Gold price manipulation is back, as was gold’s flash crash; below we skate through its details and ask: “Why now” and “how’s it done?”

Kneecapping the Competition

Many may remember figure skater Tonya Harding and the infamous pre-Olympic kneecapping of her competitor, Nancy Kerrigan, in 1994.

The scandal was simple: If there’s a stronger athlete on the rink who frightens you, “then take em out.”

Such nefarious deeds may seem unusual, but in the rigged arena of central-bank markets and derivative price fixing, this kind of desperate behavior is, well…par for the course.

When it comes to rigged markets, we’ve written extensively about the open charade which passes daily for “free market price discovery” in a nefarious COMEX trade which, for years, has been the scene of deliberate price fixing on paper gold via cleverly employed swaps, loans and precious metal “leases.”

This is not fable but fact.

Fear of Better Athletes

For the desperate architects behind a global financial system buoyed by increasingly worthless fiat currencies, their greatest fear was and remains that stubborn little athlete which mocks that otherwise pathetic little dollar, namely: Physical gold.

In simpler terms, gold is the Nancy Kerrigan to the dollar’s Tonya Harding.

Gold, after all, is the veritable anti-dollar when it comes to an actual and historically-confirmed store of value which can’t be printed/created at will like the Greenback.

This, of course, poses problems for an increasingly discredited financial system which thrives exclusively on both the artificial liquidity and false reputation of that otherwise debased and grotesquely over-created dollar.

Of course, the big boys and the bullion banks (central and commercial) know this.

They also loathe the thought of losing face or admitting their failure and guilt in destroying currencies, supply and demand forces or basic ethics.

For this reason, shady little figures from the BIS to the LBMA have been trying for decades to knee-cap gold’s natural price rise ever since shady little Nixon decoupled the dollar from its golden chaperone in 1971.

By the way, the result of that little “de-coupling” has been a 98% drop in the purchasing power of that dollar when measured against a single milligram of gold.

Stated otherwise, gold is embarrassing the world reserve currency: Its stubborn rise is proof of the dollar’s now open and obvious fall.

Solution? Knee-cap the better asset.

What About Basel 3?

But if the uber-levered COMEX arena was the shady “scene of the crime” for decades of gold kneecapping, why is gold taking yet another dramatic hit in price so soon after Basel 3’s recent efforts to clean up the price-rigging smut in the derivatives arena?

In short: What gives?

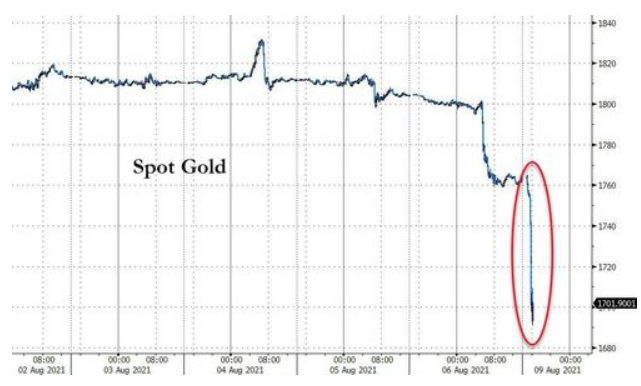

How did gold “flash crash” from $1761 on a Friday to $1677 by Monday?

Why were billions worth of gold contracts being dumped into the overnight markets with no bidders to catch them in a fall not seen since the infamous “Covid” market implosion of March of 2020?

Or stated otherwise: What sane, institutional sellers would ever make such a concentrated, 24,000-contracts “bid-nuking” trade? What market forces (a jobs report?) would justify or motivate such a deliberate sell-off?

Well, as we see below, there may be a few Tonya Hardings lurking deep within a still very rotten derivatives trading rink conspiring to kneecap gold yet again…

Basel 3: A New Era or Old Tricks?

As we wrote in detail elsewhere, the Basel 3 regs of 2021 marked a new (and needed) era of less and less derivative trading among the commercial banks.

Given that the nominal value of all derivatives traded in 2020 was 7X the value of global GDP (!), such a belt-tightening in derivatives was long overdue.

On its surface, Basel 3 seemed immediately bullish for gold, which had been the victim of decades of deliberate and highly concentrated/levered shorts by a small handful of 8 powerful players against thousands of otherwise less powerful longs.

In other words, Basel 3’s slow removal of the derivative shotgun pointed at gold should have sent its price rising not falling, especially in a backdrop of extreme currency debasement.

So again: What gives?

The Sketchy Side of Derivatives

Part of the answer lies in sifting through some derivative fog. Bear with me…

Derivatives, for example, have more than one flavor or designation.

On the one hand, you have the kind that are traded on regulated exchanges, and on the other, you have the really shady kind that are traded on the OTC (over-the-counter) market, which is just a fancy term for arms-length, unregulated and highly illiquid (i.e., risky) trades.

As a former hedge fund manager, I, and many others in Wall Street, knew the OTC market is where truth and transparency went to die and scheming, front-running and price-fixing options (forwards, swaps, and credits) went to the moon.

In other words, the OTC is a sketchy place,

Despite comical assertions by folks like Larry Summers that derivatives were designed to hedge risk, everyone knew that the OTC arrangements were and are a place where bankers went to expand risk (and credit) not for business reasons but for trading profits.

Fortunately, the Lehman crisis ultimately reminded the world that: a) Larry Summers was bad at both math and honesty, and b) derivatives created rather than hedged risk.

The clever post-08 policy makers lurking behind their heavily lobbied-curtains needed a quick, damage-control response to the sub-prime (i.e., derivatives) crisis, which they achieved with calming semantics.

The “solution” came down to “regulations” which would add two euphemistically charming new words of wisdom to the derivatives quagmire, namely: 1) “high quality risk assets” (i.e., liquid assets) and 2) “net stable funding ratios” (i.e., banks required to have enough assets to cover liabilities).

Seems pretty smart, right? All was safe again, right?

Furthermore, with Basel 3 now requiring banks to have even more safe, liquid “good stuff” and less illiquid, levered “bad stuff” (i.e., too many derivatives), one would assume that real assets would move and price more fairly, including gold, right?

Well, let’s look closer.

Making Derivatives Simple?

Given gold’s fixed supply, its $835B slice of the mega-trillion-dollar derivatives pie seemed like a needle in a haystack.

In fact, at first glance, it would appear that the big boys, including the BIS, were not even concerned about little ol’ gold and its cozy corner of the derivatives trade.

But bankers are clever little foxes guarding their own henhouse, and came up with two intentionally complex ways to classify (and hence distort) the gold derivative trade, which in turn is broken down by two types of complex trading instruments, namely futures contracts and forward contracts.

Thankfully, I will not take you too deeply into those weeds, but suffice it to say that such deliberate complexity makes it nearly impossible for the average guy or gal on the street (or 20-something “financial journalist”) to unpack and hence discredit the sketchy games played on the rink of derivative-distorted gold pricing.

The first level of intentional complexity has to do with futures contracts vs. forward contracts.

Bear with me. It’s not as boring or “smart” as they want you to think it is.

Futures contracts are traded on registered exchanges for which institutional investors and just about anyone else have unfettered access.

Forward contracts, on the other hand, are traded in that shady little OTC market, for which normal investors have far less (if no) permitted access.

Instead, the only athletes allowed on that slippery rink for forward contracts are what are known as “principals” of “unregulated institutions,” which basically just means the big boys—i.e., commercial banks, major family offices, privately-held mega companies, sovereign wealth funds and other financial choir boys like central banks.

These lucky, big-boy “foxes” are allowed to trade forward contracts and do most of their ice-skating in and among other members of the London Bullion Market Association (LBMA), who settle their trades in either London or Zurich.

According to the foxes at the BIS, there were about $530B worth of forward contracts in this members-only rink last year.

Thanks to Basel 3, those banks/players are required to treat their contracts as “unallocated (paper) gold” (i.e., “bad stuff’), which are booked as liabilities on their balance sheets.

But as Basel 3 reminds, those same banks also need to show equal amounts of “good stuff” (i.e., real, physical gold) assets to match their “bad stuff” (paper gold) liabilities.

This means those $530B worth of derivatives (forward contracts) need to either: 1) be slowly removed from their books or 2) converted into “good stuff”—namely,” allocated (physical) gold.”

In sum, the banks need more physical gold to meet Basil 3, and by year end, gold demand (and pricing) among these foxes should be rising, right?

But here’s the embarrassing rub: there’s a very real possibility that those LBMA members don’t actually have enough physical gold assets (8,667 tons) to meet their balance sheet ($530B) paper liabilities.

Banks Need More Gold Tomorrow than they “Report” Today

The foxes over at the LBMA, however, would tell you not to worry—as they have over 9500 vaulted tones of physical gold.

Unfortunately, however, what bankers say is not entirely a reflection of, well…reality.

Let’s do some armchair auditing and basic math…

The Physical Gold Supply Lie

Over 5,700 of those so-called 9500 “available” tons are held by the Bank of England, which is not in fact an LBMA member.

Yet even if it were, more than half of its “vaulted gold” has been leased out to other central banks.

In short, the required and promised gold just aint really there…

This leaves about 3800 or so tons of actual physical and vaulted gold in actual possession of the LBMA members, of which 1500 tons is already earmarked for gold ETF’s.

This means the actual and available amount of physical gold (roughly 2330 tons) does not meet the required 8667 tons needed to match the $530B of paper gold liability exposure at the LBMA membership club.

Uh-oh?

It would seem, alas, that the foxes don’t have enough real gold to meet the new regs.

Of course, if we wanted to know for sure, we could just check with the LBMA vault audits, right?

But it may surprise you to discover that no such audits have been reported.

This may explain why the LBMA members have been screaming like spoiled children to be granted an exemption from (or a start-date extension of) those pesky Basel 3 regs.

In other words, the member institutions of this insider-banking click don’t appear to own enough physical gold to meet the new regulations, which would suggest that the good ol’ days of the OTC derivative price manipulation of gold are waning.

A Forced “Clean-Up” & Pressure from China

But we are hardly the only ones calling BS on the 50-year derivative price manipulation in the gold space.

The big boys in China were taking note as well, and looking to strategically expand their role as a new zip code for fairer global gold trading.

This is because the Chinese are big fans of physical gold but no fans of US dollar policies (i.e., decades of exported US inflation) and the downward gold price-fixing by a small handful of Western banks.

In short, the Chinese want better price discovery in gold, as they fully recognize its longer-term power.

This would explain why the most active Chinese bank in London’s gold market, ICBI Standard Bank, recently bought Barclay’s 2,000-ton vault…

You can be sure that China’s growing interest as a better gold trading platform has forced the Bank of England to make an extra effort to repair its reputation (enter Basel 3) by forcing a tighter muzzle on the LBMA in particular, and OTC tricks in general, regardless of all the screaming from London.

More Gold Demand from Banks, Means More “Timely” Manipulation

This means western banks will be forced to buy more gold, as demand for this “barbarous relic” will be greater, rather than less, in the years ahead.

Which brings us back to the initial question above as to why certain parties would suddenly sell $4B (notional) worth of gold into a bid-crushing avalanche to embarrass (i.e., weaken) the gold price by 100 bucks in just 2 trading days?

Could it be that these same old western gold-manipulators wanted to see the price of this asset fall before they had to start buying more of the same?

If that sounds manipulative and sketchy, well, such manipulation and sketchy is nothing new to these Basel 3-trapped banks…

In short, the simple, sad yet unspoken truth is that most commercial and central banks don’t actually have as much gold stored in their own vaults as they claim to have.

That is, they’ve been “fibbing, fudging and faking it” for years, which, again is nothing new and amounts to a basic job description for the bullion banks.

Most of central bank gold is leased away rather than stored safely at home—and that gold aint coming back, especially from the Chinese…

“Conspiracy Theory” or Just Business as Usual?

In case you think this lack of gold is a conspiracy theory, be reminded that the New York Fed, responsible for storing earmarked gold for foreign central banks, recently refused to allow the Bundesbank and other national banks to inspect their own earmarked gold.

Why the refusal?

Take a wild guess: Because the Fed didn’t actually have enough of it.

The harsh reality is that the central banks, which have between them a declared ownership of 35,544 tons of physical gold, don’t have what they say they have.

Instead, they are concealing old leases, recent swaps and loans, and engaging in outright misappropriation of earmarked gold that simply isn’t where they say it is.

In short, after 50 years of market deception, the jig is up on these banks, and today they need to buy more gold (and fast) to save face.

Why Buy High When You Can Fix the Price Lower?

My cynical yet experienced view is that this most recent tank in gold pricing was yet another price manipulation to make such Basel 3-required gold purchases less expensive and hence less painful for the foxy bankers.

Stated simply, a handful of sketchy banks just manipulated the gold price down so they could buy it on sale rather than on high.

The Official Price Explanations Don’t Fly

The pundits, talking heads and Fed apologists, however, will roll out the standard talking points and attribute the recent and dramatic “flash crash” in gold on positive job reports, technical “death crosses,” rising rates and a stronger dollar.

Ah, the ironies do abound.

If rates are rising, it’s only because inflation is rising faster, which portends rising rather than falling gold prices in the future, something gold investors, rather than speculators, understood long ago.

And as for rising rates strengthening that precious dollar, if you still believe that a dollar drowning in liquidity and sinking toward more rather than less inflation is “strengthening,” please take yet another look at the power of the dollar (and euro) when measured against gold:

Which brings us back to Tonya Harding…

A Darker Truth?

When gold is embarrassing the US dollar with as much visual clarity as the foregoing evidence confirms, the only option left for desperate banks is to break the rules and knee-cap the one thing which is causing them fear and the embarrassment.

The recent kneecapping of gold by those mysterious players in the OTC is nothing more than that: A Tonya Harding moment in the gold market.

Shame on that, and shame on them.

In the end, however, we all know what happens to Tonya.

Your elucidation of the dynamics of the issue in this report is further appreciated.

…. And as someone who follows your reports with diligence, its explication you define is as I rationally suspected of current gold price volatility, as indicated to those of us outside the ‘click’ as inexplicably created.

Then that Basel 3 is apparent as doing its job of ‘ferreting out the foxes from the hedgerows,’ reassures me with some confidence the ‘foxes’ won’t have it all their own way.

…. For me, it continues to focus the priority for savvy investors to persist with market and economic vigilance in volatile economic times, and toward that pursuit,

…. is why I observe the information and data from Signals Matters invaluable.

Hello Matt,

Read your book “Rigged to fail” and everything you wrote makes perfect sense. One question: What if Fed and Central banks keep buying all types of bonds to curve the yield no matter what it takes and with the help of their rig everything including inflation. Now they have a new tool of COVID lockdown to tapper without slowing down money printing to curve inflation and also making people addicted to UBS. How much longer they can still do this is the question?

Timing the end-game is nearly impossible, especially given the immense as well as increasingly growing and centralized powers of our governments and banks. They can, as you say, extend and pretend far longer than any rational market would otherwise dictate. COVID, among many things, gives them a moral pretext to effectively bail out credit markets and produce even greater “liquidity,” but such liquidity merely dilutes the currency–hence my earlier report that we face either currency-killing inflation (from desperate money expansion to save the markets) or a market implosion if central banks end the charade of printing away every problem. In the end, I feel we’ll get both: inflation and a market crash–but for now, the “experts” will extend and pretend via deliberate inflationary policies (to print away debt) while mis-reporting the inflation otherwise staring us in the face. The rigged system lives so long as faith in it lives–but that faith is waning with each new lie from on high, as currencies continue to sink in purchasing power by the day. Tragic, shameless.