Below we look once again at the U.S. dollar.

Certainty in a Time of Uncertainty

Well…It’s now two days since the infamous 2020 election and here we are: Half of you nervously hoping for confirmation a new candidate and the other half of you nervously hoping for some kind of miracle for the other.

For now, we wait.

Democracy, we hope, gets the last say, and democracy, we hope, remains in place—one way or the other, regardless of who is officially determined to be the next U.S. President.

As politicians and those who vote for them stare down a long tunnel of uncertainty and anxiety, and as opinions from the left, right and center spin galvanically like bees near a hive, a couple of issues do remain certain, as well as largely ignored, by the politico’s and pundits, namely:

- US debt and 2) the U.S. dollar.

Today, everyone is exhausted and tense. No need for a long report or my views as to why.

But regardless of who becomes the next leader of the U.S., they have two elephants in the room to either address or hide from.

The First Elephant in the Room

By the time the next U.S. President takes office, he’ll be contending with a $28 trillion-dollar Federal debt.

By 2030, I believe that figure will nearly double to at least $50 trillion.

Given the condition of our broken financial system and the fragility-accelerator that is COVID, we must bluntly accept galloping deficits ahead.

Neither candidate openly confronted this issue, nor the fact that no amount of tax increases or tax revenues will solve the problem.

And despite recent GDP headlines, please don’t hold your breath for enough economic growth to climb out of a debt hole infinitely deeper than the Grand Canyon.

The Second Elephant in the Room

As you know, the only policy going forward, red, blue or paisley, is more borrowing, and the only way to “pay” for that borrowing is more magical fiat money creation.

Nine decades of running deficits by the left and the right has consequences—social, economic and market-related.

But folks, printing money also has consequences for the U.S. dollar in your pocket or levered in your local bank.

Nearly every U.S. President boasts about the “strong U.S. dollar” but none of them told those who voted for or against them that their U.S. dollar is getting closer and closer to worthless by the second.

Despite MMT fantasy or Keynesian text books, no economy ever achieves lasting prosperity via unlimited money creation.

If it were really that easy, the entire planet could simply retire and wait for a handout, printed at a central bank near you.

Golden Voices

As I’ve written countless times, the only honest voice in a world of fiat currencies is a golden voice.

Gold honestly speaks to what is actually happening to the value and purchasing power of your U.S. dollar.

By gold, I am referring to the kind you can hold and touch, not the kind of gold which the future’s markets leverage by greater than 200 to 1, or the kind that banks “store” for you in non-segregated accounts which essentially gives you a second priority lien-interest rather than actual ownership.

The current gold price doesn’t even reflect the cancerous ramifications of the foregoing debt levels and nearly $7 trillion of currency creation at the Fed.

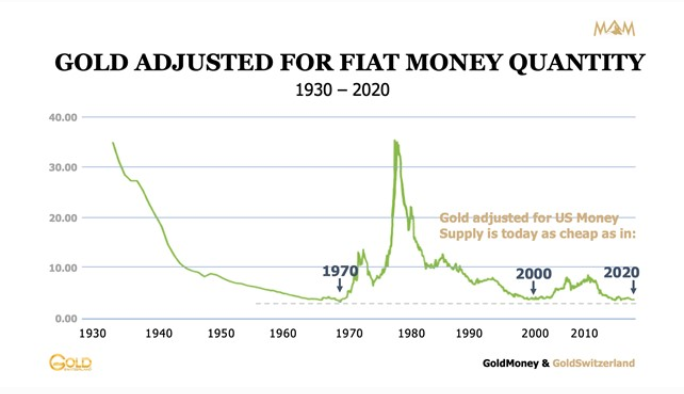

But for now, as we all pace in a setting of uncertainty and lack of clarity, I’ll just leave you with the following clear graph.

It shows that gold, when placed alongside U.S. money supply, is as cheap today as it was in 1970 (when gold was $35, or in 2000, when gold was $288.

For those looking to speculate on gold price (which will see pullbacks), a long-play is worth of consideration.

For me, I know gold will go much higher, as currency creation gets much crazier in the coming years.

But I’m not looking at gold as speculation, but rather as simple currency insurance.

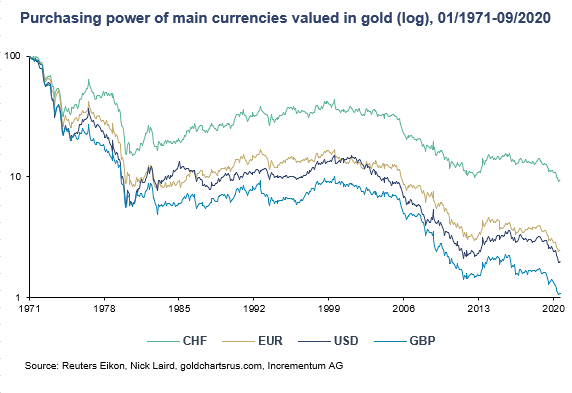

In short, gold will strengthen not because gold is getting stronger; rather, gold will strengthen because the U.S. dollar, like every other currency in a central-bank distorted world, is getting weaker.

It’s just that simple. That clear. That obvious—unlike our political environment.

For more clarity on all things market-related, simply join us here.

Best,

Matt & Tom

So Guys,

I want to make sure I understand. I have options positions out to Feb on GLD and SLV. Are you saying that in your opinion better to hold physical gold than ETF’s?

Thank you!

Hi Jeff,

My answer to your question hinges primarily on your objectives and reasons for approaching the trade–is it short term price appreciation/speculation or a long-term hedge against declining purchasing power in the fiat dollar or other currencies (CAD, AUD, Euro, Yen etc.)? These are two very legitimate but very different objectives, and thus need to be approached differently.

Given that you are talking about options, you are likely taking a more “trader” approach for short term profit capture than the longer term “investor” approach. Again–no problem there–just an entirely different sensitivity to price swings/actions. For traders, gold can make capricious swings and make your strike price feel like a strike out depending upon short term vol. Obviously, you are monitoring your entrance and exit points carefully.

For investors, the play is far more basic and far more long term: buy the gold, stop looking at price moves, and sit back for years. It’s that basic. The play is a bet against fiat currencies ruined by years of QE, not a gold-bug bet. In short, you’re not betting on gold, your betting against the currency market–long term. Gold is essentially a long-dated Leap putt on the dollar.

For those thus seeing gold as insurance against bogus monetary policies, the safest play is physical gold held outside of the banks and even the ETF’s–as ETF’s have to custody their gold in a bank and/or government owned mint–and in my opinion exposes investors to potential intermediary and operational risks in a worse-case financial scenario. If banks fail, the gold you “own” there is not directly owned by you, but then becomes balance sheet asset subject to higher-priority lien holders on the bank. In short, liquidity can dry up in a banking crisis. When gold is owned directly and physically, however, you avoid such counterparty risks. Future’s gold, moreover, is way too levered, and thus delivery is a myth, and breaks down if the future’s market breaks down via counterparty risk–all of which, again, is avoided when gold is held physically.

That’s my view: for those who can afford direct physical gold and are playing the long game–it’s the best way. For those who can’t afford direct ownership in private vaults, the best ETF’s are GLD and PHYS–again: for the long game.

Matt, thank you! You nailed my trading style for gold and silver! I also purchased calls on UUP in case I’m wrong. Complete waste of money in my opinion now. UUP doesn’t hedge the way I would have expected. Poor research on my part.

You have changed my thinking at how I look at precious metals. Room for both! Your articles now make more sense to me knowing that the purchasing power of paper (fiat dollar) is failing! I always tied the 2 (ETF’s and physical) together in some way. No longer.

Thanks again!

Thanks Jeff–glad the articles brought some clarity. In the Blogs section–just type in the word “gold” in the menu bar–there’s plenty to read. 🙂