U.S. bonds are in serious trouble. Below we show you the facts not the drama.

Safe-Haven?

As US debt to GDP ratios hover past 125%, and as fiscal deficits near 10% of GDP, perhaps you’ve been noticing a simultaneous sell-off in both U.S. bonds and stocks in a nation and market literally drowning in debt?

Remember the good ol’ days when bonds were seen as a “safe haven”?

But as we’ve been warning for well over 2 years, bonds artificially supported by a money printer are little more the Frankenstein monsters—i.e., alive but not really…

This means your “hedged” stock and bond portfolio is a fatal error. Bonds and stocks can and will fall together.

Investment Grade U.S. Bonds Falling Like Newton’s Apple

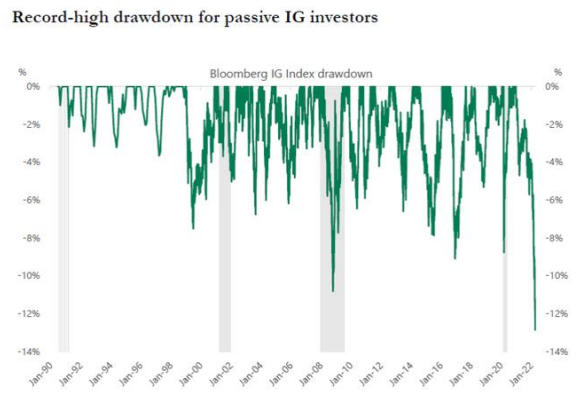

In case you haven’t noticed, we just saw the worst sell-off in Investment Grade (IG) US bonds in the last 30 years.

Folks, there’s not many IG bonds even left in our toxic bond market, so when even the best names/credits are tanking, you need to be concerned.

No Place to Hide: Return-Free Risk

There’s literally no place to hide in the U.S. bond market—even among the so-called “risk free” government credits.

In fact, risk-free return in the UST market is nothing more than return-free risk, given that inflation renders every bond out there a negative yielding asset.

Just saying…

Stocks Follow Bonds

By the way, as everyone in Wall Street already knows, the bond market has the varsity players, as credit markets signal stock prices far better than stock traders can and do.

In short, when bonds start screaming in pain, stocks follow.

Banks Follow Bonds

Needless to say, those TBTF banks you bailed out in 2008 are also starting to squirm.

Why?

Because they hold a lot of debt (i.e., U.S. bonds) on their balance sheets. As those U.S. bonds tank, bank balance sheets begin to wince and then scream.

Meanwhile, the Cornered Fed Tapers Bond Support?

YTD, as both U.S. stocks and U.S. bonds fall, we revisit the question of a Fed tapering bond support at the worst time.

But then again, there is no real options (or good times) left for the cornered Fed.

The time for disciplined tapering passed long ago, and thus all we can look forward to is pain ahead in risk assets followed, in our opinion, by a quick pivot back to money-printing to the moon and Yield Curve Controls once markets tank—all of which means more inflation and currency debasement as the end-game.

Period. Full stop.

Since I entered the markets in 1998, I’ve never, not ever, seen such a perfect set-up for total absurdity and no best-case scenarios left for the now failing Fed experiment.

Turning Japanese

We’ve written in the past about the similarities and differences between the BOJ and the Fed’s mutually desperate (fantasy-postponing-reality) attempts to monetize their national debts with money created out of thin air.

The end-game for both country codes will be the same—namely currency destruction at a pace that will make eyes water.

As Japan stares at twin fiscal and trade deficits with a money-printer rather than a productive economy, its fear of bankruptcy should bonds (JGBs) fall and yields/rates rise has placed the BOJ into a corner all too familiar to the Fed.

That is, the Japanese central bank can 1) allow JGBs to tank and hence bankrupt Japan into a high-yield-high-rate implosion, or 2) it can print more money and cap yields, the net result of which is a sickening debasement of the Yen and more inflation ahead.

It will come as no surprise that the BOJ chose to kill the Yen (suffering its worst month in 50 years) rather than allow their own Frankenstein bond market its well-deserved demise.

Now Japan (which has had more turn-over at its Finance Ministry than WeWork had morons in the C-Suite) is openly scared and running out of options.

They might consider asking Russia to sell them oil in Yen rather than USD, or settle deficits in gold rather than paper (i.e., worthless) money. See the slow trickle toward de-Dollarization?

But won’t that upset their friend, and co-sanction partner, Uncle Sam?

Yes, but as debt-soaked nations run out of options and Western tough-talk, they also run out of loyalties.

The next few months will be interesting to say the least.

One thing we can say, however, is that as the Yen weakens, it will be in no position to buy more UST’s from DC, which just puts even more pressure on Uncle Sam’s unloved bar tab of unprecedented (and unforgivable) debt.

Can a Money Printer Defy Gravity and Falling USTs?

Already, the sell-off in USTs is reaching the worst levels of 20 years, which means yields and rates will rise unless the Fed prints more money to buy the USA’s unloved bonds.

See how debt speaks the same language—be it in Japan or elsewhere?

Ah, the humanity…

Many are saying the US is turning Japanese, or are the Japanese just turning American?

The debate is moot, for both examples are two sides of the same tragic coin. Folks if printing money to solve a debt problem with more debt seemed to good to be true, then ask your central banker why he/she sold that fantasy in the first place?

Namely, and as we’ve been consistently warning: Too much debt always kills nations and markets—it’s just a question of when and how much the currency weakens first.

All the more reason for portfolios to be more prepared now than ever. Is yours ready for what’s happening now and tomorrow?

If not, let us help here.

Sincerely,

Matt & Tom

Signals Matter’s Blogs & Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly by Signing Up Here. Signals Matter’s Portfolio Solutions Made Simple are geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here.