Below I offer some admittedly biased social commentary on SBF and the FTX implosion that goes beyond just crypto debates and rigged markets to the larger question of the declining cultural and financial Zeitgeist in which we currently find ourselves.

And, of course, we add some thoughts on BTC…

Another False Idol: SBF as WMD

As the architect of what might go down in the history books as the biggest single-day loss of asset value in modern capitalism, Sam Bankman-Fried, otherwise known by the three-letter acronym SBF, is looking more like a cultural, generational and financial WMD.

In my mind, however, he’s just another false idol.

Whitewashing Dark Charters with Green Dollars

When it comes to highlighting, yet once again, just how far from the ethical plow modern “capitalism” has fallen from even a pretense of fair valuation, regulatory oversight or C-Suite decency, SBF joins a long list of mental midgets masquerading as “tech geniuses” whose wealth bought them a whitewashed respect which their characters, emotional intelligence or financial savvy never earned.

In prior reports, I have made this trend all too clear in the examples (as well as ironies) of Mark Zuckerburg at that horror show once called Facebook or of Adam Neumann, the propped-up and so-called real estate genius at a WeWork that never worked…

This trend of salesmanship over substance, sadly, is not only an indictment of false idols and 30-something billionaires like SBF, but of a larger culture and Zeitgeist in which financial success is measured only in easy dollars rather than hard-earned character and honest balance sheets.

From Hollywood to Wall Street, the open sins of far too many “generational leaders” are ignored by a herd audience whose opened-mouth awe of money has blinded them to the closed-eyed corruption and child-like ignorance of more than one false idol (and golden calve).

Core Takeaways from SBF as a Metaphor

Enough has already been said and reported of the obvious pyramid scheme, insider-trading, illegal market-making and misuse of client funds at FTX for me to add more detail here.

Nevertheless, certain core themes deserve a brief reminder/examination, indicating once again that the more things change, the more they stay the same.

Unregulated Madness

The destructive similarities, for example, of unregulated crypto exchanges like FTX to the de-regulated derivatives exchanges (nod to Larry Summers) should now be obvious.

Poisonous Overleverage

Similarly, the poisonous dangers of over-leverage at FTX are just mirror images of past sins at places like Bear Sterns or Lehman Brothers.

Misusing Client Funds

And as for the misuse of client funds despite stellar adulation from the financial press, SBF was of a similar profile to the pre-fall version of Bernie Madoff.

Thus, then and now, old and young, the financial markets remind us far too often that our so-called elites are often just a pile of anti-heroes.

The Death of Honest Capitalism

Toward this end, it has been relatively easy to track the death of honest capitalism.

I have written books as well as articles on the open rather than speculative/sensational reality of a rigged to fail financial system in which real assets are subject to legalized price-fixing while central bankers daily break the rules of honest price discovery and natural supply and demand via a counterfeit system of open fraud.

Again, and sadly, such corruption hiding in plain site is not fable, but fact.

The recent example/headline of FTX/SBF is thus only one of too many common symptoms.

Regulatory Oversight is Out of Sight

Perhaps one of the most disturbing takeaways from the SBF/FTX fiasco was the open and obvious lack of any regulatory oversight regarding this once-assumed and now obvious platform of fraud.

As I have often observed, Wall Street is loaded with clever foxes guarding their own henhouses, from the commercial banks to the central banks, and from the OTC to the FTX.

SBF’s odd relationship with Caroline Ellison, for example, raises numerous questions, chief among them being her father’s connection to the SEC’s President, Gary Gensler, who was questionably absent from any investigation of FTX’s increasingly suspect operations during the good times when SBF was making the cover of Fortune and Forbes.

Furthermore, at the same time he was illegally bailing out/propping a string of otherwise value-less/broken cryptos with investor money, it seems SBF was invited to DC to counsel Congress (and its chief financial regulator, Maxime Waters) on nothing less than crypto safety.

As for foxes in the henhouse, this was almost as tragi-comical as Bernie Madoff sitting on the board of the NASDAQ.

No, you really can’t make this stuff up…

In essence, the offices tasked with regulating specific industries are run and/or influenced by the biggest names in the very industries they are supposed to oversee.

Ah, the ironies do abound.

But how are such schemes overlooked, let alone made possible?

Paid For Politics vs Representative Democracy

Sadly, this too may have more to do with money than virtue, as SBF was the second largest donor to the Democratic party.

In fact, if DC had a motto, it might just be that: “Money over Virtue.”

SBF’s $1B pledge to the Democratic party, for example, may have something to do with this money vs. virtue tension in the capital, a sin to which all political parties are familiar.

Today, our so-called House of Representatives has four financial lobbyists attached to each member of Congress to “represent” their voting.

This begs the larger question which is worth re-addressing: Do our elected officials represent their constituents or bow instead to their legalized bribers on K-Street?

Human nature, as well as power, are odd little forces, and many politicians seek re-election with far greater passion than they seek to do good for the next generation.

Pick your own examples—there are many politicians with massive levels of self-interest but no profiles in courage…

The Vanishing Fourth Estate

As for the so-called American free-press, it’s further worth asking how “free” is any press whose investigative “journalists” get their marching orders, topics and salaries from a private owner (think of that feudal lord Bezos at The Washington Post) rather than from their own conscience or the cries of the community.

I had once thought the 4th estate was designed to protect the people from power via honest reporting; today, sadly, it seems our journalists are now just parts of that power.

As Upton Sinclair famously observed: “It is difficult to get a man to understand something when his salary depends on his not understanding it.”

Getting Back to the Crypto Thing

As for market reports rather than social commentary, the other obvious question arising from the cesspool that is SBF’s FTX implosion is the future of cryptos in general and BTC in particular.

Toward this end, I have made by views on digital currency all too clear in prior reports. Just look here, here, here and here…

I do fear, however, that the regulatory measures (and vapid DC-regulatory virtue signaling) to suddenly emerge post-FTX will be the perfect pretext by the Fed to create a governmental version of digital USD’s which will be used more to control and monitor citizens rather than to protect them from the sins of figures like SBF, who just weeks ago was a DC hero rather than villain; and a protected donor rather political pariah.

Again, the ironies abound.

Can a Market be Made Out of Thin Air?

SBF, however, has openly admitted in the meantime that cryptos are effectively a market that anyone can make, so long as there is enough hype, money and suckers to back it. His words not mine.

In all fairness to BTC, however, it is not the fault of that crypto itself that certain BTC investors chose to hold their “coins” on a broken exchange like FTX.

In short: FTX is NOT the same as BTC, and the BTC dip-buyers today may see great reward tomorrow.

Then again, they can lose a fortune too. I have no clue—hence my fear of an asset with a standard deviation over 170…

That said, and to the open and admitted chagrin of the BTC true believers, of which I know many, I have never, and will never, see BTC as a genuine alternative currency or store of value.

That is simply my view, and it is by no means gospel.

Nevertheless, hearing SBF himself describe the crypto market which he himself helped conceive, raise and then spoil, his own confessions and descriptions sound eerily familiar to a report I wrote almost two years ago, when I suggested that a market can be made for any asset, as long as there’s the right momentum behind it and a greater fool to buy it.

In honor, therefore, of SBF’s own conception of the crypto mania, I have chosen to republish that same article below for further thought—and, please, not as an insult to BTC, but simply, and again, as further thought…

Bitcoin, Gold and Polo Ponies?

December 7, 2020

Below we compare Bitcoin with gold as: 1) a store of value, 2) a wealth preservation tool and 3) as a gamble vs. an investment.

Bitcoin and Gold—A Blunt Look

This isn’t the first time I’ve written about bitcoin, and certainly not the first time I’ve written about gold.

Many are falsely equating these two investments.

When it comes to speculation, wealth preservation, inflation hedging and store of value investing, Bitcoin and gold are simply not the same animal…

For investors in both camps, the passions run high and I’m not here to criticize Bitcoin over gold, but simply to clarify how these two assets differ in use, history and value.

As we’ll see, gold and Bitcoin serve two very different mindsets and purposes, and it’s up to each of us to determine which assets and purposes best mesh with our own risk profile.

Green with Envy, Yet Deeply Distrustful

As for Bitcoin, I’ll be the first to admit a profound envy—there’s no denying that I wish I had bought some Bitcoin years ago.

Bitcoin has made many early movers and true believers very, very rich. And it will likely make others richer down the road.

Bitcoin is a classic symptom of an openly broken monetary system, and for this reason alone, is part of a mania that will likely send it much higher, even if it is, ultimately just that: a mania.

As such, I can’t trust Bitcoin (a fiat currency) as an instrument of wealth preservation or as a solution to fiat currency problem, and thus, unlike gold, I don’t see it as a component of a long-term portfolio.

This theme of trust, as we’ll discover, has numerous layers and implications for each of us to consider.

For now, let’s start with some basics to help you decide which direction to take.

Some Core Themes

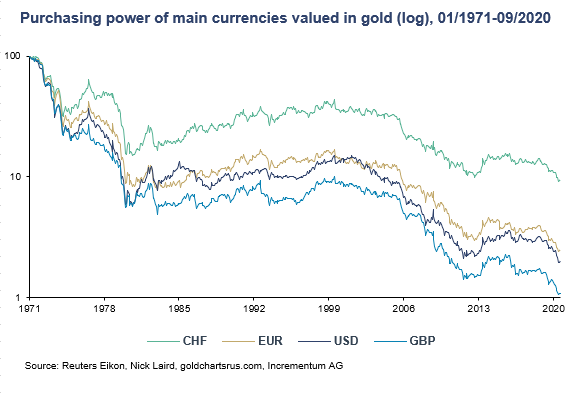

- Bitcoin and gold owners typically share a common and admirable distrust of central banks, sovereign currencies and global monetary policies—all of which have led to massive increases in the money supply, and hence to an equally massive currency debasement/dilution.

- On this point, gold and Bitcoin investors agree: traditional fiat currencies are toxic.

- Thus, Bitcoin and gold are often categorized together as alternative “stores of value” and hence alternative currencies—even common inflation hedges.

- Gold has certain basic uses beyond alternative currency roles—i.e., industrial and technological use as an electric conductor; jewelry use, some art etc. In short: Gold is an actual metal with geological properties. Central banks store them as well …

- Bitcoin is a digital creature, not a physical commodity. It has no atomic number or industrial use, but is clearly used as medium of exchange.

- Gold has unique physical properties and a limited supply. Total, above- ground gold is estimated at about 197,576 metric tonnes, enough to fit into an Olympic size swimming pool. Miners, of course, are always looking for more, but in general, gold, unlike fiat dollars, doesn’t fall from the sky and can’t be created at will or mass produced with a machine or a central bank mouse-click.

- Bitcoin too has a fixed supply, at least for now, and despite some “forking,” there are currently 21 million bitcoins in the world which central banks can’t dilute by creating more at will. Nor is there a deep derivatives or tested futures market for Bitcoin which can render it subject to scalping, front-running, spoofing and other tricks commonly used by central and bullion banks to manipulate pricing, as they do with gold and silver in the “paper market.” That’s a huge selling point and attraction for many Bitcoin holders.

- Bitcoin, critics argue, has no unique properties and theoretically can be replicated by any savvy blockchain developer. There are over 5000 crypto currencies in the world, which some argue, makes Bitcoin just the prettiest girl at the dance today, but not tomorrow. Bitcoin defenders, however, would argue that Bitcoin is much more than that. They argue that Bitcoin holds the highest market cap and market share–over 70% of the crypto market—for a reason: It’s superior.

- Toward that end, Bitcoin holders argue, and perhaps correctly, that its security protocols/technology are vastly superior to its peers, and based upon unmatched hash rates, is nearly impossible to hack or “crack.”

- Finally, Bitcoin supporters fervently maintain that digital is the future, a new “digital gold”—and that actual, physical gold is more of an old-fashioned (even “barbarous”) relic of the past—i.e., a dear old friend whose time has passed.

Of course, I could go on and on about other core (and debatable) Bitcoin themes, from price volatility, transaction speed, increased regulations and money laundering to digital autonomy and privacy advantages (or those who say otherwise), but the foregoing are core discussion points worth noting for now.

Ok, so let’s dig deeper and see which asset makes the most sense for YOU.

The Get Rich Quick Factor

For those of you looking to strike it big, there’s simply no denying that Bitcoin is far sexier than gold for instant gratification (and of course, instant tears, depending on when you buy or what the future holds for this fiat mania).

Even gold’s climb from $35 per ounce during the repressive regime years of the 1960’s to its most recent high of $2089 cannot compare to Bitcoin’s rise from zero in 2009 to $19,800 per coin in November of 2020.

End of discussion. Bitcoin, unlike gold, can make some folks very rich, very fast.

In November, for example, we saw bitcoin rise by 37% in a single month, compared to gold’s 3.6% fall for the same period.

That said, the ironic fact that gold’s rise has been so modest relative to Bitcoin’s is precisely what makes it so much more trust-worthy—a theme we’ll discuss below.

The Seasickness Factor

Of course, what rises fast can sink even faster, as we saw Bitcoin do in March, when it saw a 30% loss in a single day.

Despite these “growing pains,” the Bitcoin bulls (including the Winklevoss twins whom I genuinely like) are forecasting prices to rise to as high as $500,000 per coin.

Those are very, very seductive projections, and can tempt almost anyone looking for a miracle fortune.

For those who think big, believe big, and trust Bitcoin, such projections can make even the bumpiest ride worth the risk.

Again, to each his/her own. Bitcoin, a far better fiat currency than the USD, could indeed rise much higher, despite some seasickness along the way.

Gold investors, however, aren’t looking for seasickness, they’re looking at the purest form of real money in the history of the world to ensure slow, steady and realistic price moves.

Despite inevitable corrections, gold investors see gold as trending up for no other reason than global currencies are trending down.

Bitcoin bulls, however, see gold fading from history.

That, however, is a very arrogant presumption as well as a profound disregard for history. But hey, Bitcoin is a mania, and crowds, manias and prices can outlast the most sober understanding of history.

The volatility comparison (155% vs. 14%) clearly indicates which asset enjoys less seasickness (i.e., price volatility).

The Alternative Currency Factor

In a world soaked in debt with traditional fiat currencies (dollars, yen euro’s etc.) worth less and less by the second, most (including the World Back and the IMF) agree that an inevitable re-set is in motion.

Of course, we’ve seen this movie before of manias, panics, crashes and gold re-sets that accompany broken monetary systems.

We had the classical gold standard that ended in 1914 (due to war costs), followed by the Genoa emergency meeting for gold-backed currencies in the intra-war years, followed by more debt and hence gold decoupling in 1933, followed again by more gold-backing in Bretton Woods of 1944, followed in turn by more debt and hence gold decoupling in 1971, which has brought us to the current monetary nightmare and the need for yet another gold re-set, of which Bitcoin is NOT the answer.

The IMF has effectively confessed this.

Bitcoin bulls, of course, see themselves as the vanguard of a new currency regime in this brave new world heading toward currency and inflationary chaos.

With its fixed supply, superior security and growing reputation, they see Bitcoin emerging as a new, safer and future alternative currency.

Hmmm.

Although I agree that the current currency system is dying, and that a new “Bretton Woods” is mathematically inevitable for the simple reason that the current global debt is, once again, mathematically unpayable and unsustainable.

But is Bitcoin (which can lose 30% in a single day) truly a better store of value (i.e. a new “digital gold”) than any other fiat currency—which by definition, means a currency backed by NOTHING.

Whatever the Bitcoin bulls may say, they have to confess that Bitcoin is indeed backed by nothing. Currencies backed by gold, however, are indeed real currencies backed by something.

And the end of the day, Bitcoin by pure definition, is just another fiat currency—albeit one that can’t be debased by policy makers/central bankers in DC, Brussels or Tokyo. Hence its maniacal appeal.

And folks, manias can be profitable. Witness Bitcoin…

That said, sober and passionate Bitcoin endorsements (and investments) by Raoul Paul and others make a compelling case that Bitcoin, already accepted as a fait accompli by the central banks, will slowly become a critical part of new and regulated digital currency world. This is worthy of note as something more than just a “mania.”

The Faith Factor

Bitcoin, like all fiat currencies, is backed by faith and trust, a phrase we’ve seen on the US dollar since it was first printed.

Faith and trust, of course, are important intangibles, as alluded above, and can have many different measures.

The increasingly diluted US dollar, for example, is increasingly garnishing less “faith and trust” from informed investors by the day.

But, again, “faith” is a matter of degree when it comes to currencies.

Faith in the Zimbabwe dollar, for example, is different than faith in the US, Canadian, or Australian dollar.

In short, not every currency or dollar is the same, and not every measure or level of faith is the same.

But what every currency in the world, including crypto currencies, have in common is this:

Other than “faith”—they are all backed by absolutely nothing at all.

Read that last sentence again.

Then again faith, as Erasmus, Kierkegaard and even Nietzsche said, “is a crazy thing,” and the current faith in Bitcoin is no less so.

Technically, for example, if we wanted to make polo ponies a medium of exchange in a new monetary system, we could.

That is, if we could prove that there are only 21 million polo ponies of fixed supply, why not make polo ponies the next “bitcoin-like” medium of exchange, backed by equine characteristics as opposed to a bunch of 1’s and 0’s in a blockchain?

To do so, we’d simply have to create enough INVESTOR FAITH in polo ponies…

(I know this is a silly example riddled with metaphorical holes, but you get the point.)

In short, Bitcoin, like any fiat currency, is only as good and strong as one’s faith in it.

And today that faith is maniacally strong for the simple reason that faith in traditional currencies has effectively died.

The USD, for example, has maintained investor faith for 50 years despite Nixon having taken it off the gold standard in 71.

By extended logic (and faith), there’s no reason Bitcoin, also backed by nothing but faith and trust, couldn’t last much longer. I can admit this. Bitcoin could truly skyrocket on this (misguided) faith.

But then again, and for any reason seen or unforeseen, faith in Bitcoin could end overnight. I have no idea.

No one does.

The same, however, cannot be said at all of gold, even if it were to drop in price to 1300, 1100 or lower.

You see, Bitcoin has no genuine physical property or physical use, and thus, theoretically has a natural floor of zero if FAITH in its use were ever lost for any reason.

Gold of course, as old-fashioned and “barbarous” as it is to some, has been around for millennia, not a mere decade.

It has a natural price floor well above zero, for no other reason than it has actual (albeit limited) uses. But as a backer of currencies, its reputation is beyond compare.

Beyond compare.

Right now, some Bitcoin fans (and founders) have forgotten this, or even worse, claimed that gold is a mere relic.

The Re-Set Factor

But getting back to the “new currency future,” does anyone really believe that Bitcoin will be the leading player in a post-reset currency regime?

Is Bitcoin really the new “digital gold”?

Some believe this. And belief, like faith, can be a very, very powerful force, even if it’s based a complete disregard for history.

Such belief, however, is akin to a belief that a digital house is better than a real house, or that a virtual lover is better than a real lover.

Stated otherwise, some Bitcoin bulls believe a digital currency is better than a real currency—i.e., a currency backed by something other than faith, namely gold.

Frankly, I’d prefer reality over virtual any day—especially when it comes to lovers, homes and gold-backed currencies.

Thus, ask yourselves (again) if a crypto currency with this kind of price volatility (see below) is the kind of currency that will lead the world out of its current chaos, or one that will eventually create more chaos?

In my book, a Bitcoin world merely involves the replacing of one bad fiat currency system with another, more volatile (yet currently sexy) digital currency system.

Which brings us back to that old, barbarous relic. You know: real, physical gold.

Gold may not be as trendy as Bitcoin is today, but for over 4000 years (as opposed to 10+ years), gold has proven time, after time, after time, after time that when governments, bankers and markets get over their skis in debt (and dilute currencies to pay for that debt), the cure of last resort has always been gold—which has an intrinsic rather than digital value.

Even those banksters at the IMF know that when the next “Bretton Woods 2” moment occurs (which they’ve blamed on COVID rather than their bathroom mirror), the next global crypto to step in will have to be based in some part on gold rather than just faith (or even mania) alone.

That is, the new crypto will need something real (gold) rather than something virtual (o’s and 1’s) behind it.

If the next reset is simply one fiat currency replacing another fiat currency, then we might as well move to the moon and start over—as the lies and games down here on earth have just gone too far.

The Inflation Hedge Factor

Finally, there are those who would argue that Bitcoin is a credible inflation hedge.

Hmmmm.

This idea has gained recent and significant headline traction thanks to big names like Paul Tudor Jones, BlackRock and Stanley Druckenmiller making big investments in Bitcoin as an inflation hedge.

Michael Saylor, perhaps you noticed, made a nearly $700,000 million play in Bitcoin—doubling his money.

Again—I’ll confess to total and unadulterated envy. Manias are profitable–until they’re not.

But I’ll also confess that none of those big names were buying Bitcoin as an inflation hedge.

Folks, as a former hedge fund jock, I’ll tell you what they were doing: Gambling on a calculated (and clever) trend, not hedging against inflation.

Again: Bitcoin is not gold. It’s a digital mania, and manias can and will last longer than sanity.

Assets that rise by hundreds of percentage points in matter of weeks aren’t hedges, they’re just smart gambles marked on the books as even smarter trades. Full stop.

Summing Up

Which brings us full circle back to Bitcoin and gold.

As you can see, they serve very different needs and have very different profiles.

Gold, in short, is about a conservative, intelligent, time-tested wealth preservation tool that offers an undeniably stable insurance against (i.e. hedging of) otherwise obvious currency risk.

This explains why other big names, including Gundlach, Forbes and Paulson, are big on gold,

Bitcoin is far more (at least for now, and likely much longer) about wealth enhancement, not wealth preservation.

Deep down, all the Bitcoin bulls know this.

Of course, both are important qualities.

We all like wealth enhancement, and many of us, if wise, also enjoy wealth preservation. But let’s not kid ourselves—Bitcoin is sexy because it makes (and loses) money, not because it preserves it.

There is a difference.

At Signals Matter, we are investors, not gamblers. We have to know and TRUST an asset before we can recommend it.

Given Bitcoin’s monstrous volatility, we see it as a gamble, not a currency hedge or new currency regime. Our trust in Bitcoin just aint there—though the returns, of late, certainly are, and my envy is genuine.

It’s just that simple. Thus, you won’t see Bitcoin in our back-end portfolio recommendations.

But as I said above, I’m not here to pooh-pooh any of you with the risk profile and appetite for Bitcoin.

It will inevitably pullback to new lows, and you are certainly free to gamble at your leisure and buy the dip.

Truly, there’s great risk yet possibly great reward in doing so. Manias can last, and manias can be very profitable.

It’s your call.

But for safe portfolio’s—the kind we build every day here, Bitcoin won’t be on the roster.

Meanwhile, for those who can take and stomach the risk with their eyes wide open, the Bitcoin trade is all yours, and we hope this report at least helps clarify the gamble without mocking Bitcoin, which we are not.

Now, I have a pony to ride.

Signals Matter Market Reports generally reflect the company’s long-term macro views and are posted free of charge each week at www.SignalsMatter.com, on LinkedIn, and directly to your inbox by Signing Up Here. Our Portfolio Solutions are generally geared to shorter timeframes, may therefore differ from our longer-term perspectives, and are available to Subscribers that Join Here. For three ways to engage with us, please click: 3 Ways to Engage.