Below, we look beneath the waterline of record-high markets to reveal the debt iceberg directly off our economic bow.

The Unthinkable

The RMS Titanic is as an easy metaphor for disaster but deserves an irresistible revisit as the global and US economy steers full speed toward a debt-soaked iceberg.

The Titanic’s collision of luxury, technology, and hubris with Mother Nature has caught the imagination of generations.

Why?

Because April 15, 1912 reminds us that the unthinkable can happen in a heartbeat…

As for our current economy, our “Titanic” markets, our poor fiscal steering and the looming dangers ahead, I see numerous Titanic parallels.

That, and I love metaphors…

The Sinkable: A Titanic Metaphor

Captain Smith, a veteran professional of the sea and pilot of the Titanic, along with the ship’s owners (including the infamously confident Bruce Ismay), declared the luxury liner unsinkable just days before it lay 2.5 miles beneath the Atlantic with over 1500 souls equally waterlogged.

Such fate-taunting arrogance reminds me of the current class of store-bought pundits, Fed “captains” and “economists” who daily declare that our economy is “unstoppable,” “growing” and in full “recovery.”

The nautical experts surrounding the Titanic, like the passengers on board, had an almost irrational faith in engineering, technology, experience and, most importantly: appearances.

I’m thinking of the mother o’ pearl paneling in the ship’s smoke rooms to the mirrors, millwork and exquisite paintings on the A-Deck or the extraordinary design of the grand stair case.

The same is true of many of today’s investors. They have faith in the “experts” engineering and steering our markets at the Fed; they trust their “captains” in DC to do the right thing; and like many of us, are seduced by the “appearance” of rosy (yet fully inaccurate) GDP, employment and earnings data.

The combination of comforts and expertise surrounding the Titanic assured everyone from steerage to the First-Class dining room that everything was fine.

The same faith in appearance and surface guides our market participants.

But as anyone who has held a beautiful lover or bought a book solely for its cover can attest: don’t be fooled by appearances…

For example, the evening of the Titanic’s last sunset, that same dining room hosted a ten-course meal, replete with a first course of oysters and consommé Olga, a fourth course of filet mignon lili, a fifth course of roast squab and cress, a ninth course of pate de foie gras and a final course of Waldorf pudding and vanilla eclairs.

Whewww.

What, indeed, could possibly go wrong in a world of foie gras, roast squab and vanilla eclairs?

Well: How about an iceberg?

You see: Despite all this order, beauty and expertise, the ship was heading on glass-smooth water toward disaster without enough lifeboats.

The same tragic irony applies to our current economy and market bubble. It overflows with confidence, experts, comfort, and appearances which promotes a deadly calm despite plain-site (yet entirely ignored) dangers ahead.

We Look for Icebergs

Our job—our primary job now—at Signals Matter, is to point out this iceberg. Frankly, and other than my family, friends, and private ideals, it’s all I think about.

Why?

Because I hate to see people drown who don’t have to.

Also, and when it comes to the markets, we know this singular rule to be true: fortunes are made not by chasing tops, but by avoiding bottoms –i.e. iceberg moments.

Don’t be Fooled by the Tip

An artificial, debt-driven but otherwise “thriving” economy, like the tip of an iceberg, has a misleading surface. The real danger—90% of it—lies beneath the waterline.

Today, almost every televised market expert, from the Fed officers, the big banks, and CNBC/FOX pundits (nimrods) to the White House PR teams, are declaring “the shadow of crisis has passed.”

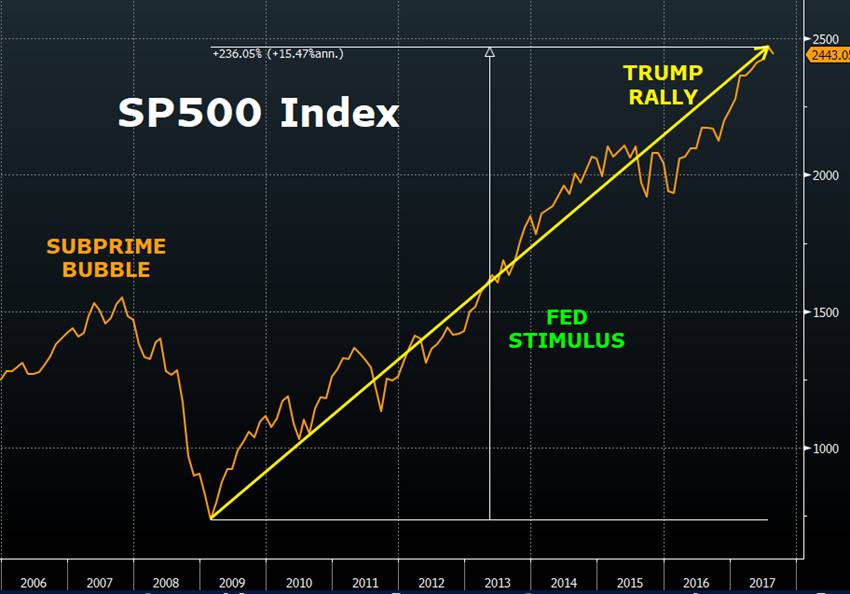

Our Presidents (Obama thru Trump) point to (and take credit for) stock markets reaching all-time highs, unemployment cured, and GDP growing steadily up and to the right.

But as I’ve written elsewhere, each of these headline-making points, from low employment and high GDP (not to mention “soaring” profits and earnings on a stock market rising almost exclusively—and artificially–on the back of low rate-induced stock-buy-backs) are empirically, well: UNTRUE.

I made a video, for example, on the stock buy-back phenomenon. It’s pretty disturbing.

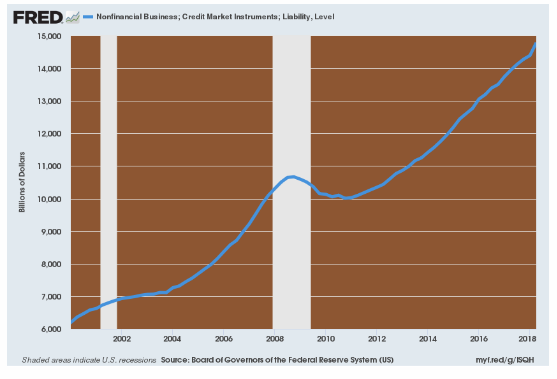

The vast majority of the companies trading on the US exchanges, for example, have mortgaged their balance sheets (i.e. taken on debt) to buy back their own stocks, a myopic little Wall-Street trick which shrinks the share pool and misleadingly boosts the EPS data.

In short, record corporate debt gives markets a record surface “shine”—but it’s a shine that hides a danger beneath the surface—much like, well…, you know: an iceberg.

That is, cheap debt (“heroically” handed down by the Fed) made debt-financed markets look calm, with balance-sheet tricks and dishonest corporate profits built on buy-back sand rather than Free-Cash-Flow cement.

Since 2007, for example, almost all of the gain in the S&P’s reported earnings per share data is due to reduced borrowing costs (i.e. low rates) and shrunken share counts.

When rates (borrowing costs) normalize and rise (by virtue of the bond market rather than Fed manipulation), that fake buy-back trick ($250B per quarter) ends.

Thereafter, the debt burden on US stock’s will rise from $20 per share to north of $40 per share in the time it takes a stone (or ocean liner) to sink in the ocean.

Keep It Simple

Stated otherwise: when debt costs rise, earnings fall, and hence stock prices sink. It’s that simple. Really. It is.

Which means… as interest rates climb, the “sandy” (rather than cement) foundation to these arrogant (and artificially stimulated) markets will give way.

If rates climb by even 2% from their current figure—the house of cards otherwise known as our economic “recovery” falls.

Despite these mathematical facts (as opposed to opinions), most of the media will have us believe that by all measures—at least superficially—we are navigating smooth (eerily smooth) seas under a starlit night of vanilla eclairs and Waldorf pudding (whatever that is…)

Hence, today, as in 1912, the 1% stroll the promenade of the first-class decks of the post-08 securities markets enjoying the greatest (fakest) business expansion and market highs in US History.

What a glorious time. Pass the foie gras.

Like the Titanic, our markets just look too powerful to sink.

Of course, a few us know that a market and economic recovery driven by debt is not a recovery at all—it’s just a debt party about to have a Titanic hangover when rising rates kill all the fun.

And the bigger the debt party, the bigger the hangover.

Meanwhile, as the iceberg looms, the US real economy and Middle Class, down there in the “steerage section” of our Titanic markets, have been totally ignored—and, along with their modest retirement accounts– will soon be drowning, and in greater numbers…

The Illusion of Grandeur

So that’s the rub. Nothing about our post-08 “recovery” is real. None of it.

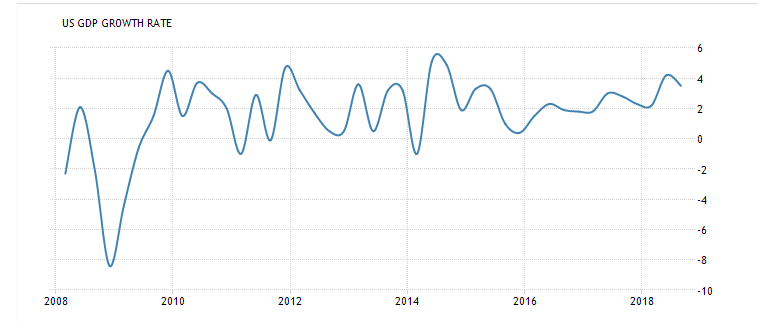

Unemployment is not cured, markets are debt-doped, not thriving, and compounding GDP (at 2% average growth since 08) is at the lowest levels in over a century.

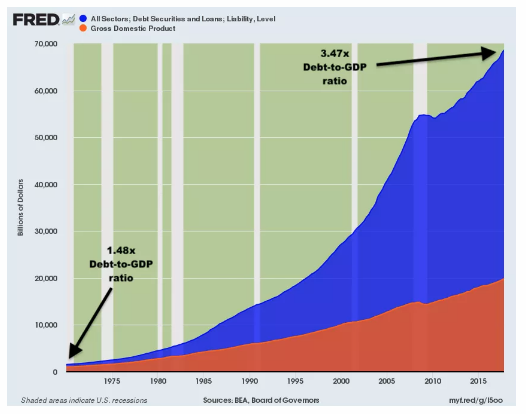

If you still don’t want to believe me, just look at the iceberg-like graph of our current Debt-to-GDP ratio:

Folks, a graph like this ought to scare you. It’s…well: an iceberg.

But—and again– these facts are hidden, even distorted; they lie 90% below the waterline of what the majority of the pundits, advisors and market salesmen are telling you.

Reality Beneath the Waterline

For example, when you account for the fact that 60% of the heralded new jobs are actually part-time or from the lowest wage sectors, or that millions of discouraged workers have simply given up job-searching and are conveniently left out of the statistical pool, you see the truth beneath the surface of the shiny employment data we are given daily.

Part of this truth is the fact that 1 in 7 Americans are on food stamps.

And as for our record-breaking stock markets… Yes, indeed they are high.

But look deeper: those same markets are not driven by productivity, economic growth or real GDP.

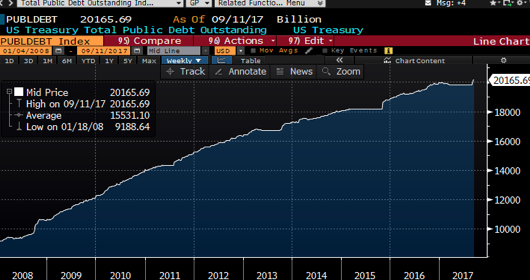

They are driven by $71 TRILLION in US debt (highest in history), money printing ($3.5T, and that’s just in the US…) and a decade of artificially suppressed interest rates.

What do low rates and cheap borrowing do to a market?

Well, they cause companies to borrow like this:

And our government to borrow like this…

And hence markets to go up like this:

If you take away this artificial, debt-driven stimulus, then the US economy and stock market would be in steerage, not the first-class dining room.

The Debt Iceberg

Current government debt is at $21T and counting; US household debt is at $15.3T, financial sector debt stands at $20T and our business sector debt is at $14.8T.

Again: the combined total is over $70 Trillion, and this number, frankly is appalling. It’s a national scandal, an aberration.

It’s also unsustainable and fatal. It’s the iceberg no wants to see.

GDP growth? The US—on the backs of an entirely artificial and un-natural (and hence unsustainable) stock and bond market (bought & engineered by the Fed), posts a couple of improving quarterly numbers and the market cheerleaders are, as their trade demands, declaring victory…

What they don’t see behind their pom-poms, however, is that pesky debt-to-GDP ratio shown above.

Again, once we look deeper (and honestly) beneath the smooth surface of things, what we see are lots of jagged edges and the iceberg ahead.

It’s composed of debt-made bubbles—stock, bond, currency and real estate—at all-time peak dimensions as world-wide debt ($250 TRILLION, WTF?) more than doubles in the span of a decade.

The global equity markets are massively inflated, historically over-valued by all measures, including median PE ratios, q-ratios, price-to-book ratios, the infamous CAPE indicator and dividend yields.

And yet everyone feels safe snuffing down that Waldorf market pudding…

It’s just crazy.

Since 2000, the global bond market has more than tripled to over $100T in size, backstopping another $555T in derivatives. The gross notional value of those instruments alone is now at $710T, which is 9X’s global GDP and, well…horrifying.

Debt like that, and global GDP at current numbers, is the equivalent of financing a Ferrari on a bus-boy’s salary: fun until the bill comes due.

And fueling this short-term binge is the easy money ($21 Trillion printed out of thin air) and low (even negative!) rate bacchanalia handed to us by the world’s central banks, from Washington to Beijing, Brussels to Tokyo, each part of the last desperate act of every failed, bankrupt and broken national system since John Law in 1720.

Namely, central banks printed fake/fiat money at artificially suppressed interest rates to buy nothing more than time—and good times indeed.

This may sound like an opinion. It’s not. It is fact, math, history and candor.

How It All Ends

And so, the good times steam Titanically along as the wine flows and the Waldorf pudding is served on our economic A-Deck.

Like the happy passengers on the last night of the Titanic, passive investors feast calmly on the comforts of surfaces and media spin, choosing to ignore what lies ahead and beneath, as it is too unthinkable, too messy, too cold and too seemingly far away.

Alas, we eat, drink and consume, and like the asset bubbles all around us, get fatter and fatter, until…

An iceberg hits.

At 11:40 PM on the night of April 14th, 1912, the unsinkable Titanic started, well… sinking.

Captain Smith and Bruce Ismay were ignoring the warnings. Like our experts (Bernanke, Yellen, Greenspan, Larry Summers and talking-head A, B, or C), they felt they knew better.

Math vs. Vanity

But one passenger, the Irish naval architect, Thomas Andrews, went below decks and counted out the rapidly filling water-tight compartments.

Once the fourth overflowed into the fifth, he bravely told the Captain the ship would sink—it’s a “mathematical certainty,” he said.

He understood physics the way some of us understand markets. That is: they both operate on natural laws, not human arrogance, wishful thinking or denial.

Here at Signals Matter, we work with math, supply and demand and common sense. We like to think of ourselves as modern-day Thomas Andrews…

Just as too much water sinks a ship, too much debt sinks an economy. Sure, you can buy time, even luxurious time (such as our current illusion), but you can’t make a flood evaporate once you’ve unleashed it, just like you can’t keep rates low forever.

And when America’s $70 Trillion-dollar debt levels hit naturally rising (rather than temporarily/central-bank suppressed) interest rates –it’s no different than the bow of ship colliding with an iceberg.

That is: dinner is over. The ship sinks.

Which is to say, the unthinkable becomes real.

And so, by 2:20 AM on the 15th of April 1912, all the paintings, mirrors and beautiful wood carvings on the A-Deck…all the majesty of the grand staircase and all the rows and rows of roast squab, vanilla eclairs, filet mignon lilis and Waldorf puddings…lay at the bottom of the ocean—along with hundreds and hundreds of tuxedo-clad and 3rd class passengers and the “experts” who brought them there.

All but one expert that is…

The Cowards

A certain Bruce Ismay, lead investor and Titanic executive owner, snuck on to the last lifeboat and survived. It was the same Bruce Ismay who decided against the extra lifeboats.

Prior to the sinking, he thought he knew everything. Afterwards, we learned he knew nothing.

The same will be said of many of today’s Fed Chairmen, politicos and “don’t worry, be happy” journalists and financial advisors.

They are a collective group of Bruce Ismays—self-seeking, risk-denying, and uniformly cowardly in both market math (and understanding) as well as speaking the hard truth.

Today, we have media bubble-heads, sell-side, Wall Street “puffers” and a cadre of DC mediocores dressed in neckties, red and blue (who do nothing but spout re-election memes and collect lobbyist checks) selling spin while our markets and economy steam straight into a debt iceberg.

At Signals Matter, we’re selling lifeboats.

There’s one graph, as I wrote here, that explains this iceberg in simple terms. I beg you to read it.

When the biggest debt bubble in our history collides with rising rates, our economic ship is going straight to the bottom.

And how do we know that are rates rising? Simple: the bond market is telling us so.

I explain this in basic-English here as well as well in video form here. I beg you to read/watch those as well.

In short: we are showing you the iceberg. It’s time to consider lifeboats, not what flavor of ice cream you want on the A-deck.

Yet not 1 in 100 of our elected geniuses or the bulk of our “buy-and-hold financial industrial complex” advisors knows anything about the bond market, the Fed or the iceberg ahead.

Instead, they’re arguing about transgender bathroom rights, 60/40 pie charts, or the latest tweet of our sitting President.

Hopefully, you have more important things to think about.

1 thought on “Titanic Markets Steaming Toward a Debt Iceberg”

Comments are closed.