Below, we look at the U.S. Dollar with blunt rather than sensational intent.

Sensationalism, like central bankers and policy makers, has many faces, views and voices.

This may explain why so many want to hold their ears, hug their knees and beg the heavens for a beacon of guiding light amidst a 24/7 fog of info-cycle pablum masquerading as information on everything from Fed policy to viral strands.

Facts in a fog of Sensationalism

With so many opposing ideas, movements, policies, parties, and personalities buzzing galvanically for attention, dollars or votes (in a world rightly or wrongly brought to its pandemic-accelerated knees), it’s becoming increasingly difficult to believe anything or anyone.

And this is likely because just about everything and everyone (from defective Fed Chairmen to defecting royal princes and politicized prompt readers) has become, well—sensationalized.

Yet perhaps perspectives like ours are no exception. The title of our 2020 best-selling Amazon book on global markets, “Rigged to Fail,” sure sounds sensational, doesn’t it?

Was it just another doom & gloom scare-book with a catchy title for profitable “info-tainment”? Just another sensational voice joining the choir of omni-present crazy?

We’ll admit it’s a fair question.

But what if…

What if… these markets truly are rigged, and what if they (and economies and currencies) truly do fail ? What if the evidence, rather than just the title, of that multi-chaptered observation is objective rather than, well…sensational?

Cynics (and I’m one of them) could say I’m plugging a book or exploiting a meme.

Fair enough.

But facts are stubborn things, and as Goethe wrote long ago: Some books are meant to show off what an author thinks he knows, while others (thankfully) are simply meant to be useful.

Something Useful

As for the open secret on the Wall Street we’ve known, it was no mystery to any of us Bloomberg jockeys that the Federal Reserve (like all the major central—and private—banks of similar ilk) were not-so immaculately conceived to serve themselves rather than transparently heed the real economy or the average Joe or Jane.

And rather than just declare this “sensationally,” we put page after page after page of facts, figures and embarrassing biographies (from Nelson Aldrich to Larry Summers, Richard Nixon to Alan Greenspan) to objectively reveal the same.

As for the far fewer paragraphs below, let’s look at further (and factual) evidence of this “rigged to fail” characterization.

Let’s look beyond what we’ve already written elsewhere about price-fixing COMEX markets, fake inflation reporting, openly fraudulent Fed counterfeiting or just plain cancerous derivatives trading (now “calmed” by Basel III?).

Instead, let’s focus on one simple, albeit “sensational,” fact, viz: That the global monetary system in general, and the fiat currency in your pocket—i.e. the U.S. dollar in particular, is indeed “rigged to fail.”

Pretending at Exceptional

The U.S. dollar with its mighty history, symbolic shape and laudable backing by the “full faith and credit” of the U.S. Treasury is not the store of value it pretends to be.

Needless to say, that U.S. dollar is certainly important to the alleged “Annuit Coeptis” (God-favored?) of the leadership in DC and the “Prima Mea” (me first) ambitions of Wall Street.

In short, the U.S. dollar is the sacred cow (rather than golden calf, post-Nixon) of power itself; it’s literally what keeps these two mythical prongs (money and politics) of so-called American exceptionalism going.

Thus, if power loves the U.S. dollar, then power will attack anything (from Bitcoin to gold coins) that gets in its increasingly discredited/debased way.

In the last 100+ years since insider bankers invented the privately-managed Fed (and in the last 50 years since Nixon neutered –de-golded–the Greenback), Uncle Sam’s favorite central bank and its spoiled (and complicit) nephews on Wall Street have done a masterful job of pretending the U.S. dollar still has power, despite the fact that the dollar index has fallen from 1000 in the “roaring 20’s” to just 37 today.

That’s a fact, not sensationalism.

In just the last year of unlimited QE, that same Fed has created more fake digital U.S. dollars than all the trillions of previously and “quantitatively eased” U.S. dollars it mouse-clicked out of thin air in the QE1-QE4 of era 2009-2014.

That’s a fact, not sensationalism.

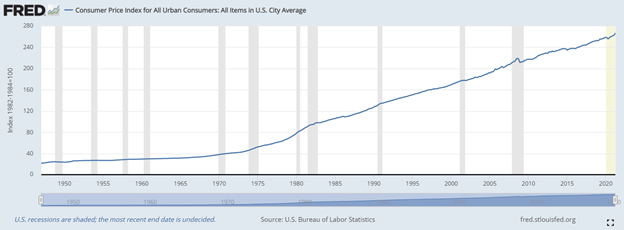

Of course, creating more U.S. dollars is the very definition of inflation, but that same Fed says it has inflation under control, despite a rigged CPI scale that literally no one respects and an M2 money supply now parabolically surpassing the $20T marker and rising.

Thus, if you want to buy anything today or tomorrow, it’s gonna cost you a lot more inflated U.S. dollars than Powell will admit, despite a carefully-hidden urban CPI that literally screams “Uh-oh” for the dollar and “hell yes” for inflation and/or currency debasement.

That’s a fact, not sensationalism.

Running Uphill in Roller Skates

Inflation, moreover, is an open and obvious tax on capital which discourages investing; it literally eats away at market returns, for even if stocks can rise with inflation, their inflation-adjusted returns are ultimately as impotent as the dollars which measure them.

Investors chasing historically over-priced stocks to beat inflation (or seeking historically negative bond yields to hide from volatility) are doing nothing more than running uphill in roller skates.

In short: They are counting their rich returns with increasingly poorer U.S. dollars.

That’s a fact, not sensationalism.

And with all these inflationary facts, deflationary debates and U.S. dollar debasing realities now before us, even the players who rigged this game are running out of lies, excuses or false narratives to keep their retail and loyal servants in line.

In short, the loyal are becoming less loyal.

Pension Funds Slowly Abandoning a Rigged Ship

The Fed’s playbook of fiduciary form over insider-substance, of course, has been adopted by all the other central banks of the world

Pension funds, for example, like commercial banks and their Private Wealth Management arms (or the financial-advisory-industrial complex which serve beneath and within them) have always towed the line of their central banks and Wall Street “advisors.”

For such fellow travelers, it was an unspoken truth to play along, invest as a pack, think as a pack, advise as pack, get richer as pack, and when things blow up, blame something other than themselves as a pack.

And to be fully and safely embraced by such a pack, it was equally understood not to invest in anything that threatened Wall Street’s plan or their sacred world-reserve currency—the mighty U.S. dollar.

Of course, the one asset which threatened the U.S. dollar (and hence the pack) more than anything was that old barbaric relic: Gold.

For decades, pension fund investment policy statements literally forbid allocations to this dangerous, dollar-threatening asset.

No one would or could touch it. The big funds bowed to their master.

In the meantime, that “master” completely (yet with just enough complexity to keep the masses unaware or bored) rigged the uber-levered COMEX market to keep a permanent boot (and short) to the neck of gold’s paper price, thus artificially preventing this precious metal from naturally humiliating the not-so-precious dollar.

We know. We were there.

Now, with Basel III requiring commercial banks to mark their paper gold as tier 3 and their physical gold as tier 1 assets, the derivatives trade in precious metal is about to shrink considerably, and thus, arguably, we can expect fairer price discovery in gold and silver.

But the real aim of Basel III and the BIS which overseas central banks, is to make the gold and silver trade far more frictional, expensive and restricted—i.e. centralized and controlled, as that’s what “centralizers” do.

Precious metals will thus see more volatility ahead, followed by inevitable surges despite every attempt from banks to reign in the anti-dollar metals.

And as the above inflationary facts and graphs (including an annualized CPI surpassing 4% and a PPI surpassing 6%) reveal, it’s getting harder and harder for those colluding members of the consensus pack to keep towing the Wall Street line or running away from gold.

Even the most loyal servants of this rigged casino can’t ignore a global bond market now openly bloated to $120T in size, $90T of which is saturated with unpayable sovereign bonds–of which $20T are negative yielding.

Not even the COVID “excuse” works anymore in a world drowning in over $280T of global debt paid with fake money and sovereign IOU’s which offer zero to negative yield.

In my father’s era, Treasury bonds were described as “risk-free returns;” today they have devolved into “return-free risk.”

Alas, the system is increasingly upside down…

Pre-COVID, $4 bought us $1 of GDP; today it buys far less.

Since March of last year, macro conditions have become so bad that pack thinking—and pack loyalty—began to shift.

In short, fund managers can’t ignore that currency debasement has now reached extreme levels, 5X the depth seen post Lehman.

Neither can they ignore the fact that commodity price inflation is at double-digits.

Those are facts, not sensationalism.

In other words, there’s going to be less and less whistling past the graveyard of rising debt, rising inflation and rising currency debasement by pension fund managers, even if the U.S. dollar has momentary surges on the back of hawkish rate talk as opposed to hawkish actions.

The servants, in other words, are questioning their master.

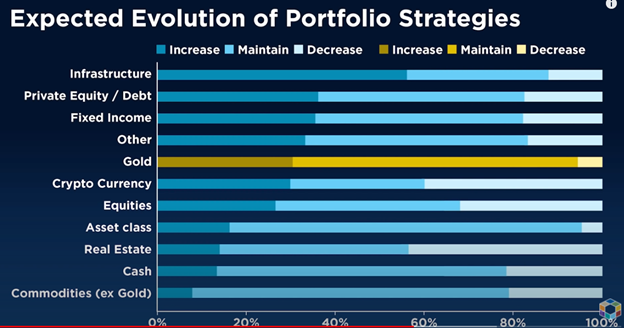

In such a monstrously and historically unprecedented backdrop of monetary expansion and price distorted risk assets, the once-faithful are catching on to the fact that they’ll need to start thinking seriously about tail risk and inflation hedging.

Imagine that?

This means that beautifully scarce ($10T) little corner of the commodity market known as gold can no longer be ignored, banned or downplayed by the master or its servants, despite even Basel III’s attempt to tighten the gold trade.

That’s a fact, not sensationalism.

A Revolutionary Middle Finger

Unbeknownst to the Wall Street media or the advisor down the street, for example, a once all-too-pack-loyal Dutch pension fund for a local chemical company (DSM) recently become the latest institutional player (following the Ohio Police and Fire fund) to break ranks with its consensus-think Wall Street master.

In 2020, DSM made a 5% allocation to gold—and even better, to physical gold in a vault rather than paper gold in a levered ETF…

This may seem like a small story, but given the nature of the rigged “pack” discussed above, such an institutional move is nothing short of revolutionary.

The allocation made by DSM represents an open middle finger to the openly debased U.S. dollar in particular and an increasingly discredited Wall Street narrative in general.

Of course, such brave middle fingers aren’t easy to wield in this rigged game.

Believe it or not, a humble little fund for glass manufacturers in that same country tried to make a 13% allocation to gold after Wall Street’s not-so-sacred Lehman imploded in 2008.

Unfortunately, these farsighted glass makers were then approached by the Dutch Central Bank (loyal to its global pack and BIS master) and were literally forced to reduce their allocation from 13% down to 3% gold in the same way that many working citizens are forced to take a COVID vaccine to keep their jobs.

That’s a fact, not sensationalism.

But going forward, more pension funds are likely to leave the old fold and lift their middle fingers.

The World Gold Council recently revealed that upwards of 30% of UK-based pension funds are considering breaking ranks with consensus and turning toward this “barbaric relic.”

That’s a fact, not sensationalism.

This slow, but revolutionary mutiny by pension funds is a direct threat to the rigged system and the dying dollar.

Although the kind of repressive tactics used in the past by the Dutch Central Bank to curb gold enthusiasm and fund allocations in 2009 may seem like outliers, they nevertheless reveal the extraordinary level of fear the rigged-players have for gold and the increasing distrust investors have for the U.S. dollar .

Again: Rising institutional gold demand is the ultimate indicator of the rising failure of the international (fiat) monetary system.

In other words, the Master’s plan is slowly failing, and they’re having a difficult time admitting this. Instead, they are doubling down on more fantasy and more controls—including Basel III.

As to such rigged controls, I wrote earlier this year of the hidden-in-plain-sight moves by international governments to guarantee the loans of commercial banks.

This subtle (yet desperate) policy move is a warning sign that governments will seek greater and greater control over how banks and institutions spend their money. Again, Basel III is yet another example.

Needless to say, those controls will be unfavorable to many players otherwise seeking to invest in or trade the anti-dollar that is gold.

Again, this is because this precious metal is the natural enemy to an unnatural and rigged-to-fail currency game.

Fortunately, individual investors, at least for now, won’t be under such capital controls. Currently, the global policy makers’ focus is on trying (and failing) to quell gold’s institutional demand.

Inevitably, however, central banks and their currency system will finally fail from an abundance of un-hidable bad data and lack of monetary faith—something impossible to time.

That’s a fact, not sensationalism.

Change is Coming

In the interim, the same central banks will eventually act to quash even retail demand for gold by outpricing this asset once inflationary conditions get too absurd to control or publicly downplay.

The players to this rigged game may be corrupt but they aren’t stupid. They may hate gold in public, but they own a lot of it in private.

In a rigged game, it’s all about the house controlling the casino.

That is, failed policy makers recognize that once faith in the global fiat system implodes, as it will, whatever new SDR or Digital Central Bank Currency (DCBC) the IMF, BIS and other rigged players impose upon us in the inevitable “re-set” to come, the new “digital solution” will have zero credibility unless it includes some form of recalibration to a much higher-priced gold.

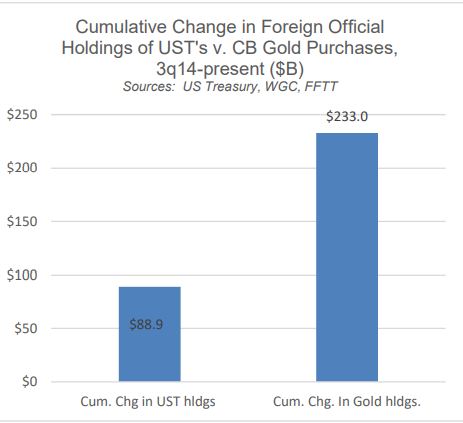

That’s why countries like Russia and China and central banks around the world are playing the long game and buying yield-less gold today at artificially repressed prices far more than they are buying negative-yielding Treasuries; but once those prices multiply, the retail investor could be easily priced out of this rising asset.

Rigged or not, the smart money knows gold follows 1) the broad increase in the money supply per capita and 2) increasingly negative real rates.

As inflation and money supply rises naturally from over-heated and smoking money printers, and as governments repress rates via monetized yield control, the setting for inflation to outpace yields is clear, which means the path ahead for gold is equally so.

Thus, if you still think today’s U.S. dollar will be king forever, think again.

That’s a fact, not sensationalism.

Sincerely,

Matt & Tom

Bitcoin may be the latest (or last) lifeboat on the US(S)/global Titanic. BUT, the US , like Rome, (not so Great) Britain and many others, is more likely to go out with a whimper than with a BIG bang.

Why do you not have any gold in any of your portfolios.

Hi Tom, as my posts confirm, including today’s Basel III report, I see gold as a critical long-term investment as well as insurance policy against weakening fiat currencies. Our portfolios, however, are actively managed trading recommendations with move with shorter-term price direction and thus do not reflect the “insurance” aspect of precious metals, which I am 100% in favor of.