A weaponized dollar is a dangerous thing.

We have dedicated numerous articles and interviews addressing the dangerous strength of the USD on the heels of a deliberately hawkish Fed hiking rates into what is clearly a recession, official or otherwise.

Explaining the Inexplicable: Rising Rates into a Recession?

On the surface, such central bank tightening in the face of a tanking economy and increasingly volatile risk asset markets makes little sense, as a strong USD and higher interest expense (i.e., interest rate policy) crushes just about every asset class in its wake, from an empirically broken bond market and grotesquely over-valued stock market to the artificially repressed precious metals space.

So, why is the openly cornered Fed acting so openly at odds with the real world and the US economy after years of feeding it instant-liquidity at every “dip,” cough or market sniffle?

The Fake War on Inflation

The standard answer is to “fight” inflation (which the Fed’s own mouse-click money alone created).

But as we’ve also written and observed so many times, a Fed Funds Rate at 3%, 4% or even 5% is not only mathematically crippling to a nation which simply can’t afford such rates, it is equally impotent against a headline CPI print in the 8-9% range (and staying).

In short: Rate hikes won’t defeat money supply driven or supply-constraint driven inflation at all.

Thus, and again, what is the Fed really doing and thinking notwithstanding the official nonsense that makes the headlines or pours from their double-speaking lips?

A Weaponized Fed Running Out of Bullets

One answer: The Fed, like the SWIFT removals and FX reserve freezes, is just another weaponized tool against Russia and the seismic shifts (petrodollar, LBMA alternatives, mono-to-multi-currency trade agreements) resulting globally ever since the openly failed sanctions against Russia were commenced earlier this year.

To any who understand the origins, history and actual practices of the Federal Reserve, the notion that this cabal of private bankers is an “independent” entity is by now an open farce.

That is, the Fed is anything but “independent” and is not only a political fixture of the DC horizon, but rather a political centralizer (hijacker) of the American economy, markets and policy in ways the go far, way far, beyond its supposed “mandate” to simply manage U.S. inflation and employment.

It is my own strong belief that one of the primary motives behind the current rate policy to strengthen the USD has been to help the U.S. government break the financial back of Russia, which like all its prior policies/sanctions (based on the re-invigorated Russian currency, trade surpluses and multi-lateral trade agreements) is failing.

Toward this end, the the Fed’s recent and “weaponized” rate hiking was no surprise to any of us, much, frankly to the chagrin of a temporarily falling gold price.

What one has to ask however, is will this policy backfire as well (?), for it seems that this game of financial chicken with Putin is breaking the back of the US markets and economy (and its EU allies) with far greater effect.

Hubris Comes Before the Fall

I am once again reminded of the 2014 statement made by then U.S. Secretary of State, Condoleezza Rice, that Russia would run out of money long before the West ran out of energy.

Less than a decade after this classic example of American hubris was made, it seems Russia (as well as China, the BRICS and a string cite of emerging market economies) would beg to differ as the world shifts from a U.S.-led mono-currency system to an increasingly multi-national currency, trading and political new direction.

None of this, by the way, will be “orderly.”

Within the US markets and economy, conditions keep trending from bad to worse in every category– from risk assets, social division, and political impotence to the headline-making layoffs at Goldman Sachs, the tanking profits at FedEx and the destruction of the U.S. working class under the invisible tax of persistent rather than “transitory” inflation, of which we warned a year ahead of the Fed.

Meanwhile In Europe…

The price for blindly following the so-called “moral” lead of the US in its political and financial war against Putin (to save a less-than-moral thespian like Zelenskyy) is becoming increasingly high as the delusion that Putin has less leverage than the West becomes increasingly harder to sell, swallow or justify.

In addition to facing an extremely cold and expensive winter…

…the Europeans are seeing their currency at 20-year lows against an artificially inflated dollar.

But it’s not only Europe’s (or Japan or England’s) currency which is tanking, but their trade balances as well, which is otherwise atypical, as weakening currencies are supposed to improve rather than weaken export competitivity.

At the End of the Day: Energy Matters

What the failed sanctions, policies and visions of the US-led West are now making abundantly clear is that energy matters, and folks, like it or not, Russia has more of it than the West as the US strangles rather than frees energy production in the US under a suicidal policy of a “green” new normal.

How the West Was Lost

In the immediate years after the Second World War, America’s greatest generation, as well as its dollar and Treasury bond, were undeniable leaders and influencers.

Those days, dollars, bonds and influencers, however, are no more.

But is it not comical to hear the IQ-challenged Governor of a failed state like California pushing electric cars as the new “solution” (?) — an example of open fantasy almost as comical as Christine Lagarde’s latest attempt to blame European inflation on climate change rather than her own bathroom mirror.

Having transitioned from a world of fair pricing, fair wages, gold-backed money, manageable bond obligations and strong exports, America has devolved into a modern feudalism of over-paid executives, a diminishing middle class, Wall Street socialism, a thin-air-backed dollar, a Fed-monetized (i.e., “zombie”) bond market, exported/outsourced labor and hence anemic productivity.

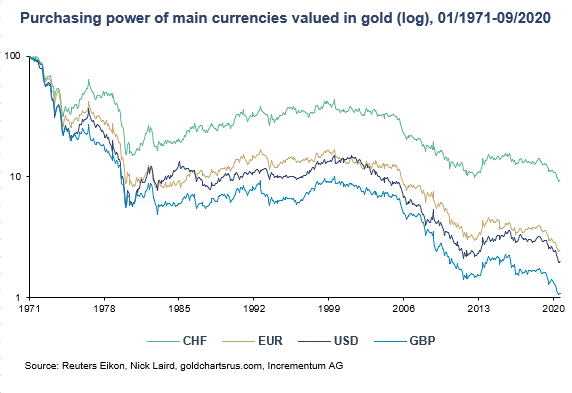

Once the world’s greatest producer and creditor, the US is now its greatest importer and debtor, and has not only exported US productivity to cheaper labor zip codes, but also exported its inflation, thereby destroying US credibility, trust and influence at the same rate America destroyed the inherent purchasing power of its so-called “strong dollar.”

The Real Cost of Only Bad Options Ahead

So, what can the Fed-directed/complicit U.S. do going forward in its pyric financial war against a changing, emerging East?

Well, it can send more debased money and scarce energy to its allies in the EU and Japan to avoid disaster there, which can only mean more not less inflation from sea to shining sea in the US.

Or, perhaps America’s allies in Brussels or Tokyo could cry “uncle” and reach a separate energy agreement with the Eastern nations who actually have the energy they need, an option which not only keeps the folks of the EU and Japan warmer, but improves their embarrassing trade imbalances (above) which resulted from the demands of Biden’s unofficial caretakers rather than the demands of realpolitik.

Of course, any such détente or separate arrangement would have to be paid for with printed euros and Yen, only adding to the global inflationary swamp our central bankers have created since the invention of the first mouse-click money printer.

As a final option, of course, Europe and Japan could simply stay the Western course and suffer an economic and currency crash (as the Yen hits 50-year lows) which would make 2020 or even 2008 seem like pleasant memories.

The West: Marching Toward a Breaking Point (and Pivot)

Without the benefit of a crystal ball or insider-influence within DC, Brussels or even Davos, one can only speculate rather than predict future events as dictated by current political charlatans.

Perhaps Japan and the EU will join the ever-increasing trend as well as crowd toward de-dollarization and reach a separate peace (i.e., trade arrangement) with the East on energy imports.

Equally likely, as well as mathematically essential, is that the Fed, after feigning concern for inflation (which they in fact needed to inflate away Uncle Sam’s bar tab), will pause and then pivot its failed QT policies by early 2023 and bring the USD and interest rates (via YCC) down to levels essential to combat a recession which they pretend doesn’t exist.

Despite all the fake, real, twisted, straight or bent words, facts and policies emerging today, the West in general and the US in particular can not escape the natural laws of debt nor the hard realities (as well as consequences) of pretending that more debt, paid for with increasingly debased, mouse-clicked currencies, is a viable policy rather than an open comedy, as well as insult to the long-forgotten science of economics.

Once the reality of math supersedes the current DC policy of fluff, distraction and finger-pointing, the USD will come down, bond markets will be further “accommodated” and currencies will be increasingly debased.

At that looming turning point, of course, those holding gold will see its recent lows race toward record highs.

Why so certain?

Because, math, history and common sense have shown us (from the Ming Dynasty or 3rd century Rome, to 18th century France, 20th century Weimar and 21st century America) that all debt-soaked, decadent and fiscally wayward nations destroy their fiat currencies without exception, and the “modern” West will be no exception.

Not at all.

Furthermore, those still trusting the Fed to save their highly correlated stock and bond portfolios are in for the shock of a lifetime as markets move toward a cliff and recession of historical proportions.

Here at Signals Matter, however, we are protecting investors with smart portfolios which measure risk before reward, as the only way to make money in the markets is not to lose money in markets in times like these.

Signals Matter Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Our Portfolio Solutions are generally geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here. For three ways to engage with us, please click: 3 Ways to Engage.

Concurring with your conclusion may not be observed rocket science, which begs the burning question,

…. of how tolerance of the level of such economic swindling as you accurately describe, materialised,

…. and is allowed continual maintenance?

Reliable reports in Australia identify the current US yield curve inversion now the worst in 40 years.

The issue raises doubt of economics as a science, as more accurately defined ‘book keeping,’

…. and as differentiated from its description by management as defining its true application.

For neoliberal economics that spawned Modern Monetary Theory, was always observed a scam as built upon platitudes without substance,

…. with its purpose to serve selective vested interest.

And if the ‘economic science’ you refer to, can be weaponised by carpetbaggers outside the recall of collective memory,

…. to plunge the world into a cataclysmic economic depression defining that approaching, then how does your economic science reconcile that recurring outcome?

I can’t decide if current central bank and sovereign economic policy is evil or stupid, so the reconciliation will hinge upon who or what will be blamed when the system unwinds. That will be the stage/setting of media and politics, not facts and honesty. The fact that Bernanke has won a Nobel Prize is evidence enough to me that reality has been buried in favor of optics.