There’s much talk these days about a future with no more interest-rate hikes and, thus, a world that will never see a recession and inflation-at least not in the U.S.

Good news, eh? A recession and inflation -free tomorrow is indeed a warm thought.

Santa Claus is also a warm thought, but how many of you still believe in him?

But given the spin coming out of D.C. and Wall Street these days, it’s getting easier to re-think just about everything, including magical elves and Rudolph the Red-Nosed Reindeer.

Remember Rudolph? How his nose would light up “red” every time he told a lie?

Well, there’s a lot of red-nosed “Rudolphs” coming at us today.

Recently, Larry Kudlow, our President’s Chief Economic Advisor, announced that he doesn’t think rates will rise in the foreseeable future.

In fact, “maybe never again in my lifetime,” said Kudlow.

Wow.

But banks like Goldman Sachs aren’t all too concerned. They recently announced that the “goalposts for the next rate hike have shifted and could move even further… making a rate hike later this year quite unlikely.”

For now, I actually agree with my friends at Goldman. But if you know a thing or two about politicians or bankers, you would also agree that they have very hard time keeping their noses from turning, well… red.

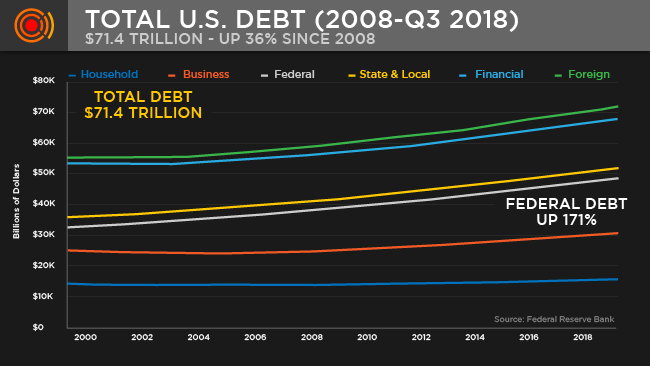

After all, bankers and politicos love a low-rate universe, because it allows the economy and markets to borrow like drunken frat boys and build up historically unprecedented debt levels like this:

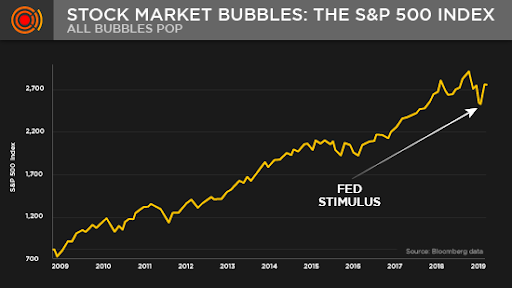

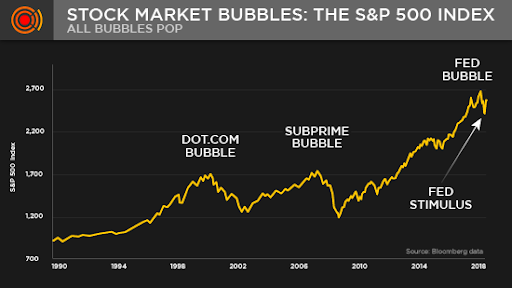

Such debt allows companies to buy backs stocks, borrow for dividend payments and hence push the stock market up like this:

Then again, banks like Goldman don’t like flat rates on the long-end of the curve as they make their money by lending long at higher rates, but those rates aren’t high enough to make banks money. I expect financial stocks to suffer by year end as we head toward flattening yield curves which steepen before the uh-oh moment comes.

Politicians (and journalists) then universally (and uniformly) confuse a rising stock market with a rising “economy,” but as our Special PDF Reports and Unemployment Lie Report make painfully (and mathematically) clear-our Main Street economy is in the gutter, rather than “growing.”

But such objective truths are bad for election campaigns and banker bonuses. Hence, such truths are pushed aside, replaced instead with positive spin and daily memes of hope.

Meanwhile, this spin continues to push investors and markets further into an increasingly risky yet indeed bullish market. After all, if rates are low, the drunken debt party at the S&P and DOW will continue. Markets will rise.

The Inflation Lie Beneath the Spin

And why are rates so “low”? The Fed and banks tell us it’s due to low inflation. But as we’ve also shown in our special Inflation Report that too is another pure fiction.

As Paul Volker keeps repeating, and as our math keeps proving, the current and never-ending “no-inflation” story is 100% false.

But even if you don’t read our report or want to take Volker’s word for it, ask yourself this: Every time you see your own costs of medical care, rent, transportation or education soaring to the moon, do you still think inflation-i.e. the costs of goods and services-is low?

The Fed thinks so. In fact, they use this low inflation story as the main reason for keeping rates stapled to the floor. They know that even a modest rate hike will kill the markets.

Thus, the folks in DC and Wall Street insist that the Fed needs to keep rates low until it hits a “target inflation rate of 2%.” Day after day, the Fed says it’s worried that there is “not enough” inflation. What the Fed is really worried about is a tanking stock market.

Again, we’ve already proven that this “low inflation fear” is objectively and mathematically untrue. Inflation is closer to 10%, not 2%. Again, just see our Inflation Report.

But even if one believes the Fed’s very own “target inflation” excuse, then one should also notice that the Fed has already “hit” that “target” rate long ago.

Even using the Fed’s own (and totally bogus) inflation scale (the CPI), the US been at an average inflation rate of 2.01% since mid-2016.

In short, the “target” is already way behind us. In other words, even the Fed’s “target inflation” excuse is an open lie that no one sees right under the Fed’s flashing-red nose. Recession and inflation reporting is just plain “rigged.”

A Clueless Media

Meanwhile, the main stream media, which is driven by journalists who’ve never sat at a trading desk or took more than a semester of economics, keep getting themselves, and thus you, confused about a recession and inflation.

Neil Irwin of the New York Times, for example, recently published a piece in which he observed that the Fed has “fewer arrows in its quiver to protect the economy from normal ups and downs.”

This part, in fact, is actually true. The Fed’s primary tool for helping the US in the next recession is to lower rates, but with rates already so low (2.4%), the Fed has almost nothing left to lower-unless it goes into negative rates.

But if you read further, Irwin is critical of the Fed’s for all the wrong reasons.

He appears generally perplexed as to why the Fed is in the low rate emergency mode despite “a decade of economic growth and amid an unemployment rate as low as it has been in decades.”

Irwin, evidently, has not read our free report on the Unemployment Lie for if he took a few minutes to examine facts rather than the feed-back loop of his own newspaper and profession, he’d know that the decade of “low unemployment” that he is referring to is a pure myth.

As for his other aspect of bewilderment, namely why rates could be so low despite “a decade of economic growth,” I’d ask him again to get his facts (as well as his market IQ) straight.

Irwin’s “decade of economic growth,” overlooks a myriad of obvious red flags, including a US GDP that annualized at a pathetically weak rate of 2.24% since 2008 and a global economy riddled by economic disasters in Italy, Venezuela, Turkey, Argentina and nearly about to send even Germany (and the EU) one decimal point away from recession.

You see, Neil Irwin, like the near entirety of his “media group-thinkers” has confused a rising US stock market with an “economic growth” meme.

But then, almost by accident, Irwin ironically (and rightly) notes that the Fed is facing a “credibility gap.”

Sadly, Irwin gets this right, but, again, for all the wrong reasons. That is, Irwin is upset that the Fed’s credibility is at stake “due to its inability to reach its inflation goal.”

Oh my gosh…What drivel. As noted, above that “inflation goal,” even as mis-reported as it is, was reached a long time ago.

Irwin then quotes Jerome Powell’s reaction to missing its otherwise dishonest inflation goal, wherein Powell merely says the Fed needs to do some more “creative thinking.”

“Creative thinking”?

Folks, the Fed has done nothing but “creative thinking” for years-namely creatively thinking of inflation lies to justify a low-rate interest policy that sustains our so-called “recovery” on nothing more than cheap debt.

Irwin then loses all credibility himself when he closes his article with the observation that maybe the Fed will have to raise rates “because of potential financial bubbles.”

Potential bubbles Mr. Irwin? Are you daft?

Would you call a bond market that is nearly 60% junk-bond/” high-yield” and levered loans or a stock market that looks like this a potential bubble? Folks, that’s a real bubble.

Folks, you can turn to the New York Times and their ilk for sports and lifestyle articles, as well as other biased headlines about global events and political opinions, but if you want to know the truth about markets, please get your facts elsewhere.

Blunt Speak Rather than Spin-The Truth Behind the Current “No-Inflation” Scam

Signals Matter was created to give blunt data about recession and inflation risks, not merely opinion or the bewildered half-insights from journalists who know very little about markets and market forces, let alone the reality of a recession and inflation.

We at Signals Matter are traders, investors and long-time market veterans who cut our teeth in the very banks, hedge funds and trading desks who know how the sausage is really made.

And if you want to know the blunt truth as to why inflation is falsely reported, it’s as simple as it is disturbing:

The entire “no-inflation” scam is just a ton of media smoke and mirrors designed to hide the Fed’s singular attempt to keep the massive bubbles it has fostered on Wall Street alive by any means, lie or excuse necessary.

Does the Truth Even Matter When Fighting the Fed?

Ok. So now we know a little more about the dishonesty and tricks the Fed and its support-team of banks on Wall Street use to keep dangerously over-valued markets from tanking.

In short, we know this consortium of bankers, Fed officials and politicos are just spin-sellers, hardly any better than the “dirty cops” of US finance.

Such insights might and should anger you. But what else can you do? Fight a dirty cop? Fight the Fed?

That’s a fight most will lose. Just because we know the data coming at us from the Fed, DC and the Wall Street media is mostly “creative thinking,” we can’t deny that this information-even misinformation-nevertheless makes markets go up.

Can the Fed Outlaw Recessions?

That’s why many are wondering if this “dirty cop” Fed can effectively “outlaw” a future recession and inflation?

In a recent interview published by CNBC, venture capitalist Chamath Palihapitiy raised this exact question.

His observations reveal a genuine candor and respect for facts often missing from the media bubbleheads and prompt-readers.

Specifically, Chamath has no illusions about how the Fed has completely destroyed normal market price discovery and hence normal recessionary forces. As he said:

“We have completely taken away the toolkit of how normal economies should work when we started with QE. I mean, the odds that there’s a recession anymore in any Western country of the world is almost next to impossible now, save a complete financial externality that we can’t forecast.”

Alas, Chamath is postulating that the Fed, much like the post 1989 Bank of Japan, can simply print and borrow the US into a zombie-like perma-state of no more recessions. As he further noted:

“Central bankers have lost all intestinal fortitude to actually put a country through a recession, because [a recession] is actually regenerative and useful.”

Chamath also recognizes the political pressure behind such schemes. He said: “Even if they [the Fed] had the wherewithal to do it [i.e. raise rates], the political infrastructure will just completely absorb that intent. So, we are probably not, save of something crazy, going to see massive, massive negative growth except in countries that are so fundamentally crippled that they tip over.”

Based on such “dirty cop” distortions, Chamath essentially foresees an America that will likely grow in single digits every year, and that US equities will benefit as the best house in an otherwise bad global neighborhood.

As a man who made his fortune in tech, Chamath obviously recommends fast growing tech stocks as one way to trade this “new, dishonest normal.”

Like Irwin, Chamath sees rates going lower, rather than higher in the near term-as the Fed focusses on the aim of “getting inflation to more consistently average 2%,” noting as well that inflation “has been consistently below that level for years.”

In this way, even Chamath is still ignorant about the inflation lie. Nevertheless, his point about a future US that never sees a recession and inflation is a valid one.

Lessons from the Ocean

Here at Signals Matter, we have, and will continue to provide, evidence for any number of possible market scenarios including a bullish melt-up, a crashing melt-down thereafter or even the above scenario-a Japan-like zombie market that crawls along on pure central-bank support for decades.

Yes, it is at least possible that the Fed completely takes over what was once natural capitalism and replaces it with centralized control from a central bank, one which represses rates and prints money for years, thus altering markets in the same way totalitarian regimes alter truth.

Sadly, we’ve already seen how the Fed literally twists the truth about such critical signals as inflation, employment and growth in prior reports. In such a twisted “new normal,” perhaps anything is possible?

But I’m a life-long sailor and a surfer in my spare time. I’ve spent countless hours in many oceans, I can say that I’ve come to respect the awesome power of the sea, the weather and the unknowns that lie beneath the waves.

In short: I’ve gained enough humility to know that one can never fully control the awesome forces of nature.

And as someone who has also spent decades in finance, I’ve gained enough humility to know that no one-including a central bank-can fully control the awesome power of market forces.

Debt is one such market force, and the debt upon which the world in general ($250T) and the US in particular ($72T) now sits is simply staggering and awesome in its power.

For now, and perhaps even for a while, the Fed can try to control this force by keeping rates low and using the inflation lie to justify this desperate policy.

But by artificially and arrogantly trying to control such forces, the Fed has driven borrowing costs to such historical lows that it has unleashed a national and global spree of drunken over-investment and fatal debt creation with no fears of a recession and inflation.

Such disastrous debt and bubble creation is like a storm gathering offshore. Like all storms, some can be weathered with an umbrella, while others destroy lives. By trying to control this storm, the Fed is merely making it the largest in recorded history.

At Signals Matter, we are tracking this storm daily, and speaking to it bluntly. In the end, even the best umbrella of a central bank will be a little use against the current debt storm it has created.

Please stick with Signals Matter as we track this perfect storm with facts rather than “creative thinking,” media spin and Fed-based distortions of truth.

In the interim, and as always, be careful out there.

Comments

3 responses to “You’re Being Conned: The Blunt Truth About a “Recession-Free Tomorrow””

- Larry Barnessays:

May 6, 2019 at 8:08 AM

I’m just getting started in this so I will hold my comments for now.

- Greg Rogerssays:

May 6, 2019 at 10:30 AM

Thank you for posting what I call the obvious, I have told my friends and family … we can not spend more than we take home in net pay. Yet the federal government has continued to add Red Ink since the mid 2000. I recall printing our Federal Deficit back in 2005 which at that point in time was 7.4 Trillion. The cost per person in 2005 to retire this debt was somewhere around $25,000 per person (man,woman and child) in the United States. My work colleagues laughed and said the country has the means to take care of this debt. Here we are not even 15yrs Later and over $21 Trillion in debt with no conversation about attempting to reduce or address this debt crisis. I have moved 33.33% of my 401K in precious metals. As a baby-boomer raised by my father who went through the Great Depression told me to live within my budget. Sorry to ramble but I am VERY CONCERNED about the future of our Democracy. *********

- David Reidsays:

May 6, 2019 at 10:45 AM

Good article please keep sending them to me.