If the pending debt ceiling “crisis” and “debate” has you biting your nails, well…

Don’t call a manicurist just yet.

Nothing New…

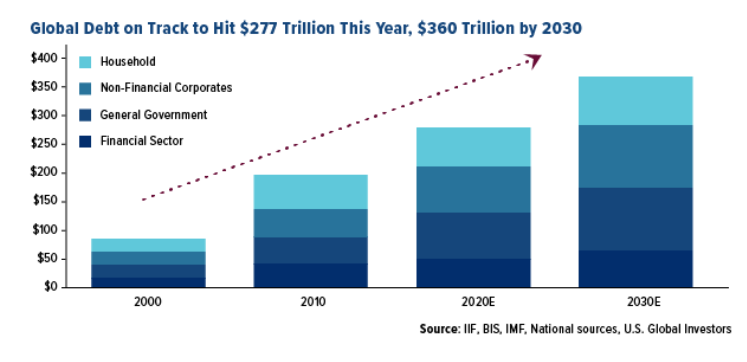

Debt ceilings are nothing new to a nation that lives off debt, is grossly in debt, and will never get out of debt other than by inflating it away with dramatically negative real rates and other “re-structuring” tricks—all of which destroy currencies—i.e.: Your wealth.

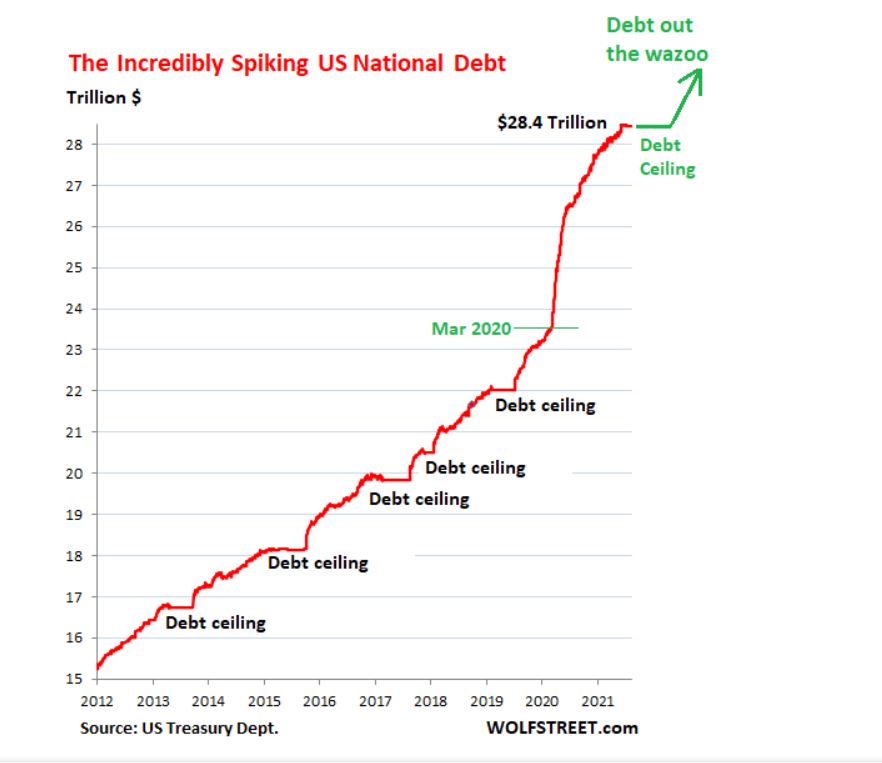

In short, that debt ceiling is made of cheap paper and will likely (more than likely) just be “pierced” (i.e., extended) yet again, as it was in 2011, 2013, 2019 etc. etc.

The Big “What If”

But what if… just what if someone in Congress had the backbone, calculator and honesty to say, “enough is enough?”

The latest 3.5 trillion-dollar spending bill (set to reach impasse or pass next week) is just the latest example of the US acting like a spoiled kid with dad’s maxed-out credit card…

“What if,” for example, some majority members of Congress looked at the national balance sheet and said what any normal mother or father who didn’t have enough money to pay tuition, trade in the mini-van for a Porsche or fund a Disney holiday would say to their kids: “We just can’t afford it.”

Sadly, politicians lack the kind of kitchen-table honesty which most hard-working, real people exercise on a daily level.

Instead, they like to spend money and give the bill to the next generation in order to stay elected in this generation.

Then again, if every family in the U.S. had a money printer in their basement, perhaps they would buy that Porsche, send their kids to Exeter and (if vaccinated and therefore permissioned to actually move freely) fly to the Caribbean or the Swiss Alps for a weekend away.

After all, money printers can make anyone a bit extravagant…

That Seductive Magical Money Printer

Congress, of course, knows about that magical money printer down the street at the Eccles Building, and for years have been living grotesquely beyond their means (and precedent) in ways we write about every chance we can.

The blunt and simple fact is this: America is bankrupt, writing bad IOUs to the world in the form of Treasury bonds which are repaid by the Fed with money created with a mouse-click.

If that sounds insane, then welcome to the new Twilight Zone, Danger Zone and just plain Surreal Zone that is the Divided States of America…

Again with the “What If”

But let’s get back to the “what if” above.

What if the debt ceiling, by some miracle of honesty and accountability (two fundamental traits which politicians pathologically lack), isn’t raised and America admits it’s over its skis in debt and can’t pay?

That is, what if the U.S. defaults on its increasingly comical IOU’s?

Interestingly enough, Anne Saphir at Reuters recently asked the same question, and one of our readers recently asked us to dig a little deeper into the implications of such a scenario.

So, here we go.

The Fed: “Solving Debt with More Debt”

Needless to say, it will come as no surprise to those of you who follow the toxic relationship between U.S. monetary policy, inflated securities bubbles and just plain stupid politics.

In this sordid but oh-so seductive menage a troi, just about every monetary, fiscal or market problem boils down to having that private bank otherwise known as the “Federal” Reserve magically “solve” for the same.

After all, when money can be created out of thin air, why worry about debt? Just issue more bad debt paid for with equally bad (i.e., fiat) dollars and call that “stimulus,” “policy,” “accommodation,” or even worse, a “recovery.”

But if this sounds too good to be true, it’s because it is.

Magical money is just another word for debased money, and that is precisely what the Fed is doing to the dollar in your pocket right now.

But again, “what if” Congress reaches an impasse and doesn’t extend its debt ceiling by October of 2021?

In short, “what if” Uncle Sam can’t issue more IOU’s or defaults on its current batch?

As usual, the Fed has become the clueless but go-to “solution provider” for otherwise (and equally) clueless policy makers.

Looking Behind the Fed Curtains and Into the Fed Notes

How do we know this?

Well, we read the Fed’s diary…

As Saphir’s article reminds, in prior debt-ceiling stand-offs, the Fed took notes in 2011 and 2013 on what they might have to do if the U.S. indeed reached an actual impasse on its debt ceiling, which as of 2021 has reached an embarrassing height of $28 trillion debt.

That figure alone should make anyone wince.

What these prior notes imply and portend is quite illuminating, as well as just plain pathetic.

In a nutshell, both Powell and Yellen in prior years (i.e., before they became a Treasury Secretary or Fed Chair), seriously considered (as Fed governors and vice-chairs) the possibility that the Fed would have to do something to “avoid a market catastrophe” if debt ceilings weren’t further extended (and pretended).

What was that “something”?

Well, it boiled down to an emergency plan in which the Fed would make greater capital requirement concessions to TBTF banks while simultaneously agreeing to purchase defaulting U.S. Treasuries.

That’s right. The Fed would just go on treating (and supporting) defaulting bonds as if they were solvent bonds.

How’s that for magical?

This kind of absurdity, of course, is no surprise, given that the Fed’s primary mandate and objective is Wall Street first, as we’ve written countless times.

Thus, to keep the greatest asset bubble of all time even more “great” (i.e., suicidally destructive), the Fed will do its twisted “magic” so that even more fantasy can buy even more time for a financial system, currency and market losing more credibility and faith by the day.

Toward this end, the Fed has considered a scenario for a defaulting Uncle Sam.

They plan, if necessary, to support DEFAULTING sovereign bonds in the form of lending against defaulting securities, purchasing defaulting securities and, as we warned many times, expanding their repurchase program (i.e. more fake money to solve all-too-real problems).

In a nutshell, the Fed will “save the day” (i.e., the bond and stock markets) even if the U.S. were to do the once unthinkable and default on its debts.

By “saving the day,” of course, they leave out the little details of how they drown the dollar and what’s left of the dying middle class.

In those meeting notes, Powell and others once nobly condemned such desperate considerations in 2011 and 2013 as “unthinkable,” “loathsome,” and “repugnant.”

They even warned that such emergency measures would mean crossing an ignoble line in which that private bank otherwise known as the Fed essentially became the direct financier for the United States.

But folks, that line has been flirted with for years, and as we’ve warned in numerous articles and one full-length book, the Fed has since gained increasing centralized control over our county and markets with such elan that we have bluntly confirmed that capitalism died long ago.

Instead, we, as a country, are now broke and live off IOUs monetized by mouse-click money rather than homemade productivity.

When countries go broke, they become more centralized and authoritarian—on everything from central bank currency controls to vaccine mandates, absurd lock-downs and outright censorship.

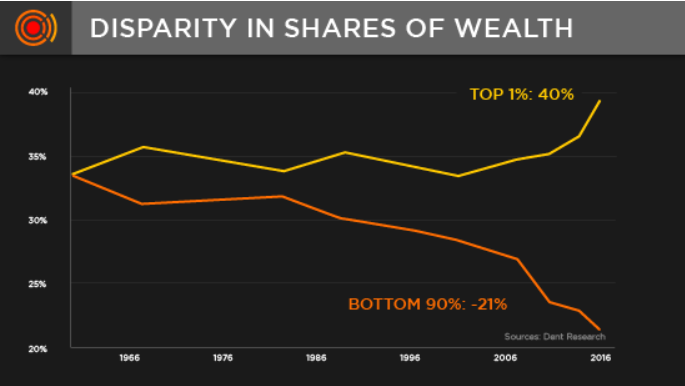

Meanwhile, the top 1-10% get richer while the bottom 80% get poorer.

History has shown us these trends time and time again, and we wrote at length of the obvious example of France.

It’s worth re-reading here.

From Once-Repugnant to Desperately “New Normal”

For now, however, what was once a “repugnant” consideration in 2011 or 2013 is effectively the “new normal” today.

In other words, if the $28T debt ceiling is not extended, as it always has been and likely will be again, the Fed will simply take more control over our economy and hence lives—the very fear of which made Thomas Jefferson wince and Andrew Jackson sick.

And even if the debt ceiling is extended, as we expect, this just the means the Fed will be instrumental in buying more of Uncle Sam’s IOU’s with increasingly debased money printed out of thin air by the Fed.

Either way—default or no default, debt ceiling extension or no debt ceiling extension, the Fed is already in charge, which means the U.S. Dollar will be inflated away to almost nothing but a distant memory of its former, pre-1971 self.

Again: We’ve been warned by prior generations as well as history to be weary of such a central bank taking control over our systems of money and governance.

But our current leaders in DC (and the endless crops of anti-heroes out of Wall Street) are so embarrassingly ignorant of their own founding fathers and basic history that such warnings have been ignored.

History Repeating Itself

And what are the consequences of ignoring history’s lessons and mistakes?

Simple: We repeat them.

Going forward, and regardless of how this debt-ceiling drama plays out, either way, we can therefore expect:

1) more centralized control from a private bank and a “stimulus addicted” DC;

2) more desperate spending by a broke country that solves debt problems with, alas… more debt;

3) a Fed-supported stock and bond market “monetized” by unlimited QE and/or a Repo Market on steroids and…

4) a U.S. Dollar that is losing its purchasing power by the second despite the Fed’s promise that the very inflation that it alone created is merely “transitory.”

But as for Powell (or Yellen) worrying about a potential sovereign debt default, we have news for them which they won’t admit to you.

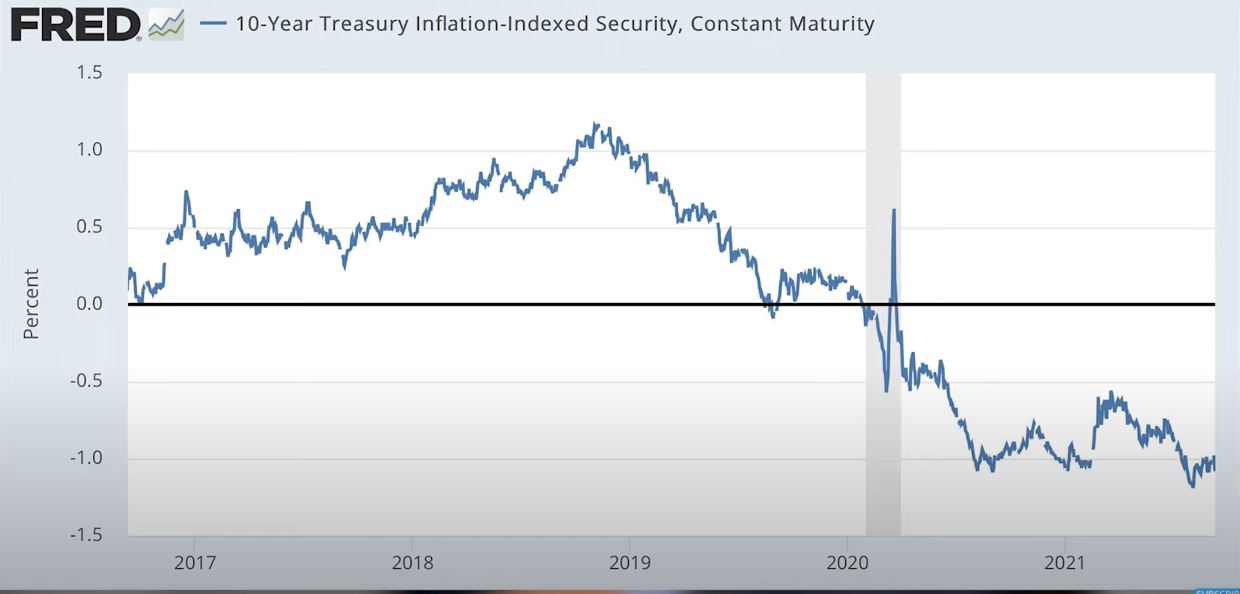

That is, when inflation outpaces the yield on U.S. Treasury bonds, the real yields on those bonds are negative, which be definition, makes them defaulting bonds.

In short, Janet and Jay: Uncle Sam is already in default.

Just saying…

Thanks Matthew for clarifying. James Stivaly