Below, we look at how inflation can bring these dishonest markets to their knees and make one re-consider true love.

Breaking Up is Hard to Do

In markets, as in love, it’s obviously hard to let go of something that clearly isn’t working; but as all sober romantics eventually discover: It’s such relief once you face the facts and move on from a toxic relationship.

As for our toxic yet often enjoyable ride through the post-08 markets, it was easy to be seduced by the surface of things, as low rates, FAANG-driven tech beauties and a now unlimited money printer seemed to make an otherwise ugly financial system appear attractive.

But a bad love is still a bad love, and a bad market is still a bad market, no matter how much lipstick one puts on a securities pig.

Nowhere is this truer than in the global and US credit markets.

The Courage to Walk Away?

Many investors, however, like star-crossed lovers, still feel the need to hold on to illusions, nostalgia and thus bad unions (and useless bonds) despite all the danger signs lurking beneath an otherwise unhealthy relationship with risk assets and debt-soaked markets.

In the end, however, it takes a kind of personal courage to face unwanted dangers and facts. It takes time to shed illusions.

But we are all, as Nietzsche warned, human, all too human. We love our illusions. We stay too long with the wrong relations.

As such, we are prone to prefer fantasy over reality. Like hopeless romantics chasing shallow and vapid loves, many investors are chasing empty promises from an equally empty bond market.

Goethe and the Bond Market

In The Sorrows of Young Werther, von Goethe tells the 1787 tale of a young artist placing his love and blind faith in a woman who otherwise lacks the depth of his generous soul.

In the end, Werther wastes his life chasing the equivalent of an empty cup. This happens…

Speaking of empty cups, the U.S. bond market comes to mind, and those who place their trust in it are doomed to become a large group of market “young Werthers.”

As Bob Prince, co-chief investment officer at Ray Dalio’s Bridgewater fund recently warned, investors have fallen foolishly in love with bonds and negative yielding returns despite obvious signs of deception and risk.

COVID conditions and market risk have sent more investors into the “safe arms” of bonds as a traditional place to “store wealth.”

But with the Fed buying bonds as well as repressing rates, the net result is that investors are literally paying to lose rather than store their wealth.

Adjusted for inflation, U.S. Treasuries produce negative returns.

Stated otherwise, many investors are falling for the wrong gal…

Folks, if there is no interest rate, that means there is no discount rate on cash flows.

This means the reward of holding bonds is blatantly asymmetric to the risk of losing money.

In short, investors are buying lots flowers but getting no kisses. Alas, time to move on.

It will take years, not days, for the economy to return to “normal,” which as we warned elsewhere, is itself an extreme irony, as “normal” before COVID was anything but normal…

In other words, even going back to Pre-Covid markets is nothing to get excited about. The love story was bad then, and bad today. Why fall for it?

Inflation’s Dark Side—How the Love Affair (and Party) Ends

Although the pundits and mad scientists behind MMT still believe inflation is an extinct remnant of the past, should the US see even a slight rise in otherwise bogusly reported CPI data, this inflation would be devasting to bonds, or as Prince described it: “mind-blowing.”

WHEN, not IF, inflation returns and investors finally end their bad love affair with bonds, then bond prices will fall, which means bond yields will rise—which means interest rates will rise too.

Furthermore, we all know that the day the headlines promise some miracle virus vaccine (likely around election time…), stocks will surge and investors will dump bonds, sending bond yields—and hence interest rates—higher.

But as I’ve written countless times in the bond section of our markets reports, rising yields and rates are to a record-breaking debt bubble what shark fins are to a surfer—really bad news.

I may not have Goethe’s writing prowess, but throughout the pages of our Amazon No 1 Release, Rigged to Fail, I warned readers that markets driven by debt eventually die (and I mean die hard) when the cost of servicing that debt (i.e. interest rates) becomes too high.

Why?

Because rising rates means rising debt costs, and rising debt costs means the party in every debt bubble, from Fed-supported junk bonds to face-shot-flirty real estate agents comes to an abrupt end as inflation slowly rears its all-too-real head.

Still in Love with the Illusion of No Inflation?

But again, love-sick folks often ignore the pig beneath the lipstick. And bond-enamored investors often ignore the inflation risk beneath these markets.

As discussed here, inflation vs. deflation is not a debate, it’s a cycle. Inflation, alas, is coming.

But let’s consider reality, not face shots or dishonest romantic dinners.

How the Love Affair with Bonds Turns into One Big Regret

First, and as usual, the US Treasury Dept, having no national income to really speak of, will do what it always does to “solve” a debt crisis: Issue more debt.

This means more long-term Treasury Bonds (IOU’s) are being issued minute by minute in DC. After all, we have a $3 trillion budget deficit this year to “pay for” (i.e. deficit spend/borrow away).

But who will want to buy those Treasury bonds if their real return (i.e. inflation-adjusted return) is negative?

This means that Uncle Sam will have no choice but to sweeten the dinner date by promising higher yields/returns to his star-crossed investors.

Ah the sweet lies and petty games of a bad love…

This, however, also puts Uncle Sam (and hence the bond market) into a viscous circle of almost comical proportions, for: A) DC needs to raise yields/rates to attract bond buyers (suckers), yet B) if yields/rates rise, the government can’t afford the debt cost.

See the dilemma?

Falling Back in Love with Precious Metals

But we already know, of course, what the US will do to pay for this increasingly painful debt cost—namely what they always do (and all that they can do) in world of just horrendously crappy GDP data and tanking national productivity, namely: Print more money…

Printing more money, in turn, simply means that the purchasing power of the dollars sitting in your current bank account are getting weaker by the second as the dilution effect of unlimited QE does its silent yet dirty work on your trust and currency like a secretive and toxic partner in a love gone bad.

The obvious remedy in this toxic relationship with bonds, the Fed and false hope is to do what Young Werther could not do—that is: Wake up and then break up with your toxic partner and find a new one.

And what better asset to fall in love with today than gold and silver, as precious metals are absolutely precious to a broken-hearted currencies diluted by years of dishonest, low-rate supported bond markets and a national and global debt bubble that just screams of toxic.

I’ve been talking about gold for years, not weeks. But Goldman Sachs and others will not. Why? Simple: There’s no big fee gain for the big banks to recommend gold. So much for “fiduciary care.”

For more facts rather than prose on the importance (rather than trend) in gold, simply look here, here or here.

But I know, I know…It’s hard to let go of the past; it’s hard to erase those fond “good-time” memories of traditional portfolio construction, our conditioned faith in stocks, bonds, tech names and, of course, our rich Uncle Fed and his magical, Santa Clause-like powers to solve every problem with a new bag of debt and fiat dollars.

Please don’t be fooled by the current surface of things or the sweet lies of the rigged market past. It’s time, again, to face facts and break up with what is not working.

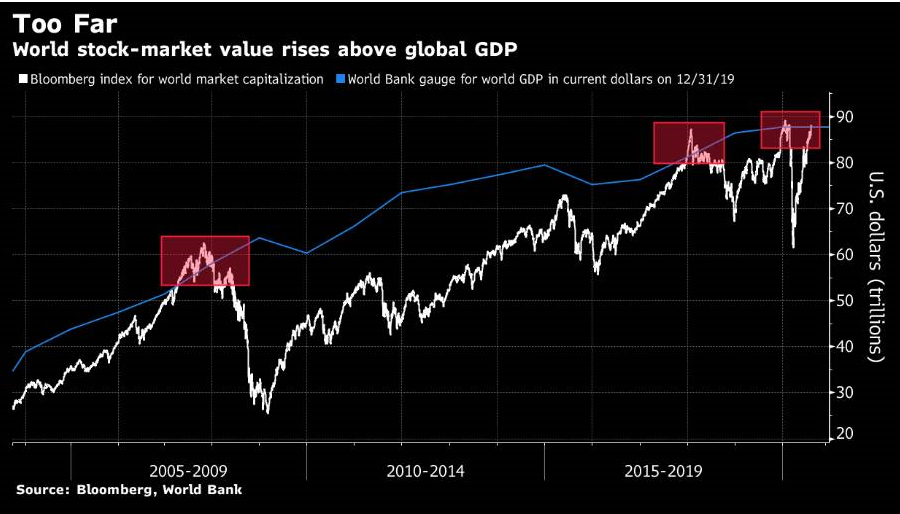

A Chart is Worth a 1000 Words

In case you still need more signs of this toxic relationship between investors and dishonest markets, just consider the following simple warning sign…

The above data confirms that the market value of the world’s equities has once again risen above the dollar value of the entire world economy.

Read that again and let it sink in.

In effect, stocks are now valued at levels higher than global GDP! If there was ever one warning sign of an over-heated (i.e. cheating) market, this is it.

On Sunday, total stock-market capitalization reached $87.83 trillion compared with the 2019 GDP of all countries at $87.75 trillion.

Needless to say, the 2020 global GDP numbers are even worse in this year of recessions, so the bubble you’ve fallen for is even more of a femme fatale than the chart above warns.

In short, be warned—this market is toxic.

At Signals Matter, however, we’ve learned how to accept, deal with and move on from toxic relationships. It feels so good to so…

If you want to protect your portfolio from the heartbreaks of what has been and what is still to come from this vapid, secretive and communication-challenged market, we have the communication skills (i.e. market signals) to walk you from a bad relationship to a rewarding one.

Simply join us here and we’ll point your portfolio toward a more transparent and rewarding relationship with market reality rather than dishonest fantasy.

Sincerely, Matt & Tom

Great stuff, Matt. Love your book. Look forward to meeting you!