation here?

As for Cortez, I respect her climb from poverty, her part-time work as a waitress, and her legitimate disgust with the wealth inequality and the national embarrassment of our dying and ignored middle class.

Like Cortez, I come from humble origins and worked humble jobs to pay tuition. But unlike Cortez, I studied history and economics and traded in the markets for clients rather than promising fantasies in exchange for votes.

And like Cortez and McCulley (or even PIMCO’s other famous alum, Bill Gross), I recognize that when reported inflation is low (or dishonest) and yields are stapled to the floor (for now), one can at least “theoretically” argue that a nation can print money and go into further debt without much immediate pain.

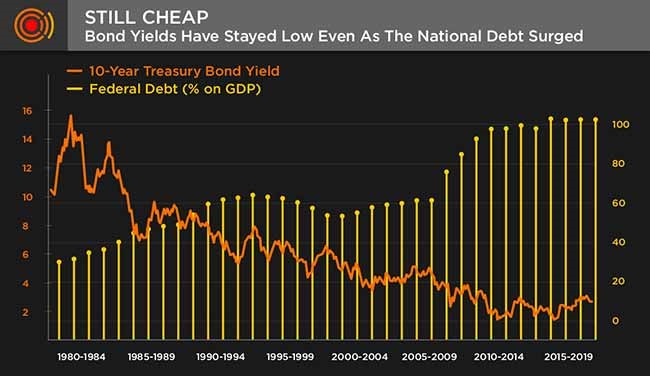

Indeed, right now the $15.6 trillion U.S. Treasury market seems to be as “fantasy struck” about massive debt levels in practice as the MMT enthusiasts are in principle.

Think about Japan

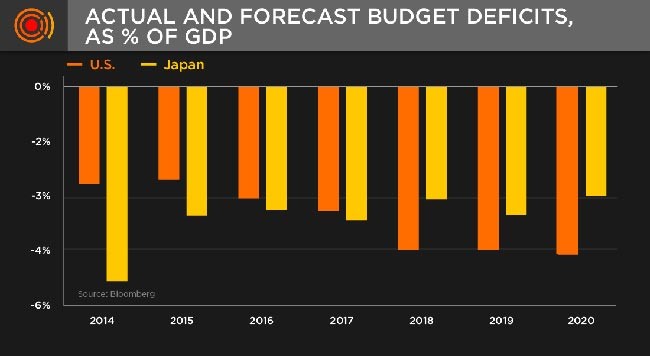

And as we’ve seen in Japan, a country can literally send its debt levels to the moon if it forces interest rates (i.e. the cost of that debt) to the floor and lies about inflation.

Bill Gross even says he admires what Japan has done to revive its economy. The former bond king, once a vocal critic of post-crisis money printing, now sounds like a near-convert to MMT. Gross suggests the U.S. government could even double its deficit.

But calling Japan a success story is like calling Lance Armstrong a clean athlete. Mr. Gross, please read my report on the real Japan…

But as debt-soaked crazy as Japan is, the U.S. is about to get even crazier, with current and projected debt levels reaching the highest in history…

Despite such insane debt levels, “experts” like Cortez (who know as much about markets as Dr. Seuss does about open-heart surgery) will tell you not to worry. Deficits don’t matter, they smile – because inflation doesn’t exist and rates only go down, never up. Again: Think Fantasy Island.

Unfortunately, however, my other reports on market history confirm that debt cycles always (i.e. every time) end painfully. Even if the Fed continues to lie about inflation and keeps rates low, the U.S. can still go into a low-rate recession that ends in a rising-rate death spiral.

Perhaps the MMT pundits can simply print all the money in the universe and buy every bond in circulation to keep rates down and solve the problem? But to do that without stimulating fatal inflation (and hence rising rates) is the equivalent of thinking one can drink 20 martinis without a hangover…

And so, like Berkshire Hathaway’s Mr. Buffett or even BlackRock’s CEO, Larry Fink, I’ll call MMT what it really is: garbage.

As Fink recently (and correctly) said in a Bloomberg interview: “I’m a big believer that deficits do matter. I’m a big believer that deficits are going to be driving interest rates much higher and it could drive them to an unsustainable level.”

But for now, at least in the current fantasy era of cheap money (already into its second decade) in the developed countries of the world, there’s been plenty of borrowing – primarily from governments – and thus plenty of fantasy fun and faith in fantasy solutions.

In this backdrop of fantastical money printing and debt can-kicking, sober facts like history, math, and debt are ignored in favor of inflated markets dangerously close to topping as politicos of every stripe (and bond traders who’ve made billions during a credit bubble) peddle spin rather than honesty.

Here at Signals Matter, however, we stick to facts, numbers, and blunt speech. We’ll be tracking the markets in real time (as well as in factual context) so that readers will know how to navigate their portfolios through this fog of fantasy with a lighthouse of factual reality.

In the interim, and as always: Stay informed, honor your common sense, and stick to the facts – not fantasy. Yes, more money printing may just postpone a natural crash, but it can’t prevent one. We are here to track how such theories and reality play out in real time.

Stay tuned!